Your browser will soon be unsupported by T. Rowe Price. To ensure security and proper site functionality, please update to the latest version of Chrome, Edge, Safari, or Firefox. For work devices, contact your IT administrator.

How to minimize taxes when leaving assets to the next generation

November 2025

- Key Insights

-

- If your heirs will have a higher future tax rate, it may make sense to leave them different types of assets than tax-deferred accounts.

- Leaving taxable assets to heirs allows them to benefit from the step-up in cost basis, making the gains during the original owner’s lifetime tax-free for the heirs.

- If you’re considering passing along taxable assets to your heirs, take into account the investments’ cost basis, your tax rate on capital gains, and your life expectancy.

You’ve planned well enough to be able to leave some money to your children or grandchildren. But have you thought about the tax consequences of your gift?

Tax-efficient withdrawal strategies can be helpful for people looking to spend down their assets in retirement while paying fewer taxes. It may also be beneficial to address strategies for a tax-efficient way to leave assets to your heirs—specifically income taxes (rather than estate taxes, which affect very few people). Here are two factors to consider:

1. Your heirs’ tax rates

The decision to draw from Roth or tax-deferred savings depends largely on future tax rates—yours and your heirs’. If your heirs’ tax rates are likely to be higher than yours, you may want to use assets from your tax-deferred account for spending and leave your loved ones the taxable and Roth assets. That’s somewhat different from the conventional wisdom approach, where you exhaust taxable accounts, then tax-deferred accounts, then finally Roth assets.

2. Taxable assets with gains, which can be passed down to your heirs tax-free

Under current tax law, the cost basis for inherited investments in taxable accounts is the value at the owner’s death. This is known as a “step-up in basis,” and it effectively makes gains during the original owner’s lifetime tax-free for heirs. This benefit is why you may want to hold some taxable assets as long as possible, contrary to the conventional wisdom that suggests spending taxable assets first. This can be an especially beneficial strategy with highly appreciated investments in your later years.

Putting your plan into action

The right approach to drawing down your retirement portfolio may involve different tactics at different stages of retirement based on your marginal tax rate. Required minimum distributions (RMDs)—annual withdrawals that people generally are required to take from tax-deferred retirement accounts, such as individual retirement accounts (IRAs)—limit your flexibility and can affect what tactics are best in different years. RMDs must be taken once you reach age 73.1

For example, for the years—if any—that you are in the 10% or 12% tax bracket, capital gains you realize are generally not taxed. Therefore, you might take advantage of this period to sell investments in taxable accounts. In other years, you may want to preserve taxable assets by prioritizing either tax-deferred or Roth distributions.

How would these strategies work? Let’s consider a married couple retiring at age 65.

- They have $2.5 million in assets: 40% in tax-deferred accounts, 50% in taxable accounts (with a 25% cost basis), and 10% in Roth accounts.

- They plan to spend $140,000 per year and would have total annual Social Security benefits of $54,000 if they claim at their full retirement age (with similar amounts for each spouse).

- Based on these facts, they are highly likely to leave assets to beneficiaries, who we assume will have a marginal tax rate of 28%. That is higher than the couple’s top rate even under the conventional wisdom strategy.

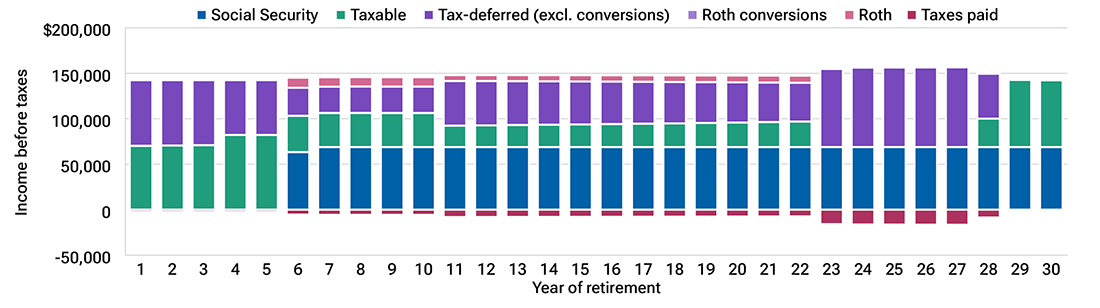

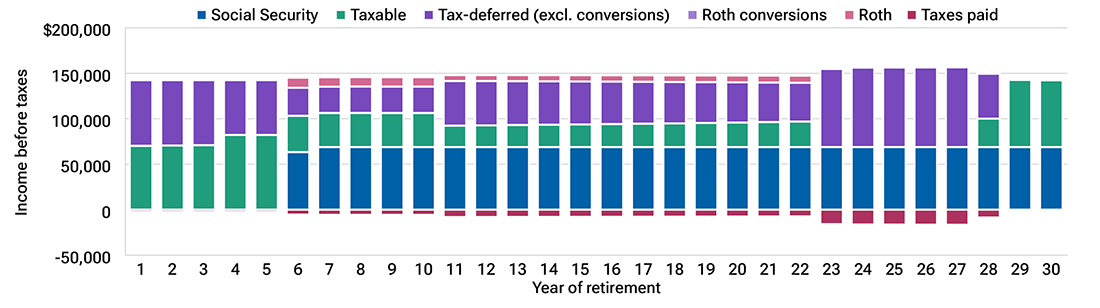

Sources of retirement income drawing down tax-deferred accounts before death

(Fig. 1) Heirs with a high tax bracket can benefit from the step-up on taxable investments rather than inheriting tax-deferred accounts.

close

close

Because of the heirs’ tax rate, it makes sense for this couple to draw down their tax-deferred assets before death. As illustrated in Figure 1, the best strategy carefully chooses when to take those tax-deferred distributions.

- Before the couple claims Social Security at age 70 (their best strategy), they would rely on both tax-deferred distributions and selling taxable account assets. The tax-deferred distribution approach would fill the 10% bracket.

- Over the next 17 years, the strategy supplements Social Security (and eventually RMDs) with a proportional mix of all account types, which keeps the household comfortably in the 12% bracket. During those years, the couple’s taxable income is low enough that all of their capital gains are tax-free.

- Thereafter, spending needs are met by tax-deferred distributions to deplete the accounts shortly before death. That leaves taxable accounts to meet their spending needs at the very end, and the remaining taxable account assets pass to their heirs with the benefit of the step-up.

While this strategy results in only slightly lower taxes during the couple’s lifetime compared with the conventional wisdom strategy, it helps the higher-taxed heirs.

Therefore, the after-tax legacy of the recommended strategy is 12%, or $169,000 higher than with the conventional wisdom strategy.

A few final tips and reminders:

- While Roth conversions were not part of the best strategy we found for this example, they could make sense in other situations.

- As a result of the SECURE Act of 2019, most non-spouse retirement account beneficiaries will need to draw down the account fully within 10 calendar years of the original owner’s death. That could increase their tax rates during the 10-year period. That higher tax rate should be considered in your withdrawal strategy and may make Roth conversions or tax-deferred distributions in retirement more beneficial.

- Taking large tax-deferred distributions to fund spending needs (like the couple above) can help your highly taxed heirs but incurs a significant tax burden for you.

- We recommend using a tax professional or financial planner and starting the planning process at least 10 years before you’re subject to RMDs.

When planning your estate and retirement income strategy, it may not be easy to predict your heirs’ future financial situation, let alone their tax bracket. Even so, it can be worth taking some time to weigh the possible income tax consequences for the estate recipients versus taxes you will pay during your lifetime.

(For additional details, see troweprice.com/ withdrawalstrategiesreport)

Roger Young, CFP®

Thought Leadership Director

Roger Young, CFP®

Thought Leadership Director

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

T. Rowe Price Insights delivered to your inbox

Receive monthly retirement guidance, financial planning tips, and market updates to help you make confident decisions about your finances.

By subscribing, you agree to receive occasional emails about our products and services. The Privacy section of our Help Center has information about how to opt out or update your preferences. This offer is intended for persons in the United States and should not be considered a solicitation or offering or any investment products or services to investors residing outside the United States.

Thank you for subscribing

Each month, we'll keep you connected with retirement guidance, financial planning tips, and market updates.

Something went wrong

Please try submitting again.

We're sorry for the inconvenience. Please come back later to try again.

That email address is already in use

Please try submitting again with a different email address.

Want a personalized financial plan delivered by a T. Rowe Price Financial Advisor?

Five important actions that can help women build financial security

1 The SECURE 2.0 Act of 2022 changed the RMD age to 73 for individuals who turn age 72 on or after January 1, 2023. The new law also provides that the RMD age will change again to 75 in 2033.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

Any tax-related discussion contained in this material, including any attachments/links, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. Please consult your independent legal counsel and/or tax professional regarding any legal or tax issues raised in this material.

The views contained herein are those of the authors as of November 2025 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual future outcomes may differ materially from any estimates or forward-looking statements provided.

Past performance is not a guarantee or a reliable indicator of future results. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor. T. Rowe Price Associates, Inc., investment adviser. T. Rowe Price Investment Services, Inc., and T. Rowe Price Associates, Inc., are affiliated companies.

© 2025 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators (see troweprice.com/ip) are trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of their respective owners.

- 202511-4970682

Grow your retirement with us.

Want a personalized financial plan delivered by a T. Rowe Price Financial Advisor?

Questions?

Speak with one of our trusted Financial Consultants.

Monday–Friday, 8 a.m.–8 p.m. ET

Planning for the financial future

Gain valuable insights on retirement guidance and financial planning.

Your future. Our expertise. Call us at 1-800-366-5910

Your future. Our expertise. Call us at 1-800-366-5910