March 2023 / INVESTMENT INSIGHTS

Is now the right time for Euro corporate bonds?

Three reasons why we think now is a good time to consider a higher allocation to euro-denominated corporate debt

The recent volatility witnessed in euro credit markets has acted as a sharp reminder that investment grade is not a risk-free asset class. However, the repricing witnessed in 2022 has reset bond yields to meaningfully higher levels that offer investors higher potential income and a margin of safety, even at turbulent times. Against a darkening economic backdrop, yields, fundamentals, and flows paint a better picture for euro-denominated investment grade corporate bonds.

This article highlights three reasons why we think now is a good time to consider a higher allocation to euro-denominated corporate debt:

- The level of income offered by the asset class is once again attractive

- Despite some recent deterioration, fundamentals for European companies remain strong

- Technicals are supportive, in particular for companies on the right side of the ESG spectrum

Income is back

In July 2022 the European Central Bank (ECB) raised all three of its key interest rates by 0.5%, the first upward movement in rates for eleven years. Reflecting these moves and similar rate rises in the US and elsewhere, the yield offered by euro corporate bonds recently hit 4.5%, a level last seen during the eurozone crisis of 2011.

For most of the last decade, euro corporate bond yields have bumped along at or below one percent (see Exhibit 1), reflecting a highly accommodative stance from the ECB and an extended absence of headline inflation. During this period, euro corporate debt looked unattractive in historical and absolute terms from a valuation standpoint — if no more so than bonds elsewhere.

But this has changed dramatically in the past twelve months. On the back of the ECB raising rates and the market repricing the risk of a potential recession, yields suddenly look attractive again. Today the income offered by euro corporate debt seems competitive not only in absolute terms, but also in relative terms against traditional government bonds. On a recent trip, we asked German investors, “why would an investor choose a 5-year German government bond yielding 2.30% when they could buy euro corporate bonds with a similar duration profile at a current yield of 4.30%?”

Exhibit 1. Euro corporate bond yields back to the historical average

Source: Bloomberg Euro Aggregate – Corporate Bond Index as of 28 February 20231

Past performance is not a reliable indicator of future performance.

Fundamentals remain strong

“What about corporate credit risk?” was the response. “Surely corporate creditworthiness is going to suffer if we head into a recession and it’s better to stick with lower-yielding government bonds?”

During the last five years European companies have been relatively prudent with their balance sheets. They have reduced leverage, resulting in a lower average level of debt relative to their assets, both on a gross and net basis.

This is partly a reflection of the way companies responded to the coronavirus pandemic: they built up cash on their balance sheets for fears of Covid-19 leading to decreased capital expenditures and increased saving rates.

But there were other factors at play too. Covid-19 not only pushed poorly ran companies out of the investment universe, but also led to increased government intervention in the money markets.

In turn, during the last three years many companies have been able to refinance their debt at lower interest rates, extending the average maturity profile of their bonds and leaving relatively small amounts to be repaid in the next couple of years.

Therefore, although interest rates have recently gone up, the increase in refinancing rates has been less of a shock as many companies have already locked in lower rates.

Technicals have turned positive, especially for ESG

Demand is even greater for companies scoring highly from an environmental, social and governance (ESG) standpoint. Their bond issues are more likely to be considered by investors and the ECB, which is trying to align its corporate bond buying program with its decarbonisation targets. In my mind this demand will continue to support the market.

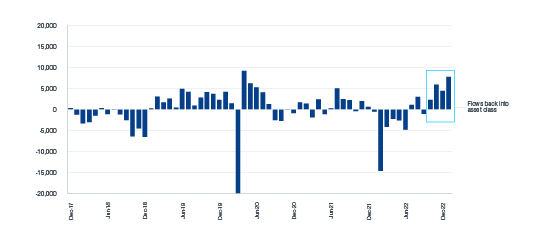

Flows can be an important driver of performance.

Since October 2022, there has been increasing investor demand for the asset class, reflected in positive net inflows. It seems that investors’ recent search for yield is benefiting all parts of the euro corporate debt market, from short-dated bonds to lower rated securities, and I expect this trend to continue based on the market’s recent appetite for new bond issues.

Exhibit 2. Euro corporate bond monthly flows - in EUR Millions

Source: EPFR data as of 28 February 2023

Starting 2023 with a bang

Despite last year’s shock and the recent financial sector woes the euro corporate bond market has started 2023 with a bang. In the first quarter, companies have been queuing to issue new euro- denominated bonds and refinance their debt, with a record EUR 108.5bn in issuance in January alone.

Some argue the refinancing boom reflects worries among corporates that interest rates could rise further in Europe over the next few months. They say it is time to lock in funding at manageable levels.

But the evidence suggests investors have responded quickly to the increased supply, eager to capture attractive opportunities and to profit from the jumbo corporate bond deals offering ample liquidity.

For example, IBM’s four different euro-denominated bond issues at the start of February, totalling EUR 4.25bn in face value, were massively oversubscribed.

Following last year’s dramatic decline in bond prices, it would be easy for investors to retreat from corporate bonds and cut allocations. But we argue the contrary is the correct approach: even if a recession is on the way, it’s time to keep a steady head and maintain or boost portfolio weightings.

Risks - the following risks are materially relevant to the portfolio:

Contingent Convertible bond risk – Contingent Convertible Bonds may be subject to additional risks linked to: capital structure inversion, trigger levels, coupon cancellations, call extensions, yield/valuation, conversions, write downs, industry concentration and liquidity, among others. Credit risk – Credit risk arises when an issuer’s financial health deteriorates and/or it fails to fulfill its financial obligations to the fund. Default – The issuers of certain bonds could become unable to make payments on their bonds. Derivative – Derivatives may be used to create leverage which could expose the fund to higher volatility and/ or losses that are significantly greater than the cost of the derivative. High yield bond – High yield debt securities are generally subject to greater risk of issuer debt restructuring or default, higher liquidity risk and greater sensitivity to market conditions. Interest rate – Interest rate risk is the potential for losses in fixed-income investments as a result of unexpected changes in interest rates. Liquidity – Liquidity risk may result in securities becoming hard to value or trade within a desired timeframe at a fair price. Total Return Swap – Total return swap contracts may expose the fund to additional risks, including market, counterparty and operational risks as well as risks linked to the use of collateral arrangements. Sector concentration risk – Sector concentration risk may result in performance being more strongly affected by any business, industry, economic, financial or market conditions affecting a particular sector in which the portfolio’s assets are concentrated.

General Fund Risks

Counterparty – Counterparty risk may materialise if an entity with which the fund does business becomes unwilling or unable to meet its obligations to the portfolio. ESG and Sustainability risk – May result in a material negative impact on the value of an investment and performance of the portfolio. Geographic concentration risk – Geographic concentration risk may result in performance being more strongly affected by any social, political, economic, environmental or market conditions affecting those countries or regions in which the portfolio’s assets are concentrated. Hedging – Hedging measures involve costs and may work imperfectly, may not be feasible at times, or may fail completely. Investment portfolio – Investing in portfolios involves certain risks an investor would not face if investing in markets directly. Management – Management risk may result in potential conflicts of interest relating to the obligations of the investment manager. Market – Market risk may subject the portfolio to experience losses caused by unexpected changes in a wide variety of factors. Operational –Operational risk may cause losses as a result of incidents caused by people, systems, and/or processes.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.