April 2021 / INVESTMENT INSIGHTS

Why ESG Factors Matter in Asia Credit Investing

Integrating ESG factors can help manage downside risk and identify high‑quality businesses driving positive change.

Key Insights

- ESG investing is on the rise in Asia, where regional governments have stepped up disclosure requirements amid a drive toward sustainability.

- We believe that ESG integration can help identify high-quality, forward-thinking businesses for investment and manage downside risks in credit portfolios.

- For an investment to earn a position in our Asia Credit Bond Strategy, it should satisfy a three-step process with ESG analysis embedded at every stage.

Already mainstream in Europe, responsible investing is fast becoming a key consideration in Asia as well. The integration of environmental, social and governance (ESG) factors into investment decisions has gained recognition as an important method of downside risk management and a driver of risk-adjusted returns. Looking specifically at credit investing, 60% of regional investors expect governance issues will impact corporate bond yields in 2022, while more than two out of five expect environmental and social factors will matter.¹

The ESG landscape in Asia should continue to evolve since it is still at an early development stage. We also expect that there may be a divergence in terms of which countries make the most strides in promoting ESG awareness and implementing reporting requirements based on their unique characteristics.

A growing push for responsible investing from across the stakeholder spectrum suggests that it is here to stay. Adapting an approach for Asia requires careful monitoring of the latest developments within the region along with a robust ESG research platform. We believe strategic investors who are able to do that should find themselves well positioned to drive positive change and capitalize on potential opportunities presented by the evolving ESG landscape.

ESG Investing in Asia

Although Asia has been a relative laggard in adopting ESG integration or applying sustainable objectives to their investment mandates, this region has been at the forefront of socially responsible investing (incorporating values into their investment mandates) with regard to Islamic finance. Malaysia established a law in 1983 to regulate banking compliant with Islamic tradition and topped the Global Islamic Economy Indicator rankings for an eighth straight year. Indonesia, which has the world’s largest Islamic population, ranked fourth behind Saudi Arabia and the United Arab Emirates.²

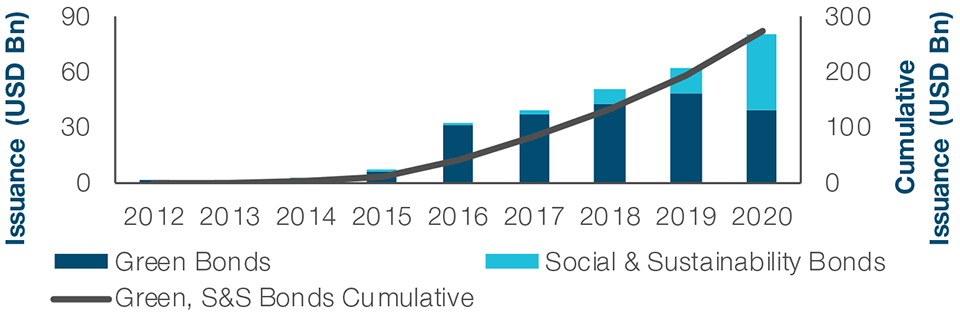

More recently, investing with sustainable objectives has also gained a foothold in the region. The cumulative value of sustainable issuance in Asia surged sevenfold in just four years to USD 275 billion in 2020 (see Fig. 1). China and South Korea combined to account for two-thirds of the total with the rest split between Hong Kong and countries like Japan, India and the Philippines.

ESG Investing on the Rise in Asia

(Fig. 1) Growth in Asian sustainable issuance

As of December 31, 2020.

Sources: BNP Paribas and Bloomberg Finance L.P. Data analysis by T. Rowe Price. Sustainable issuance is defined as the combined total of green bond and social & sustainability bond issuances.

The growth in sustainable issuance has come as government regulations have expanded the depth and breadth of comparative ESG data. For instance, ESG disclosure requirements are now mandatory for publicly listed companies in Hong Kong, Singapore, Thailand and the Philippines. In China, listed companies already face certain reporting requirements, while the China Securities Regulatory Commission is expected to announce mandatory ESG disclosure guidelines later this year. Elsewhere, India and South Korea have updated voluntary recommendations to enhance ESG reporting.

Further ESG disclosure requirements are also likely to arise out of the growing push underway in most countries across the region to shrink their carbon footprints and curb the usage of fossil fuels for power generation. China, for example, has redoubled its environmental focus and has committed to having its carbon dioxide emissions peak before 2030, and becoming carbon neutral before 2060. We also expect that another tailwind for ESG investing will come from asset owners themselves who feel that investments should not only deliver strong performance potential but also drive positive change.

ESG Challenges and Opportunities in Asia Credit

We anticipate that sustainable issuance will continue to increase rapidly in Asia as ESG investing becomes an increasingly important priority for asset managers and owners alike. There are still plenty of growing pains to push through, however, creating an opportunity for strategic investors to capitalize on any price dislocations.

Asian issuers have tended to screen poorly in terms of ESG disclosure, making it difficult to form a comprehensive picture of their potential liabilities and the steps that they might take to overcome them. Investors could potentially overcome this challenge through increased engagement. In a similar vein, bondholders who are able to collaborate jointly across the asset classes should be able to improve their access to corporate management and possibly gain more influence when discussing ESG factors.

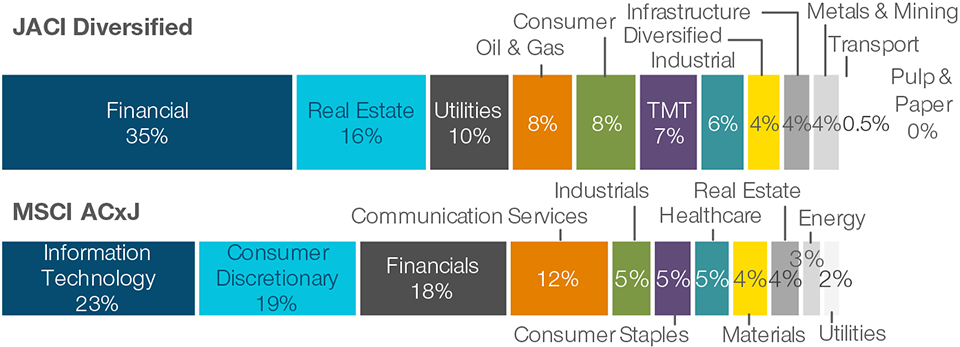

Concentrated Investment Opportunity Set in Asia Credit

(Fig. 2) Benchmark sector weightings

Numbers may not add to 100% due to rounding.

As of February 28, 2021.

Sources: MSCI, JP. Morgan, Bloomberg; Analysis by T. Rowe Price.

Indices: JACI Diversified—J.P. Morgan Asia Credit Index Diversified; MSCI ACxJ—MSCI All Country Asia ex‑Japan Index.

Going forward, we also expect that Asia’s increasing push toward sustainability and reducing a reliance on fossil fuels could provide a structural tailwind for higher sustainable issuance. Currently, the investment universe is skewed towards capital- and commodity-intensive industries, while the technology and consumer sectors make up a far smaller weighting when compared with the regional equity market where they represent more than a combined third of the benchmark. In our view, this is likely to change and creates an opportunity for investors to capitalize on a broader opportunity set through fundamental, bottom-up research.

Considering ESG Factors Can Help to Manage Downside

We believe that incorporating ESG factors into our investment process alongside financial, valuation, macroeconomic, and other fundamental factors, is consistent with our central mission of helping clients reach their long-term financial goals. Our philosophy is that ESG factors are another key component or input into the decision-making process—meaning they are not the sole driver of an investment decision, nor are they considered separately from more traditional analysis.

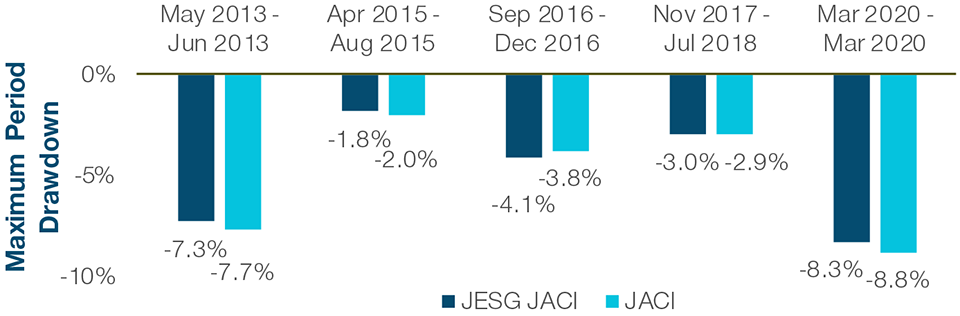

In terms of the Asia credit asset class, we believe that integrating ESG considerations into a fundamental, bottom-up research process can help to identify high-quality, forward-thinking companies—businesses with greater prospects for long-term sustainability and, in turn, potential for improved credit risk profiles. Importantly, we believe this ESG integration could potentially provide some downside risk management to portfolio performance. In practice, an ESG-version of the J.P. Morgan Asia Credit Index (JESG JACI), which is a USD-only benchmark covering Asia ex-Japan, showed positive convexity, with greater beta in weeks of positive spread return (0.980) than in negative weeks (0.955).³

Indeed, JESG JACI managed to outperform the broader JACI benchmark on multiple occasions over the past decade during downturn periods. Although it did not outperform in every instance, the positive track record signals that considering ESG factors could potentially help mitigate downside risk. The maximum drawdown in JESG JACI was less, for instance, during the global market rout in March 2020 that was triggered by the onset of the COVID-19 pandemic.

ESG Index Outperformed During Sell‑offs

(Fig. 3) Maximum period drawdown during downturn periods

Past performance is not a reliable indicator of future performance.

As of February 28, 2021.

Source: T. Rowe Price, based on data from J.P. Morgan.

Indices: JESG JACI—J.P. Morgan ESG Asia Credit Index; JACI—J.P. Morgan Asia Credit Index.

Asia Credit Bond Strategy Utilizes a Fully Integrated ESG Approach

For an investment to earn a position in the Asia Credit Bond Strategy it should satisfy the following three steps: (1) fundamental analysis (2) issuer engagement and (3) portfolio construction. Importantly, ESG analysis is embedded throughout this process.

Fundamental Analysis: We believe the best investment decisions are made when multiple perspectives are considered in the research process. Credit analysts collaborate with Responsible Investing (RI) analysts to incorporate ESG considerations into both qualitative and quantitative credit analysis. We utilize the Responsible Investing Indicator Model (RIIM), our proprietary tool developed by our ESG specialists to help screen our investment universe for responsible investing risks and opportunities. RIIM is currently able to analyze the RI profile of approximately 15,000 companies.

Issuer Engagement: Credit analysts routinely maintain dialogue with issuer management teams to stay on top of evolving investment theses and to identify potential risks, their materiality, their probability and mitigants. These will often be conducted alongside RI analysts and other interested parties (i.e., equity analysts, sector specialists, portfolio managers) to optimize the quality of information gathered. As it relates to ESG, we aim to be agents of change and want to support proactive issuers that show an approach to minimize potential liabilities from ESG risks.

Portfolio Construction: The Asia Credit Bond Strategy follows a transparent and consistent process to size positions. The process is underpinned by several inputs, such as analyst conviction scores, credit ratings, and the assessment of ESG considerations. The portfolio manager balances factor exposures at the portfolio level, including ESG risks. Given the asymmetry in bond returns, the main focus is to limit exposure to issuers that may be subjected to headline risk.

ESG Integration In Action

The consideration of ESG factors has been a direct influence in helping us to identify certain high-quality companies that we believe offer attractive risk‑return potential.

For instance, we invested in a Philippine utility company, which manages a growing portfolio of renewable assets and which has set ambitious targets for further deployment of solar, wind, and geothermal capacity, while selling down stakes in its legacy thermal business. In our opinion, the company presented an attractive investment opportunity given its forward-thinking approach and comprehensive level of disclosure, alongside fundamental considerations, including improved leverage and a strong track record with investors.

Elsewhere, we also invested in a nutrition products provider in China, which is a market leader in its field. The company’s management have demonstrated a clear commitment to reducing carbon emissions and also improving employee wellbeing. Our investment case was supported by the company’s clear sustainability strategy, as well as its consistent track record of stable growth and positive free cash flow.

What We're Watching Next

While ESG is fast becoming mainstream in Asia, we expect that there will be an inevitable divergence within the region in terms of which countries make the most strides in promoting ESG awareness and increasing company disclosure requirements. This only reaffirms the importance of a robust, dedicated ESG research platform that can keep pace with new developments.

The nature of ESG investing is also likely to evolve as future issues cast current ESG factors in a new light. We believe maintaining a regular dialogue with the management teams of companies represented in our portfolios is the best way of staying ahead of any changes that may affect their businesses.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

April 2021 / MARKETS & ECONOMY

April 2021 / INVESTMENT INSIGHTS