November 2021 / ECONOMICS

China Remains Compelling Despite Regulatory Upheavals

Understanding the government’s social agenda is key

Key Insights

- China’s recent regulatory crackdown on tech and private education companies surprised markets with its intensity and reach.

- However, we believe that China’s stated commitment to “common prosperity” does not herald a return to communism and that its commitment to competition and innovation remains intact.

- In our view, the most effective way to invest in China is to keep sight of the government’s social objectives and incorporate them into the investment process.

China’s latest regulatory crackdown, which wiped hundreds of billions of dollars from the value of some of its largest companies, showed that the authorities in Beijing remain capable of taking the markets by surprise. It also served as a useful reminder that anybody who wishes to remain invested in China—and we believe there are plenty of compelling reasons to do so—should probably try to become better at understanding and measuring Chinese regulatory risk.

Even by its own standards, the Communist Party’s recent crackdown on China’s tech and private education industries has been far‑reaching—according to Alibaba, there have been 28 different pieces of legislation so far this year. Previous actions, such as the 2018 clampdown on the gaming industry, were more narrowly focused and ended sooner. However, Chinese government clampdowns are in themselves nothing new—they have tended to occur in three‑year cycles. The focus of the current round has been fairly well signposted over the past few years, although the bluntness of its implementation clearly caught the markets unawares.

Typically, China’s approach to regulation is to go in hard, observe how the market responds, and then pull back a little if the reaction is particularly negative. This way, the authorities can test how far they can regulate without damaging sentiment so much that growth is threatened. Although China is probably more willing than most developed market countries to tolerate a negative market reaction to new policies, it has invariably stepped in to provide reassurance—and, if necessary, stimulus—if investors become too spooked.

Social Priorities Drive Regulatory Tightening

Beneath these policy oscillations, however, a direction of travel is discernible. Driving the recent regulatory reset was China’s desire to move away from a “growth first” policy to strike more of a balance between growth and sustainability. President Xi Jinping confirmed this when he recently said that the Communist Party will work toward “common prosperity” in a bid to close China’s stubborn wealth gap. A stated objective of common prosperity is to build a stronger middle class, so while there may be some tax increases (particularly for the wealthy), there is also a keen desire to avoid a heavy “tax and redistribute” model that leads to welfarism.

Monitoring China’s Drive for Common Prosperity

Shifting sectors under the policy microscope

*Workers with temporary jobs, typically in the service sector.

This is not surprising—nor is it particularly radical. Rebalancing wealth distribution to support domestic consumption is a valid goal, particularly for a rapidly developing economy such as China’s. There is also nothing especially draconian in Beijing’s desire to constrain the dominance of big tech firms—regulators in Washington are similarly seeking to tighten antitrust measures to restrict the power of Apple, Google, Facebook, and Amazon. Likewise, China’s move against private tutoring can be seen as an attempt to create a fairer, more egalitarian society, which may be positive for the country’s development.

The main difference between regulation in developed markets and in China is transparency: In the U.S., UK, and EU, policies are visible as they work their way through the legislative process, which typically allows for pushback from affected parties and can, therefore, take many years to become law; in China, new policies typically appear abruptly, with little consultation, and are accordingly implemented much more quickly.

Chinese Firms’ Offshore Entities Come Under Scrutiny—Again

China’s tendency to announce new policies without warning complicates matters for investors—it is difficult to invest with confidence if you do not know what the authorities will focus their attention on next. There have, for example, been long‑standing concerns over Beijing’s attitude to the variable interest entity (VIE) structure, through which foreign investors can invest in Chinese companies.

VIEs are offshore holding companies, usually based in the Cayman Islands, that some large Chinese firms set up for overseas listing purposes. They are designed to get around strict rules that prevent foreign investors from any ownership over key sectors of the Chinese economy. This is achieved by giving the foreign investor a claim on the cash flows of the company but no ownership control. VIEs are not technically legal under Chinese law, but—for the most part—the authorities have turned a blind eye to them.

However, China does occasionally decide to tighten regulations on companies using VIEs, as shown in its recent announcement of sweeping new rules governing private tutoring firms. When this happens, it inevitably raises fears that Beijing may launch a broader clampdown on VIEs in general—something that might concern investors in China. In July, the U.S. Securities and Exchange Commission said that it will also require additional disclosures from Chinese companies using VIEs.

Common Prosperity Is Not Code for a Return to Communism

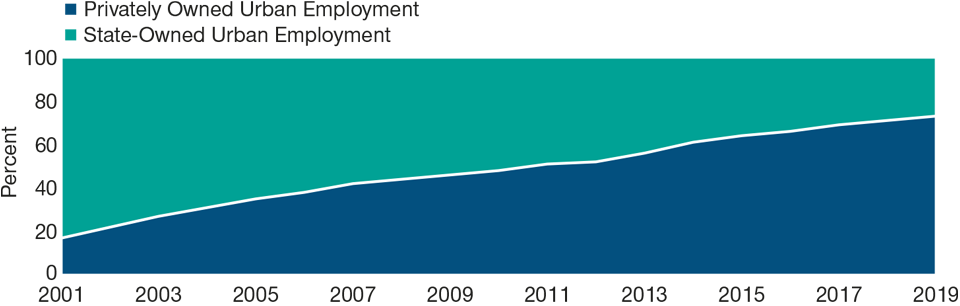

So is China about to turn its back on capitalism and outlaw VIEs? It is highly unlikely. Private companies in China employ far more people than state‑owned enterprises (Figure 1). They play a crucial role in creating jobs, raising living standards, driving innovation, and maintaining social stability. By targeting huge companies that have grown to dominate their industries, it can be argued that Beijing is merely trying to help smaller firms, thereby creating a more competitive environment and encouraging innovation.

The Private Sector Is China’s Biggest Urban Employer by Far

(Fig. 1) The composition of urban employment in China

As of December 31, 2019. Most recent data available.

Source: Haver Analytics/China National Bureau of Statistics.

However, it is important to understand that the Chinese government’s ideas of how the private sector should function does differ from that of most western governments. The phrase “common prosperity” implies that, having used market forces to power growth, the authorities are now keen to ensure that wealth is distributed more evenly, which could mean reigning in firms that become too large. So while a revival of the Mao era is highly unlikely, we are likely to see a new approach that seeks to balance growth with equality and fairness.

The markets have yet to fully grasp the implications of this. The recent regulatory announcements clearly surprised investors, sparking tremendous volatility in stock prices. And while the events of the past few months have prompted intense discussion over the risks of investing in China, it is not yet clear how the regulatory risk premium that investors require for investing in the country will be affected by the latest developments.

Cool Heads and Local Knowledge Are Vital

Given the events of the past few months, some investors might be tempted to avoid China altogether. However, we do not believe this is necessary or advisable. Regulatory crackdowns in China are nothing new and should be expected. The latest one has gained more attention than previous ones because the hardest-hit stocks were those of the biggest firms—and hence those most held by investors. However, the reasons for investing in China—its rapid growth, surging middle class, and low correlation to other markets and the development of “made in China” technology—remain compelling. We believe President Xi’s determination to address what he sees as the capitalist excesses in the current system—and the authorities’ blunt policy and communications strategy—do not offset them.

In the meantime, we believe the most effective way to invest in China is to never lose sight of the government’s social objectives, but rather to understand them as fully as possible and incorporate that understanding into the investment process. Which industries and companies are regulators likely to turn to next? Which sectors will the government want to promote?

These are questions that can be best answered with in‑depth local knowledge, which means that a deep understanding of the policies and behavior of the Chinese government will be essential to investing in China in the future. So far, the drive for common prosperity has manifested itself in policy thrusts in areas such as data security, gig workers’ rights, and big tech’s abuse of monopoly power. Going forward, the government’s social equality drive is anticipated to be felt most keenly in three key sectors: property, health care, and education.

In the near term, as we pass the “peak regulation” of the current crackdown, the market will likely begin to distinguish between the likely winners and losers. Some companies and sectors will become permanently impaired, while others will adapt, survive, and even thrive. Most importantly, it may usher in a new set of opportunities in the next three to five years. This is where cool heads and local knowledge are vital.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.