Market Volatility

The High Cost of Cashing Out

When the stock market takes a dip, moving to cash can be a tempting option for investors seeking a respite from volatility. However, cashing out of a declining market could come at a cost.

A tale of two investors

To see the benefit of staying invested through varying market conditions, let’s consider two hypothetical investors.

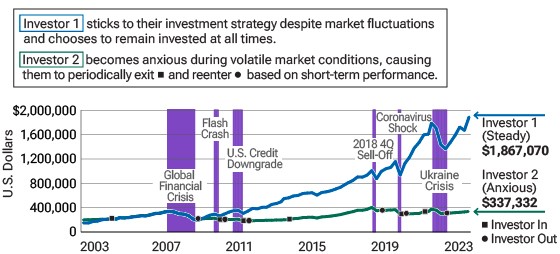

Both investors contributed $2,000 each quarter to their investment accounts. Investor 1 (blue, top line in the chart) kept their money and ongoing contributions invested, riding out the stock market’s ups and downs. Investor 2 (green, bottom line in the chart) moved their account balance and contributions to cash when stocks dropped 10% or more in a quarter. They only felt comfortable putting money back into equities after a fourth consecutive quarter of positive returns. This behavior was repeated throughout several market cycles.

THE 20-YEAR MARKET PERFORMANCE OF INVESTOR 1 AND INVESTOR 2 FROM 2003 to 2023

In this example, two investors with identical portfolios achieve vastly different returns based on their decisions to either stay invested during periods of volatility or repeatedly exit and reenter the market. Both investors started investing in 1990 in the same portfolio. By March 30, 2001, both investors have $177,502. Starting in the second quarter of 2001, Investor #1 continued to invest in the same way and Investor #2 decided to avoid steep losses and exited the market. Investor #2 reentered in 2004.

Investor 2, the anxious style of investor, is assumed to be invested in three-month Treasury bills as a cash equivalent. The $2,000 contributed each quarter in this example assumes minimal interest earned. The anxious style of investor also assumes that cash is invested in Treasury bills during those periods when it is not invested in the stock market. The performance of stocks shown is that of the S&P 500 Stock Index, which measures the performance of large-capitalization companies that represent a broad spectrum of the U.S. economy. Charts are for illustrative purposes only. Investors cannot invest directly in an index. Past performance cannot guarantee future results.

Sources: T. Rowe Price and S&P. See Additional Disclosures.

How investor behavior impacts long-term returns

While both investors saw their portfolio balances decline during downturns, they continued to contribute to their accounts. Investor 1 took advantage of lower stock prices through their ongoing contributions and was rewarded as the market recovered. Investor 2 earned less than a quarter of what the steady, long-term investor earned at the end of the period. Investor 2 exited before the market had the opportunity to correct, essentially locking in their investment losses. Doing so eliminated the opportunity for them to benefit from a recovery.

In times of stress, we feel the need to do something—even when the best course of action may be to stick with the plan we already have.

The anxious style of investor is assumed to be invested in 3-month Treasury bills as a cash equivalent. The $2,000 contributed each quarter in this example assumes minimal interest earned. The anxious style of investor also assumes that cash is invested in Treasury bills during those periods when it is not invested in the stock market. The performance of stocks shown is that of the S&P 500 Stock Index, which measures the performance of large-capitalization companies that represent a broad spectrum of the U.S. economy. Charts are for illustrative purposes only. Investors cannot invest directly in an index. Past performance cannot guarantee future results.

Sources: T. Rowe Price and S&P. See Additional Disclosures.

Additional Disclosures

Copyright © 2023, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action. This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types; advice of any kind; or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

T. Rowe Price Investment Services, Inc.

Investment products are:

NOT FDIC-INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

202404-3457176