May 2022 / RETIREMENT INSIGHTS

Reference Point: Annual Recordkeeping Report

Reference Point provides T. Rowe Price recordkeeping data and actionable insights into plan and participant activity throughout the year.

This valuable benchmarking tool analyzes key trends and shared expert commentary you can use to inform your plan strategy decisions.

Report Highlights

Two years in from the onset of the COVID-19 pandemic, we examine how T. Rowe Price recordkeeping plans and participants have fared. Despite the challenges, the data highlight encouraging signs observed over the past year.

Plan sponsors and participants took positive steps that show they realize the value of retirement savings programs:

- The percentage of plans offering a match returned to pre-pandemic rates or higher.

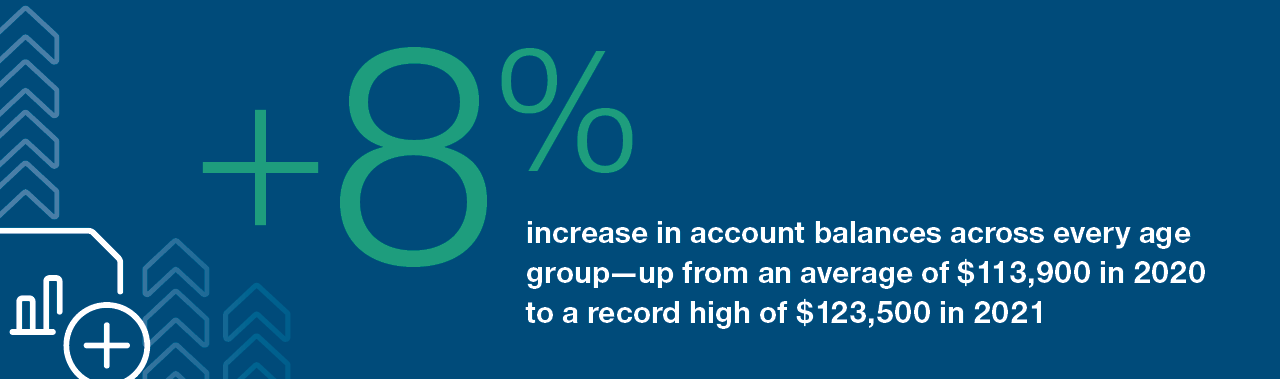

- Average employee deferral rates have climbed steadily to an all-time high of 8.5% in 2021.

- After two years at 50%, the percentage of auto-enrollment plans defaulting to 5% deferral rates or more increased to 52%.

- The percentage of participants with outstanding loans decreased from 20% in 20220 to 18.8% in 2021.

- Plan participation increased from 67% in 2020 to 68% in 2021.

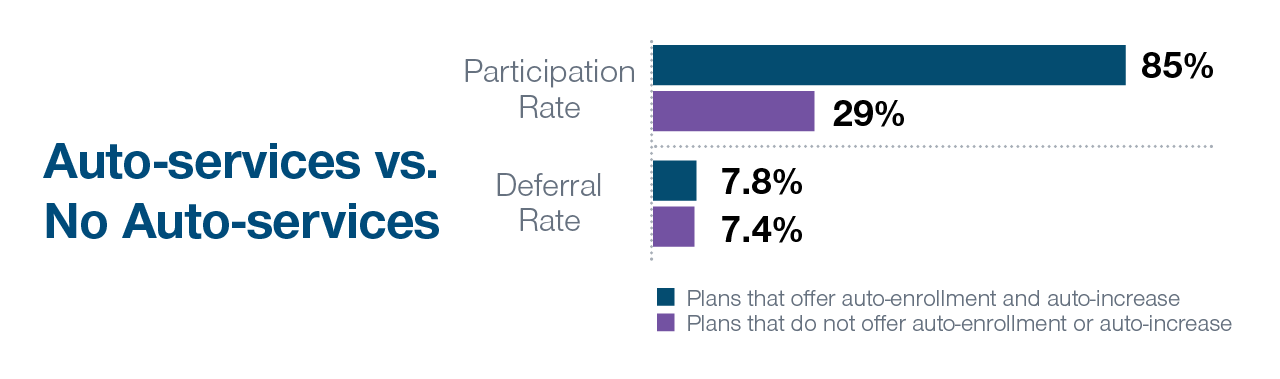

Combining auto-solutions can help achieve better results:

- Plans using auto-enrollment and auto-increase in tandem achieve an 85% participation rate compared with only 29% for those that do not offer the services.

- Participants in plans with both auto-enrollment and auto-increase are saving 5% more than those in plans that did not adopt the solutions.

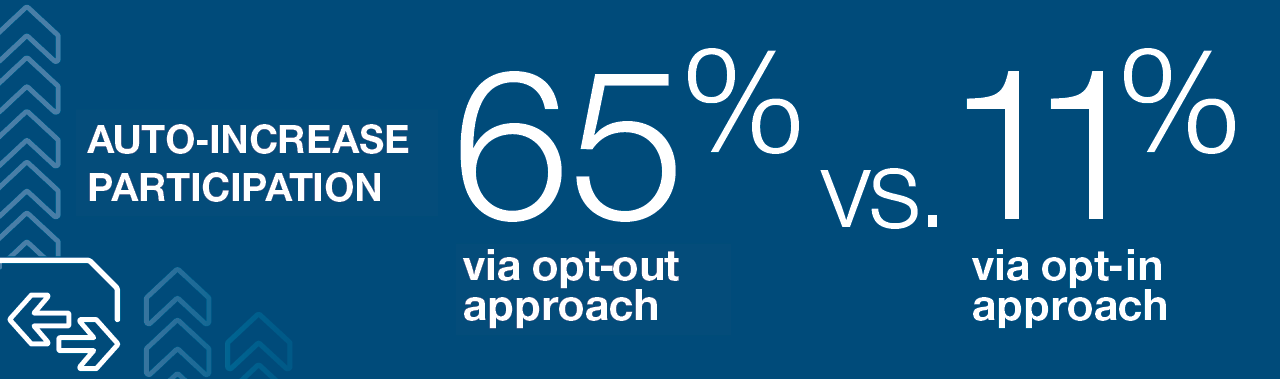

- Auto-increase using the opt-out approach proves more effective than the opt-in approach. In 2021, participation in auto-increase was 65% in plans that used the opt-out approach compared with only 11% for plans using the opt-in approach.

The data from 2021 show us that sponsors and participants continue to understand the value of retirement savings programs. There is still a need for financial wellness programs to help participants manage challenges without losing sight of their long-term goals. Continued adoption of plan design best practices can help drive increased participation and savings rates.

IMPORTANT INFORMATION

This material is provided for general and educational purposes only and is not intended to provide legal, tax, or investment advice. This material does not provide recommendations concerning investments, investment strategies, or account types; it is not individualized to the needs of any specific investor and not intended to suggest any particular investment action is appropriate for you, nor is it intended to serve as the primary basis for investment decision‑making.

The views contained herein are those of the authors as of March 2022 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

Study results provided throughout the material are as of the most recent date available and are subject to change.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

©2022 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, RETIRE WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

T. Rowe Price Associates, Inc., T. Rowe Price Investment Services, Inc., T. Rowe Price Retirement Plan Services, Inc.