September 2023 / INVESTMENT INSIGHTS

A Surprising Rise in US Treasury Yields

Rate volatility is likely to persist as Fed pursues 2% inflation target

Key Insights

- A sharp rise in US Treasury yields—pressured by a resilient US economy and supply and demand imbalances—has caught many investors by surprise.

- We believe that rate volatility is likely to persist as the US Federal Reserve pursues a 2% inflation target and restricts monetary policy for longer than expected.

Despite evidence of easing inflation and peaking policy rates in the US, 10-year US Treasury yields surged in July and early August to levels not seen since late 2007, catching many defensively positioned investors by surprise. Several factors have pushed yields higher, including the strong US economy and supply and demand imbalances in the US Treasury market.

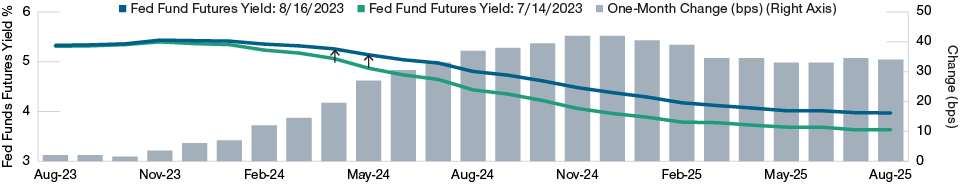

US economic data have continued to surprise on the upside, led by labour market strength, solid consumer spending, and above-trend growth. This has pushed out expectations of a sharp slowdown in growth or a recession. Meanwhile, the economic impacts of the Fed’s aggressive rate hikes have been delayed, and inflation has proven stickier than expected, especially in labour and housing markets. As a result, investors now expect rates to remain higher for longer, a shift reflected in the federal funds futures market (Figure 1).

The Federal Reserve Is Expected to Remain Hawkish for Longer

(Fig. 1) Fed funds futures curve

July 2023 through August 2025. The one-month change is between the data as of July 14, 2023, and August 16, 2023.

Actual outcomes may differ materially from estimates. A basis point (bps) is 0.01 percentage point.

Source: Bloomberg Finance L.P.

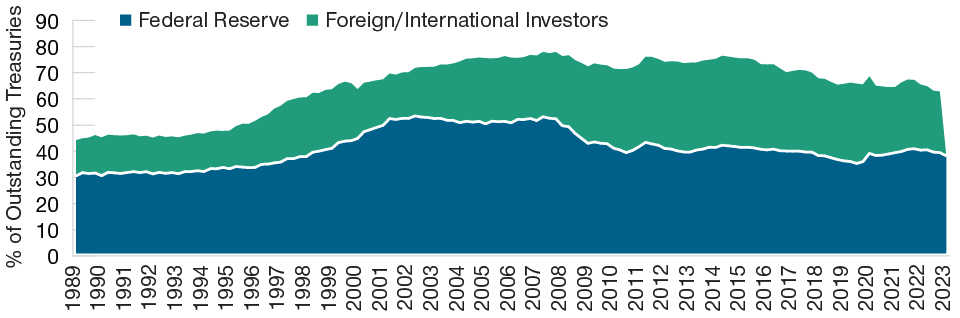

Supply and demand dynamics in the US Treasury market have also pressured yields higher. On the supply side, the US Treasury surprised markets at the end of July when it announced the need to issue more debt in order to fund the government’s growing budget deficit. This additional supply comes at a time when demand has been falling (Figure 2). The largest Treasury owners—the Federal Reserve and investors outside US—are buying less US debt amid quantitative tightening and more attractive yields on global bonds relative to Treasuries.

Rate volatility is likely to persist, in our view. As the Fed pursues a 2% inflation target, US monetary policy also may remain restrictive for longer than many previously expected. While it is hard to predict if we have seen the top in rates, we believe a much higher neutral rate1 is likely given the resilient US economy.

Demand for U.S. Treasuries Is Fading

(Fig. 2) Ownership shares of outstanding U.S. Treasuries

March 31, 1989, through March 31, 2023.

Source: U.S. Treasury/Haver Analytics.

With this backdrop, our Asset Allocation Committee has remained balanced across fixed income sectors, maintaining an overweight to cash and cash equivalents while opportunistically adding to longer-term Treasuries amid the recent move up in rates.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

September 2023 / INVESTMENT INSIGHTS

September 2023 / ASSET ALLOCATION VIEWPOINT