April 2022 / U.S. FIXED INCOME

Agency Mortgage Market in Transition

MBS valuations are renormalizing as the Fed steps aside.

Key Insights

- Following a difficult 2021 and a volatile start to 2022, agency mortgage-backed securities (MBS) continue to be challenged by monetary policy uncertainty.

- Amid a shifting fundamental and technical picture, intra-sector performance has been divergent, creating relative value opportunities within the market.

- With the Fed set for quantitative tightening, we anticipate opportunities in agency MBS as investors are incentivized to rotate to higher-quality securities.

Agency mortgage-backed securities (MBS) endured a difficult year in 2021, when the sector1 posted its first negative annual total return since 2013. Relative to similar-duration2 Treasuries, the MBS sector last year recorded its worst underperformance since 2011. While the broad agency MBS and Ginnie Mae (GNMA)3 markets face challenges with uncertainty over the timing, pace, and composition of the Federal Reserve’s (Fed) removal of accommodation through interest rate hikes and balance sheet reduction, MBS are arguably on better fundamental footing this year.

We also see private investor demand helping to offset technical headwinds from the Fed unwinding its agency MBS holdings. Cheaper valuations combined with the sector’s high quality and relatively strong liquidity may attract outright interest in agency MBS or rotational demand from less liquid credit sectors as financial conditions tighten.

That view is anchored in the Fed’s portfolio balance theory working in reverse as it begins to step away from the mortgage and Treasury markets. Just as quantitative easing (QE) through purchases of agency MBS and Treasuries incentivized investors to move out the risk spectrum in search of higher returns, the reversal of QE—quantitative tightening—should incentivize private investors to move up in quality for a minimal cost to capitalize on the liquidity, quality, and depth of the agency MBS sector. As this rotation occurs, we believe it will present opportunities for active investors.

A Volatile Start to 2022 Amid Monetary Policy Uncertainty

A noticeable hawkish shift in rhetoric from the Fed has raised anxiety for investors regarding the path and pace of renormalizing policy. With inflation risks clearly the central bank’s utmost concern, Fed policymakers foresee a steeper rate hike path and have signaled an earlier start to and quicker pace of balance sheet normalization than seen in the last tightening cycle.

A major concern for mortgage investors is that the Fed could engage in outright asset sales to address the need to significantly reduce its bloated balance sheet. The Fed’s release in January of high-level principles for reducing the size of the balance sheet helped to ameliorate these concerns. The document indicated that the Fed intends to reduce its security holdings over time in a predictable manner, primarily by adjusting principal reinvestments received. Still, important details of the plan remain unknown, and the Fed has not ruled out the possibility of asset sales, creating uncertainty for the market.

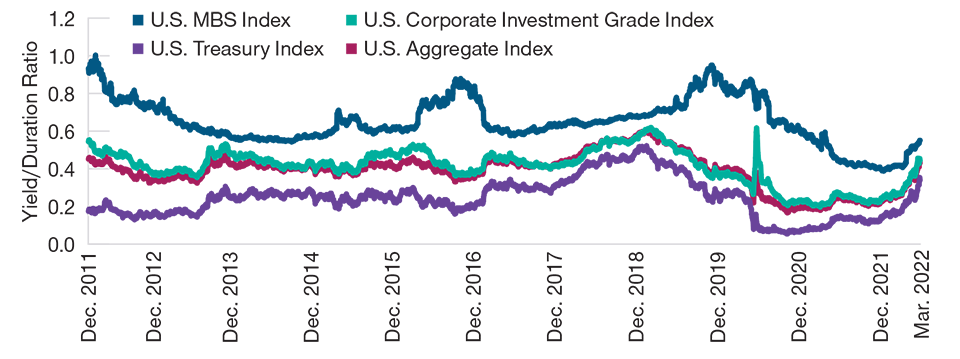

Competitive Duration-Adjusted Yields

(Fig. 1) Yield to worst* divided by duration†

As of March 23, 2022. Data is provided for Bloomberg indices.

Past performance is not a reliable indicator of future performance.

Source: Bloomberg Finance L.P.

*Yield calculated based on the earliest possible bond retirement date.

†Option-adjusted duration.

Competitive Duration-Adjusted Yields for Agency MBS

As of March 23, 2022, the yield of the Bloomberg U.S. MBS Index stood at 2.91%, roughly in line with the post-2008 average but well above the lows of early 2020, when the yield briefly fell below 1% in late March after the Fed aggressively intervened with large-scale asset purchases.

With the recent increase in Treasury rates and, by extension, mortgage rates, the duration of the index has extended from a low of 1.3 years in April 2020 to about 5.3 years in late March amid slowing prepayment rates. Prepayments occur when a homeowner pays off a mortgage before maturity, such as when refinancing. These early principal payments can reduce returns for MBS investors.

Despite the significant increase over the past two years, the duration of the overall MBS sector remained lower than that of the Bloomberg U.S. Aggregate Bond Index, a popular domestic fixed income benchmark, which recently stood at about 6.6 years. Indeed, the amount of yield investors can earn per unit of duration risk was higher for MBS than for U.S. Treasuries or investment-grade corporate bonds—the two other major components of the aggregate index.

Relative Value Opportunities in the Broad Agency MBS Market

In late March, our agency MBS team maintained a neutral view on the sector versus Treasuries in the context of an active multi-sector bond portfolio. Spreads4 were near the midpoint of their longer-term range, offering better value than in 2021. Looking within the sector, there has been wide dispersion in performance for the year to date, and higher interest rate and curve volatility has led to relative value opportunities.

Lower-coupon MBS, which were the primary beneficiaries of the Fed’s QE, have underperformed the broad sector in 2022. Lower coupons are now trading at significant price discounts, which limits some further downside risk. However, their volatility-adjusted spreads are still tight relative to higher coupons. Meanwhile, fundamentals have become more supportive for higher coupons. The year-to-date rise in mortgage rates of more than 100 basis points5 should discourage refinancing activity and reduce prepayment speeds.

Higher mortgage rates have also started to weigh on home purchases. We have recently seen housing data, such as pending and existing home sales, falling short of consensus expectations as the combination of higher borrowing costs and rapid home price appreciation makes home purchases less affordable. A reduction in MBS supply due to lower mortgage origination could help to offset a reduced footprint in the market from the Fed.

Within our strategies that hold material allocations to MBS, we have favored positions in higher-coupon segments offering more attractive valuations with relatively shorter durations. In higher-coupon MBS, we have favored pools of mortgage loans with specific characteristics that we believe should provide more predictable cash flows, as well as Ginnie Mae securities that have a more favorable convexity6 profile. In lower coupons, while we continue to hold to-be-announced (TBA) securities, which offer good liquidity and can sometimes augment total returns, we have found increased value in pools of loans with specific geographic footprints, credit scores, and loan balance attributes that can benefit from the health of the consumer.

A More Constructive Outlook for Ginnie Mae MBS

The government-guaranteed GNMA MBS sector fared particularly poorly in 2021, posting its worst annual performance versus similar-duration Treasuries since 2008 at the height of the global financial crisis. While the GNMA sector still faces challenges in 2022 with the Fed stepping away from supporting the market, there is optimism that the major themes of uncertainty in monetary and housing policy should be less of a headwind going forward. Moreover, valuations versus Treasuries have improved, helping to mitigate another performance headwind experienced last year.

Similar to the broader agency MBS market, GNMAs should benefit from a reduction in net supply, due in part to the deterioration in housing affordability. Higher mortgage rates should also help reduce refinancing risk in the sector, which had been even more problematic for GNMA MBS than for conventional agency MBS. Additionally, international demand should help support the GNMA market given that currency-adjusted yields overall are at the best levels in over six years.

From a relative valuation perspective, the additional spread premium offered by GNMAs above intermediate-term Treasuries has renormalized to levels consistent with a period where the Fed is running off its balance sheet. The yield differential versus intermediate real (inflation-adjusted) yields is historically wide. And compared with AA rated intermediate-term corporate credit, investors appear to be fairly compensated for exchanging default risk in the corporate market for prepayment risk in the government-guaranteed GNMA market.

Like the conventional MBS market, we are seeing fundamental opportunities within the GNMA sector. We believe seasoned loans—those that have been outstanding for some time—in lower-coupon GNMAs offer superior protection against extension (unexpected lengthening of time to receive principal payments) at current dollar prices below par value, while higher-coupon GNMAs are expected to see tamer prepayments.

In conclusion, while a reduced Fed footprint remains a key concern for MBS investors, the transition process is well underway. Moreover, rising rates have not been entirely negative for the mortgage market. They have also worked to improve the fundamental and technical backdrop, helping to offset the risks from a less supportive central bank.

What We’re Watching Next

As was widely expected, the Federal Open Market Committee decided to raise the target range for the federal funds rate by a quarter percentage point to between 0.25% and 0.50% at its March meeting. The committee’s policy statement indicated that it plans to begin reducing its Treasury and agency MBS holdings at a coming meeting. To gauge the potential impact on the MBS market, we will look for more clarity on how quantitative tightening will be implemented when the minutes from the March policy meeting are released.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is no guarantee or a reliable indicator of future results.. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.