May 2022 / U.S. EQUITIES

Dedicated to Value Investing and Focused on Fundamentals

We seek compelling value opportunities across the risk spectrum.

Key Insights

- Since its inception, the US Select Value Equity Composite outperformed the Russell 1000 Value Index without significant style drift.

- Stock selection accounted for the bulk of the strategy’s outperformance.

- Three pillars are at the heart of this concentrated strategy: valuation discipline, rigorous fundamental research, and a willingness to take the long view.

The US Select Value Equity Composite outperformed the Russell 1000 Value Index by 246 basis points (bps)1 annualized, net of fees, from its inception on March 31, 2017, to April 30, 2022 (Figure 1). The strategy originated after a client suggested that Portfolio Manager John Linehan develop a concentrated large‑cap value solution. This request and the strategy’s history of strong relative returns are testaments to Linehan’s dedication to value investing.

Linehan has a wealth of experience as a value investor, having served as co‑portfolio manager of the US Large‑Cap Value Equity Strategy since its inception in 2000. He also managed the US Value Equity Strategy from 2003 to 2009, before stepping down to become T. Rowe Price’s head of U.S. Equity, a role he held until 2014. He has managed the US Large‑Cap Equity Income Strategy since 2015 and serves as the chief investment officer of equity.

In this Q&A, Linehan discusses how his disciplined investment approach has resulted in strong relative returns while staying true to the value style.

From its inception on March 31, 2017, to the end of April 2022, the US Select Value Equity Composite outperformed the Russell 1000 Value Index by 246 bps annualized, net of fees (Figure 1). How did you accomplish this feat in a difficult market for value investing?

For the past five years, the easiest way for value managers to beat their benchmarks was to tilt their portfolios toward growth stocks. That was the right decision. The Russell 1000 Growth Index significantly outperformed over this longer time frame, even though large‑cap value stocks fared better over the six months ended March 31, 2022.

US Select Value Equity Composite Has Generated Excess Returns

(Fig. 1) Returns and relative value added over standard periods

| Annualized | ||||||

|---|---|---|---|---|---|---|

| Last Month | Year to Date | Last 12 Months | Last 3 Years | Last 5 Years | Since Inception March 31, 2017 | |

| US Select Value Equity Composite (Gross of Fees) | ‑5.86% | ‑2.70% | 5.96% | 11.17% | 12.00% | 11.88% |

| US Select Value Equity Composite (Net of Fees) | ‑5.91 | ‑2.86 | 5.44 | 10.62 | 11.44 | 11.32 |

| Russell 1000 Value Index | ‑5.64 | ‑6.34 | 1.32 | 9.58 | 9.06 | 8.86 |

| Value Added (Gross of Fees) | ‑0.22 | 3.64 | 4.64 | 1.59 | 2.94 | 3.02 |

| Value Added (Net of Fees) | ‑0.27 | 3.48 | 4.12 | 1.04 | 2.38 | 2.46 |

Past performance is not a reliable indicator of future performance.

Periods ended April 30, 2022.

Source for Russell Index Data: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). Data analysis by T. Rowe Price

See Additional Disclosures.

Figures are calculated in U.S. dollars.

Gross performance returns are presented before management and all other fees, where applicable, but after trading expenses. Net-of-fees performance reflects the deduction of the highest applicable management fee that would be charged based on the fee schedule contained within this material, without the benefit of breakpoints. Gross and net performance returns reflect the reinvestment of dividends and are net of all non‑reclaimable withholding taxes on dividends, interest income, and capital gains.

Index returns shown with gross dividends reinvested.

The Value Added rows are the US Select Value Equity Composite return minus the benchmark return.

Since the US Select Value Equity Strategy’s inception, our dedication to using a valuation framework has not wavered. We did not tilt the portfolio to be growth‑oriented, so the last five years have seen stylistic headwinds for us. Nonetheless, the portfolio has done well during periods when growth stocks have outperformed value, even though we have remained disciplined from a style perspective. The strategy’s strong performance more recently occurred against the backdrop of the value style working and shows that we were able to make hay while the sun was shining. (See Figure 1 and GIPS® Composite Report.)

Running a concentrated portfolio allows us to focus on finding companies that we believe have both compelling fundamental characteristics and attractive valuation appeal. This combination of qualities is the sweet spot for us, and it is our belief that companies with both these attributes can perform well regardless of the market environment.

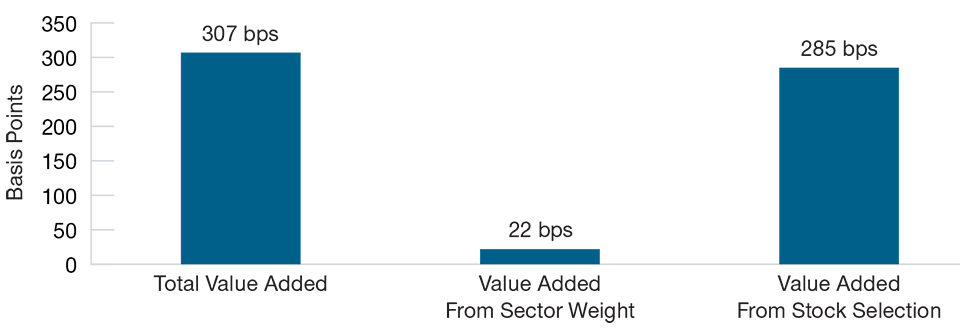

Over the five years ended March 31, 2022, the bulk of the strategy’s excess return versus the Russell 1000 Value Index came from stock selection (Figure 2). How do you decide to invest in a particular company?

Our investment strategy is based on our three pillars: having a valuation focus, finding companies with attractive fundamentals, and employing a long‑term investment horizon.

Let’s start with valuation appeal. We are not dogmatic about how we value individual names, as each company tells its valuation story differently. However, valuation is a critical element in our process. We look for companies that we believe are attractively valued in that they appear inexpensive relative to the market, their peers, or their own price history. Valuation appeal can also be found in companies where the market has priced the stock below our view of its intrinsic value or what we think the firm might sell for in a private market transaction. For us to invest, a company must have a compelling valuation.

Stock Selection Accounted for the Bulk of Excess Returns

(Fig. 2) US Select Value Representative Portfolio* vs. Russell 1000 Value Index†

Past performance is not a reliable indicator of future performance.

March 31, 2017, to April 30, 2022.

Source: Attribution by sector and stock selection is T. Rowe Price analysis using data and analytics provided by FactSet Research Systems, Inc. All rights reserved. See Additional Disclosures.

*Returns for the representative portfolio are gross of fees. As shown in Figure 1, returns would be lower as a result of the deduction of such fees. The representative portfolio is an account in the composite that we believe most closely reflects current portfolio management style for the strategy. Performance is not a consideration in the selection of the representative portfolio. The characteristics of the representative portfolio shown may differ from those of other accounts in the strategy. Please see the GIPS® Composite Report for additional information on the composite. Numbers may not total due to rounding.

† Index returns shown with gross dividends reinvested.

Our second investment pillar is fundamental appeal. We do not look to invest in 30 to 40 of the cheapest companies in the market. Rather, we want to invest in the names that we regard as the most compellingly valued and exhibit attractive fundamental attributes. Consequently, fundamental appeal is as important as valuation appeal. In conducting our fundamental analysis, we take advantage of T. Rowe Price’s research capabilities, which are exceptional in their breadth and the quality of the insights that the team generates. We work closely with the analysts to identify names where we think that the underlying business can exceed the market’s expectations. When the prevailing expectations are low enough, sometimes only marginal improvements in a company’s fundamentals can create value.

We are also thoughtful about incorporating environmental, social, and governance (ESG) factors in our fundamental analysis to ensure that we understand the risks and opportunities on this front. This means that if we invest in a company that has some ESG issues, we typically require a higher bar for the other elements in our investment thesis. We are also mindful that a company’s ESG profile has the potential to improve over time.

The third pillar is our longer time horizon, which, I think, differentiates our concentrated strategy and typically has resulted in a relatively low annual turnover rate of 20% to 30%. Economist John Maynard Keynes described the market as a voting mechanism in the short term and a weighing mechanism in the long term. We want to give ourselves the latitude to allow the market to weigh the fundamental value in our investments.

How do you make your sell decisions?

We aim to buy companies at a discount to fair value and sell them at fair value. You can end up treading a lot of water if you get in the habit of buying things at a discount and then exiting at a slightly lower discount to buy something else. We constantly stress-test our assessment of a holding’s fair value, as this view can change over time as company and industry fundamentals evolve.

The US Select Value Equity Strategy’s Three Pillars

The principles underpinning our approach

Source: T. Rowe Price. For illustrative purposes only.

Selling is probably the most difficult part of the process for most managers, especially with names that have underperformed. You always question if you are being stubborn or if the market has not yet reflected the value that you see into the company’s stock price. The uncertainty can make this scenario a white‑knuckle experience. The hard work of T. Rowe Price’s analyst team can give us conviction to make these difficult investment decisions and helps to guide us when we decide to enter or exit a position.

How do you manage risk and keep the portfolio balanced while running a concentrated strategy?

Collaboration with the research team is critical. Deep down, I am still an analyst at heart. I enjoy delving into individual companies and meeting with their management teams as I seek to understand their incentives, how they view the competitive landscape, and their strategic priorities. The analysts and I often travel together on these visits, and I greatly enjoy working with them. As part of our work, we assess the possible downside risk of an investment as well as the longer‑term upside potential.

I also try to be mindful about how different scenarios—such as a significant runup or pullback in energy prices or an economic crisis in a particular country or region—might affect the portfolio. These kinds of risk exposures can sometimes be less obvious, so, as a result, I need to be constantly vigilant. It helps that I have experienced a lot in my more than two decades as a portfolio manager. I try to be mindful of these less obvious sources of risk when constructing the portfolio.

From the day we launched this concentrated strategy, we wanted to make sure we did not just stock the portfolio with ideas that we regarded as the least risky. We would prefer, all else being equal, to invest in higher‑quality companies. But if lower‑quality companies trade at a significant discount that we believe creates a compelling risk/reward setup, we try to take advantage of those opportunities. I think what this product offers clients is the ability to invest in the large‑cap value space via a balanced portfolio that is thoughtfully invested and seeks to take advantage of opportunities that we identify based on a combination of valuation and fundamentals.

Technology‑driven innovation and disruption have shaped the investing landscape over the past decade. How do you navigate the challenges and opportunities created by this dynamic?

Ten to 15 years ago, I would say that my investment approach was more reflexively contrarian. If a high‑quality company had underperformed, I was more inclined to invest in it than I would be today. We try to be very thoughtful when we assess companies and industries facing secular risks.

The past few decades have preconditioned the market to react quickly to the slightest hint of secular disruption. This dynamic can create opportunities for us if we believe that the risk of disruption is overblown or is more than priced into the stock at current levels. Some companies at risk of disruption still generate meaningful cash flows that will have value and can offer opportunity—if you pay the right price. Expectations are typically quite low for companies that appear to face secular risk or disruptive competition. If we can identify instances where we believe a company’s business prospects could exceed prevailing expectations, that can be a compelling setup.

Additionally, incumbent companies do not always stand still. For example, one legacy media company may not have been a first mover in streaming video on demand, but it eventually leveraged its deep content library to roll out a compelling online service. We spend a lot of time evaluating whether management teams understand and are responding appropriately to disruption.

Some of the most appealing opportunities occur when we believe the market focuses too much on the secular headwinds that a company might face and overlooks the tailwinds that might also be on its side. We get especially excited when we find a company that we believe looks inexpensive and appears to offer a sneaky way to take advantage of innovation and secular trends.

Consider the automotive industry. Tesla2 deserves plaudits for bringing high‑end electric vehicles (EV) to the market and emerging as an industry leader. But some legacy automakers have also invested meaningfully in developing differentiated EV product lines. In our view, the EV market should be large enough for certain well‑positioned legacy names to also capture market share—a potential that we believe is not reflected in what we view as undemanding valuation multiples.

You have a wealth of experience as a value investor. What are some of the most valuable lessons that you have learned?

It is critical to understand who you are as an investor and to develop a process and discipline that accounts for your strengths and weaknesses. I am a frugal person, by nature: It kills me to buy things at full price, and it kills me to sell things at less than full price.

A willingness to take a differentiated tack—to zag when others are zigging—is another important part of my practice that comes from my confidence in our process and research capabilities. I like to say that you often embrace mediocrity when you assume the consensus view. I try not to chase the latest fads and strive to stay grounded and thoughtful during periods of upheaval and uncertainty, as we are experiencing today with inflation, monetary policy, and Russia’s invasion of Ukraine.

I remind myself that the race is often won in the longer term and invest with that in mind. Being patient is important. You also need to have the discipline to accept when you are wrong, which can be difficult. I try to focus on the quality of our decision‑making more than the outcome. Sometimes we can follow our rigorous process but end up with less desirable outcomes because of factors beyond our control. Conversely, poor decisions can sometimes lead to a good outcome. We will not always be right, but I think that if we consistently make high‑quality decisions, we have a better chance of doing right by our clients.

What is the case for value investing today?

I am a firm believer that valuation does matter and that what you pay for a dollar of sales, earnings, or cash flow will be an important factor in an investment’s performance. Some academic studies have shown that value stocks actually have outperformed growth stocks over the longer term. While growth stocks might outperform for an extended period—as they have for the past decade—history suggests that eventually there will be a recoupling, and value can catch up. In essence, the value‑growth dynamic is reminiscent of the tortoise and hare fable that we all learned growing up. Unlike the fable, we do not know if value or growth will outperform in the long run, but I think we can make a strong argument that there is a place for both in a portfolio.

Risks—the following risks is materially relevant to the portfolio:

Style risk—different investment styles typically go in and out of favor depending on market conditions and investor sentiment.

General Portfolio Risks

Capital risk—the value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between the base currency of the portfolio and the currency in which you subscribed, if different.

ESG and sustainability risk—May result in a material negative impact on the value of an investment and performance of the portfolio.

Equity risk—in general, equities involve higher risks than bonds or money market instruments.

Geographic concentration risk—to the extent that a portfolio invests a large portion of its assets in a particular geographic area, its performance will be more strongly affected by events within that area.

Hedging risk—a portfolio’s attempts to reduce or eliminate certain risks through hedging may not work as intended.

Investment portfolio risk—investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Management risk—the investment manager or its designees may at times find their obligations to a portfolio to be in conflict with their obligations to other investment portfolios they manage (although in such cases, all portfolios will be dealt with equitably).

Operational risk—operational failures could lead to disruptions of portfolio operations or financial losses.

Additional Disclosure

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2022. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is no guarantee or a reliable indicator of future results.. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.