April 2021 / INVESTMENT INSIGHTS

Five Forces in International Equities Investors May Be Underestimating

China, Japan, technology, and value have potential to shape global markets in 2021 and beyond

Key Insights

- A range of market dynamics are in play that are having long‑term impacts on performance that may surprise some investors.

- Closer attention is warranted on the longer‑term potential of China as an investment market, Japan’s often unheralded structural changes, technology opportunities beyond the U.S., and the prospects for value in emerging markets.

- As 2021 progresses, understanding these dynamics can help investors identify or amplify potential sources of return for their international portfolios.

The Five Forces in International Equities to Monitor

(Fig. 1) Key themes shaping the direction of international markets

International investors appear to be underestimating five global trends that have the potential to shape the direction of markets. These areas of focus—China, Japan, technology, value, and the resiliency of international markets—may provide distinct opportunities as investors seek to shape portfolios in the wake of the coronavirus pandemic.

Investors Are Still Slow Off the Mark in China

The rapid rise of China to the world’s second‑largest economy is widely observed. Yet, investors appear to underappreciate China’s opportunity to continue expanding.

While China’s share of global gross domestic product ballooned from 9% to 16% between 2010 and 2019,1 its expansion has not been matched in global equity indices. MSCI ACWI’s China exposure, for example, expanded from 2% to just 5% over the same period. Gaining exposure to China by simply aligning to global indexes means investors risk missing out on much of the potential that this engine of global growth represents.

A closer look within the China growth story reveals an even more astonishing representation of the expanding opportunity set for internationally minded investors. Initial public offerings (IPOs) in the Asia ex Japan region far outstripped those in other emerging market regions by a factor of almost 10 to one from 2015 to 2019.2 IPOs in China specifically made up around one‑third of newly listed equities in the region as a whole, approaching 1,200 in the period.2

This growth in listed equities in China has occurred across a range of sectors, representing an impressive universe of companies for alpha‑seeking investors to explore. It means that there is an ever‑expanding opportunity set for investors in China.

While investors might be familiar with a handful of big‑name Chinese companies that have captured global headlines in sectors such as technology and communications, those willing to explore the opportunities at the margins have the potential to discover the lesser known stock stories of tomorrow—those with the potential to compound over time and generate real value when held over the long term. For example, outlier stocks within the market (which we determined was a group of 51 stocks),2 compounded by over 20% per annum over the 10 years to November 2020, cumulatively far in excess of the gain of the broader CSI 300 Index and matching the trajectory of the market’s leading tech performer over the period.2

These macroeconomic and market dynamics are set to continue. China’s economy has enjoyed a V‑shaped recovery from the coronavirus‑induced shock in the first quarter of 2020. Successful containment of the virus has enabled manufacturing to bounce back strongly, followed by a recovery in the services sector. Meanwhile, Chinese policymakers continue to support innovation and rebalancing toward domestic consumption as core components of the nation’s future economic strategy.

We believe many investors are under‑indexed to Chinese securities. Investors can do more to uncover the alpha potential of China’s growing and diverse market as a potential feature of their international equity portfolios.

Japan’s Gains Are By Design, Not Chance

It has now been 30 years or so since Japan’s infamous stock market bubble faced a reckoning. For many investors, the popular narrative since has been to associate the Japanese economy with perennially low growth and inflation and an economy lumbered with a poor demographic profile due to its aging and falling population.

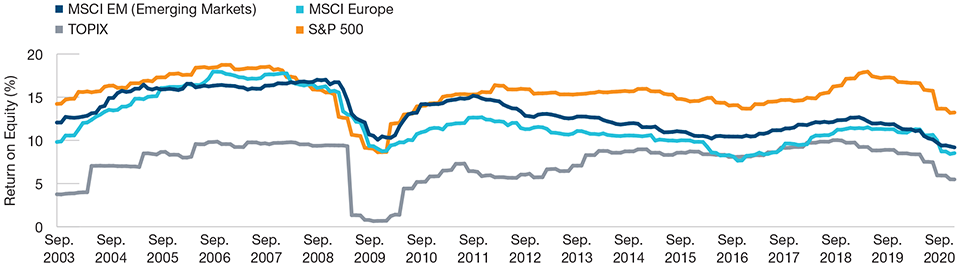

Japan Is Breaking From Its Low‑Return Past

(Fig. 2) Regional return on equity comparisons show TOPIX upwards trend since 2009 (%)

As of December 31, 2020.

Past performance is not a reliable indicator of future performance.

Sources: FactSet Research Systems Inc. All rights reserved. TOPIX—Tokyo Stock Exchange, Inc., MSCI, S&P (see Additional Disclosures).

Less appreciated, however, is that despite these headline trends, Japan has been the best‑performing major developed equity market over the past 10 years outside the U.S.* Performance has been bolstered by orchestrated, long‑term structural changes in company governance and levels of foreign investment, alongside a decrease in domestic cross‑ownership. The impact has been to underpin improvements in company earnings profiles that have seen Japanese equities successfully break from a low‑return past and converge with the profitability levels of global peers.

The renowned might and efficiency of Japan’s industrial production is now accompanied by encouraging improvements in capital and balance sheet management. These are manifested in changes to patterns of capital allocation—with the combination of dividends and buybacks having increased over time, bolstering potential returns for equity investors. These changes are set to be powerful drivers of equities over the next cycle.

For investors, perceptions of a post‑1990s Japan as a weakened economic force only serve to underrate the less obvious changes over the past two decades that have demonstrably bolstered the market’s return growth potential. As a result, we believe there are potential opportunities for investors in a strategic allocation to Japanese equities.

The Tech Story Knows No Borders

The story of the disruptive trends that have changed the face of global commerce and equity markets over the past decade has both transfixed and rewarded many investors. Former market leaders across a range of sectors have been usurped by new entrants that have rapidly challenged old business models, as many incumbents struggled to adapt. Companies at the epicenter of technological obsolescence continue to be negatively impacted across media, retail, entertainment, and communications.

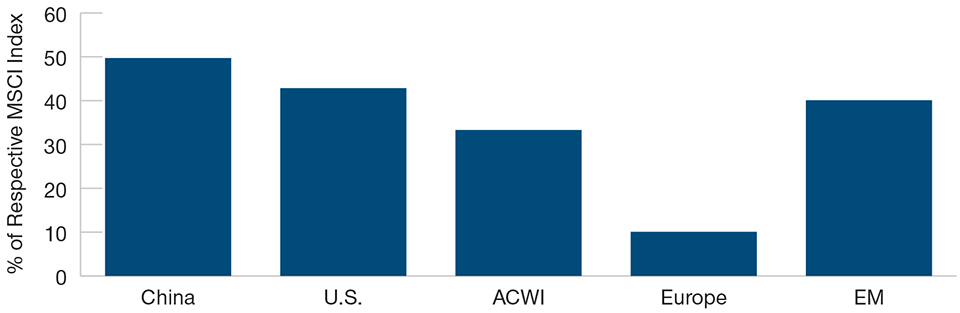

Comparison of MSCI Index Exposures to Disruptive Technology

(Fig. 3) Emerging markets punching above their weight

As of December 31, 2020.

Sources: FactSet; T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved. “Disruptive Technology” is defined as the information technology sector, the internet and direct marketing retail industry within the consumer discretionary sector, and the media and entertainment industry group within the communication services sector. The regions are represented by the MSCI China Index, MSCI USA Index, MSCI All Country World Index, and MSCI Europe Index (see Additional Disclosures). T. Rowe Price uses the current MSCI/S&P Global Industry Classification Standard (GICS) for sector and industry reporting. T. Rowe Price will adhere to all updates to GICS for prospective reporting.

The economic and social consequences of the coronavirus pandemic have served to accelerate the rise of some technology platforms in retail, social media, streaming content, and remote conferencing. It has served to further expose the divide between industries and companies benefiting from disruption and those challenged by it.

The consequent reweighting toward companies that have innovated successfully has reshaped the composition of many equity markets. Amid the shakeup, a range of big‑name U.S. tech stocks have tended to dominate the headlines and investor enthusiasm. Often this had been with good reason, given staggering growth and the ability to capture revenue streams.

However, innovation and disruption are not the preserve of the U.S. Disruptive technology companies have grown to represent 50% of the MSCI China Index and 40% of the MSCI EM Index, providing an abundant source of opportunity for investors seeking exposure to these trends.

The upshot for investors looking to take advantage of ongoing disruptive trends is that innovation is shaping international markets, not just the U.S. A global investment lens is essential in seeking to fully capture the multitude of opportunities this represents.

Value Is Back—Particularly in Emerging Markets

Global equity markets staged a striking recovery after the initial shock of the pandemic‑related downturn in February and March 2020. That pace of the markets’ rebound has given international investors pause to consider where the strongest opportunities for 2021 are to be found.

Prior to the pandemic, “growth” as a factor had already been in the ascendency for a long time—this was then extended by the acceleration of disruptive forces brought about by the pandemic. Now, signs of improving macroeconomic conditions, massive fiscal measures by governments of major economies, ongoing monetary stimulus, a cyclical rebound in oil prices, an uptick in inflation, and a steepening yield curve provide a compelling backdrop for a recovery in value stocks.

An Extended Cycle of International Underperformance

(Fig. 4) Rolling three‑year excess returns—MSCI EAFE vs. Russell 1000

As of December 31, 2020.

Past performance cannot guarantee future results.

Sources: T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved. MSCI. LSE Group, S&P Global Market Intelligence (see Additional Disclosures). “U.S.” is represented by the Russell 1000 Index. “EAFE” is represented by the MSCI EAFE Index.

With markets currently elevated and in the wake of the prolonged growth cycle, relative prices look increasingly favorable for value‑orientated areas of the market. Specifically, stock‑specific valuation multiples have widened, creating a much better backdrop for value stock pickers. It remains important, however, to distinguish between companies that are cyclically depressed and those that have more underlying long‑term structural concerns.

Emerging markets provide a particular opportunity here, with the polarization in valuations between the growth and value segments of the market clearly evident.

We believe emerging market currencies are undervalued. As non‑Chinese emerging market countries have relatively high exposures to cyclical sectors such as financials, resources and industrials, these segments of the market are potentially good opportunities for investors seeking to benefit from the “value” play.

International Markets Are Poised to Gain the Ascendency

Several factors indicate that international equities are poised to reverse an extended period of underperformance versus the U.S. and regain the ascendancy.

Since 2011, U.S. equities (represented by the Russell 1000 Index) have outperformed international developed markets (represented by MSCI EAFE Index) in over 133 consecutive months. This cycle of international underperformance relative to the U.S. is twice as long as seen in a typical cycle. It’s an impressive run, but it’s one that may be about to change.

Factors that have previously favored the U.S. equity market, such as a low‑rate environment, are likely to come under pressure. A post‑pandemic recovery in growth, fueled by consumer confidence and massive fiscal spending, is likely to feed through to inflation expectations. That would eventually drive policy rates higher and weigh on tech and other sectors that have benefited from historically low rates. Further, the potential for value stocks to return to favor, supported by post‑pandemic recovery and associated policy measures, may limit the advantage that the growth cycle has conveyed on U.S. equities.

Meanwhile, a weaker U.S. dollar may benefit international returns. The dollar has weakened against every other G‑10 currency since April 2020. An end to the era of U.S. exceptionalism in terms of higher real interest rates, higher nominal and real growth rates coupled with a now abundant supply of dollars could lead to a period of sustained weakness for the dollar.

Ultimately, if the tide does turn against the trend of U.S. equity outperformance versus international, investors could pivot allocations to try to catch the wave, generating additional momentum for international equities.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

April 2021 / MULTI-ASSET SOLUTIONS