January 2024 / INVESTMENT INSIGHTS

Macro-implied earnings

A simple model can explain how earnings will respond to changes in the health of the economy

Key Insights

- A “soft landing” for the economy might not guarantee robust earnings growth in the coming year.

- The Multi-Asset team has put together a model that shows how earnings historically have responded to changes in the economy, and it’s not as intuitive as you might think.

- For example, the narrative du jour is that inflation is bad for stocks, but inflation actually turns out to be good for earnings.

We need to cut economists some slack.

Yes, most of them have been wrong of late. The most anticipated recession in history has become the most delayed recession in history. Forecasts that linked rate hikes with higher unemployment have spectacularly missed the mark. For example, back in December 2022, the Fed’s Summary of Economic Projections predicted that the unemployment rate would be 4.6% in the fourth quarter of 2023. As of November, we were at 3.9%.

And here’s a whopper: The consensus forecast for 2023 third‑quarter real gross domestic product growth was about 0.5%1 (annualized) at the beginning of the quarter. Growth came in at 4.9%, a 4.4% miss.

But it’s hard to imagine a period in history during which macroeconomic data were as distorted as they’ve been over the last two years. The macroeconomic shock waves of the pandemic continue to reverberate. Conventional economic models have failed because conditions have been decidedly unconventional. It’s time to rewrite the playbooks.

Where do we go from here? As the economy continues to normalize, I believe inflation and unemployment will become more predictable again. Let’s continue to listen to talented economists.

Of course, even if you could forecast macroeconomic data perfectly, to the nth decimal (say, with a crystal ball), you could still get bad investment results. The link between the economy and markets is tenuous. Markets are prediction machines. They react mostly to unanticipated information.

Hence, forecasting stock returns with macro data is difficult. Over a year ago, in July 2022, as I was preparing for an Asset Allocation Committee meeting, I asked my colleague Grace Zheng to try something slightly easier: to forecast earnings. The results surprised me.

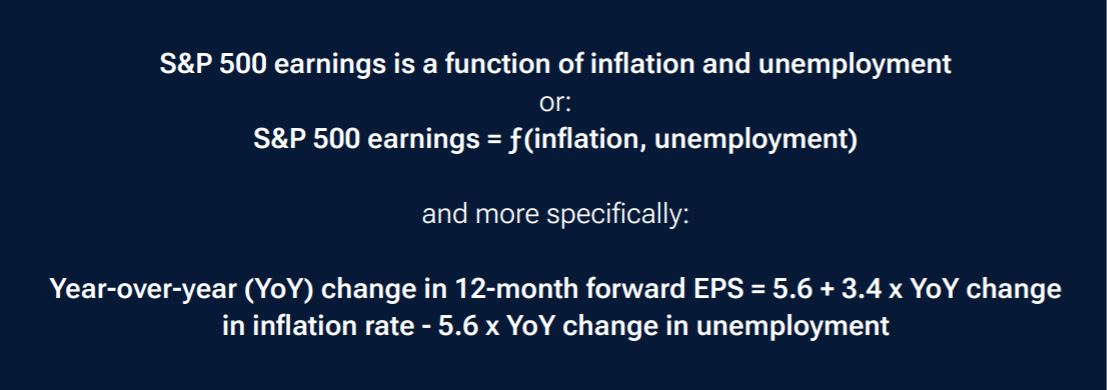

We explored different data and models. (That’s a polite way to say that we data-mined a little.) We found that we could explain changes in overall S&P 500 Index earnings based on a simple two‑factor model with remarkable accuracy. Here’s the model:

We chose forward earnings per share (EPS) because the data are smoother and better behaved than trailing EPS. Also, forward EPS approximates what’s priced in; hence, they should explain stock returns better than other earnings measures.

And we used changes in the variables instead of levels, because doing so produced a better fit.2

You can use this model yourself on the back of an envelope. It’s plug and play: Insert your forecasts for inflation and unemployment, and you will obtain a macro‑implied forecast for S&P 500 Index earnings.

Download the full article here:(PDF)

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.