October 2022 / INVESTMENT INSIGHTS

Click Here – Has the Boom in Digital Advertising Peaked?

Four key factors set to shape the outlook for digital advertising

Key Insights

- From relatively low penetration a decade ago, digital advertising today serves as the primary platform for most companies’ marketing activit.

- However, a confluence of factors is contributing to a current recession in digital advertising spending, raising questions about the sector’s long‑term growth profile.

- Yet, powerful structural characteristics supporting the industry are central to its longer‑term prospects.

The growth in digital advertising spending in recent years has been nothing short of spectacular. From relatively low penetration a decade ago, digital advertising today serves as the primary platform for most companies’ marketing activity. And it’s not difficult to see why. More efficient and quantifiable than any other advertising solution, digital advertising has offered superior returns on investment for companies. Recently, however, various factors have combined to negatively impact the digital sector. Has digital advertising reached its peak, and can the growth profile of previous years be repeated? Here we look at four key reasons why the near‑term challenges digital advertising faces are expected to be a temporary blip on the industry’s longer‑term growth profile.

Digital Is the New Norm

Targeted, multi‑channel, advertising providing easily measurable results

1. Powerful Long‑Term Tailwinds

The powerful tailwinds that have supported the rapid growth in digital advertising over the past decade—growing internet penetration, rising popularity of smartphones, increase in social media usage, rising penetration of e‑commerce, increased investment in technology and digital platforms—are very much intact, and it is these same tailwinds that are expected to underpin growth moving forward. These secular trends show no sign of abating, and as has been the case over the past decade, we expect digital advertising to continue to outperform other forms of media for years to come.

The past year has been illuminating in the sense that it has highlighted the underappreciated cyclicality of digital advertising. Amid a more volatile macro environment, where spending visibility has become less clear, it has been a little surprising to see how quickly companies have moved to cut the digital portion of their overall marketing budgets. Nevertheless, despite the recessionary period we are currently seeing, the long‑term potential that digital advertising offers is hard to deny. One of the main reasons is the opportunity for superior returns on investment.

2. Opportunity for Attractive Returns on Investment

Digital advertising offers companies the potential for superior returns on invested capital. Advertising no longer needs to be a case of going in blind. Instead of generic advertisements aimed at no particular audience, the data‑driven nature of digital advertising provides more accurate, measurable, and immediate customer feedback. This allows marketing teams to plan campaigns in a much better—and more targeted—way, zeroing in on a specific audience and providing tailored offers or products to the very people most likely to act on those offers. This compares with more traditional avenues like print media or billboards, which provide zero feedback or customer insights.

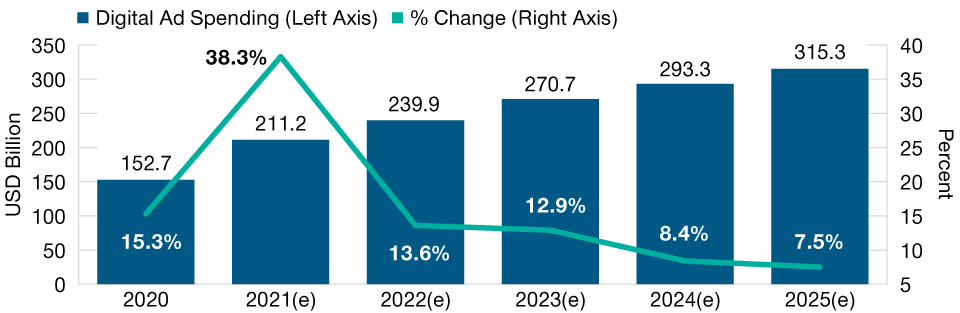

It is also worth noting that, despite the sharp deceleration in digital ad spending seen in 2022, which also needs to be considered in the context of the pandemic‑distorted levels of 2021, the U.S. digital advertising market is expected to continue to grow at a steady pace. Spending in the U.S. is anticipated to surpass USD 300 billion by 2025, which would account for roughly 75% of all media spending (Figure 1).1

3. Digital Is a “One‑Stop Shop”

The one‑stop shop nature of digital advertising should see it continue to take market share from other, more traditional, advertising channels. Whereas print can only serve text and picture ads, radio only audio ads, and television only video ads, the internet can serve all of the above and more. As such, digital advertising is likely to continue cannibalizing these legacy advertising forms. The internet wraps all of their individual strengths into one.

4. The Shift Toward E‑commerce

Additionally, the shift toward e‑commerce, which was significantly boosted by the restrictions imposed during the coronavirus pandemic, is turning more consumers away from brick‑and‑mortar retail and toward online shopping. This is creating greater opportunities for digital advertisers to reach an ever‑growing online consumer audience.

U.S. Digital Advertising Spending, 2020–2025(E)

(Fig. 1) Anticipated growth in percentage and USD billion terms

Actual digital advertising spending data used for 2020, with estimated (e) data used from 2021-2025.

Data estimates are based on the analysis of various elements related to the ad spending market, including macro-level economic conditions; historical trends of the advertising market; historical trends of each medium in relation to other = media; reported revenues from major ad publishers; consumer media consumption trends; consumer device usage trends. eMarketer interviews with executives at ad agencies, brands, media publishers and other industry leaders.

Actual outcomes may differ materially from estimates.

Includes advertising that appears on desktop and laptop computers as well as mobile phones, tablets, and other internet‑connected devices.

Source: eMarketer. Analysis by T. Rowe Price

Short‑Term Challenges

Digital advertising spending soared during pandemic‑induced lockdowns because of increased screen time and new digital advertising channels, but more recently, a confluence of factors has caused the market to cool down considerably.

- First, the lockdowns provided a vast captive audience for digital advertising. Now that they are over, people are returning to everyday life. That means less time on screens so less time to see ads.

- The market environment has become more difficult. Higher inflation has caused businesses to reexamine spending, while also pushing consumers to spend less. The last 12 months have shown us how quickly digital spending can be turned off in the short term—much more easily than TV advertising, for example. That said, over the medium term, digital advertising is expected to recover, while TV advertising contracts are likely to be renegotiated lower at renewal.

- The digital advertising landscape has also been shaken up in a big way by the privacy and tracking changes introduced by Apple on its iOS platform in April 2021. The implementation of Apple’s App Tracking Transparency (ATT) feature to its iOS system requires platforms to get permission from users in order to track their activity while using iPhone and iPad devices. For digital advertising companies, where collecting and analyzing user data is crucial, this has effectively changed the rules of the game and forces companies to adapt to a new landscape.

Data Privacy and Tracking Changes

This latter challenge—Apple’s introduction of the ATT feature—is particularly noteworthy in that it has had very different impacts on two of the dominant players in the digital advertising space. For Alphabet and Meta, for example, the impact of the changes to Apple’s privacy rules was far more challenging for one company than the other.

Meta underperformed significantly over the past 12 months, to the point that, at the time of writing, the company was trading around its cheapest valuation levels in a long time. The introduction of Apple’s ATT feature to its iOS platform has proved a major blow for social/interactive media companies in particular, as companies like Meta rely on this data to target and measure ads on their apps. Meta estimates that Apple’s ATT feature will decrease the company’s 2022 revenue by around USD 10 billion, as the majority of iPhone and iPad users are choosing to opt out of ad tracking.

Alphabet in comparison, posted stronger performance in recent quarters, as it was less impacted by the privacy changes made by Apple to its iOS platform. A main reason for this is that Alphabet organically collects vast amounts of user data through its search engine, making it much less vulnerable to users opting out of mobile online tracking through Apple’s ATT feature. Alphabet also collects data from its 3 billion Android operating system devices worldwide—devices that are little impacted by changes to Apple’s operating system. As such, Alphabet has been retaining more of the valuable information pertaining to consumer buying intentions and habits, which we believe makes its platform more attractive to advertisers.

Whether the decrease in digital advertising spending is a downturn or just a stabilization, the near‑term impact of the post‑pandemic environment on advertising and related industries is undeniable. Companies that overextended during the pandemic by increasing ad spend or head count are now pulling back. Longer term, however, we anticipate spending growth to resume to a more normalized path. The digital advertising market is expected to remain robust as more advertisers turn to digital for the considerable benefits it offers compared with traditional media channels, including greater targeting and measurability. In terms of the leading incumbents in the space, we prefer those businesses that are masters of their own fortune, in this case, data collection—the lifeblood of digital advertisers—rather than reliant on collecting this data via others.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

October 2022 / INVESTMENT INSIGHTS

November 2022 / INVESTMENT INSIGHTS