September 2021 / MARKETS & ECONOMY

Germany’s New Government Is Likely to Rewrite Economic Policy

There will be a focus on green fiscal policy and redistribution

Key Insights

- Irrespective of the precise result of the German election, it is almost certain that the Green party will form part of the next ruling coalition.

- New policies that prioritize Germany’s transition to green technology are virtually guaranteed to be part of the next government’s legislative agenda.

- Higher spending, more aggressive carbon reduction targets, tax hikes, and increased bond issuance may trigger a sell‑off in bunds next year.

German economic policy looks set to change direction after this month’s election as the Green party is almost certain to form part of the country’s new governing coalition. More aggressive carbon reduction targets, increased spending to renew infrastructure, and tax hikes on brown energy consumption are likely as the Greens push for an ambitious environmental agenda. This could lead to a sell‑off in bunds next year.

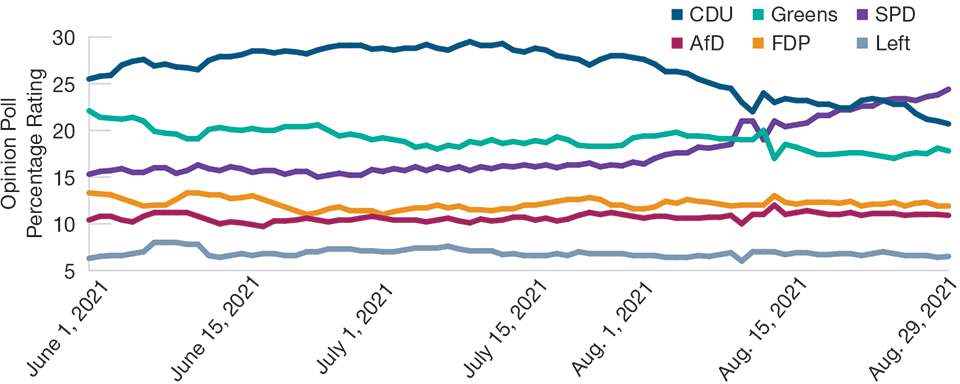

The precise outcome of the September 26 election remains uncertain. However, repeat of the current coalition of the Christian Democratic Union (CDU), its sister party the Christian Social Union of Bavaria (CSU), and the Social Democratic Party (SPD) is highly unlikely: While such an outcome might theoretically be possible based on current polling, the SPD’s proposed program of greater wealth distribution and labor market regulation makes it unlikely that it would choose to form another coalition with the conservative CDU/CSU if there were other options available. Indeed, after the 2017 election, the current coalition only emerged as the second‑best outcome after efforts to form a coalition between the CDU/CSU, the Green party, and the liberal Free Democratic party (FDP) failed.

Whatever happens on the 26th, this election is set to be a watershed moment because the Greens are almost certain to be part of the new coalition. Current polls suggest that an SPD/Green‑led coalition is the most likely outcome. In this scenario, economic policy will take a very different direction to that taken by Chancellor Angela Merkel’s government over the past 16 years. The policies proposed by an SPD/Green party‑led coalition will focus on easier access to social benefits, redistribution, and more proactive use of fiscal policy to achieve transition to the net zero carbon economy within 20 years. At the European level, the Green party is proposing to make the Recovery Fund a permanent tool, thereby adding an instrument of fiscal policy to the repertoire of EU institutions.

While the degree to which these policies can be implemented will depend on the negotiation demands of the Greens’ coalition partners, the inevitable shift toward a more environmentally focused legislative agenda is likely to prove structurally bearish for bunds—an outcome not fully priced into current valuations.

Four Possible Coalitions

At the time of this writing, the SPD was leading the polls with around 25% of the vote, followed by the CDU/CSU (20%), the Greens (16%), the FDP (13%), the right‑wing Alternative for Germany (AfD, 12%), and the Left (6.5%). The polls have been highly volatile, however—three different parties have led in the past four months—and there are likely to be further twists before election day.

The number of possible coalitions seems bewildering on paper, but I believe that four outcomes are plausible:

SPD/Green Coalition

It is possible that the SPD and Greens get a majority on their own. They only need around 46%–47% of the overall vote because parties that do not meet the 5% hurdle (i.e., do not get at least 5% of the vote) do not enter Parliament, so their votes are redistributed to the other parties. In the past, this has amounted to 6%–10% of the vote share. In my view, a two‑party SPD/Green coalition has around a 10% chance of occurring.

SPD/Green/FDP Coalition

If the SPD and Greens need a coalition partner, they would likely negotiate with the pro‑business FDP. The Greens and SPD could still get most of their policies but would likely not be able to raise taxes on entrepreneurs and on wealth. There would also be less flexibility around the debt brake. However, these parties are most likely to find a compromise. I believe there is a 40% chance of this scenario occurring.

SPD/Green/Left Party Coalition

The Left party is the successor to the party that ruled East Germany before reunification. While it is close on many issues with the SPD and Green party, it is the most left‑wing party in Germany. Its manifesto contains several proposals that are highly incompatible with Germany’s current foreign policies. The party would have to drop all of these. Interestingly, the Left party’s recent summary election manifesto deemphasizes the controversial foreign policy aspects, putting greater emphasis on overlap with the SPD and the Greens. I think that this has a 15% chance of happening (which is higher than the market estimate of 5%).

CDU/Green Coalition

Until mid‑August, this was the most likely outcome according to the polls. Today, the polls show that the CDU is unlikely to win the largest share of the vote. This is primarily because Armin Laschet, the CDU’s chancellor candidate, is not popular and time is running out for him to turn things around. He recently tried to shift his party to the right to get more votes, and his candidate for finance minister, Friedrich Merz, is hawkish with respect to European Central Bank quantitative easing and the Recovery Fund. Laschet has a history of turning hard campaigns around, so I think that this has a 35% chance given where we are today.

The SPD Party Looks Set to Win the Biggest Vote Share

(Fig. 1) The center‑left party has moved ahead of the conservative CDU

As of August 29, 2021.

Sources: Kantar Group, INSA, Forsa, IPSOS, YouGov, GMS, Forschungsgruppe Wahle, Allensbach, Infratest dimap, Redfield & Wilton Strategies.

Green Policies, More Spending, and Greater Redistribution Almost Certain

New policies that prioritize Germany’s transition to green technology are almost certain to form part of the next government’s legislative program, regardless of the exact composition of the coalition. The Greens have pledged to spend EUR 500 billion over the next decade to accelerate Germany’s transition to renewables, which they intend to achieve through a combination of infrastructure investment and higher carbon taxes. To help fund these ambitious spending plans, the party has signaled its intention to revise Germany’s so‑called debt brake, which prevents governments from taking on too much debt, and increase taxes on wealth and high incomes. It has also pledged to raise the minimum wage to EUR 12 per hour (26% above current levels) within its first 100 days in office.

The Greens’ ability to push through its ambitious agenda will depend on whether its main coalition partner is the CDU or the SPD. In a coalition with the fiscally conservative CDU, a green transition program is feasible but will be limited, to a degree, by the CDU’s desire to eventually return the fiscal deficit to levels implied by the German debt brake. Similarly, the CDU would likely agree to raise the minimum wage, and perhaps even agree to some tax redistribution to help less well‑off households cover the costs of green energy. However, as part of the compromise of entering a governing coalition with the CDU, these policies will likely be more moderate versions of the Green party’s proposals.

The SPD shares many manifesto promises with the Green party. However, current polls suggest that a SPD/Green coalition would most likely require a third party to govern. While a coalition with the pro‑business FDP would impose fewer constraints than with a CDU/Green coalition, the FDP will likely name several red lines on taxes on wealth and higher incomes as condition to join the government. A coalition between the Green party, the SPD, and the Left would result in a virtually no constraints toward resources for the Green transition and redistribution. While the chancellor would be from the party with the most parliamentary seats (currently the SPD), these three parties have a large manifesto overlap on these issues. This constellation would therefore lead the German government to push for stronger acceleration toward net zero carbon emissions at the EU level.

Higher Bund Yields Beckon in 2022

The looming shift in German economic policy has important implications for the country’s economy and asset prices.

The new German government will likely soften the debt brake. The path of least resistance is funding a special‑purpose vehicle for green investments with public debt. To qualify for exclusion from the debt brake, the proceeds need to be administered by independent fund managers, not the government. The debt brake could also be suspended for several years, citing risks of “natural disaster,” which the law allows for. A final option is to permanently exclude green investment from the debt brake, but this would require a two‑thirds approval in the German Parliament—a higher bar than any governing coalition can achieve. The need, based on current polls, to go into coalition with a center‑right party means that the path of least resistance is a likely outcome. Overall, I estimate the rise in spending financed by debt will be between 0.5% and 1.5% of gross domestic product per year.

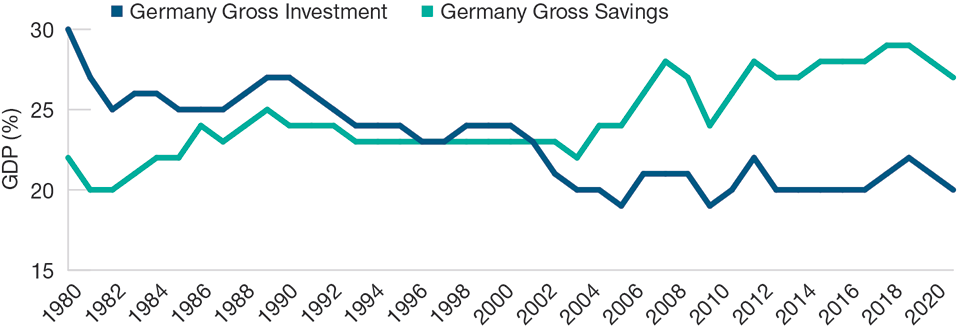

Germany Has Saved More Than Invested in Recent Years

(Fig. 2) Yields on bunds and other safe‑haven assets have fallen

As of December 31, 2020.

Source: IMF World Economic Outlook.

The SPD and the Green party made key promises about redistribution and social safety net access. To help the least well‑off households shoulder the costs of the green transition, higher minimum wages and even direct redistribution are a possibility. The last time the SPD was in power it implemented labor market reforms. These led to greater means‑testing of the social safety net and increased labor force participation among 55‑ to 65‑year‑olds from around 45% in the early 2000s to around 75% today. However, the SPD’s popularity declined after these reforms. Its current manifesto seeks to partially reverse some of these past reforms to help regain popularity among its core electorate.

The economic effects of these policies together will be significant. Since the early 2000s, Germany has saved significantly more than it invested. These excess savings, relative to investment, not only reduced the yields on bunds, but also other global safe‑haven assets. The Green investment program will reduce this savings glut by raising investment. Redistribution from better‑off households to the least well‑off households, which tend to consume more of their income, will raise consumption and reduce savings. A stronger social safety net will also likely lead to less household precautionary savings. Finally, greater bund issuance to finance the transition to net zero would push yields higher. Collectively, these policies could trigger a marked sell‑off in bund yields in 2022.

We anticipate that the impact on equity markets will be more mixed. The earnings of firms that specialize in carbon‑intensive activities will likely fall as those activities will become subject to higher carbon taxes. On the other hand, firms that either help to facilitate the green transition or provide less‑carbon‑intensive activities would significantly benefit from these major expected changes in government policy—and this should be reflected in their share prices.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

September 2021 / MARKETS & ECONOMY