EM Corporate Debt’s Time Has Come

Its role in investor portfolios is set to expand.

Key Insights

- The stage is set for a secular reflation of asset prices in emerging markets becausxe they offer three key advantages of growth, demographics, and change.

- We believe emerging market corporate debt is positioned to perform well when rates are both rising and falling because of its relatively high yield, short duration, potential for narrowing spreads, and wide opportunity set.

- In a multi‑asset portfolio context, the role of emerging market corporate bonds is to bring diversification benefits and an independent source of return.

Emerging market (EM) corporate debt is still regarded by many as a niche investment and is consequently not as prominent in portfolios as other asset classes. That could be about to change, however. As investors position their portfolios to benefit from the post‑coronavirus economic recovery, EM corporate debt’s unique combination of characteristics could make it increasingly in demand.

Not only has EM corporate debt benefitted from the secular trends that make EM in general an attractive place to invest, it also has features that distinguish it from other forms of EM investment. Its mix of historically attractive yields, relatively low duration, and low correlation with sovereign bonds make it an attractive option for investors seeking to boost the performance and diversify the risk of their bond and multi‑asset portfolios.

Emerging markets should benefit from a “triple premium” of three key factors: growth, demographics, and change.

Emerging markets should benefit from a “triple premium” of three key factors: growth, demographics, and change.

Emerging Markets’ Triple Premium: Growth, Demographics, and Change

Emerging markets should benefit from a “triple premium” of three key factors: growth, demographics, and change. The growth premium relates to the pace of the economic growth of emerging markets, which has recently converged with the peak growth rate of developed markets during the 1980s and—as predicted by the International Monetary Fund—should remain at this level over the next few years.

At the same time, the economic expansion of developed economies has settled at a lower level than in the past, partly for structural reasons and partly because developed market economic cycles have become longer. Since 2000, emerging markets have consistently grown at a higher pace than developed markets and although the emerging market economic expansion has slowed in recent years, it still offers a growth premium over developed economies.

The demographics premium exists because the percentage of the population aged 65 and above in emerging markets is the same as it was in developed countries back in the early 1970s. This gives EM countries an advantage over the developed world: Not only do emerging markets benefit from a younger workforce and better dependency ratio, they also have populations that are growing faster where there is a higher fertility rate.1 Moreover, the coronavirus crisis is likely to have a larger impact on the older populations of developed markets than on the younger populations of some emerging economies.

Several developments provide emerging markets with a change premium. Chief among these is that the moderation of inflation in emerging markets means that EM central banks should be able to ease monetary conditions in coming decades to stimulate growth because they do not need to keep rates high to battle inflation. Lower inflation and accommodating central banks should support lower bond yields over the long term. The potential for falling rates should boost EM asset prices, while a fall in interest rates and lower borrowing costs should support corporations.

Other structural changes that should benefit EM assets include the fundamentally improved growth and fiscal discipline of EM governments and improving corporate governance. The structure of many of these economies has also changed as they have shifted from being dominated by industrial production and natural resources to having more balanced economies, including a thriving services sector. These changes should support emerging economies and corporations operating in them.

We believe EM corporate bonds offer unique properties that mean they are well positioned to perform well in several different scenarios.

We believe EM corporate bonds offer unique properties that mean they are well positioned to perform well in several different scenarios.

The Unique Characteristics of EM Corporate Bonds

There are several ways to invest in emerging markets: through equities, sovereign debt (which can be denominated in either local or hard currency), or corporate bonds. We believe EM corporate bonds offer unique properties that mean they are well positioned to perform well in several different scenarios.

Figure 1 shows the duration (x axis), yield (y axis), and correlation with global equity (the size of the bubble indicates the magnitude of correlation; blue is the positive and, orange is the negative correlation). The most obvious conclusion from the chart is that not all fixed income asset classes are alike—they can have short or long duration (i.e., different sensitivities to changes in interest rates), low or high yields, and low or high correlation with equities (i.e., some are conservative assets that may diversify equity risk, while others are not).

Duration, Yield, and Correlation With Equities

(Fig. 1) Fixed income is a heterogeneous asset class

Past performance is not a reliable indicator of future performance.

As of March 31, 2020.

Source: T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved.

Yield and duration as of March 31, 2020. Correlation for the period December 2001 through March 2020. IG = investment grade. The size of each bubble indicates the correlation of the monthly total returns of the index with those of MSCI AC World Index (ACWI). Blue is positive correlation, orange is negative correlation. European sovereigns = Bloomberg Barclays Pan‑European Aggregate Treasury EUR. European IG corporates = Bloomberg Barclays Pan‑European Aggregate Corporate EUR. European high yield = Bloomberg Barclays Pan‑European High Yield EUR. UK gilts = Bloomberg Barclays UK Government All Bonds GBP. U.S. Treasuries = Bloomberg Barclays U.S. Treasury hedged to USD. U.S. IG corporates = Bloomberg Barclays Global U.S. Corporate hedged to USD. U.S. high yield = Bloomberg Barclays U.S. Corporate High Yield hedged to USD. EM IG = Bloomberg Barclays Emerging Markets Investment Grade hedged to USD. EM hard currency sovereigns = JP Morgan EMBI Global Diversified Composite hedged to USD. EM corporates = JP Morgan CEMBI Broad Composite hedged to USD. EM high yield = Bloomberg Barclays Emerging Markets High Yield hedged to USD.

EM corporate bonds offer an attractive yield, nearly on par with that of high yield bonds and EM hard currency sovereigns. The duration of the EM corporate bond index is shorter than that of EM and developed market (DM) government bonds and most DM investment‑grade corporate bonds. The average credit quality of EM corporates is BBB-, as is that of EM hard currency sovereigns, while that of global high yield is BB—in other words, EM corporate and sovereign bonds have an average investment‑grade credit rating. The lack of CCC rated credit and frontier market‑issued bonds in EM corporates means that the asset class has lower structural tail risk than EM hard currency sovereigns and high yield bonds.

The relatively short duration and high carry should allow EM corporate credit to perform well in both environments of modestly rising or falling rates. When rates rise, carry could buffer some losses due to duration risk—rates need to rise by about 0.9% to generate capital losses at current yield levels. When rates fall, returns could come from both carry and duration.

The profile of the EM corporate debt market has been improving over time: At the start of 2020, about 70% of EM corporate debt was investment grade, compared with less than 40% at the start of 2000.3 This improvement in credit quality has been driven by two main factors: first, by the fundamental improvements in EM countries and companies arising from growth and fiscal discipline, and second, a compositional change in the index as higher‑quality Asia corporate debt has accounted for nearly all net supply since 2015. If these trends continue, the spreads between EM bonds and DM bonds will narrow over time, providing another potential boost to the performance of EM corporate bonds.

Because EM corporate bonds are denominated in U.S. dollars, they carry no currency risk for dollar‑based portfolios. For non dollar‑based portfolios, the currency can be either easily hedged (given liquidity of U.S. dollar) to the portfolio’s base currency or left unhedged (given the appetite for U.S. dollar exposure). As the U.S. dollar is a safe‑haven currency, U.S. dollar exposure could mitigate drawdowns during some stressful economic scenarios.

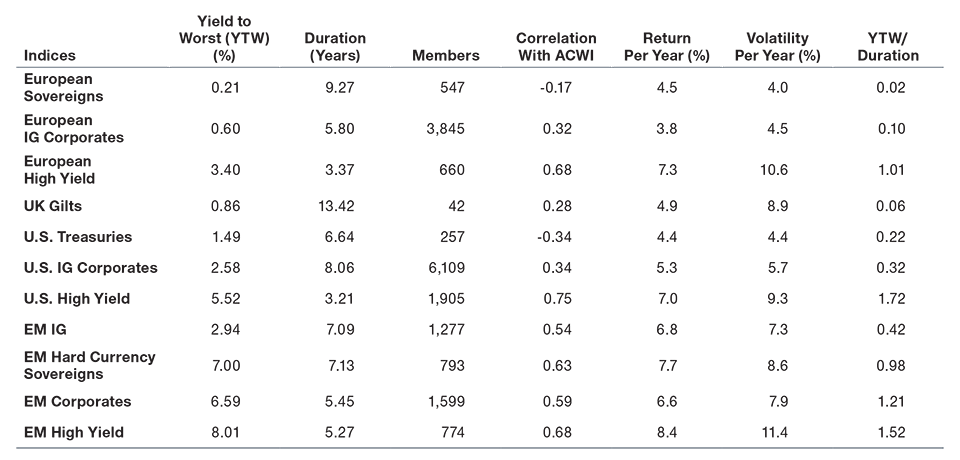

As Figure 2 shows, EM corporate bonds offer the highest ratio of yield to duration of all the bond indices shown.

EM corporate bonds also offer a wide investment opportunity set—the index includes over 1,600 constituencies from over 50 countries—and it is less researched and efficient compared with its DM counterparts. EM corporate debt spans a universe of issuers with different macroeconomics, countries, sectors, durations, and credit qualities. These features offer more opportunities for active management to potentially add value over and above the performance of the index.

Index Characteristics

(Fig. 2) EM corporates offer highest ratio of yield to duration

Past performance is not a reliable indicator of future performance.

As of March 31, 2020.

Source: T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved. Yield, duration, and members of the index as of March 31, 2020. Correlations, returns and volatility are measured from December 2001 through March 2020. IG = investment grade. ACWI = MSCI AC World Index. European sovereigns = Bloomberg Barclays Pan‑European Aggregate Treasury EUR. European IG corporates = Bloomberg Barclays Pan‑European Aggregate Corporate EUR. European high yield = Bloomberg Barclays Pan‑European High Yield EUR. UK gilts = Bloomberg Barclays UK Government All Bonds GBP. U.S. Treasuries = Bloomberg Barclays U.S. Treasury hedged to USD. U.S. IG corporates = Bloomberg Barclays Global US Corporate hedged to USD. U.S. high yield = Bloomberg Barclays U.S. Corporate High Yield hedged to USD. EM IG = Bloomberg Barclays Emerging Markets Investment Grade hedged to USD. EM hard currency sovereigns = JP Morgan EMBI Global Diversified Composite hedged to USD. EM corporates = JP Morgan CEMBI Broad Composite hedged to USD. EM high yield = Bloomberg Barclays Emerging Markets High Yield hedged to USD.

Role in a Portfolio Context

EM corporate bonds are correlated with global equities. They are therefore a risk asset and would not hedge equity risk as effectively as high‑quality, long‑duration DM government bonds. However, while EM corporate bonds have shown strong, equity‑like performance, they have also exhibited lower risk than other growth assets, such as high yield, while they offer diversification benefits, in particular, with DM government bonds.

As Figure 3 shows, since 2001, the cumulative performance of EM corporate debt has been on par with that of global equities but with visibly lower volatility. Income is the leading component of total return in many asset classes over the long term, so the relatively high coupons of EM corporate bonds have helped to contribute to the strong returns of the asset class.

Performance of Bonds and Stocks Since 2001

(Fig. 3) EM corporate debt has delivered equity‑like returns

Past performance is not a reliable indicator of future performance.

As of March 31, 2020.

Source: T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved. December 2001 through March 2020. IG = investment grade. EM corporate bonds = JP Morgan CEMBI. Global high yield hedged to USD = Bloomberg Barclays Global High Yield hedged to USD. Global IG corporate bonds hedged to USD = Bloomberg Barclays Global Aggregate Corporate hedged to USD. Global government bonds hedged to USD = Bloomberg Barclays Global Aggregate Government hedged to USD. ACWI = MSCI AC World. All indices rebased to 100 on November 30, 2001.

Since 2002, EM corporate bonds have had only three years of negative returns, two of which with returns not worse than -1.5%. The only year with a significant drawdown of nearly 17% was 2008—the year of the global financial crisis—but in the following year, there was a significant rebound of over 37%. So far in 2020, EM corporate bonds are down about 8%. Long‑term investors who do not panic because of a single bad year have been rewarded for investing in EM corporate bonds over time.

The long‑term correlation of EM corporates with global equity is 0.59 and with EM equity is 0.62.4 While the correlations are positive, they are still imperfect, meaning EM corporates bring diversification benefits when mixed with stocks. Since 2004, EM corporates have exhibited lower volatility than global equities and, for the most part, global high yield bonds (which only exhibited lower volatility than EM corporate bonds during very calm market environments).5 However, it is important to note that during periods of stress, the correlation of EM corporates with stocks tends to rise.

Because of their low correlation with global government bonds, adding some EM corporate bonds to a portfolio could—perhaps counterintuitively—mitigate risk.

Because of their low correlation with global government bonds, adding some EM corporate bonds to a portfolio could—perhaps counterintuitively—mitigate risk.

Because of their low correlation with global government bonds, adding some EM corporate bonds to a portfolio could—perhaps counterintuitively—mitigate risk. Figure 4 shows different mixes of global DM government bonds and EM corporate bonds. Allocating 10% to EM corporates and 90% to global DM government bonds reduces risk while increasing past and potential performance; allocating 20% to EM corporate bonds only marginally increases volatility.

Blends of Government Bonds and EM Corporate Bonds

(Fig. 4) Adding EM corporates can reduce risk and improve performance

Past performance is not a reliable indicator of future performance.

As of March 31, 2020.

Source: T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved. The percentage at each point shows the hypothetical allocation to emerging market corporate bonds, represented by the JP Morgan CEMBI. The reminder is allocated to global government bonds hedged to USD represented by the Bloomberg Barclays Global Aggregate Government hedged to USD. Returns and volatilities are calculated using monthly returns over the period December 2001 through March 2020, assuming monthly rebalancing to target weights. This is for illustrative purposes only and is not representative of an actual investment or strategy. Actual investment results may vary significantly. Indices cannot be invested into directly.

Risk vs. Reward

EM corporate bonds offer the potential for strong returns because of high yields, potential for capital appreciation, and alpha from active management, as well as diversification benefits in portfolio context. It is a risk asset, correlated with global equities. Investors in EM corporates should consider their volatility and drawdowns, as well as the risks of investing in emerging markets, such as political risk and legal standards of corporate governance and accounting practices still converging toward established conventions in developed markets. Nevertheless, active management and careful selection could mitigate risks, helping investors to reap the benefits of the asset class.

What we're watching next

We are closely following the ongoing developments of the coronavirus crisis and its impact on both developed and emerging markets. As the level of uncertainty is high, it is still too early to comprehend all the potential outcomes of the crisis. However, valuations of many risk assets, including EM corporate bonds, have become more attractive than they were before the onset of the crisis. While we may not have seen the bottom of the market, buying risk assets that are not yet bottomed out could be appropriate for some long-term investors who have a healthy risk appetite and a properly diversified portfolio.

1 According to The World Banks, the fertility rate in high income countries is 1.6, while it is 2.3 in middle income countries, as of 2017. A fertility ratio of about 2.1 is needed to keep a steady population.

2 As of March 31, 2020. Average credit quality of JP Morgan CEMBI Broad Diversified Index for EM corporate bonds, JP Morgan Emerging Market Global Diversified for EM hard currency sovereigns and JP Morgan Global High Yield Index for global high yield.

3 Source: ICE BofAML EM Corporate Indices (see Additional Disclosures).

4 Based on monthly total returns measured in USD December 2001 through March 2020. EM corporate bonds = JP Morgan CEMBI. Global equity = MSCI AC World. EM equity = MSCI Emerging Markets.

5 Such as November 2005 through June 2007 and December 2014 through December 2015.

Additional Disclosure

ICE Data Indices, LLC (“ICE DATA”), is used with permission. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD-PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES AND REPRESENTATIONS, EXPRESS AND/OR IMPLIED, INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD-PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD-PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND T. ROWE PRICE OR ANY OF ITS PRODUCTS OR SERVICES.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

EEA ex-UK—Unless indicated otherwise this material is issued and approved by T. Rowe Price (Luxembourg) Management S.à r.l. 35 Boulevard du Prince Henri L-1724 Luxembourg which is authorised and regulated by the Luxembourg Commission de Surveillance du Secteur Financier. For Professional Clients only.

Switzerland—Issued in Switzerland by T. Rowe Price (Switzerland) GmbH, Talstrasse 65, 6th Floor, 8001 Zurich, Switzerland. For Qualified Investors only.

UK—This material is issued and approved by T. Rowe Price International Ltd, 60 Queen Victoria Street, London, EC4N 4TZ which is authorised and regulated by the UK Financial Conduct Authority. For Professional Clients only.

202004-1150671