March 2023 / INVESTMENT INSIGHTS

2023 Five Investment Trends for the Next 12 Months

Positioning your portfolio for the challenges and opportunities ahead

Key Insights

- While returns in 2023 are not anticipated to be as disappointing for most investors as in 2022, we expect elevated levels of uncertainty and volatility to continue.

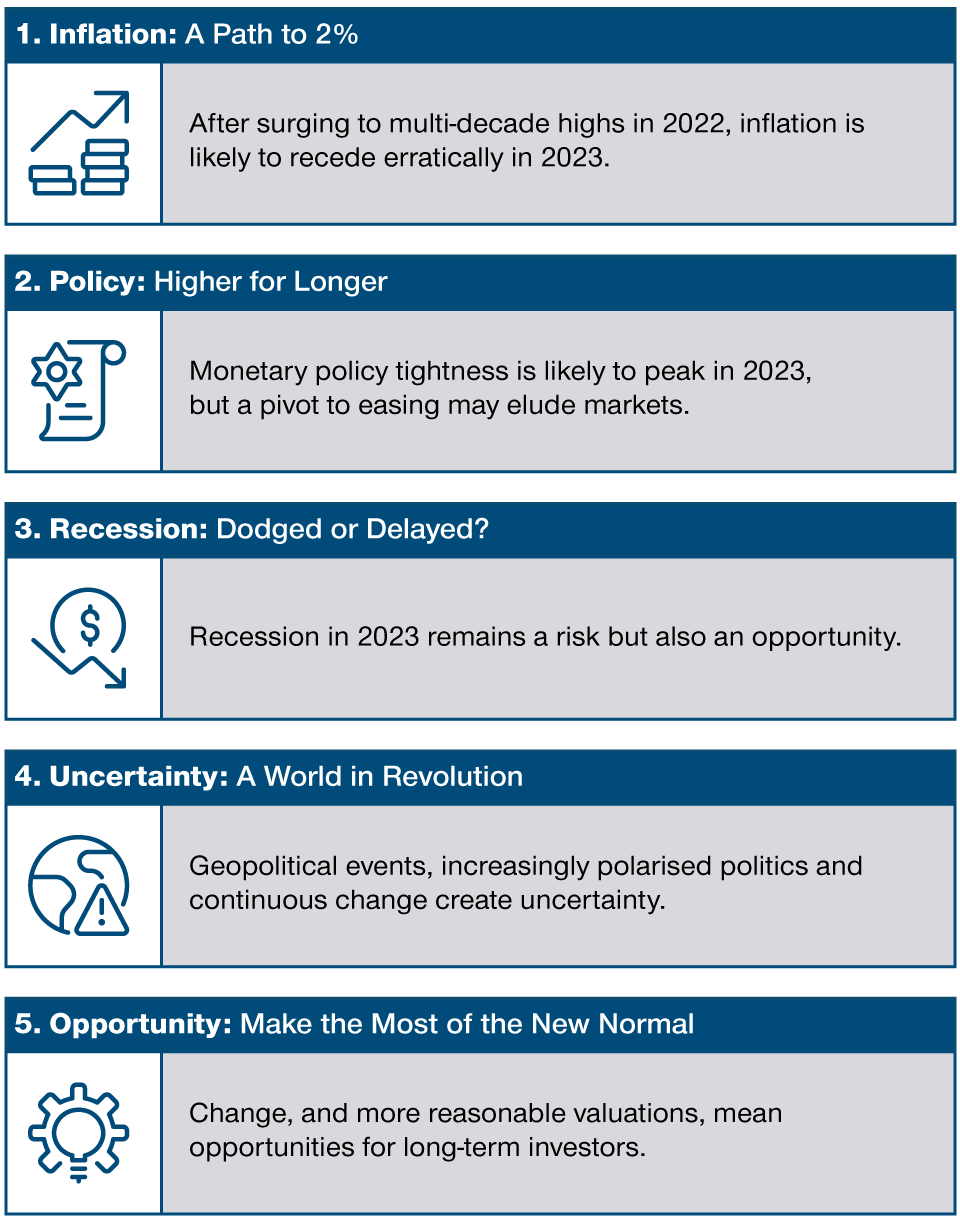

- We believe five trends will dominate markets over the next 12 months: (1) inflation, (2) policy, (3) recession, (4) uncertainty and (5) opportunity.

- We have identified a range of investment ideas that we believe may be effective in helping to steer portfolios through the period ahead.

Investment outcomes in 2023 are anticipated to be better for most investors than in 2022. After more than a decade of relatively benign markets, benefitting from low inflation, supportive central banks and moderate economic growth, conditions changed in 2022. With global equities falling 18.0% and global fixed income falling 11.2%,1 investors had only a few places to hide. Historically high inflationary pressures, central banks aggressively raising interest rates and increasing concerns about an economic slowdown or recession weighed on markets. A new regime has come to pass.

We expect more changes in 2023 as the new regime matures, entering a new phase. Inflation is likely to linger at higher levels but recede over time. This above‑target inflation means that many central banks may well have to keep interest rates elevated for a prolonged time. However, while a pivot to monetary easing may be elusive, this tightening cycle is nearing its peak. The global economy is likely to continue to slow down. It is yet unclear whether major economies will slip into recession or manage to avoid it.

Furthermore, geopolitical risks include the ongoing war between Russia and Ukraine, the impact of the post‑COVID reopening and the centralisation of power in China and political polarisation in the US ahead of next year’s presidential election. Add to this the recent duress in the U.S. and European banking sectors, and these concerns will continue to have a major impact on sentiment and the direction of the markets, adding to uncertainty. So much change means volatility could remain elevated, ripe with both risks and opportunities.

Our Multi‑Asset Solutions team has identified five key trends that we believe will drive the performance of markets over the coming 12 months, and beyond:

Five Investment Trends for 2023

Download the full article here: (PDF)

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

March 2023 / INVESTMENT INSIGHTS