March 2021 / INVESTMENT INSIGHTS

Five Diversification Ideas For UK Investors in 2021

Diversifying differently will be a key theme this year

Key Insights

- With policy decisions set to drive markets in 2021, investors may need to adopt a new approach to diversification.

- This may include seeking to better understand crisis correlations, becoming more global in bond allocations and increasing bond duration.

- It may also include using risk overlays to manage equity volatility and more effectively balancing active and market risk.

Equity and bond markets have recovered strongly from the sharp falls seen in the first quarter of 2020. Global equities, government bonds, investment‑grade (IG) corporate debt and high yield bonds all produced positive returns last year, with major stock markets such as the US, Japan and emerging markets in China and India up over 15% in local currency terms. Things could be about to become more complicated, however.

We see three key factors driving markets in 2021:

- The pandemic—the vaccines may defeat the coronavirus, but lockdowns will have a negative impact in the short term.

- Politics—the balancing act between lockdowns and the economy and

- Policy—fiscal support and central banks’ monetary stimulus. As most professional investors do not have special insights into political and policy decisions, these factors can be outside of their usual ‘comfort zone’ when predicting market or security returns.

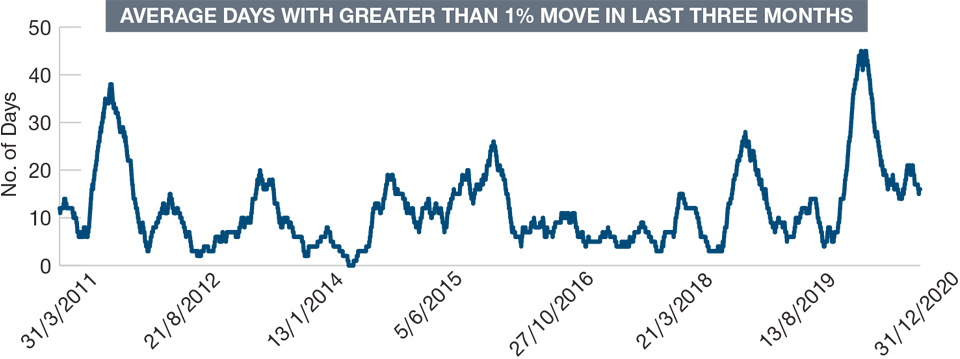

Equity Market Volatility Is Elevated

(Fig. 1) Number of days of 1%+ moves in MSCI ACWI in previous three months

As of 31 December 2020.

Shows number of days when the MSCI All Country World Index (ACWI) in GBP moved by more than 1% in absolute terms over the previous 65 business days.

Source: Bloomberg Finance L.P., analysis by T. Rowe Price.

Markets are reflecting this uncertainty, with equity market volatility at elevated levels. The number of days in which global equities moved more than 1% in the previous three months (Figure 1). Although this has fallen considerably from last year’s highs, it remains at elevated levels. These returns mean valuations for many asset classes appear inflated (Figure 2).

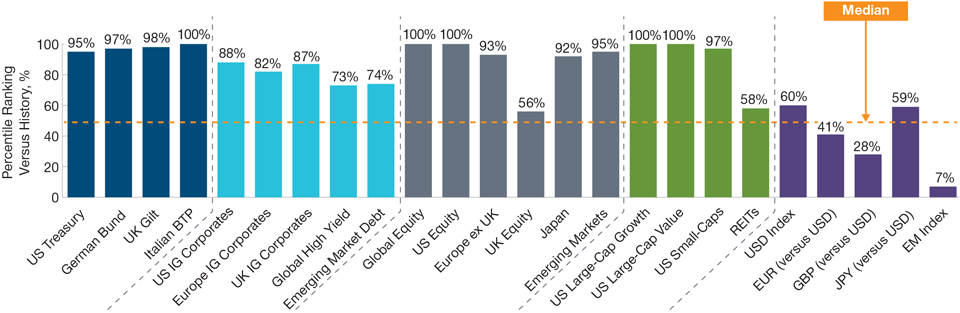

The Valuations of Major Asset Classes Are Inflated

(Fig. 2) Prices are above long-term average levels

As of 31 December 2020.

Indices: US 10-year Treasury, German 10-year bund, UK 10-year gilt, Italian 10-year BTP, Bloomberg Barclays (BB) US Corporate Aggregate, BB EuroAgg Corporate, BB Global Aggregate Corporate–United Kingdom, BB Global High Yield, BB EM USD Aggregate, MSCI AC World, S&P 500, MSCI Europe ex UK, MSCI UK, MSCI Japan, MSCI EM, Russell 1000 Growth, Russell 1000 Value, Russell 2000, FTSE EPRA/NAREIT Developed, US dollar index, EUR spot, GBP spot, JPY spot, JPM EM currency index.

Sources: T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. Source for Bloomberg Barclays index data: Bloomberg Index Services Limited. MSCI, Standard & Poor’s. (See Additional Disclosures.)

This leaves investors with a dilemma: How can a portfolio be positioned to benefit from market gains if economic conditions improve and mitigate against potential losses if things deteriorate? This balancing of ‘greed’ and ‘fear’ is one of the oldest problems in investing and one with a relatively simple solution: diversification. We believe that diversification is vital to building well‑balanced portfolios in the current environment—but also that some tried and tested approaches may no longer apply.

What Does Diversification Look Like in 2021?

What Does Diversification Look Like in 2021?

Below are some examples of approaches we believe UK investors should try to diversify their portfolios.

1. Define growth and defensive assets, and understand crisis correlations

When constructing multi‑asset portfolios, we do not allocate based on asset class labels such as equities or fixed income. Instead, we use a component‑based approach that examines the outcomes and characteristics of assets. Allocations to growth assets play a key role in delivering client returns; however, we believe it is also vital to include genuinely defensive assets to deliver stability in volatile markets.

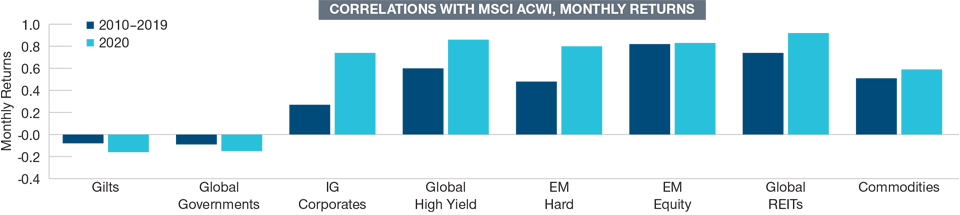

When considering which investments are truly defensive, we focus on conditional correlations with global equities. Long‑term correlations can be misleading; more important are correlations during sell‑offs, when diversification is most needed. For example, correlations of IG, emerging market debt and high yield bonds with equities tend to jump towards one in market volatility such as 2020 (Figure 3). By contrast, these correlations for global government bonds and gilts were lower in 2020 than over the previous decade.

Correlations Rise During Bouts of Volatility

(Fig. 3) Realised asset correlations for 10 years to end 2019 and in 2020

Past performance cannot guarantee future results.

As of 31 December 2020.

Correlations based on historical monthly returns in GBP. Please see appendix for information detailing representative index for each asset class.

Sources: MSCI, Bloomberg Barclays, Bloomberg and J.P. Morgan Chase (see Additional Disclosures). Analysis by T. Rowe Price.

This differentiation helps to ensure each asset plays a clear role in the overall portfolio, linked to its true growth or defensive characteristics.

Contrast this with the approach of some strategic bond funds, which many investors have adopted as anchor holdings within fixed income portfolios. Many assets in such portfolios are likely to fare less well in periods of market volatility compared with truly defensive assets, leaving investors more reliant on manager positioning. This increases the likelihood of negative surprises when other parts of an investor’s portfolio lose value. We believe that true diversification requires assets with defensive features that are always ‘on’ and do not rely on tactical portfolio positioning to deliver protection.

2. Invest in global bonds and currencies

For UK investors, gilts are widely seen as the least risky building block for multi‑asset portfolios. However, we believe that investing in global fixed income markets hedged to sterling comes with significant benefits—not least because it increases diversification. UK rates have fallen more than those on some ‘safe haven’ overseas government bonds, particularly US Treasuries, in recent years. What’s more, we believe the market is underestimating the likelihood that the Bank of England (BoE) will introduce negative interest rates later in 2021, further reducing the cushion—and therefore the diversification benefits—that gilt holdings would provide in bouts of turbulence.

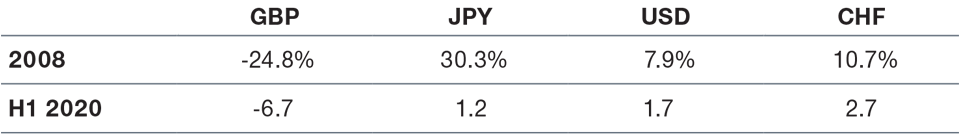

This increases the relative attractiveness of overseas government bonds as a ‘shock absorber’ in periods of market turmoil. While foreign currency exposure generally adds to a portfolio’s expected volatility, unhedged exposures to overseas assets can, in some instances, increase a portfolio’s potential for risk mitigation. Not all currencies are created equal, however. For example, the US dollar, which has often been seen as a bolthole in times of market stress, declined from the second quarter of last year and is expected to continue falling this year. Other currencies, including the Japanese yen and Swiss franc, have also played this role historically (Figure 4). We therefore suggest that investors should review their hedging approach on a currency‑by‑currency basis to avoid unwanted additional portfolio volatility from currencies with fewer diversification benefits.

Currency Hedging Can Mitigate Sterling Losses

(Fig. 4) Trade‑weighted GBP versus JPY/USD/CHF in 2008/H1 2020

Past performance cannot guarantee future results.

As of 31 December 2020.

2008 performance from 31 December 2007 to 31 December 2008, H1 2020 performance from 31 December 2019 to 30 June 2020.

Source: Bloomberg Finance L.P. Analysis by T. Rowe Price.

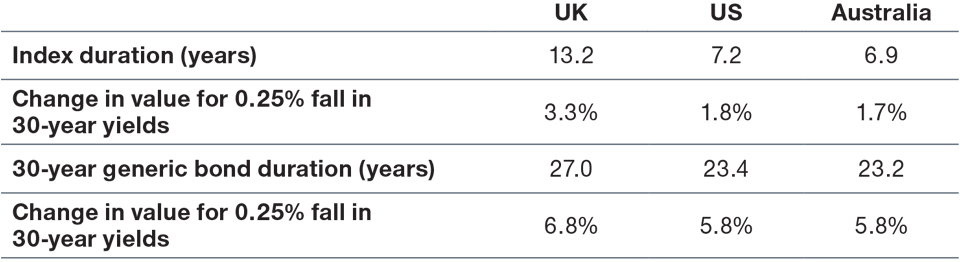

3. Increase bond duration

Broad market government bond indices represent instruments issued across all maturities. One way of diversifying is to invest in longer‑dated bonds. These generally have higher yields than those at shorter maturities and are less directly impacted by central bank policies, so are expected to be more affected by economic drivers than policy drivers. Their higher duration also gives more ‘bang for the buck’ in terms of sensitivity to movements in yields of similar amounts (Figure 5). The longest‑maturity gilt in the UK matures in 2071, while the US issues Treasury bonds with maturities of up to 30 years. Some other governments have issued even longer‑dated bonds—Austria, for example, has issued 100‑year bonds in recent years.

Longer-Dated Bonds Are Less Impacted by Central Bank Actions

(Fig. 5) Durations for government bonds in the UK, US and Australia

As of 31 December 2020.

Indices used: UK Gilts: Bloomberg Barclays UK Government Bond Index, US Treasuries: Bloomberg Barclays US Treasury Index, Australian Government Bonds: Bloomberg Barclays Australian Government Bond Index. Durations shown are Macauley duration for UK gilt index, option-adjusted duration for US Treasury and Australian government bond index, modified duration for individual bonds.

Source: Bloomberg Finance L.P., and Bloomberg Index Services Limited (see Additional Disclosures). Analysis by T. Rowe Price.

4. Use a risk overlay to manage equity volatility

Equities are among the most economically exposed assets and so tend to be among the worst‑hit in periods of market uncertainty. Therefore, a key decision in asset allocation is how much equity risk to hold. For example, the FTSE All‑Share Index fell by about 35% from a peak in January 2020 to its low in March—just two months later.

Home bias within equity holdings is common in the UK, as it is in other countries. UK investors with home bias in equities are heavily exposed to country‑specific events, as well as to moves in sterling. Although agreement on the terms of the UK’s departure from the European Union has been reached, the impact of that departure remains unclear. The country has been the worst hit by the pandemic amongst the nations of the G‑7, with the time frame for recovery uncertain.

Compared with the US and global markets, the FTSE 100 Index overweights the sectors most associated with value—financials, utilities, consumer staples and energy—and underweights the sectors most associated with growth—information technology and consumer discretionary. Investing in the UK stock market is therefore taking a view that ‘old economy’ value sectors are likely to outperform ‘new economy’ growth sectors—a view that has not been rewarded in recent years. Global diversification is more likely to ensure that portfolio balance across sectors, market capitalisations and styles, for instance, is not jeopardised.

Even for globally diversified equity portfolios, periods of crisis are usually accompanied by a substantial increase in market moves. Few investors can afford to retreat to less risky assets when yields are low and valuations are expensive relative to history. Risk management overlays can mean sharing in the upside if markets continue to do well and mitigate downside risk if markets retreat.

A further step would be to control the exposure of the equity portfolio to these moves. Managed volatility risk overlays aim to maintain equity volatility within a prescribed range. When expected equity volatility rises, the overlay reduces portfolio risk—this allows investors more confidence in maintaining equity market exposure even when the outlook is uncertain.

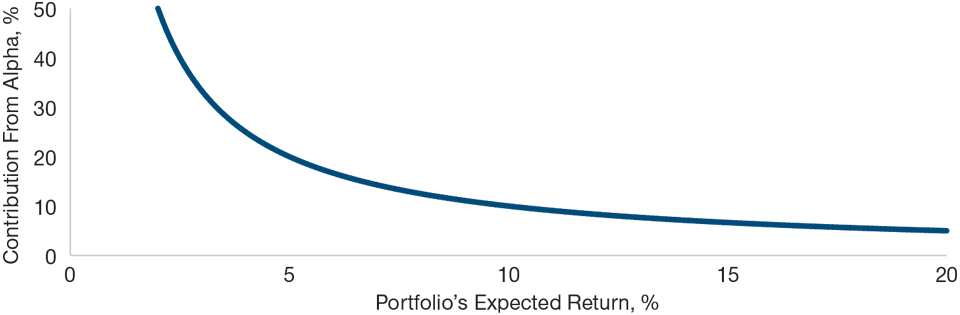

5. Balance active and market risk

For many investors, exposure to equity and fixed income markets has been sufficient to meet absolute return targets in recent years. A UK investor holding a portfolio made up of 50% in global equities and 50% in global bonds, for example, would have gained a return of 7.6% p.a. in the 10 years to the end of 2020. However, with valuations elevated in many markets, we expect a return of 3% or less on such a portfolio over the next five years. Investors may therefore see an increased role for active risk in the pursuit of higher returns (Figure 6).

Active Risk Can Boost Returns

(Fig. 6) 1% alpha as a proportion of total portfolio expected return

As of 31 December 2020.

For illustrative purposes only. Analysis by T. Rowe Price.

In the current uncertain environment, new trends and creative disruption mean opportunities for skilled active managers to add value. This greater focus on manager risk could come via the active management of existing asset holdings or from strategies such as hedge funds, which look to generate most or all of their return regardless of market direction. Active returns—or alpha—have imperfect correlations with market returns and can therefore add to the diversification of portfolios.

A More Creative Approach

Asset allocation in 2021 presents almost unprecedented challenges for investors. The path for asset returns will heavily depend on events relating to the coronavirus pandemic, politics and policy responses—areas where investors may feel less comfortable and more likely to plan for a wide range of possible outcomes. Elevated valuations across asset classes are a further concern, while low yields on gilts make traditional ways of diversifying portfolios less attractive.

We believe that this environment favours more creative approaches to diversification, including:

- More global bond allocations, especially if the BoE adopts negative interest rates, and considering the role overseas currency exposure can play

- Allocations which focus on outcomes—what assets will truly deliver defence in difficult times?

- Ensuring ‘bang for the buck’ in terms of duration from high‑quality government bonds

- Gaining diversified equity exposure via more risk‑managed approaches

- Reviewing budgeted allocations to active versus market risk

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

March 2021 / INVESTMENT INSIGHTS

March 2021 / MARKETS & ECONOMY