How to save yourself money by lowering your 2025 taxes

January 2026, Make Your Plan

- Key Insights

-

- These “above the line” tax deductions are allowed whether you use the standard deduction or itemize your deductions.

- Contributions to Traditional individual retirement accounts (IRAs), spousal IRAs, SEP‑IRAs, and Health Savings Accounts may be fully or partially deductible for tax year 2025.

- Certain households may also benefit from the Saver’s Credit.

Most tax-related activity had to be completed by year-end to affect taxable income for 2025. However, there are a few ways individuals can still reduce their taxable income, and they do not require extensive tax planning. These tax deductions are allowed whether you use standard or itemized deductions. Commonly called “above the line” deductions, these are captured on your IRS Form 1040 Schedule 1 as Adjustments to Income, and they must be made by the tax filing deadline on April 15, 2026.

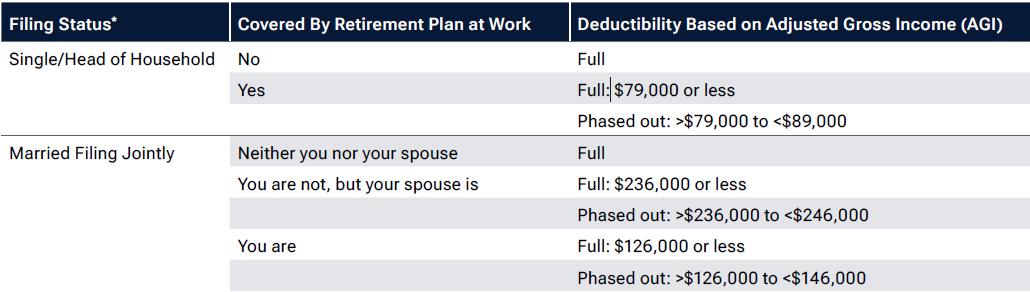

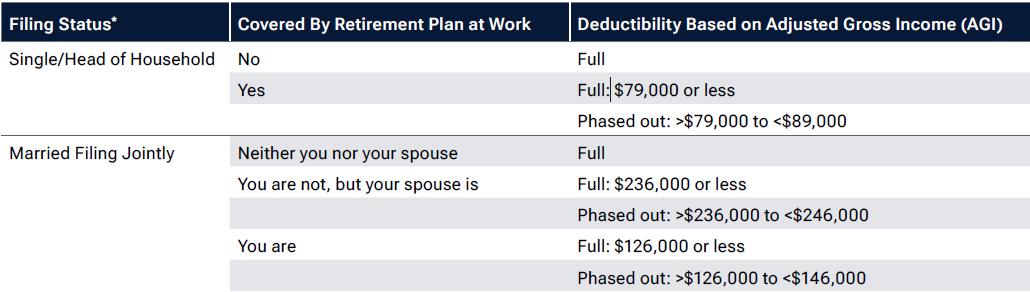

Tax year 2025 income limits for Traditional IRA deductibility

(Roth IRA contributions are not tax-deductible.)

* Consult IRS rules or a tax professional if your status is married filing separately or qualifying widow(er).

close

close

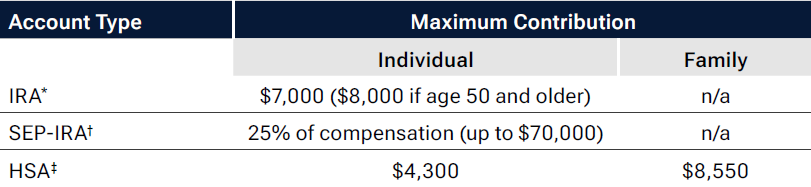

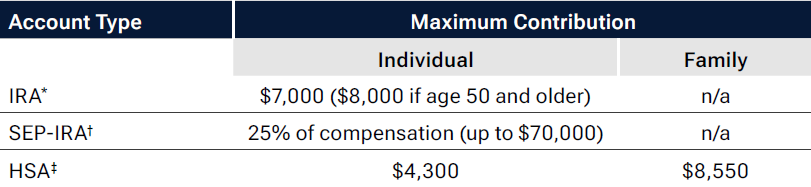

Maximum contributions for tax year 2025

* Contributions to Roth IRA are subject to income limitations and are not tax-deductible.

† The plan is funded solely by the employer.

‡ Only available to those participating in a high-deductible health plan (HDHP).

close

close

How do I lower my taxable income after the end of the year?

There’s still time to make a $7,0001 ($8,000 if age 50 or older) contribution to your IRA for the 2025 tax year. You may be able to deduct some or all of the amount of the contribution depending on your income level and if you (or your spouse) are covered by a retirement plan at work.

Spousal IRA contribution

Generally, you must have earned income to contribute to an IRA. However, if your spouse doesn’t earn income or has very little compensation, they can fund their own IRA up to the contribution limit based on your compensation if you file a joint income tax return. This is known as a spousal IRA contribution. While your combined IRA contributions can’t exceed your combined income, you could possibly double the amount of your deduction depending on the limits outlined in the previous table (see Tax year 2025 income limits for Traditional IRA deductibility).

With a spousal IRA contribution, you could possibly double the amount of your deduction.

SEP-IRA contributions

Small business owners and self-employed individuals may use a Simplified Employee Pension (SEP) plan to save for retirement. Each eligible employee, including the business owner, has an individual SEP-IRA under the plan that is funded solely by the employer. The contribution limits are quite generous at 25% of compensation (up to $70,000) for tax year 2025. The contribution amount is tax-deductible for the employer and offers an opportunity to reduce tax liability by a significant amount, even for high-income earners. Contributions may be made by the due date (including extensions) of the business’s income tax return for that year.

HSA contribution

If you participated in a high-deductible health plan (HDHP), you can contribute $4,300 for individual or $8,550 for family coverage (an additional $1,000 for those 55 and older) for tax year 2025 to a Health Savings Account (HSA). Many people use HSAs to cover immediate out-of‑pocket health care costs. But HSAs are also a good way to invest for the long term—tax‑free—to offset future qualified health expenses in retirement. Your contribution amount is generally fully tax-deductible and is recorded on IRS Form 8889 (Health Savings Accounts (HSAs)).

Saver’s Credit

Certain households making contributions to an IRA or a workplace retirement plan may also benefit from a tax credit called the Saver’s Credit. If your adjusted gross income is $39,500 or less ($79,000 or less if married filing jointly), you could receive a tax credit up to $1,000 ($2,000 if married filing jointly). While $1,000 to $2,000 may not seem like a large sum, a tax credit reduces your tax liability dollar for dollar. This credit, however, will not result in a tax refund if your tax liability is less than zero. If you fall into these thresholds, you may want to spend a little extra time to complete IRS Form 8880 (Credit for Qualified Retirement Savings Contributions).

Final thoughts

If you haven’t taken full advantage of your 2025 tax deductions, now’s the time to act. All it requires is a little tax planning. Determine what type of contributions you’re eligible for, along with what works best for your overall financial plan. Saving as much as you can now may provide a tax break today, but it could also grant you valuable time to allow your investments to grow for the future.

All contributions make a difference.

1 For 2025, the total contributions you make each year to all of your Traditional IRAs and Roth IRAs can’t be more than $7,000 ($8,000 if you’re age 50 or older), or if less, your taxable compensation for the year.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the author as of November 2025 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types; advice of any kind; or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual future outcomes may differ materially from any estimates or forward-looking statements provided.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc.

© 2025 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators (see troweprice.com/ip) are trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of their respective owners.

- 202510-4867961