February 2023 / INVESTMENT INSIGHTS

Russia-Ukraine War One Year On

Ongoing war continues to reverberate through the economy and energy markets

Key Insights

- Ukraine is likely to continue to receive strong external financial support, but we still expect a deep restructuring of its sovereign debt.

- Sanctions have hit Russia’s economy hard and should continue to weigh on growth for some time.

- The eurozone economy has outperformed expectations, but with ongoing challenges around energy, a recession this year cannot be ruled out.

Russia’s invasion of Ukraine on February 24, 2022, has become the most significant conflict in Europe since the Second World War. The ensuing humanitarian crisis remains deeply concerning, with the lives of ordinary Ukrainians immeasurably disrupted.

The invasion itself was the catalyst for substantial economic and financial market upheaval in Europe and beyond. With the conflict entering a second year, we examine its impact on the economies of Ukraine, Russia, and Europe, as well as implications for energy and other commodities.

Ukraine—Economic Toll Makes Deep Debt Haircuts Likely

Ukraine’s wartime economy continues to face significant challenges, with gross domestic product (GDP) estimated to have shrunk by more than 30% in 2022. With continued attacks on infrastructure and power shortages, we expect economic activity to contract again this year, albeit at a low‑single‑digit rate. Meanwhile, although the budget deficit is expected to remain large, strong external support from Western governments and the International Monetary Fund is likely. This should help to plug the financing gap, which in turn should help to reduce reliance on monetary financing in 2023.

Given the immense pressure on Ukraine, external creditors agreed to a two‑year standstill on its sovereign debt in August. We believe that this will likely be the first step of the restructuring, with a deep haircut on the debt likely. It is difficult to predict the size of this debt reduction as it depends on the state of the Ukrainian economy at the time the restructuring is agreed. There will also be a political decision to be made about how much private creditors should share in the reconstruction cost.

The damage to infrastructure has been huge so far. When this war does eventually end, the scale of the reconstruction and recovery effort is likely to eclipse anything Europe has seen since World War II.

Russia—Sanctions Starting to Hurt

Deep and wide‑ranging sanctions have caused Russia’s economy to weaken considerably, with a contraction of around 3% anticipated for 2022. This year we expect further weakness, and we anticipate Russia’s economy will likely settle at a meaningfully lower level of growth over the long term. Iran is a useful comparison here as it has faced similar heavy sanctions from the U.S., which led to nominal GDP shrinking from around USD 644 billion in 2012 to an estimated USD 240 billion in 2020. This illustrates how painful sanctions can be if imposed over an extended period. However, it is important to note that as Russia is a large exporter of oil and gas, it will be more difficult to close off its economy from the rest of the world.

Europe—Energy Crisis Averted, but Challenges Lie Ahead

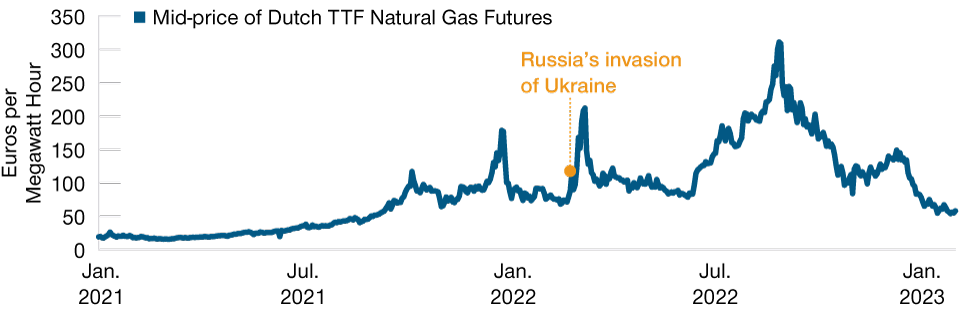

The eurozone economy has weakened but not as deeply as feared immediately after Russia invaded Ukraine. An energy crisis has been so far avoided as European countries largely succeeded in filling their gas storage facilities before the winter. This, combined with the mild winter, has helped wholesale gas prices come down meaningfully from their 2022 peaks. While this is encouraging, however, Europe’s transition from Russian gas remains a major challenge for 2023 and beyond, so it would be a mistake to assume the energy crisis is over. In many ways, it is only just beginning.

Europe’s gas infrastructure was set up to receive imports from Russia through pipelines, and it will require time and money to change this. Imports of liquefied natural gas (LNG) from the U.S. and Qatar offer a potential alternative, but it is unlikely there will be enough supply to meet Europe’s demand beyond the short term. There is also limited capacity in Europe to process LNG imports, and while there are plans to build new processing infrastructure, this will likely take several years to complete. In the long term, renewables will replace Russian imports as a key supplier of Europe’s energy needs—but it will take many years to build the required infrastructure to achieve this.

Energy Crisis Averted For Now

(Fig. 1) Milder winter has helped European gas prices retreat

As of January 31, 2023.

Past performance is not a reliable indicator of future performance.

Source: Bloomberg Finance L.P.

Against this backdrop, we believe that European countries are likely to continue to face challenges to obtain enough fossil fuels to meet demand in the winter of 2023 to 2024 and beyond. This could mean higher prices, which will likely require governments to continue subsidizing energy bills. We believe that this may weigh on growth and possibly tilt the bloc into recession later this year, particularly as the European Central Bank is expected to start quantitative tightening soon.

Commodities—Grain Prices Have Eased, but Risks Remain

In line with other commodities, grain prices have eased from their highs thanks to bumper crop supply and the grain deal struck between Ukraine and Russia. This may only be short‑term relief, however, as the deal needs to be renewed in March. A failure to extend the deal could lead to a rise in food prices, which could put pressure on lower‑income countries. Furthermore, Ukrainian farmers—who have been a key provider of wheat and other grains to emerging markets—have been hit hard since the war broke out, and their output is likely to fall meaningfully. Combined, these factors—plus the additional price pressures coming from less availability and higher prices of fertilizers—underline how precarious the situation is and reinforce the likelihood that we will live in a world of tight commodity markets for some time.

This tightness creates potential economic challenges and headwinds for global growth. Throughout 2022, growth was slow, which took demand pressure off commodity prices. But when the world economy does eventually rebound, so too will demand for commodities, and prices will likely rise as a result. This could feed through into higher inflation, which may weaken household purchasing power and weigh on growth. Although financial markets appear to have settled into living with this war, ongoing growth headwinds will likely persist.

With no clear path toward de‑escalation, the war is likely to grind on with ongoing implications for the economy and commodity markets. We expect Ukraine’s economy will continue to face significant challenges, and a large debt restructuring looks likely in the future. For Russia, sanctions are taking their toll and should continue to undermine growth for some time. While warmer weather has helped the eurozone economy perform better than expected and avoid an energy crisis, challenges lie ahead on this front and a recession at some point this year is a real possibility. Meanwhile, notwithstanding the vast economic burden, the physical toll of war remains a distressing reality for the people of Ukraine.

T. Rowe Price cautions that economic estimates and forward‑looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual outcomes could differ materially from those anticipated in estimates and forward‑looking statements, and future results could differ materially from historical performance. The information presented herein is shown for illustrative, informational purposes only. Forecasts are based on subjective estimates about market environments that may never occur. The historical data used as a basis for this analysis are based on information gathered by T. Rowe Price and from third‑party sources and have not been independently verified. Forward‑looking statements speak only as of the date they are made, and T. Rowe Price assumes no duty to and does not undertake to update forward‑looking statements.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

February 2023 / INVESTMENT INSIGHTS

February 2023 / INVESTMENT INSIGHTS