September 2023 / INVESTMENT INSIGHTS

Emerging Markets Bond Investing: A Q&A With Samy Muaddi

Managing through an unprecedented period for EM bond investors

Key Insights

- Complex market environments over recent years emphasize the importance of having a long‑term approach with fundamental research and risk‑awareness at its foundation.

- A disciplined risk management framework is critical in the emerging market debt space.

- While some emerging market countries are currently experiencing distress, this may lead to reforms and better policies that help improve future prospects.

Samy Muaddi recently marked his three‑year anniversary as lead manager of the Emerging Markets Bond Strategy. We discuss how he has managed the strategy through an unprecedented period for both emerging markets and fixed income more broadly. He talks about the successes and the lessons learned, describes his investment process, and emphasizes the importance of prudent risk management in the emerging market space.

Q. How would you describe your first three years as lead portfolio manager?

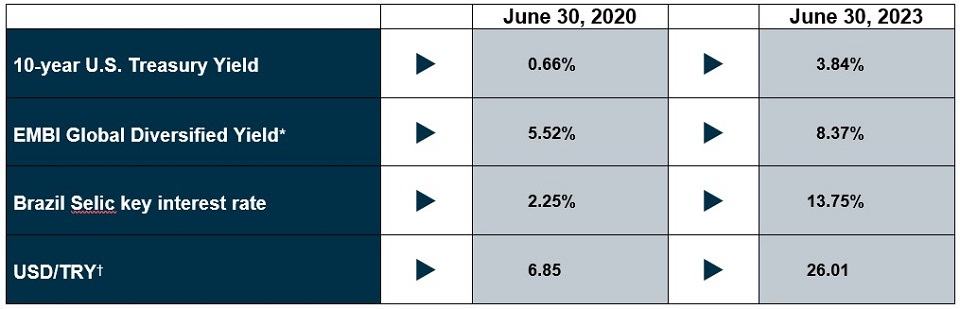

It has been quite a roller coaster—managing through a global pandemic, the outbreak of war in Ukraine, and central banks unleashing aggressive hiking cycles to respond to multi‑decade high inflation. The developments have brought about huge changes in markets—the 10‑year US Treasury yield was only 0.66% when I took over, but it was yielding over five times that level at around 3.84% on my three‑year anniversary.1 In emerging markets (EM), it’s a similar story—bond yields have risen considerably. Then there’s Russia, which has gone from trading with a credit spread above 100 basis points to having its entire market sanctioned to the point of residual value.

Significant Change in Market Dynamics

(Fig. 1) A comparison of prices and key metrics with three years ago

As of June 30, 2023.

Past performance is not a reliable indicator of future performance.

*Yield to maturity of the J.P. Morgan Emerging Markets Bond Index Global Diversified.

†USD/TRY exchange rate. TRY = Turkish lira.Source: Bloomberg Finance L.P., J.P. Morgan, analysis by T. Rowe Price (see Additional Disclosures).

It’s unsurprising that these multiple crosscurrents have weighed on the overall performance of the sector. But I’m proud that the composite outperformed its benchmark index during such a challenging period.2 Outperforming when markets are rising is typically “easier,” but mitigating loss when markets are falling is what separates managers. I’m pleased that we have been able to do that for our clients during such challenging circumstances.

Q. What have been your biggest investment successes? What have been your mistakes, and what lessons have you learned?

EM risk is not evenly distributed, so it’s important to get the big calls right. Russia’s invasion of Ukraine in February 2022 was the catalyst for substantial economic and financial market stress that reshaped the EM investing sphere. The onset of heavy Western sanctions resulted in the collapse in value of Russian government and quasi‑government bonds. Thanks to our research platform, we were able to help mitigate the impact for our clients, which is something I’m very proud of. How did we do this? In the final quarter of 2021, our dedicated research analysts for the region flagged that Russian rhetoric was becoming more aggressive and that the tail risk of military escalation was rising. In response, we reduced Russian exposure across our EM debt portfolios in the months prior to the invasion.

Our research platform also benefited the strategy in other areas. We identified credit upgrade stories, such as Angola and Oman, early. We also identified areas of deterioration and potential for a rating downgrade such as Ghana, which went into default in late 2022.

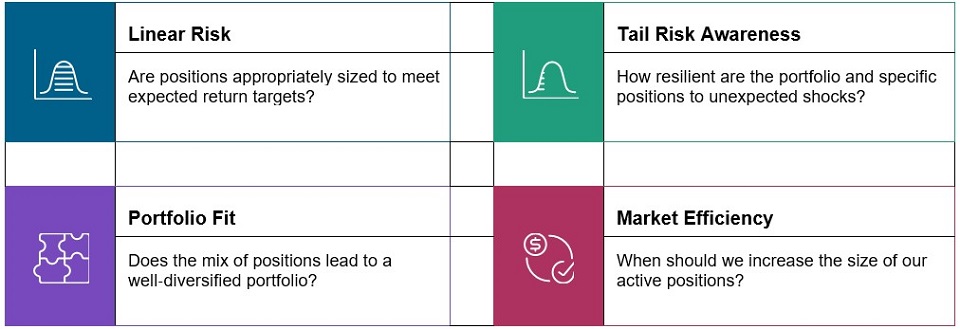

Risk Management Approach

(Fig. 2) Four dimensions of risk management

As of June 30, 2023.

Source: T. Rowe Price.

Not everything has gone right, so it’s been important to recognize that and learn. A contrarian view on China property implemented during the fourth quarter of 2021 and first quarter of 2022 was a bad call that weighed on performance. But our risk management approach helped mitigate the extent of losses, underscoring the importance of a disciplined risk framework.

Q. How would you describe your investment process and style?

At the heart of our process is fundamental research and active involvement in the full emerging markets opportunity set. Emerging markets remain one of the last plentiful sources of pricing inefficiencies in the financial world. Dispersion of asset prices, lack of transparency, information gaps, illiquidity, and other technical factors can cause significant valuation anomalies for us, as active investment managers, to potentially exploit. We believe that our long‑term focus and extensive research resources that integrate our proprietary corporate; sovereign; equity; and environmental, social, and governance (ESG) analysis allows for the early identification of countries with the greatest long‑term potential for rerating and outperformance, as well as those countries with deteriorating credit profiles or increased risks due to ESG considerations. This research is used to build a portfolio that balances conviction, flexibility, and risk‑awareness.

Q. Can you tell me more about your risk management approach?

Risk management is critical. I have evolved our approach in three distinct ways during my tenure. First, the implementation of a position‑sizing framework to help with diversification and the balancing of risk exposures. This means the portfolio does not become overly concentrated in riskier segments of the market. Allocations to distressed issuers are capped at 2% net, frontier issuers at 4% net, and mainstream issuers at 10% net.

Second, we have an anchoring framework to assess which countries meet the distressed threshold. This country‑specific debt sustainability analysis evaluates four interrelated components (fiscal; external; social, political, and institutional; and contingent assets and liabilities). Each represents a potential anchor to market confidence and access to capital markets throughout an economic cycle. (Readers can learn more in “Foundations of Emerging Market Bond Investing” published in May 2023.)

Third, we developed a 4D risk management process in collaboration with our credit and quantitative teams. This looks at four key dimensions of portfolio risk: linear risk (Are positions appropriately sized to meet expected return targets?); tail risk awareness (How resilient are the portfolio and specific positions to unexpected market or exogenous shocks?); portfolio fit (Does the mix of positions lead to a well‑diversified portfolio?); and market efficiency (When should the size of our active positions be increased?).

Risk management is ingrained in every step of my investment process, from bottom‑up fundamental research to position sizing and the incorporation of custom‑built quantitative models that provide holistic analysis of risk. Even once a position is implemented, we continue to monitor for risks as circumstances can change quickly in emerging markets.

Q. How do you see the market environment for emerging market debt going forward?

Emerging markets are going through their greatest period of debt distress since the 1990s. The cycle is not over—I anticipate more sovereign defaults, with recoveries potentially below the historical average. This is a consequence of three issues: first, a narrow group of developing countries losing market access due to policy slippage; second, this slippage is occurring at a time of aggressive tightening in financial conditions; and third, untested policy architecture is slowing the adoption of sustainable, multilateral supported solutions.

However, we have been here before. The concept of creative‑destructive tells us that the best policies can be formed as a result of stress. This happened in the 1990s when we had the Asian financial crisis and the Russian default. This was followed by a five‑year period of reform that set off a 20‑year boom in emerging markets. So, it may take time for distressed emerging market countries to work through their issues, but we are optimistic for reforms and better policies.

Risks—the following risks are materially relevant to the portfolio:

Contingent convertible bond—Contingent Convertible Bonds may be subject to additional risks linked to: capital structure inversion, trigger levels, coupon cancellations, call extensions, yield/valuation, conversions, write downs, industry concentration and liquidity, among others.

Country (Russia and Ukraine)—Russian and Ukrainian investments may be subject to higher risks associated with custody and counterparties, liquidity, market disruptions, as well as strong or sudden political risks.

Credit—Credit risk arises when an issuer’s financial health deteriorates and/or it fails to fulfill its financial obligations to the portfolio.

Currency—Currency exchange rate movements could reduce investment gains or increase investment losses.

Default—Default risk may occur if the issuers of certain bonds become unable or unwilling to make payments on their bonds.

Derivative—Derivatives may be used to create leverage which could expose the portfolio to higher volatility and/or losses that are significantly greater than the cost of the derivative.

Distressed or defaulted debt—Distressed or defaulted debt securities may bear substantially higher degree of risks linked to recovery, liquidity and valuation.

Emerging markets—Emerging markets are less established than developed markets and therefore involve higher risks.

Frontier markets—Frontier markets are less mature than emerging markets and typically have higher risks, including limited investability and liquidity.

High yield bond—High yield debt securities are generally subject to greater risk of issuer debt restructuring or default, higher liquidity risk and greater sensitivity to market conditions.

Interest rate—Interest rate risk is the potential for losses in fixed‑income investments as a result of unexpected changes in interest rates.

Issuer concentration—Issuer concentration risk may result in performance being more strongly affected by any business, industry, economic, financial or market conditions affecting those issuers in which the portfolio’s assets are concentrated.

Liquidity—Liquidity risk may result in securities becoming hard to value or trade within a desired timeframe at a fair price.

Sector concentration—Sector concentration risk may result in performance being more strongly affected by any business, industry, economic, financial or market conditions affecting a particular sector in which the portfolio’s assets are concentrated.

General Portfolio Risks

Capital risk—The value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between the base currency of the portfolio and the currency in which you subscribed, if different.

Counterparty—Counterparty risk may materialise if an entity with which the portfolio does business becomes unwilling or unable to meet its obligations to the portfolio.

ESG and sustainability—ESG and Sustainability risk may result in a material negative impact on the value of an investment and performance of the portfolio.

Geographic concentration—Geographic concentration risk may result in performance being more strongly affected by any social, political, economic, environmental or market conditions affecting those countries or regions in which the portfolio’s assets are concentrated.

Hedging—Hedging measures involve costs and may work imperfectly, may not be feasible at times, or may fail completely.

Investment portfolio—Investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Management—Management risk may result in potential conflicts of interest relating to the obligations of the investment manager.

Market—Market risk may subject the portfolio to experience losses caused by unexpected changes in a wide variety of factors.

Operational—Operational risk may cause losses as a result of incidents caused by people, systems, and/or processes.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

September 2023 / INVESTMENT INSIGHTS

September 2023 / INVESTMENT INSIGHTS