April 2021 / INVESTMENT INSIGHTS

Loans May Provide Solid Returns in Multiple Rate Environments

The asset class offers a low-duration profile, attractive yields

Key Insights

- We have endeavored to gain more cyclical exposure in market segments tied to the overall economic recovery, including sectors impacted by the pandemic.

- Perhaps best known for historically performing well in rising rate environments, floating rate bank loans provide a unique combination of high yield potential and low duration.

- The long‑term historical performance of the asset class in a range of rate environments speaks to its durable nature and value as a strategic allocation.

Many investors tend to focus on bank loans only when there is a broad consensus about the Federal Reserve raising interest rates in the short term. While loans have historically performed well under those conditions, we believe the asset class can add value as a strategic allocation in various market environments within the economic and interest rate cycles. Loans have provided investors with positive returns in 23 out of the last 24 years.1 This speaks to the historically durable nature of the asset class over time. Due to its unique low‑duration2 profile, the loan asset class has generally been negatively correlated with many fixed income alternatives. Therefore, it can act as an effective diversifier in a broader fixed income portfolio.

The current macro environment has led to an increase in intermediate‑ and long‑term Treasury yields as investors contemplate whether a broad economic recovery could trigger inflation, bringing duration risk to the foreground. The floating rate feature of loans—where coupons adjust based on a short‑term benchmark rate such as the London Interbank Offered Rate (LIBOR)—gives them a low‑duration profile, which means that they should perform well relative to other fixed income asset classes as rates increase. As a result, loans should offer some degree of insulation from rising rates while delivering attractive yields.

Meaningful Income From Bank Loans

Given the current prevalence of higher‑quality assets with very low or negative yields, the loan asset class is one of the few fixed income segments where investors can find relatively greater income. In 2020, after the global pandemic stalled new issuance, issuers incentivized investors to reengage in the loan market with favorable deal terms, including LIBOR floors—a minimum value imposed on the benchmark component of the floating rate coupon—and original issue discounts (loans issued at prices below par value).

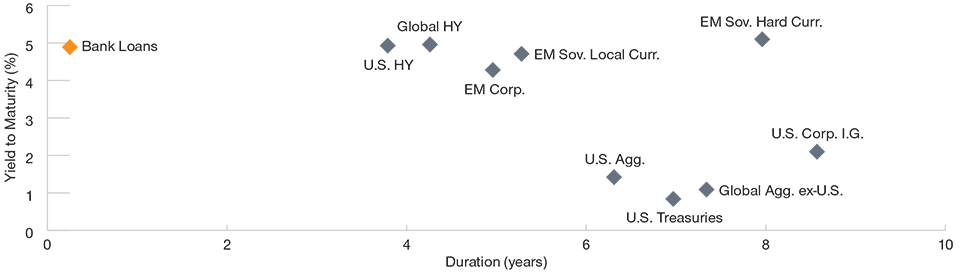

Higher Income With Lower Duration

Duration and yield across fixed income sectors

As of February 28, 2021.

Past performance is not a reliable indicator of future performance.

Sources: Bloomberg Finance L.P., T. Rowe Price, and J.P. Morgan Chase (see Additional Disclosures).

Indexes used: U.S. Treasuries: Bloomberg Barclays U.S. Treasury Index; U.S. Aggregate: Bloomberg Barclays U.S. Aggregate Bond Index; U.S. Corp. I.G.: Bloomberg Barclays U.S. Corp. I.G. Index; U.S. High Yield: Bloomberg Barclays U.S. High Yield Index; EM Sovereign Hard Currency: J.P. Morgan EMBI Global Diversified; EM Corporates: J.P. Morgan CEMBI Broad Diversified; EM Sovereign Local Currency: J.P. Morgan GBI‑EM GD Index; Global Aggregate ex‑U.S.: Bloomberg Barclays Global Aggregate ex‑U.S. Index; Global High Yield: Bloomberg Barclays Global High Yield Index; Bank Loans: JPM Levered Loan Index.

Yield and duration are subject to change.

If the Fed remains on hold for the next year or two, we believe loan investors will be fairly compensated with solid income relative to other fixed income alternatives. On the other hand, if inflation picks up and the Fed is compelled to normalize rates earlier than anticipated, bank loan coupons will reset higher. The potential resiliency of loan income in differing rate scenarios contributes to the attractive value of the asset class.

Relatively Lower‑Risk Way to Access Sub‑Investment‑Grade Credit

Loans generally have high yield credit ratings but provide a lower‑risk way to access the sub‑investment‑grade credit market relative to high yield bonds. As an asset class, loans have a higher repayment priority than high yield bonds if an issuer defaults. Historically, this has resulted in higher recovery rates in default situations. At the end of 2020, for example, the long‑term recovery rate for high yield bonds was around 40%, compared with roughly 65% for loans. Even so, we expect default activity to decline this year from elevated 2020 levels as pandemic‑related economic stress impacted the profitability and liquidity of several issuers. However, in the wake of the March 2020 sell‑off, most loan issuers who needed new capital successfully raised it to bolster liquidity enough to participate in the economic recovery.

Historically, loans have tended to yield less than high yield bonds due to their higher‑quality characteristics, but today, the two options have roughly similar yields. Given their shorter‑duration profile and seniority in the capital structure, the loan asset class provides investors a more defensive way to add exposure to below investment‑grade names while also providing attractive income. Still, bank loans can become illiquid during periods of market stress, and the asset class is subject to credit risk. Therefore, selecting winners and avoiding troubled credits through active management is critical.

Collaboration May Foster Better Outcomes

Our long‑tenured team has significant experience and scale in the bank loan market. T. Rowe Price’s sub‑investment‑grade platform is a single research team covering high yield bonds and bank loans, which allows us to try to capture relative value and inefficiencies across both asset classes. Furthermore, our below investment‑grade analysts are part of a much broader research organization. The ability and willingness to share information and insights between the Equity Division and all fixed income teams are crucial in striving to generate better outcomes for our clients over time.

Fiscal stimulus and continued Fed support for risk assets have created a constructive backdrop, and we believe that coronavirus vaccines are a game changer. We expect the default rate to decline in 2021 and believe the earnings outlook is improving. We have endeavored to gain more cyclical exposure in market segments tied to the overall economic recovery, including sectors impacted by the pandemic.

At the onset of the pandemic, we were underweight sectors directly hit by the economic fallout of lockdowns. This gave us the flexibility to take advantage of the value we later found in some of these market segments. Specifically, we increased our allocation to the airlines, retail, gaming, and automotive industries.

In the gaming segment, we invested in issuers with greater exposure to regional casinos, which we believe will recover faster than destination resorts as restrictions are eased. After collaborating with the firm’s equity and investment‑grade bond analysts, we participated in new deals tied to the customer loyalty programs of major airlines. These loans are collateralized by cash payments from major U.S. banks’ credit card rewards programs and provide opportunities to benefit from a recovery in consumer spending.

What We're Watching Next

The emergence of virus variants that could delay the reopening of the economy from the impact of the pandemic is an important consideration. Although progress in vaccine distribution, fiscal stimulus, and accommodative central bank policy can help offset this key risk, it is one we are closely monitoring.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

April 2021 / MULTI-ASSET SOLUTIONS