January 2022 / INVESTMENT INSIGHTS

Investment ideas for the next 12 months

Our Multi-Asset Solutions Team share a range of investment ideas to position portfolios for the opportunities and challenges of 2022

Key Insights

- The recovery from the worst of the pandemic is ushering in a new regime marked by decelerating growth, elevated inflation and a hawkish monetary policy.

- We believe five themes will dominate markets over the next 12 months: slowing growth, shifting policy, sorting fundamentals, seeking sustainability and softening returns.

- We have identified a range of investment ideas we believe may be effective in helping to navigate portfolios through the period ahead.

The COVID pandemic whiplashed the global economy in 2020, resulting in the largest-ever quarterly contraction immediately followed by the strongest quarter’s growth in memory. 2021 has been more stable: supported by generous monetary and fiscal stimulus, the global economy has continued its recovery, leading to surging demand. Supply has struggled to keep up, however, resulting in bottlenecks, rising prices and signs of decelerating economic growth. The world is healing, but it has not recovered yet.

In 2022, investors will need to adapt to this post-pandemic ‘abnormal normality’. Policymakers must carefully balance controlling inflation with supporting economies that are still dealing with the pandemic. In addition, markets may be at the cusp of a major regime change: a shift to elevated inflation, a shift to rising bond yields, a shift to tighter monetary and fiscal policy. Combined with rich valuations across asset classes, this may lead to uncertainty as investors grapple with unfamiliar challenges.

Although uncertainty can quickly change the circumstances – such as the discovery of the Omicron variant of the coronavirus in November 2021 – we have identified five key themes that we believe will drive the performance of markets over the coming 12 months and beyond:

- Slowing growth

- Shifting policy

- Sorting fundamentals

- Seeking sustainability

- Softening returns

1. Slowing growth

We expect the global economy to slow in 2022 as supply catches up with demand. Supply bottlenecks need time to abate, which may delay the recovery but will not derail it. Inflation will likely persist.

Despite headwinds to growth – such as new COVID variants, supply bottlenecks and labour shortages in some countries – we believe the global recovery is on track. Indeed, the spread of the Delta variant may have delayed economic activity rather than derailing it – meaning growth in the coming quarters could be modestly more robust than it otherwise might have been.

Although the fiscal and monetary stimulus measures that sustained the initial stages of the recovery appear to have peaked, key central banks are likely to move only gradually to a tightening stance. As the tailwinds of stimulus fade, we believe the focus of growth will shift to infrastructure spending, including the green transition.

The key question is whether the surge in inflation proves to be transitory or persistent. Inflation in many key economies is currently at levels not seen this century, leaving markets uncertain as to how best to react. Investors will need to watch closely to see what steps fiscal authorities and central banks take to stem price pressures while sustaining growth.

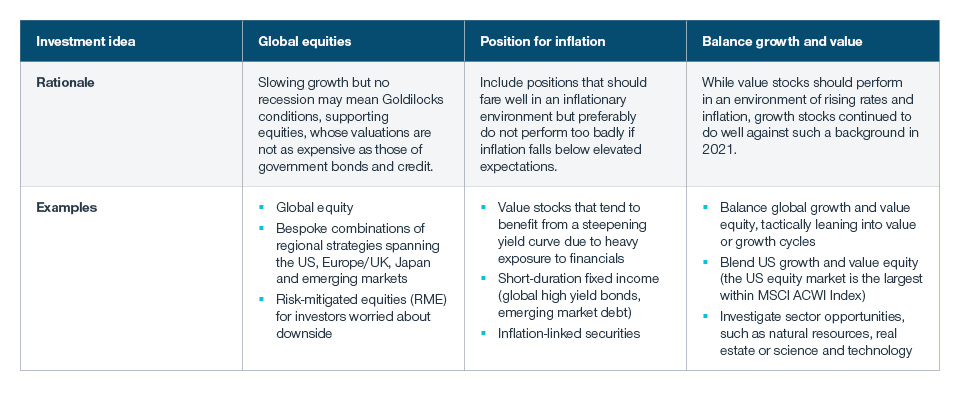

Investment ideas

Click to enlarge

2. Shifting policy

The regime of ultra-accommodative policy is shifting to tightening. Investors need to navigate the volatility that may ensue in both equity and fixed income markets.

We are seeing a gradual cyclical shift towards more hawkish, but unsynchronized, monetary policies worldwide. Although the European Central Bank remains cautious and the Bank of Japan is unlikely to change its dovish policy, the US Federal Reserve (Fed) has begun to taper its quantitative easing measures and the Bank of England is expected to start hiking rates around the turn of the year. Meanwhile, several emerging market (EM) central banks have started to raise interest rates to combat inflation.

With tapering on the table and inflationary pressures visible, the tide seems to be finally turning towards higher interest rates. However, the Fed appears to want to move slowly, meaning US interest rates could remain range-bound heading into 2022. Fiscal policies, including the potential for higher US tax rates and the continuing conflict over the US debt ceiling, may also impact fixed income markets, contributing to volatility.

For investors with income needs, we believe this may be a good time to diversify across bond sectors and regions. While credit spreads continue to tighten across most sectors, global dispersion highlights the importance of credit selection – in global high yield and EM debt, for example.

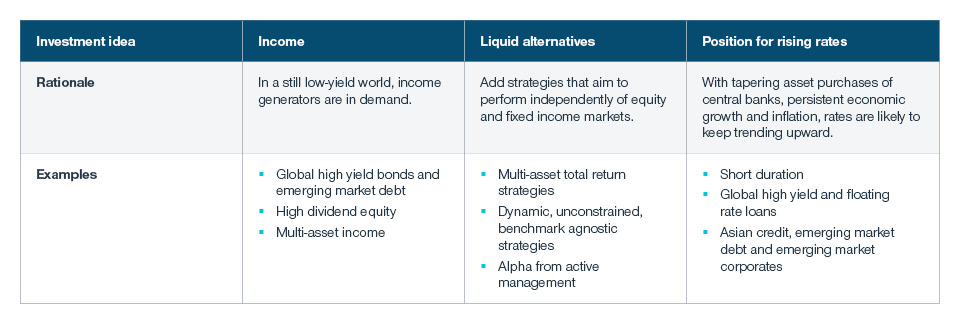

Investment ideas

Click to enlarge

3. Sorting fundamentals

Some secular forces that have supported earnings for decades may be fading as new ones emerge. Investors will need to identify fundamentals to select the likely winners and avoid the likely losers.

Equity valuations and investor sentiment both appear elevated heading into 2022 after global markets enjoyed an almost uninterrupted upward march during 2021. However, while forward earnings estimates were consistently revised upwards through the first half of the year, they flattened out in the third quarter.

The key question now is whether the long-term trend towards wider profit margins over the past three decades will be reversed. This trend has been driven by several factors, including globalisation, digitisation, falling real interest rates and lower corporate tax rates. However, globalisation may have peaked, interest rates would appear to have little room to fall further, and US corporate tax rates may increase. We believe that some long-term secular themes – such as the disruptive impact of technology across many industries – will endure. However, a cyclical recovery may create potential opportunities in value sectors, as well as in Japanese and emerging market equities. Diversification and careful security selection will remain critical.

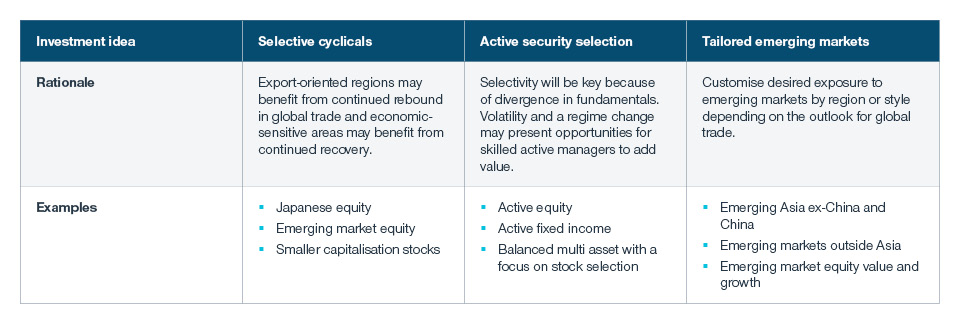

Investment ideas

Click to enlarge

4. Seeking sustainability

The transition to clean energy will be long and uneven. In the meantime, during the green transition, energy prices may remain elevated.

In the aftermath of the recent COP26 summit, we believe the sustainability of economic systems – in both the short and in the long term – is likely to remain high on the global policy agenda in 2022. Concerns include the vulnerability of global shipping networks and supply chains, natural gas shortages in Europe and rapid demand growth in China, and the longer-term need for investments to reduce carbon emissions. We believe these policy priorities could spur a boom in both public and private infrastructure investment that sustains economic and earnings growth in 2022.

In our view, this wave could drive a new ‘super cycle’ of demand for certain commodities – such as lithium, nickel and copper – and industrial goods that are vital to the development of renewable energy sources, storage systems and upgraded power grids. While investment ultimately should expand capacity and productivity, the shorter-term impact of sustainability efforts could be inflationary, particularly if this is combined with supply chains moving onshore.

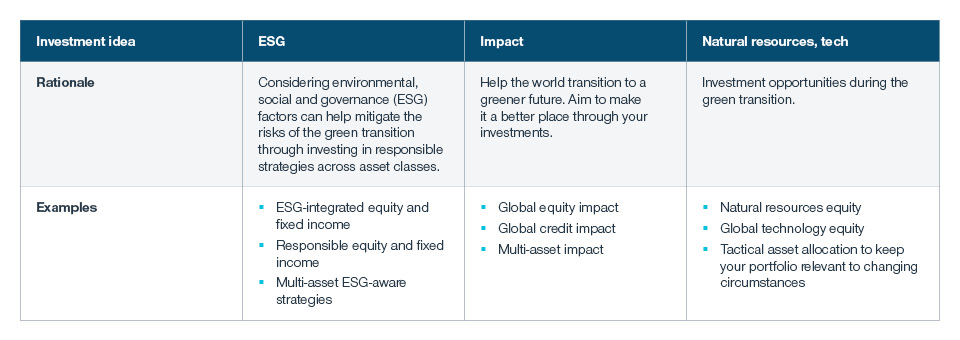

Click to enlarge

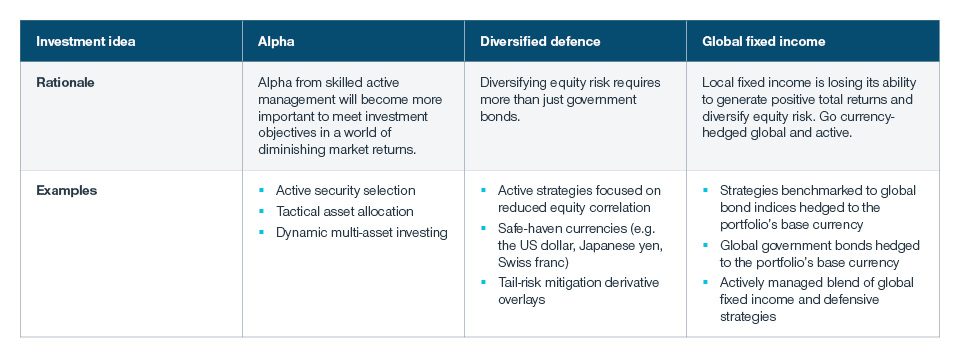

5. Softening returns

Elevated valuations, fading stimulus, rising real rates and slowing earnings growth mean market returns are likely to be more modest than in the past across both equity and fixed income markets.

Although valuations directly impact returns over the long term, not over the short term, elevated valuations today mean more modest expected returns in the future compared to those of the last decade. Investors should either accept the likelihood of lower returns or start adapting their portfolios to the new environment of modest market returns. The way to enhance performance when market returns are more muted is to use skilled active management across bottom-up active security selection, top-down dynamic asset allocation and creatively adding new sources of returns and techniques to mitigate risks.

Investment ideas

Click to enlarge

During tectonic shifts, when old paradigms fade and new ones emerge, markets tend to be volatile. Although risks and challenges are abundant, so are opportunities. We believe the three ways to navigate the turbulence are: 1) Genuine multi-asset diversification; 2) Equity and fixed income investing across a global opportunity set; and 3) Skilled active security selection and asset allocation.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.