David Stanley, Portfolio Manager in T. Rowe Price’s Fixed Income division, Citywire rating

David Stanley is a portfolio manager in the Fixed Income Division at T. Rowe Price, responsible for European corporate bond selection. He is a vice president of T. Rowe Price Group, Inc. and T. Rowe Price International Ltd.

Stanley has 32 years of investment experience, 16 of which have been at T. Rowe Price. Prior to joining the London team in 2003, he was employed by Bank of America Capital Management, where he was a director and portfolio manager responsible for the analysis of international corporate bonds and cash investments. Prior to working for Bank of America, David Stanley was employed for eight years in Morgan Stanley Asset Management's London office, where he served as a fixed income fund manager responsible for international corporate bonds. Stanley earned a B.A. in economics and social studies from the University of Manchester.

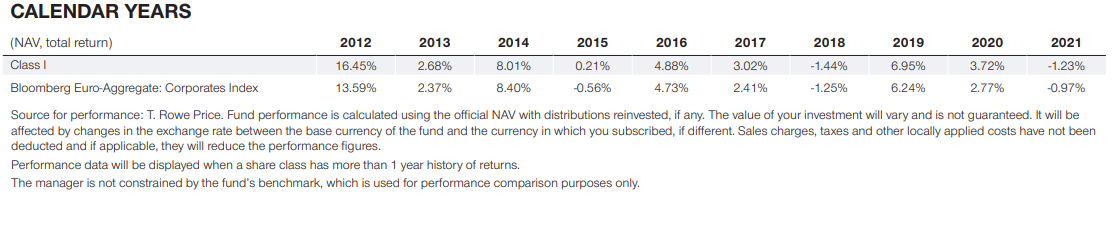

In May 2022, Citywire Selector published a ranking of the top five fund managers who have spent the most consecutive months rated above the benchmark. T. Rowe Price’s Citywire AA-rated David Stanley has been ranked third with the longest consecutive Citywire rating.1 The publication informed that since November 2011, Stanley has summed 127 months of consecutive Citywire ratings, out of which 52 were spent as AAA-rated. This comes from one single fund, the T. Rowe Price Funds SICAV Responsible Euro Corporate Bond Fund, which Stanley has managed for two decades. The Responsible Euro Corporate Bond Fund, also rated with Morningstar’s five stars, celebrates its 20 anniversary this year. The fund aims to maximise the value of its shares through both growth in the value of, and income from, its investments. It is actively managed and invests mainly in a diversified portfolio of corporate bonds.

How do the Citywire Selector Ratings work?

Citywire launched its Fund Manager Ratings over 18 years ago. The ratings calculate the total percentage returns generated by individual fund managers in a sector and show which funds they are currently managing. These ratings consider three-year performance and are updated monthly. To be rated, a fund manager will need to beat his or her benchmark over a three-year period. According to the publication, the methodology is approved by AKG, and independent actuary.

1 https://citywireselector.com/news/the-five-pms-with-the-longest-consecutive-citywire-rating/a2388449?re=97450&refea=327999

2 https://citywireselector.com/news/citywire-fund-manager-ratings-frequently-asked-questions/a703353

Fund Risks

The following risks are materially relevant to the portfolio Credit - Credit risk arises when an issuer's financial health deteriorates and/or it fails to fulfil its financial obligations to the fund. Default - Default risk may occur if the issuers of certain bonds become unable or unwilling to make payments on their bonds. Derivatives - derivatives may result in losses that are significantly greater than the cost of the derivative. Emerging markets - Emerging markets are less established than developed markets and therefore involve higher risks. Interest rate - Interest rate risk is the potential for losses in fixed-income investments as a result of unexpected changes in interest rates. Liquidity - Liquidity risk may result in securities becoming hard to value or trade within a desired timeframe at a fair price. Sector concentration - Sector concentration risk may result in performance being more strongly affected by any business, industry, economic, financial or market conditions affecting a particular sector in which the fund's assets are concentrated. Total return swap - Total return swap contracts may expose the fund to additional risks, including market, counterparty and operational risks as well as risks linked to the use of collateral arrangements. General fund risks - to be read in conjunction with the material fund risks above. Counterparty - Counterparty risk may materialise if an entity with which the fund does business becomes unwilling or unable to meet its obligations to the fund. ESG and sustainability - ESG and Sustainability risk may result in a material negative impact on the value of an investment and performance of the fund. Geographic concentration - Geographic concentration risk may result in performance being more strongly affected by any social, political, economic, environmental or market conditions affecting those countries or regions in which the Fund’s assets are concentrated. Hedging - Hedging measures involve costs and may work imperfectly, may not be feasible at times, or may fail completely. Investment fund - Investing in funds involves certain risks an investor would not face if investing in markets directly. Management - Management risk may result in potential conflicts of interest relating to the obligations of the investment manager. Market - Market risk may subject the fund to experience losses caused by unexpected changes in a wide variety of factors. Operational - Operational risk may cause losses as a result of incidents caused by people, systems, and/or processes. ABOUT T. ROWE PRICE Founded in 1937, Baltimore-based T. Rowe Price Group, Inc. is a global investment management firm with €1,402.8 billion in assets under management in assets under management as of March 31, 20223. The company offers a broad range of commingled funds, sub-advisory services, separate account management and related services for advisors, institutions, financial intermediaries and retirement plan sponsors. The company also offers sophisticated investment planning and guidance tools. T. Rowe Price's disciplined, risk-conscious investment approach focuses on diversification, style consistency and fundamental research. For more information, visit troweprice.com. IMPORTANT INFORMATION The funds are sub-funds of the T. Rowe Price Funds SICAV, a Luxembourg investment company with variable capital which is registered with Commission de Surveillance du Secteur Financier and which qualifies as an undertaking for collective investment in transferable securities (“UCITS”). Full details of the objectives, investment policies and risks are located in the prospectus which is available with the key investor information documents in English and in an official language of the jurisdictions in which the Funds are registered for public sale, together with the articles of incorporation and annual and semi-annual reports (together “Fund Documents”). Any decision to invest should be made on the basis of the Fund Documents which are available free of charge from the local representative, local information/paying agent or from authorised distributors. They can also be found along with a summary of investor rights in English at www.troweprice.com. The Management Company reserves the right to terminate marketing arrangements. The latest fund prices are available online from Morningstar. This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested. The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction. Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price. The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction. EEA - Unless indicated otherwise this material is issued and approved by T. Rowe Price (Luxembourg) Management S.à r.l. 35 Boulevard du Prince Henri L-1724 Luxembourg which is authorised and regulated by the Luxembourg Commission de Surveillance du Secteur Financier. For Professional Clients only. ADDITIONAL INFORMATION The Morningstar rating is sourced from Morningstar. ©2022 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Citywire Data Source: Citywire – where the fund manager is rated by Citywire, the rating is based on the manager’s 3-year risk adjusted performance. For further information on ratings methodology, please visit www.aboutcitywire.com. 2255793