July 2022 / INVESTMENT INSIGHTS

Four Key Considerations Within the U.S. Energy Sector

Looking for “multiple ways to win” in the broad energy space

Key Insights

- The cyclical nature of the energy sector has been clearly demonstrated over the past 18 months, underscoring its sensitivity to the macroeconomic environment.

- Energy demand has recovered faster than many anticipated as economic activity has rebounded strongly from the depths of the pandemic‑driven slowdown.

- Having more than doubled in weight within the S&P 500 Index, how much energy exposure, and in which areas, has become a key consideration for U.S. equity investors.

The highly cyclical nature of the global energy sector has been acutely demonstrated over the past 18 months, underscoring the sector’s sensitivity to the macroeconomic environment. This has certainly been true in the U.S., where energy demand has recovered faster than many anticipated as economic activity has rebounded strongly from the depths of the pandemic‑driven slowdown.

The Energy Sector Has Surged

Four Key Factors to Consider

Source: T. Rowe Price.

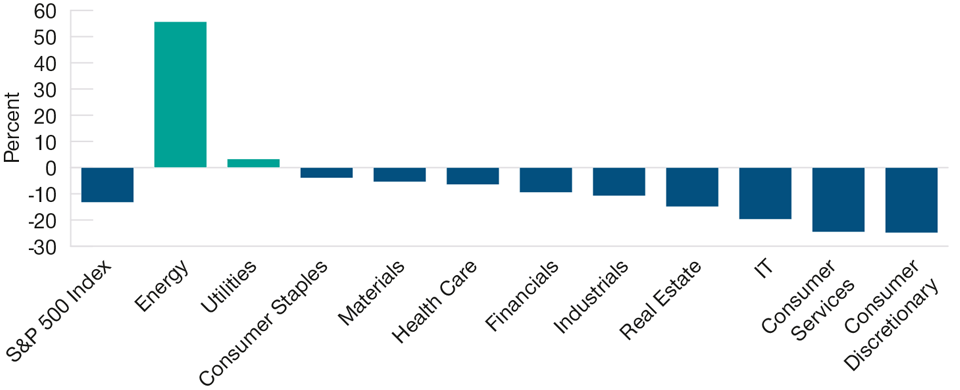

During the first five months of 2022, the energy sector within the S&P 500 Index has advanced almost 60%, by far the best‑performing area of the U.S. equity market, with the next best‑performing sector (utilities) up by less than 5% for the year. Since the winter of 2020, the energy sector’s weight within the index has gone from less than 2% to almost 5% as of the end of May 2022. Having more than doubled, how much energy exposure, and in which areas, has become a key consideration for investors in U.S. equities.

Not All Energy Companies Are the Same

A big part of the energy sector rally has been the soaring prices of crude oil and natural gas. However, it is important to remember the diversity of companies within the energy sector, spanning integrated multinationals; exploration and production companies; and refining, transportation, and equipment and services companies. Meanwhile, in terms of energy source, the outlook for natural gas, for example, is quite different to that of crude oil, in our view. We believe the former is undergoing a longer‑lasting, secular disruption as a result of the Ukraine‑Russia conflict, whereas the latter is likely to remain heavily influenced by shorter‑term supply and demand factors within a backdrop of ongoing productivity gains.

The Energy Sector Has Massively Outperformed in 2022

(Fig. 1) S&P 500 Index sector returns

As of May 31, 2022.

Past performance is not a reliable indicator of future performance. Returns shown are price returns. Period covered is January 1, 2022, to May 31, 2022.

Source: S&P Dow Jones Indices LLC (see Additional Disclosure). Analysis by T. Rowe Price.

Impact of Higher Prices Not Limited to Energy Companies

The sharp rise in oil and gas prices recently is not only significant for companies within the energy sector—it also alters the competitive landscape for many companies across the broader market. For example, in the materials sector, certain U.S. companies with operational exposure to natural gas have benefited from cheaper input costs than their European competitors, due to the cheaper cost of natural gas supply in the U.S. In turn, U.S. companies can charge similar prices to their European competitors but generate greater profits due to the input cost advantages. More broadly, we believe that companies with significant liquified natural gas operations—some U.S. utility names, for example—could benefit from a meaningful tailwind going forward, due to anticipated increased demand for natural gas.

Finding “Multiple Ways to Win”

We are focused on investing in companies that are less reliant on higher—or even stable—commodity prices to drive future returns. Looking at where we are today, we expect oil prices to decline from current levels and for the price of natural gas to remain structurally higher. However, predicting price levels and the timing of inflection points in commodity markets is notoriously difficult. Accordingly, we look for opportunities where the potential for outperformance is not dependent on commodity prices. Strong management, sound capital allocation, and a sound balance sheet—are some of the additional elements that could help drive company outperformance.

Active and Opportunistic

Back in the early days of the pandemic, in the middle of 2020, we took the opportunity to significantly add to our energy holdings, during a period of relative weakness. We moved from a sizable underweight position in energy, to an equally large overweight position. Over recent quarters, however, we have been progressively reducing this overweight stance, taking advantage of sector strength to trim our energy exposure. As of May 31, 2022, we are broadly in line with the comparative benchmark weighting (Russell 1000 Value Index), at around 8.4%. Drilling down, our portfolio holds more natural gas exposure and less crude oil exposure than the comparative benchmark. We are invested in companies that we believe can deliver strong returns to shareholders across a relatively wide range of commodity prices.

The continuing Ukraine‑Russia conflict is likely to remain a pivotal influence on energy prices moving forward. If hostilities continue and the war grinds on, supply constraints will keep upward pressure on natural gas prices, in particular. There are also concerns that rising interest rates will slow the economy, perhaps to the point of recession, which would take a significant bite out of overall energy demand. Given the uncertain near‑term outlook, we are comfortable maintaining a sector exposure broadly in line with the comparative Russell 1000 Value benchmark, but with a slightly more defensive tilt via a lower direct exposure to oil and gas companies. This approach is designed to help manage challenges throughout the market cycle, and within changing price environments.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

June 2022 / INVESTMENT INSIGHTS