April 2023 / INVESTMENT INSIGHTS

A More Turbulent Path for the Fed

Calming banking jitters amid high inflation and slowing growth

Key Insights

- The Federal Reserve faces a delicate balance as it tries to maintain financial stability while fighting high inflation and trying to navigate a soft landing.

- In our view, broader equity markets do not fully reflect the potential for a more significant downturn in economic growth and earnings later in the year.

Both the banking industry and the capital markets have gone through a tumultuous period since the Silicon Valley Bank (SVB) collapsed on March 10, 2023. Smaller regional banks, in particular, have borne the brunt of the sell-off as fears of contagion caused a flight of deposits into larger banks and money market funds (Figure 1). However, there does not appear to be a systemic threat to the entire banking industry.

Regional Banks Have Sold Off Steeply

(Fig. 1) KBW Regional Banking Index

March 31, 2022, to March 27, 2023.

Past performance is not a reliable indicator of future performance.

Source: Bloomberg Finance L.P.

Before the SVB collapse, financial markets anticipated that the U.S. Federal Reserve (Fed) would raise its target federal funds rate by 50 basis points (bps)1 following hotter-than-expected inflation data in January and February. However, in an effort to combat inflation amid uncertain risks in the banking industry, the Fed announced a 25 bps increase on March 22, 2023—an apparent compromise between a 50 bps hike and no move at all.

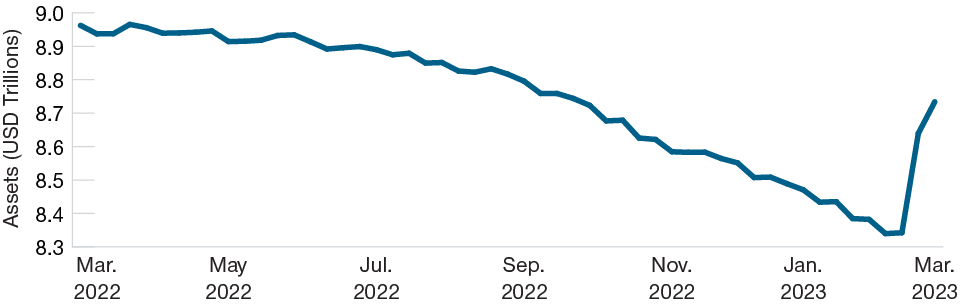

The Fed also swiftly launched a new emergency lending facility, the Bank Term Funding Program. In exchange for qualifying assets, the program helps banks shore up their balance sheets and also provides access to liquidity in case of potential runs on deposits. While this expansion in the Fed’s balance sheet has occurred during a period of tightening monetary policy, it is expected to be temporary as the Fed seeks to maintain financial stability while fighting inflation and trying to navigate a soft landing (Figure 2).

Fed’s Balance Sheet Expansion Is Expected to be Temporary

(Fig. 2) Federal Reserve Assets

March 31, 2022, to March 31, 2023.

Source: Bloomberg Finance L.P.

Even though it has slowed the pace of rate hikes, the Fed remains dependent on incoming data and has acknowledged that interest rates may need to go higher and stay higher for a prolonged period, which is a headwind for the economy. The aftereffects of the banking crisis also could be problematic as risk-conscious banks tighten lending standards to preserve liquidity.

In our view, broader equity markets do not fully reflect the prospects for a more significant downturn in economic growth and earnings in the back half of 2023. As a result, the T. Rowe Price Asset Allocation Committee remains cautious and underweight to equities.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.