Blog

Investment Ideas for a New Decade

Executive Summary

- The next 10 years will likely be characterized by lower returns and higher volatility than the past 10 years, with the potential for a recession.

- Challenges include generating returns in a low-return environment, diversifying equity risk, and remaining invested while preparing for the end of the cycle.

- Fresh approaches may be required, making greater use of active management strategies, alternatives, idiosyncratic alpha, and multi-asset investing.

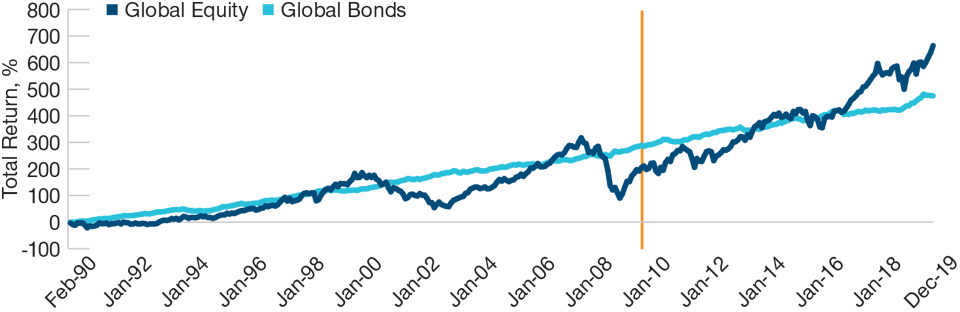

The past decade was a great one for investors. During the 2010s, the MSCI All Country World Index rallied nearly 146% and the Bloomberg Barclays Global Aggregate Bond Index climbed by more than 49% (see Fig. 1). And while it was an unusually strong decade for nominal returns, it was an even better one for real returns as inflation was exceptionally low.

The next decade will be different. Relatively modest returns and, at some point, a recession should be expected. This is neither to suggest that the bull market will end in 2020 nor that a recession is imminent. However, it is to suggest that investors should start taking actions in preparation for potential far‑reaching changes. The bull market party may continue for another year or two—possibly more—and nobody wants to leave too soon and regret it afterward. But neither does anybody want to be left on the dance floor when the music stops, cleaning after everybody else has left.

I believe investors will face three main challenges over the next decade: (1) how to generate returns in a low‑return environment, (2) how to diversify equity risk, and (3) how to remain invested while preparing for the end of the cycle.

Let’s look at each of these in turn.

1. How to Generate Returns in a Low‑Return Environment

Valuations matter: History shows us that, in normal circumstances, higher prices today mean lower returns tomorrow. During the 2020s, returns from both equity and bond markets are likely to fall short of those of the 2010s, during which they delivered annualized returns of 9.4% and 4.1%, respectively.1

(Fig. 1) The Decade That Delivered

How stocks and bonds performed in the 2010s

As of December 31, 2019

Past performance is not a reliable indicator of future performance.

February 1990 through December 2019. Global equity = MSCI All Country World Index measured in U.S. dollars. Global bonds = Bloomberg Barclays Global Aggregate Bond Index hedged to the U.S. dollar.

Source: FactSet (see Additional Disclosures), analysis by T. Rowe Price.

During the 2020s, returns from both equity and bond markets are likely to fall short of those of the 2010s...

During the 2020s, returns from both equity and bond markets are likely to fall short of those of the 2010s...

When asset prices rise, passive investment strategies tend to perform well; during periods of lower and negative returns, passive strategies are less successful. We believe investors therefore have three choices: (1) to calibrate return objectives downward with likely more modest future returns; (2) to change portfolio composition to lower quality and higher risk; and/or (3) to deploy active investment strategies, making their money work as hard as possible. For many investors, accepting lower returns or taking on lower‑quality/higher‑risk assets to maintain existing returns is not a realistic option. Such investors may need to seek alternative, creative approaches.

Three Investment Ideas

1. Active management: As monetary stimulus fades, volatility is likely to rise unless ample liquidity persists, keeping it subdued. Volatility means security prices are prone to diverge from valuations, and the dispersion among returns of securities and asset classes is expected to widen. An environment of heightened variability and wide dispersion of returns should be supportive for skilled active managers who can differentiate between winners and losers, identify mispriced investments, and add value through security selection and dynamic asset allocation.

2. Investments offering a growth premium: In a low‑growth world, assets offering above‑average growth rates warrant a premium. Growth stocks in the U.S. are one example. While growth has outperformed value during the 2010s—U.S. large‑cap growth stocks returned 15.2% per annum and U.S. large‑cap value stocks returned 11.8% per annum2—this trend could continue into the 2020s.

Another example is emerging market assets, both equities and bonds, offering higher potential growth, albeit with additional risks. As we enter the 2020s, current interest rates in many emerging markets are at the level where the developed market rates started in 2010.3 Should emerging market bond yields follow the developed market downward path, the next decade could support emerging market asset prices, as the liquidity boost did for developed market asset prices in the 2010s.

3. Alternatives: When traditional sources of market returns—equity, duration (term), and credit risks—are modest, investors should seek alternative sources of returns. Some alternative investments could offer such sources, not only through passive exposure to alternative risk premia, but also through proven active management, generating active alpha. Alternatives with low correlation to equity and bond markets can add diversification as well as unique return streams, mitigating risks and potentially enhancing performance.

2. How to Diversify Equity Risk

The main risk, and driver, of returns in most portfolios is equity risk. Even in a “balanced” portfolio of 60% equity and 40% bonds, over 90% of risk could come from equity market exposure—in other words, the portfolio is not really balanced after all.

Equity market downturns are not a major problem for investors with very long time horizons and nerves of steel—they could remain invested and ride through the storm. For everybody else, however, diversifying equity risk is likely to be beneficial—and may even be necessary for survival. To diversify equity market risk, investors used to buy long‑term government bonds— which tend to be negatively correlated with equities—and received yields of 4% and above for doing so. However, those days are long gone and are unlikely to return for the foreseeable future. Government bond yields have fallen and in many cases are negative. Investors no longer get paid for diversification; often, they need to pay for it.

Three Investment Ideas

1. Government bonds: As yields are unlikely to fall much below current levels, government bonds do not offer significant return potential. However, they can still provide useful diversification against equity risk during drawdowns. Long‑duration bonds—whose values rise more than those of short‑duration bonds when yields decline—are the most effective diversifiers against equity risk.

On January 1, the 10‑year U.S. Treasury yield was 1.9%—relatively high compared with the yields of UK, German, and Japanese government bonds. In ordinary circumstances, a good rule of thumb is to hedge the currency risk of foreign developed sovereign bonds—and indeed, buying U.S. Treasuries without hedging the currency exposure could triple volatility. However, when the role of bonds in a portfolio is to diversify equity risk rather than generate returns, we may deviate from this rule. Holding unhedged U.S. Treasuries could be a sensible way to include high‑quality duration risk as well as the U.S. dollar—two safe‑haven assets in a single go.

2. Currencies: Investors should seek other ways to diversify equity risk beyond government bonds. Currencies are another venue to explore, offering in some cases low correlation with equities. In particular, the U.S. dollar and the Japanese yen are two traditional safe‑haven currencies that tend to perform well when equity markets perform poorly.

3. Idiosyncratic alpha: Active alpha generated through bottom‑up security selection and top‑down tactical asset allocation is often lowly correlated with equity, as well as bond, markets—as long as the alpha is not just running an excess beta risk. Alpha could be a diversifier of equity market risk, achieving two goals at the same time: reducing risk and enhancing performance. In other words, viewing alpha not only as a source of return but also as a diversifier of risk, and using it as such in portfolios, could improve risk‑adjusted performance, allowing investors to generate outcomes that may go beyond those available just by blending passive market returns of different asset classes.

3. How to Remain Invested While Preparing for the End of the Cycle

There is no way of knowing how bad a recession will be until it happens. When the next recession occurs, it may either be a shallow one or a deep one. Investors should be humble, hoping for a shallow recession but preparing for a deep one. If it turns out to be the latter, it could destroy profits that took years of investing to generate.

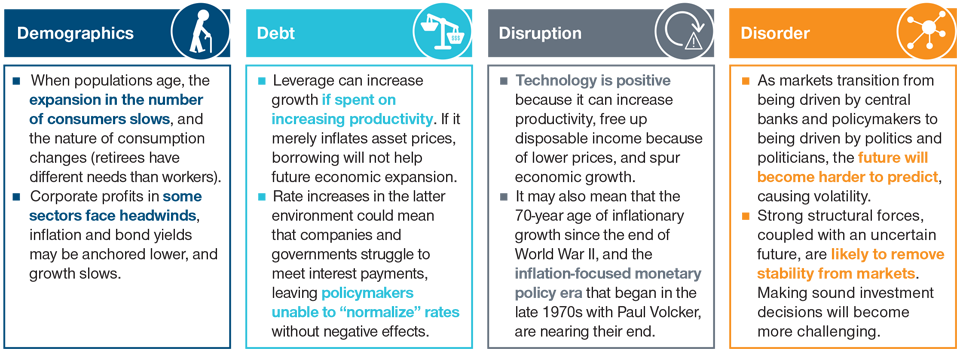

Four “Ds” are approaching: demographics, debt, disruption, and disorder. Demographics refers to the aging population of the developed world, leading to an increasing number of people at or near retirement with fewer workers supporting them. Debt refers to the global mountain of liabilities reaching all‑time highs. Disruption refers to technological changes that have brought us—among other things—online shopping and new energy sources, which have increased consumer choice and driven down prices. Disorder refers to global political displacements, such as widening inequality, populism, and trade disputes, which increase uncertainty, surprises, and volatility. The main impacts of the four Ds are explored in more depth below.

The Impact of the “Four Ds”

While demographics, debt, disruption, and disorder might lead to a serious recession, an alternative, more positive, view is possible. Most policymakers forecast an economic slowdown and then a gradual recovery. Climate change is one of the biggest challenges that humanity has ever faced. The required investments to move to a climate‑friendly infrastructure could serve as a huge fiscal stimulus. As building America helped to end the Great Depression in the 1930s, adapting old infrastructure to that of a green world could stimulate the economy. If this happens, alongside advances in productivity, the global economy could muddle through and avoid a recession.

Three Investment Ideas

1. Tail‑risk mitigation strategies: Remaining invested while mitigating downside risk, and not paying too much for defense, is one of the main challenges for investors. A diversified basket of derivative overlay strategies could be attached to portfolios, aiming to cut tail events and offset some losses that might occur when equity markets drop. Examples include buying stocks with low volatility or defensive risk premia strategies while removing the market exposure, buying protective put options while hedging them by using futures contracts, buying 10‑year U.S. Treasury futures, and using a systematic strategy that dynamically alters equity exposure based on predicted equity risk.

2. Multi‑asset investing: Security selection in a single asset class could add value. So could security selection across many asset classes. And there are other sources of returns—tactical asset allocation, risk factor investing, and so on. So, why not dynamically blend all the available sources of returns—both alpha and beta—to potentially benefit from all the available returns out there? This is the gist of multi‑asset investing. When most asset classes rise—as they did in the 2010s—multi‑asset investing is not as important as during times when different investments’ performance diverge. When the future is uncertain, we believe the best approach is to maintain a dynamic, diverse exposure to independent sources of return, adapting it to current market conditions to keep it relevant.

3. ESG: One aspect of the green revolution is that investors are likely to increasingly seek companies that acknowledge shareholders are not their only stakeholders. ESG—environmental, social, and governance—factors may be compensated over the long term as they increasingly fit the global desire for sustainability and for tackling the challenges humanity faces. Securities of ESG‑compliant companies could enjoy a premium for helping the world overcome some of its ESG‑related challenges.

Investing in sustainability could make a difference. Allocating to ESG enterprises could shift investments into next‑generation, green infrastructure. This could be the implementation of the next stage of the current industrial revolution as humanity deals with climate change and the digital revolution. This global transition could create employment, including for low‑skilled employees, and provide the necessary fiscal boost—as the world has had since the end of World War II—to keep the cycle and the bull market going for a long time. Climate change could be the next challenge that helps push the global economy forward.

What we’re watching next

The challenges highlighted in this article are long term in nature. In the near term, however, even though we do not expect the bull market to end or a recession to start in the next 12 months—or perhaps longer—we will be closely monitoring economic data for any indications to the contrary. We will also keep a keen eye on our four Ds: demographics, debt, disruption, and disorder. Changes in any of these could have a major impact on markets.

1 Source: FactSet (see Additional Disclosures). Equity = MSCI All Country World Index, bond = Bloomberg Barclays Global Aggregate Bond Index hedged to the U.S. dollar.

2 Total return of Russell 1000 Growth Index and Russell 1000 Value Index, January 2010 through December 2019, measured in U.S. dollars. Source: FactSet (see Additional Disclosures).

3 Some examples of 10‑year sovereign debt yields denominated in U.S. dollars as of December 31, 2019, include Mexico 3.3%, Indonesia 2.9%, Russia 3.0%, Turkey 6.1%, Qatar 2.7%, and Brazil 3.7%. Source: FactSet (see Additional Disclosures).

Additional Disclosure

T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

202001-1063807