March 2023 / INVESTMENT INSIGHTS

When Markets Twist and Turn, Flex Your Fixed Income

Five bond strategies to help investors navigate evolving markets

Key Insights

- The pain of 2022 has reset bond yields to meaningfully higher levels that offer investors higher potential income and a margin of safety.

- With diverse sectors, fixed income markets offer solutions that can potentially help support investors with a range of goals and risk tolerances.

- For investors seeking diversification, absolute return bond strategies may help, while those with a higher risk tolerance and longer‑term horizon could find attractive opportunities in high yield corporate bonds at present.

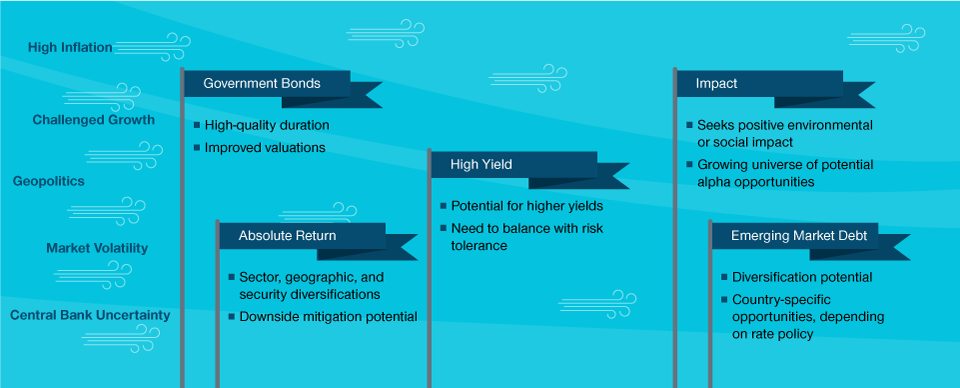

Investors are grappling with a number of market and economic challenges at present, including high inflation, geopolitical risks, banking sector worries, and heightened uncertainty over the path of monetary policy.

These dynamics are challenging to navigate in portfolios, but the good news is fixed income has come a long way. The pain of 2022 has reset bond yields to their most attractive levels in many years. That means for investors there’s not only the potential to earn higher income from bond investing, but also a margin of safety to help protect investors should interest rates rise again.

A key pressure point for investors during 2022 was that the rise in bond yields coincided with stock markets selling off. This goes against the traditional tendency for fixed income to be a diversifying asset class that typically performs well when equity markets decline. Inflation has been the main driver of this, but that is showing signs of cooling. That together with a material slowdown in growth could help bonds potentially reassert themselves this year as a useful diversification tool for riskier assets. Also, with bond yields now at meaningfully higher levels, they simply have more room to rally should economic slowdown fears or a market shock put major selling pressure on risk assets.

“After a challenging period, bond markets are now much better priced for the new market realities,” says Amanda Stitt, a portfolio specialist at T. Rowe Price.

Why Fixed Income?

With diverse sectors, fixed income markets offer solutions that can help support investors with a range of goals and risk tolerances. A key appeal of fixed income investing is that there are opportunities for defense and offence. The asset class is more fragmented than others. What drives one sector of the market is different than what drives another, so there’s often a wide dispersion among sector returns. This provides investors with the flexibility to find a sector and/or combination of sectors that can suit their particular needs—whether that’s generating consistent income, defense against equity market volatility, or, in some instances, capital appreciation.

Fixed Income Approaches in a Changing Market Climate

(Fig. 1) With diverse sectors, investors can find flexibility in bond markets

As of February 28, 2023.

For illustrative purposes only. This is not to be construed as investment advice or a recommendation to buy or sell any security. Investments involve risks, including possible loss of principal. Diversification cannot assure a profit or protect against loss in a declining market.

Source: T. Rowe Price analysis.

Download the full report here: (PDF)

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.