February 2023 / ASSET ALLOCATION STRATEGY

A Long-Awaited Reversal

Near-term tailwinds could favor international markets

Key Insights

- After nearly a decade of outperformance, U.S. equities trailed the rest of the world in 2022, and many wonder if this shift in performance will continue in 2023.

- In our view, improved economic outlooks in China and Europe, coupled with a weaker U.S. dollar, may favor international markets in the near term.

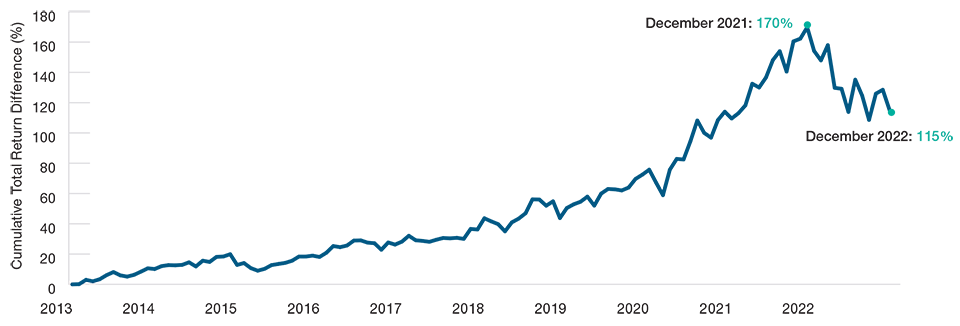

For the nine years from 2013 through 2021, MSCI indices show that U.S. equities outpaced the rest of the world by 170%, cumulatively. However, the cumulative U.S. equity outperformance significantly narrowed in 2022 to 115% (Figure 1). Many investors are wondering what has driven this shift and if the trend is likely to continue in 2023.

U.S. Equity Performance Versus the Rest of the World

(Fig. 1) Index performance: MSCI U.S. Index versus MSCI All Country World Index ex-U.S. (in local currency)

January 31, 2013 through December 31, 2022.

Past performance is not a reliable indicator of future performance.

Sources: T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. MSCI data. See Additional Disclosures

Notably, improved economic outlooks in China and Europe appear to favor non-U.S. equites. After the recent relaxation of COVID-related restrictions in China, we believe economic activity there is poised to increase significantly in 2023. Increased credit use by Chinese borrowers—which historically has had a strong lagged effect on the country’s economy—is also likely to boost reported activity.

In Europe, natural gas supply disruptions caused by Russia’s invasion of Ukraine were expected to cause widespread power shortages and significantly curtail economic activity during the winter. However, relatively warm weather, coupled with imports of liquefied natural gas, allowed storage levels to rebound to nearly full levels by year-end. So far, industrial activity in Europe has largely remained unaffected, and the region’s near-term growth outlook has improved considerably. An expected recovery in demand from China should also be beneficial.

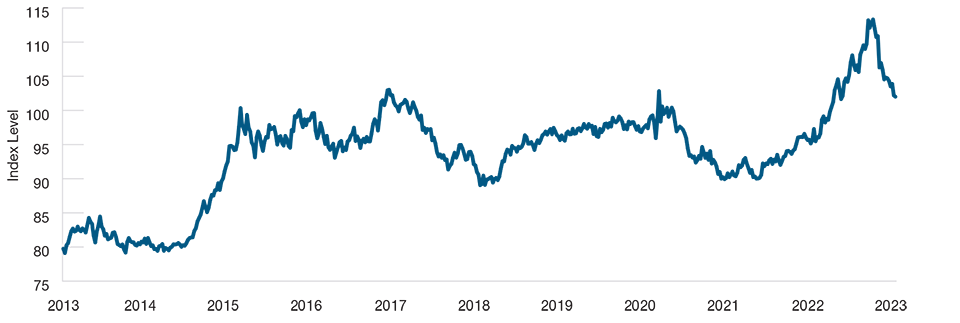

Meanwhile, the strong U.S. dollar has begun to fade—a weaker dollar is typically supportive for non-U.S. stocks as it tends to increase the dollar value of dividends earned in foreign currencies. We believe the dollar is likely to weaken further as interest rate differentials narrow, reflecting a potential dovish shift in U.S. Federal Reserve policy relative to other major central banks. Improved economic outlooks in China and Europe could also narrow regional economic growth differentials, further weighing on the dollar.

A Weaker U.S. Dollar

(Fig. 2) U.S. Dollar Index

10 years ended January 23, 2023.

Past performance is not a reliable indicator of future performance.

Source: Bloomberg Finance L.P.

The year 2022 brought a notable shift in performance for global equities. In our view, improved outlooks in China and Europe, coupled with a weaker U.S. dollar, should be tailwinds for non-U.S. equity markets in the near term. As a result, T. Rowe Price’s Asset Allocation Committee is maintaining an overweight position in non-U.S. equities relative to U.S. equities.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

February 2023 / INVESTMENT INSIGHTS