May 2022 / DEFINED CONTRIBUTION

2021 Defined Contribution Consultant Research Study

Insights on retirement trends from the nation’s leading consulting and advisory firms.

T. Rowe Price, in partnership with Schaus Group, is delighted to share insights on retirement trends from our latest survey of the nation’s 32 leading consulting and advisory firms that provide services to more than 33,000 plan sponsor clients and report nearly $7.2T of assets under advisement.1 The study was conducted at the end of 2021 during the continued coronavirus pandemic.

Recent years have presented unprecedented challenges, and we find the consulting and advisory community evolving their businesses to address both obstacles and new opportunities. Consultants and advisors work along with their plan sponsor clients to help participants prepare for retirement and seek broader financial well-being. Study results are summarized in three sections.

Firms That Participated in the 2021 Defined Contribution Consultant Research Study

(Fig. 1) Each firm completed one study questionnaire from September 20 to November 8, 2021.

Focus on Retirement Income and Qualified Default Investment Alternatives (QDIAs)

Traditionally, defined contribution (DC) plans were built to help workers accumulate retirement assets, and QDIAs have played a central role in meeting this objective since the emergence of auto-enrollment. More recently, many plan sponsors (and their consultants) have also sought to address the needs of participants who keep assets in their DC plans after they retire. Viewed within the broader context, the emergence of DC-sourced retirement income paired with the existing infrastructure devoted to asset accumulation suggests a more comprehensive set of solutions targeted to deliver better outcomes for participants. In this way, QDIAs (to save for retirement) and retirement income solutions (for living in retirement) may be conceptually linked.

Key Findings

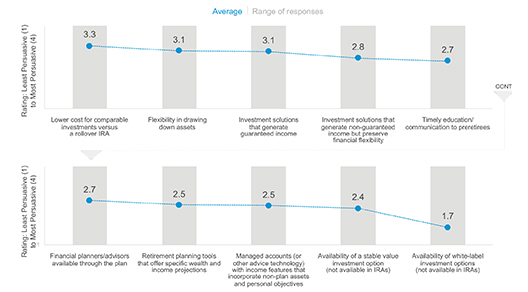

- T. Rowe Price data suggest that more participants are remaining in their DC plans for longer after they retire. Potentially accelerating this trend, lower cost for comparable investments versus a Rollover IRA, flexibility in drawing down assets, and investment solutions that generate income were all cited as features that may best persuade more participants to stay in plan after they retire (Figure 1).

- Focusing on solutions and methods to deliver retirement income from DC plans, consultants report simple systematic withdrawal capabilities as most appealing despite limitations. However, multi-asset investment solutions—managed accounts with income planning features and target date investments with embedded managed payout features—follow closely behind in rated appeal.

- Consultants strongly support increasing focus on CIT-based target date solutions and pursuing blend solutions that may deliver the benefits of active and passive investment management. Of note, these cost containment trends received greater support than simply increasing use of passive investment management. Consultants show less support for use of managed accounts as QDIAs and mild support for adding or increasing allocations to diversifying asset classes (e.g., TIPS, private equity, and real estate).

- Looking to managed accounts, greater need for participant engagement and difficulty in getting information on other participant assets were cited as key factors that have stood in the way of greater adoption of managed accounts as QDIAs.

Solutions That May Best Persuade Retired Participants to Remain in Plan

(Fig. 2) Consultant firms were asked: What solutions and features may best persuade retired participants to remain in plan?

As of September 20, 2021, to November 8, 2021.

Asset Trends and Environmental, Social, and Governance Interest

Despite the pressure on fees, consultants and advisors believe DC plans should offer investment options across all asset classes that are either actively managed or a combination of both active and passive management. Interest rate and inflation concerns coupled with more retiree assets in plan are influencing the evaluation of fixed income and capital preservation investment options. Interest in environmental, social, and governance (ESG) factors is being motivated by the desire to drive positive engagement among participants and better align with corporate sustainability targets.

Key Findings

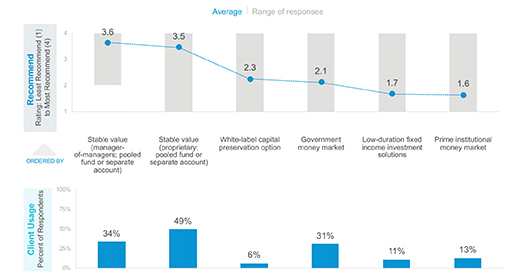

- Consultants tend to recommend stable value ahead of money market strategies. While they report stable value is used by more of their clients, 31% of clients still use government money market investments (Figure 2).

- Regarding ESG, consultants recommend active investment management over passive investment management or providing access through self-directed brokerage windows. They shared that plan sponsors are monitoring DOL progress with ESG guidance and are considering current plan offerings before implementing.

- Consultants are seeing plan sponsors evaluate investment managers’ diversity, equity, and inclusion (DEI) baseline reports to satisfy basic due diligence. Further integration of DEI information into plan and investment decisions may require more evolution.

Financial Wellness Programs

Capital Preservation Investment Option(s) Generally Recommended and Client Use

(Fig. 3) Consultant firms were asked: Which capital preservation investment option(s) do you generally recommend, absent specific plan sponsor preferences, and what percent of your clients use each option?

As of September 20, 2021, to November 8, 2021.

In response to the pandemic and “great resignation,” employers are more aware of the need for financial wellness programs. Employers’ key financial wellness objectives are to improve worker satisfaction/retention and reduce financial stress, which are also reported as the most measurable. Consultants largely believe that the pandemic has increased the relative importance of both emergency savings and debt management.

Key Findings

- The majority of consulting and advisory firms report that at least a quarter of their clients offer health savings accounts. Student debt and emergency savings programs are offered by far fewer plan sponsors (Figure 3).

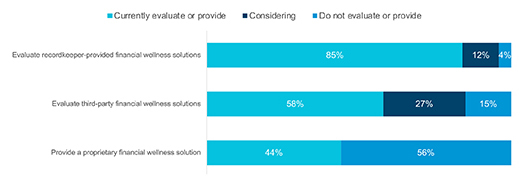

- Consultants and advisors broadly offer evaluation of recordkeeper-provided financial wellness solutions, while just over half evaluate third-party wellness solutions.

- Most consultants currently evaluate recordkeeper-provided and third-party financial wellness solutions, but a smaller number also provide proprietary financial wellness solutions for their clients.

More About This Study

The 2021 Defined Contribution Consultant Research Study was conducted by T. Rowe Price in partnership with Schaus Group. The survey population includes 32 defined contribution consulting and advisory firms responding from September 20, 2021, to November 8, 2021. Firms that participate also receive a custom report comparing their firm’s responses with the aggregate responses.

How Consultant Firms Evaluate and/or Provide Financial Wellness Solutions

(Fig. 4) Consultant firms were asked: In what ways does your firm evaluate and/or provide financial wellness solutions?

As of September 20, 2021, to November 8, 2021.

Visit troweprice.com/dcio to access additional T. Rowe Price proprietary retirement research based on plan sponsor and participant insights. For questions, please contact your T. Rowe Price representative.

Important Information

This material is provided for general and educational purposes only and is not intended to provide legal, tax, or investment advice. This material does not provide fiduciary recommendations concerning investments or investment management; it is not individualized to the needs of any specific benefit plan or retirement investor, nor is it directed to any recipient in connection with a specific investment or investment management decision. The T. Rowe Price group of companies, including T. Rowe Price Associates, Inc., and/or its affiliates, receive revenue from T. Rowe Price investment products and services.

Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation, or a solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

© 2022 Schaus Group LLC - All Rights Reserved.

Issued in the USA by T. Rowe Price Associates, Inc., and T. Rowe Price Investment Services, Inc., 100 East Pratt Street, Baltimore, MD 21202, which are regulated by the U.S. Securities and Exchange Commission and Financial Industry Regulatory Authority, Inc., respectively.

© 2022 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks T. Rowe Price Group, Inc.