April 2021 / INVESTMENT INSIGHTS

A Shift Toward Value

The tide may be turning for value stocks

Key Insights

- As the rollout of coronavirus vaccines paves the way for a version of economic normalisation, global GDP growth in 2021 may potentially be the strongest in decades.

- Investors may want to consider opportunities in asset classes such as value stocks, which could benefit from strong economic growth in particular because of their exposure to the Financials and Energy sectors.

- While we expect value to outperform growth in 2021, maintaining a balance between the styles with a potential tilt to value could ensure diversification, mitigating the risk of a rotation back to growth.

A post‑pandemic economic recovery is underway, with millions of COVID-19 vaccines administered globally every day. The population of the US, the UK and other countries at the forefront of vaccine rollouts is rapidly gaining protection against the coronavirus, and vaccination campaigns in a number of other countries, while slower, appear to be progressing in a positive direction. With the successful rollout of vaccines, economies are expected to gradually re-open, consumer confidence is likely to improve - bringing demand with it - and a recovery is likely to ensue.

As we move toward a version of normalisation – buoyed by unprecedented fiscal and monetary stimulus – many economists expect global GDP growth in 2021 to be the strongest in decades. 2021 has already seen rising inflation, rising yields on government bonds, increasing commodity and energy prices. Sustainable growth could boost these further. We think investors may want to consider opportunities in segments that were neglected during the eruption of the pandemic and are now likely to benefit from renewed economic growth, such as small‑cap and value stocks, with particular emphasis on the latter.

In the initial phase of the pandemic, small‑cap and value stocks both underperformed, weighed down by lockdown restrictions and economic uncertainty. Large-cap growth stocks, heavily skewed toward the Information Technology (IT) and Consumer Discretionary sectors, outperformed. However, as optimism recovered, small‑cap stocks rebounded much faster than value stocks and have now considerably outpaced large‑cap stocks over the course of the pandemic, stretching their valuations. Value stocks, on the other hand, have only begun to regain the ground they lost relative to growth companies in 2020 – a year which came on top of a decade of generally strong performance by growth stocks.

This longer-term pattern has been heavily influenced by falling interest rates, creating a headwind for financial stocks – a significant component of the value universe. However, an environment of rising interest rates, higher inflation and positive economic growth would be expected to boost value stocks.

Therefore, while both small‑cap and value stocks could likely benefit if economic growth accelerates, in our view, value stocks may offer investors more upside potential over the coming year.

The widely used global equity benchmark MSCI All Country World Index (ACWI) can be split into ACWI Growth and ACWI Value. The two most prominent sectors in ACWI Growth are IT, with a weight of over 33% (compared to about 10% in ACWI Value), and Consumer Discretionary, with a weight of over 18% (compared to less than 8% in ACWI Value). Within ACWI Value, the largest sector is Financials with a weight of over 23% (compared to less than 5% in ACWI Growth). Energy is another sector with larger weight in ACWI Value of over 5% compared to a weight of less than 1% in ACWI Growth.

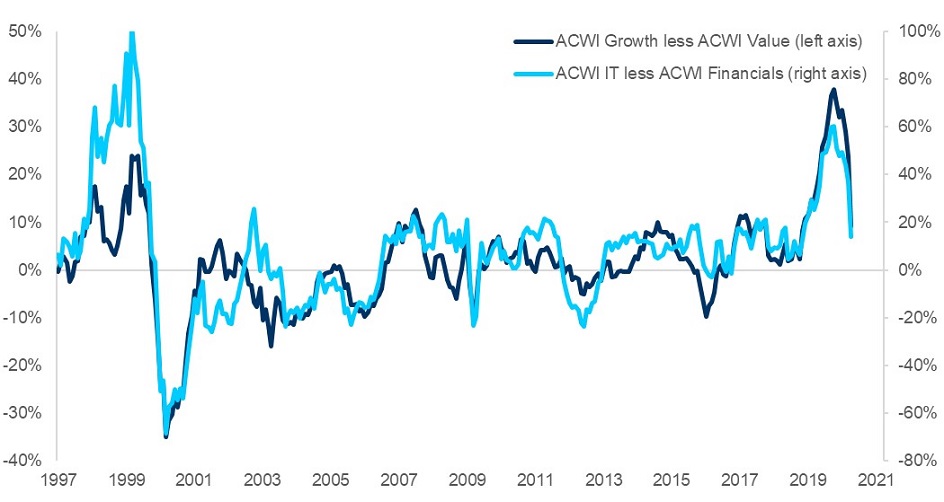

This difference in sector weighting, in particular the gap between IT and Financials, can explain a large portion of the performance differentials between value and growth, as illustrated in Figure 1. When IT outperforms, growth tends to do likewise, and when Financials outperform, value generally does relatively well.

Figure 1: ACWI Growth less Value and ACWI Information Technology less Financials

Past performance is not a reliable indicator of future performance.

Sources: T. Rowe Price analysis using data from MSCI. Returns are measured in US dollars. For the time period January 1997 through March 2021. Rolling 12-month total returns.

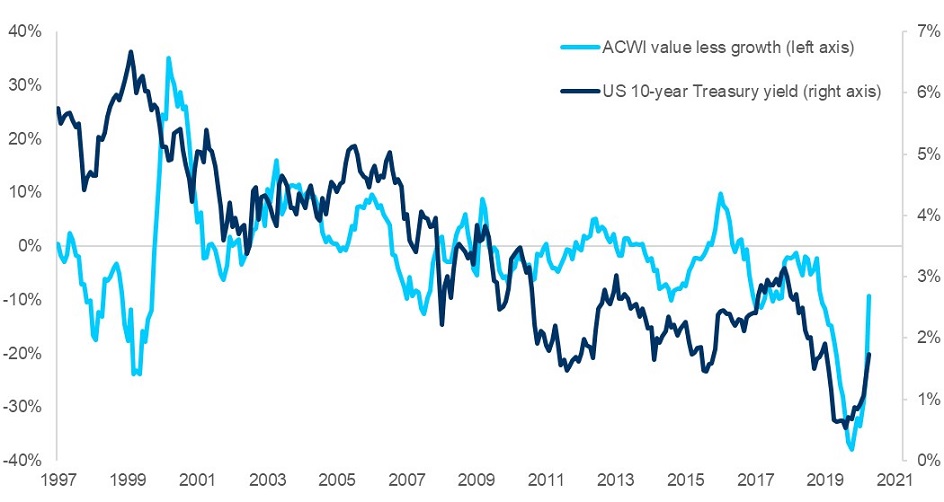

With the re-opening of economies and a reduction in remote working, connecting and online shopping, the relative attractiveness of IT diminishes. As government bond yields rise, reflecting more positive economic outlook and higher inflation expectations, banks can be more profitable on their lending operations (collecting higher interest on long-term lending than what they pay on short-term deposits). As Figure 2 illustrates, rising government bond yields tend to correspond to value outperforming growth, mainly because of value’s extensive exposure to Financials.

Figure 2: ACWI Value less Growth and US 10-year Treasury yield

Past performance is not a reliable indicator of future performance.

Sources: T. Rowe Price analysis using data from MSCI and Haver Analytics. Returns are measured in US dollars. For the time period January 1997 through March 2021. ACWI value less growth is rolling 12-month total return of MSCI ACWI Growth Index less MSCI ACWI Value Index.

Another way to look at it is the duration – or sensitivity to interest rates – of growth and value stocks. Growth stocks typically pay lower dividends than value stocks. Therefore, the potential cash flows to investors from growth stocks are further in the future compared to those from value stocks, so the duration of growth is longer than that of value. Because of their longer duration, growth stocks have benefited from falling interest rates over most of the last decade. Rising interest rates, on the other hand, may boost the performance of value stocks, while being a headwind to growth stocks.

In addition, strong economic growth leads to rising demand for commodities and oil in particular, improving the prospects of the Energy sector. Outperformance of Energy could be another tailwind for value relative to growth, given the sector’s greater allocation within value indices.

CONCLUSIONS

After over more than a decade of growth outperforming value, 2021 may be the year of a shift to value. However, because fortunes can change quickly, we think investors should consider balancing value and growth in their portfolios by introducing a tactical tilt to value. Growth may have underperformed in recent months, but we may see further rotations in investor sentiment. Over the long-term, IT is still an attractive sector with room for continued innovation and changes wrought by the pandemic will have long-lasting impacts. Balancing value and growth is a healthy way to diversify portfolios and to mitigate the regret risk of wrongly betting on one style over the other.

Key Risks

The following risks are materially relevant to the information highlighted in this material: Even if the asset allocation is exposed to different asset classes in order to diversify the risks, a part of these assets is exposed to specific key risks.

Capital risk – The value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between the base currency of the portfolio and the currency in which you subscribed, if different.

Equity risk—in general, equities involve higher risks than bonds or money market instruments. Credit risk—a bond or money market security could lose value if the issuer’s financial health deteriorates. Currency risk—changes in currency exchange rates could reduce investment gains or increase investment losses. Emerging markets risk—emerging markets are less established than developed markets and therefore involve higher risks. Foreign investing risk—investing in foreign countries other than the country of domicile can be riskier due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. Interest rate risk—when interest rates rise, bond values generally fall. This risk is generally greater the longer the maturity of a bond investment and the higher its credit quality. Investment portfolio risk - Investing in portfolios involves certain risks an investor would not face if investing in markets directly. Real estate investments risk—real estate and related investments can be hurt by any factor that makes an area or individual property less valuable. Small‑ and mid‑cap risk—stocks of small and mid‑size companies can be more volatile than stocks of larger companies. Style risk—different investment styles typically go in and out of favor depending on market conditions and investor sentiment. Operational risk - Operational failures could lead to disruptions of portfolio operations or financial losses. ESG and Sustainability risk - May result in a material negative impact on the value of an investment and performance of the fund.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.