March 2022 / INVESTMENT INSIGHTS

A Q&A Session With Ernest Yeung

Attractive opportunities for active investors in EM stock

Key Insights

- A successful vaccine rollout and a second year of above-trend global economic growth provide strong underpinnings to EM value stocks in 2022.

- “Green” infrastructure spending to meet the 2050 carbon-neutral goals should accelerate economic activity, benefiting traditional industries.

- We expect to see more incremental policy easing in China and are taking advantage of recent market weakness that presented attractive valuation opportunities.

Given the robust rally in equity and bond markets since the pandemic bottom, 2022 may test the nerves of investors amid expectations of uneven economic recovery, the threat from the new Omicron variant of the coronavirus, tightening global monetary policy, and rising inflation. Ernest Yeung, the manager of T. Rowe Price’s Emerging Markets Discovery Equity Strategy, explains how an active investor with a disciplined focus on valuation and fundamentals can still find attractive investment opportunities among emerging market (EM) stocks.

Q1: Emerging market value stocks performed well last year, as you expected. What makes you think that the rally can be sustained in 2022?

We believe the recovery of emerging markets is still in its midcycle with COVID‑19 reopening and a key structural change in government stimulus that is targeting the consumer directly. This favorable economic backdrop should continue to support a style regime change in EM from growth to value in 2022. Although EM value stocks outperformed growth stocks by a significant margin in 2021, we think this trend can continue since the valuation gap between the two styles remains wide by historical standards. At the same time, EMs’ subdued stock market performance in 2021 increases the chances of both value and growth stocks doing better in 2022, both in absolute terms and relative to their developed market peers.

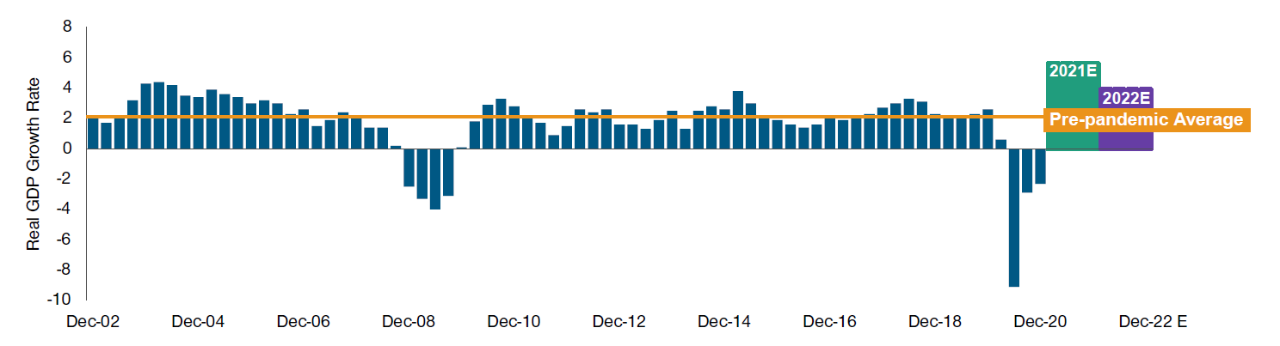

We anticipate further gains in EM value stocks to be supported by a second recovery year of above‑trend global growth, where the World Bank forecasts 4.1% in 2022, which is above the 20‑year average. We also expect to see an acceleration in “green” infrastructure spending, as more and more countries become serious about taking action to reverse climate change. A successful vaccine rollout and global economic recovery together provide strong underpinnings to EM value stocks. Economic growth in EMs should continue to normalize as vaccination rates and business activity pick up.

EM investors in 2022 will need to navigate a gradual normalization of policies from 2021 peak levels as major central banks remove some of the emergency support provided during the pandemic, which could trigger bouts of volatility. However, we believe that both economic growth and inflation in 2022 will reset at higher levels than in the immediate pre‑pandemic era. The switch to a more reflationary regime for the global economy implies that the rotation to more cyclical markets should continue, favoring value stocks over growth stocks.

U.S. GDP Growth Expectation for 2022 Is Above 20‑Year Average

(Fig. 1) U.S. real GDP growth rate % YoY

As of December 31, 2021. Source: Bloomberg Finance L.P. (See Additional Disclosures.)

E=Estimated. Actual outcomes may differ significantly from estimates.

Q2: China is often regarded as the key to EM fortunes, as it is the largest trading partner for many larger EM economies and the major regional growth driver in Asia. After last year’s regulatory shocks and turmoil in the property sector, what is your view on China for 2022?

A severe China slowdown in 2022 would be a problem for all investors, but that is not what we expect. I think we are nearing the end of the latest regulatory cycle, and so what was a big headwind for Chinese equities in 2021 will start to fade in 2022. In other words, in 2022, China will continue to absorb the policy shocks from 2021, but there will be no additional major domestic policy shocks, in my view. Foreign investors are already warming toward China based on the recent fund flows, which were positive in six out of the final eight weeks of 2021.

In the short term, the next couple of quarters or so, China’s economic growth will slow further due to these lagged effects. But regulatory tightening in China is essentially cyclical in nature, and we are approaching an inflexion point. We expect to see more incremental policy easing, both monetary and fiscal, in 2022. It will be more selective, however, than in previous cycles and will only target certain areas. The People’s Bank of China cut its reserve requirement ratio for banks by 50 basis points effective December 15 and also made a small cut in the one‑year prime lending rate, signaling that liquidity will remain easy in 2022.

As ever, our investment focus will be on the abundant bottom‑up investment opportunities in the exceptionally deep Chinese stock market of over 5,800 listed companies.1 In our view, China remains a very fertile hunting ground for bottom‑up investors. Markets in 2021 underestimated the amount of short‑term pain and volatility Beijing is willing to incur in order to improve the quality of future economic growth. China can enjoy sustainable growth if the government can better balance equity with preserving entrepreneurship. The drive for common prosperity and fair competition could also serve as a tailwind for small and medium‑sized businesses to thrive.

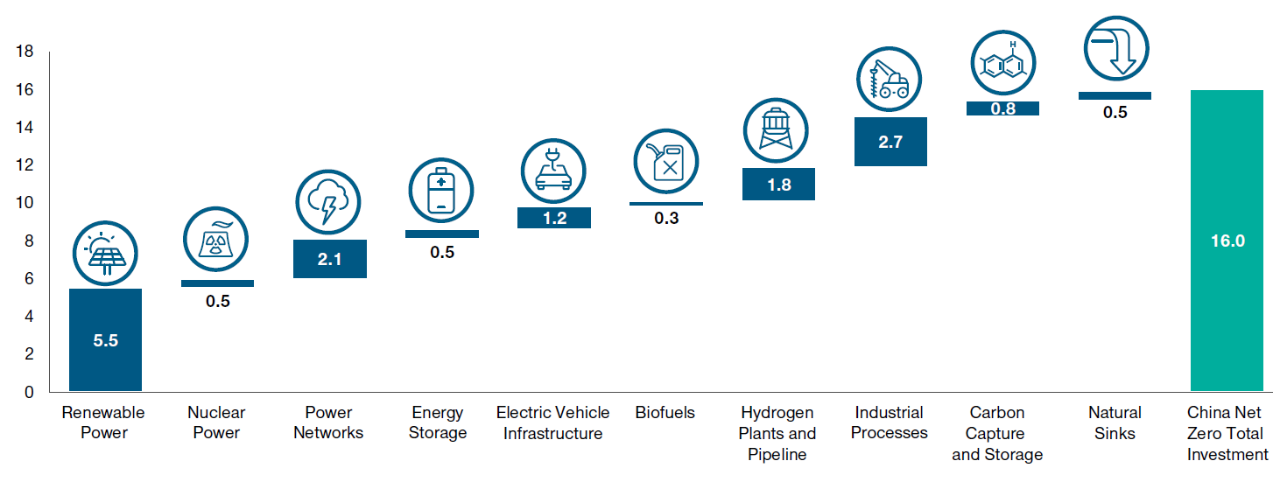

Carbonomics Investment Opportunities in China

(Fig. 2) Cumulative investment by sector for net zero in China by 2060 (USD trillion)

As of December 31, 2020.

Source: Goldman Sachs Global Investment Research.

Numbers may not total due to rounding. There is no guarantee that any forecasts made will come to pass. Most recent data available.

Q3: Where do you see the best investment opportunities for EM value stocks today?

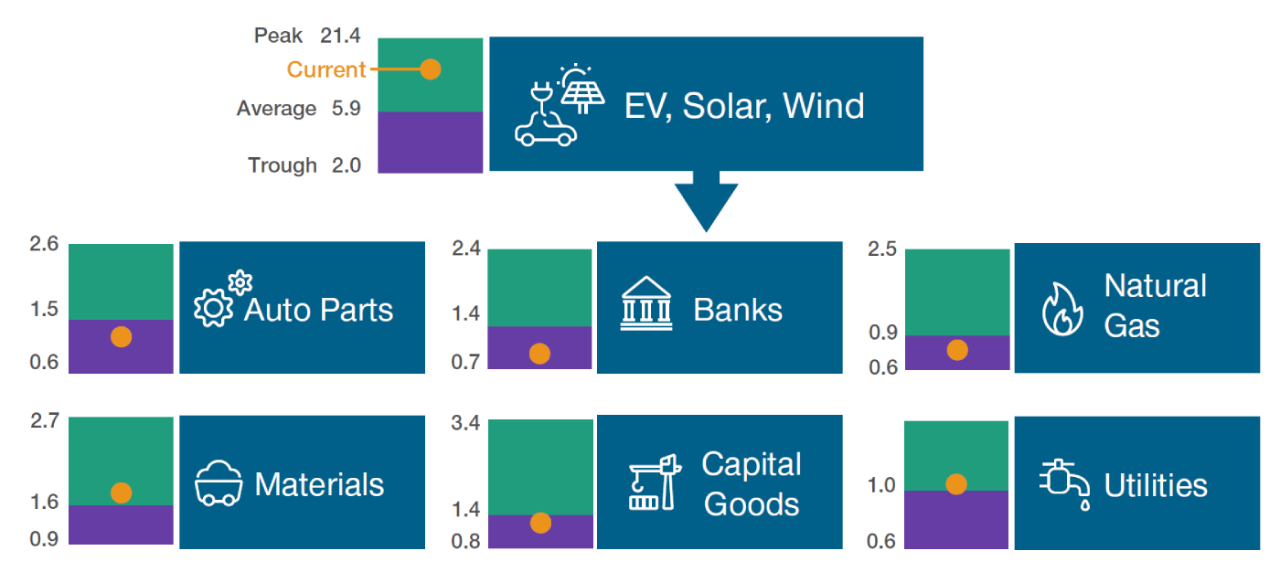

The 2050 carbon‑neutral goals should lead to increased infrastructure spending on a global scale to facilitate the transition. Such green infrastructure spending would accelerate economic activity, benefiting traditional industries. Government policies linked to renewable energy, electric vehicles, and decarbonization are widely seen as metals intensive. After nearly a decade of underinvestment in new metals supply, this is an investment theme for the medium to longer term. We expect it to be a secular bull story for a number of commodities, including iron ore and copper (a universal beneficiary of electrification), and battery raw materials such as nickel and lithium. Natural gas will also play a key interim role for EMs in their transition away from coal and oil toward cleaner fossil fuels. The large amount of financing required to support the green energy transition of EMs is also likely to open up significant new business opportunities for the banking sector.

We believe there are ample opportunities in 2022 for us to identify pockets of “forgotten” EM stocks with potentially asymmetrical risk/return profiles, where fundamental changes or operational improvements may drive a rerating, while at the same time there is potential downside support from strong balance sheets and healthy dividends. Our current bias in EMs is to focus on corporate “self‑help” stories and reopening opportunities, in addition to the role that traditional economy stocks can play in the transition to a greener world mapped out at the November COP26 climate summit in Glasgow. Under the self‑help category, the pandemic has prompted the management teams of EM companies to become more proactive in their restructuring efforts—cutting costs, selling assets, shifting capacity, and changing product mix. T. Rowe Price’s experienced global bottom‑up research team can help me to identify good investment opportunities among these companies.

We are also taking advantage of recent market weakness that presented attractive valuation opportunities in China. For example, we are finding pockets of forgotten stocks in China’s internet sector following the regulatory cycle of 2021. The change in the policy landscape is also prompting these companies to make internal changes to survive under the new regime. Moreover, history tells us that the negative impact from previous bouts of regulation and reforms on Chinese equity performance has been short term in nature and not long‑lasting.

Polarization of Opportunity Sets Within Green Transition

(Fig. 3) MSCI EM sectors: trailing price‑to‑book value

As of December 31, 2021. End-quarter data from Q1 2004 to Q4 2021.

Sources: MSCI (see Additional Disclosures) and financial data and analytics provider FactSet. Copyright 2022 FactSet. All Rights Reserved.

T. Rowe Price uses the current MSCI/S&P Global Industry Classification Standard (GICS) for sector and industry reporting. T. Rowe Price will adhere to all updates to GICS for prospective reporting. Please see Additional Disclosures page for information on this GICS information.

Q4: Finally, in your role as manager of the Emerging Markets Discovery Equity Strategy, what are the key issues keeping you awake at night?

I am cognizant of the key risks for EM investors in 2022, which include a sharper‑than‑expected slowdown in China, the emergence of new coronavirus variants like omicron that could trigger renewed levels of restrictions and dampening the recovery, and the heightened geopolitical tensions, particularly the unpredictable policies of Russian president Vladimir Putin and his shocking military invasion of Ukraine. A significant further rise in the crude oil price would hurt EM economies that are manufacturing‑oriented. But 2022 currently looks to be adequately supplied with crude oil at the current price. Thus a further spike higher in price would most likely be a consequence of supply disruption. That could happen if Russia were to significantly cut its oil and gas exports, which is not something that investors can predict. Finally, a few EM countries, like Turkey and Argentina, lost their currency anchor in 2021. While U.S. interest rates are expected to rise this year, supporting general dollar strength versus EM currencies, much of the rise in rates by the Fed should have already been discounted.

Biography

Ernest Yeung is a portfolio manager for the Emerging Markets Discovery Equity Strategy at T. Rowe Price. He was the co‑portfolio manager for the International Small‑Cap Equity Strategies from 2009 to 2014. Mr. Yeung is a vice president of T. Rowe Price Group, Inc., and T. Rowe Price Hong Kong Limited.

Mr. Yeung has 20 years of investment experience, 18 of which have been with T. Rowe Price. Prior to joining the firm in 2003, he was an analyst with HSBC Asset Management in London. Mr. Yeung has an M.A., with honors, in economics from Cambridge University. He has also earned the Chartered Financial Analyst designation and the Investment Management Certificate.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

March 2022 / INVESTMENT INSIGHTS