June 2022 / RETIREMENT INSIGHTS

Automatic Enrollment’s Long-Term Effect on Retirement Savings

Defaults matter: Do automatic features in 401(k) plans lead to better financial outcomes?

Key Insights

- 401(k) savings plans are increasingly offering automatic enrollment coupled with higher employee default deferral rates.

- Automatic enrollment almost doubles plan participation and successfully gets participants who might not have otherwise saved saving. However, it can also result in participants saving less than those who voluntarily opt in and set their own deferral rate.

- Automatic enrollment combined with automatic escalation creates better participation and savings outcomes.

Automatic enrollment in employer‑sponsored 401(k) savings plans has transformed the way that millions of Americans save for retirement.

Contrary to common perception, automatic enrollment did not start with the passage of the Pension Protection Act (PPA) in 2006. Rather, it was made possible by Internal Revenue Service Revenue Ruling 98‑30 in 1998. This ruling gave employers the ability to automatically enroll employees through a concept called “negative consent,” where, absent objection, employees were automatically enrolled in their company’s 401(k) plan and needed to voluntarily opt out of participating.

The PPA as a Catalyst

Still, the true catalyst for adoption of automatic enrollment was the protections and opportunities provided in the PPA. Specifically, federal preemption over state laws that may have prohibited automatic enrollment (because of broader prohibitions on wage withholding without affirmative consent), fiduciary protection for Qualified Default Investment Alternatives (QDIAs), and a new safe harbor for qualified automatic contribution arrangements (QACAs). The latter provided relief from contribution restrictions on “highly compensated employees” for plan sponsors who automatically enroll their eligible employees at a minimum of 3% of compensation and achieve a target of 6% within four years but no greater than 10%. In the 15 years following the PPA, the number of T. Rowe Price clients who implemented automatic enrollment almost doubled from 37% to 74%.

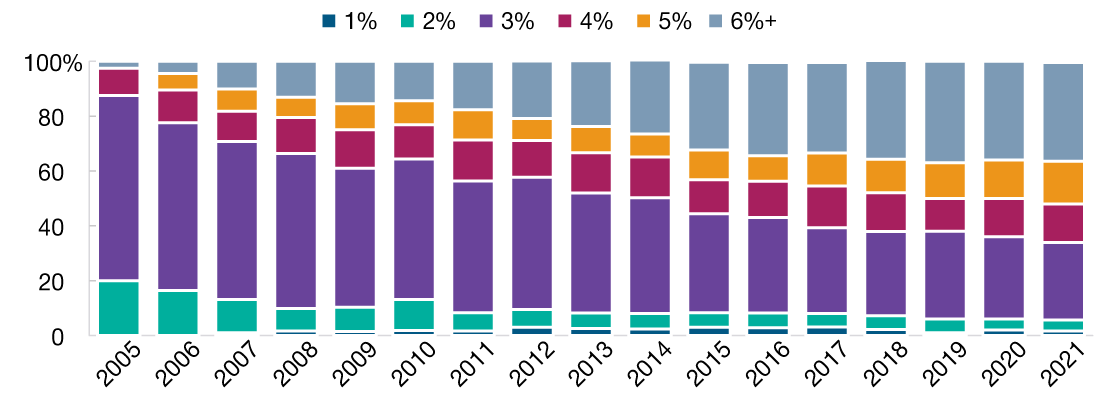

When the PPA was enacted, the most common default rate was 3%, and 61% of T. Rowe Price’s clients who implemented automatic enrollment chose that as their default (likely influenced by Internal Revenue Service rulings approving of automatic enrollment arrangements using a 3% default as an example). Figure 1 shows that number had fallen to 31% by 2018. Moreover, the percentage of clients who are setting their default deferral policy rate to at least 6% has grown from 4% to 36%—a likely result of some plan sponsors availing themselves to the QACA safe harbor and others simply adopting 6% as a perceived best practice.

Default Automatic Enrollment Contribution Rate in 401(k) Plans

(Fig. 1) More employers are raising the amount from 3%

Source: T. Rowe Price Retirement Plan Services.

Defaults play a large role in helping employees achieve financial security in retirement, but are they enough? T. Rowe Price has long professed that the key to achieving financial security in retirement is to save at least 15% of one’s gross income or salary annually, inclusive of both employee and employer contributions.

So where do savers stand? In 2018, T. Rowe Price surveyed 1,000 participants for whom it recordkeeps and asked them: How much should you be saving, and how much are you saving? Positively, 62% said they needed to save at least 15% of their income. However, on average, they are only saving 11% (including employee and employer contributions), which is below the target amount.

So, what can an employer do to help employees save more?

Employers are increasingly being asked to and, as a result, are proactively stepping forward to encourage employees to adopt healthy financial behaviors. However, success isn’t a function of luck. There needs to be intentionality and purpose to achieve a desired outcome. That said, not every employer’s desired outcome is the same. Let’s face it: Employers offer retirement plans for a variety of reasons. Some view it as a means of attracting and retaining talent. Others may view it as a means of creating a more engaged workforce. Or it may be a lever to drive greater corporate profitability. Whatever the combination of factors, there is an implicit acknowledgment that for 401(k) plans to be as effective as possible, the design needs to be reflective of a benefit vision or philosophy. After all, form follows function, or, put another way, the 401(k) plan design is a means to an end.

There is little doubt that plan sponsors have embraced the use of automatic enrollment as a means of creating employee engagement with retirement savings and promoting a healthy financial behavior—saving for retirement. Further, automatic enrollment is clearly an effective means of increasing plan participation. In fact, plan participation for T. Rowe Price‑recordkept plans that have adopted automatic enrollment is 85% compared with just 39% for those who had not implemented it.

However, with the good comes an unintended consequence of lower savings rates. Those who were not automatically enrolled deferred more compared with those who were automatically enrolled. This discrepancy suggests that deferral rates set by the employer could result in an endorsement effect. The employee might infer that the default rate is “safe” and may not think of contributing more.

So, how can plan sponsors optimize both participation and savings?

New Research Yields New Insights

Recently, Taha Choukhmane, Ph.D., a retirement researcher at the MIT Sloan School of Management, used this lens to examine automatic enrollment. He was curious to see if automatic enrollment in a 401(k) plan increases lifetime wealth accumulation and benefits all participants equally. And if so, could that result in plan designs that better reflect the plan sponsor’s desired outcome?

To answer these questions, Dr. Choukhmane analyzed two sets of data. The primary set of data was from 600 firms recordkept by T. Rowe Price that covered 4 million employees over the years 2006–2017. These records yielded insights into savings behaviors resulting from automatic enrollment and opt‑in enrollment. A secondary set of data was from the United Kingdom’s (UK) Office of National Statistics on contributions to the National Employment Savings Trust (NEST), the UK defined contribution savings plan. The data track individuals’ enrollment behaviors as they change jobs. Thus, one can observe the effect of automatic enrollment and opt‑in enrollment on savings over longer periods of time and across multiple employers.

So, what did he learn, and why is it important to plan sponsors?

1. Enrollment Is a Learned Behavior

As the UK implemented NEST, some employers were required to automatically enroll their employees into NEST, but some were not. The data showed that automatic enrollment and opt‑in enrollment are learned behaviors. The illustration below explains how experience predictively affects future behavior. Take note: Consistency matters.

The evidence suggests that automatic enrollment alone does not create healthy, long‑term financial behaviors. In fact, the opposite is true. Dr. Choukhmane’s research suggests that employees who have experienced automatic enrollment in the past are less likely to join a new plan where the employer does not offer automatic enrollment.

The research also suggests that the employees who are automatic enrolled run the risk of becoming conditioned to it, and its absence at future employment can result in missed or delayed savings.

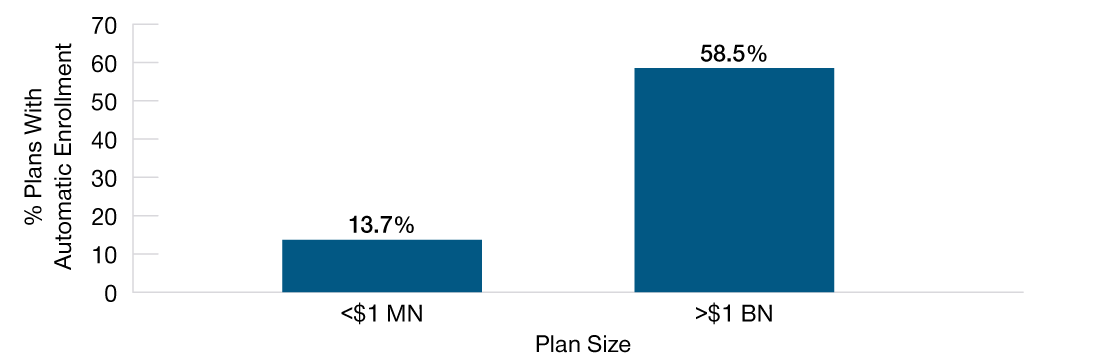

This last point not only underscores the need for consistency among employers offering automatic enrollment into their 401(k) plans, but it is a challenge because larger employers are more likely to offer automatic enrollment than smaller ones, as shown in Figure 2. Thus, those who shift employment between firms of different sizes are particularly at risk for adopting this adverse behavior.

Automatic Enrollment and Plan Size

(Fig. 2) Large plans are more likely to offer automatic enrollment

Source: The Cerulli Report: U.S. Retirement Markets 2021.

The data also point to the paradox of automaticenrollment. Though automatic enrollment is framed as a means to increase savings, the reality is that it is a better means to increase participation. Automatic enrollment suppresses savings compared with opt‑in regimes. Dr. Choukhmane explains this by observing that employees intuitively know that they can save more later, a fact borne out in T. Rowe Price’s analysis of employee deferral rates. There is a correlation between age and savings rates. What is often omitted is the means to increase savings—automatic escalation.

Both Dr. Choukhmane’s and T. Rowe Price’s analyses suggest that automatic enrollment is a beginning, not an ending, for creating healthy, long‑term financial behaviors among employees. For employees to fully benefit from automatic enrollment, it needs to be combined with auto‑escalation. That way, employees can enjoy the benefits of compounding rates of return by saving early in their careers and may be able to avoid the need to save more later in order to compensate for missed opportunity.

2. Higher Defaults Won’t Discourage Savings

Employers often ask if participants will opt out if the automatic enrollment default rate is raised. The evidence suggests that is not the case. The analysis of T. Rowe Price’s recordkeeping data looked at the effect of employers raising their defaults above 3%. As one can see in Figure 3, there is minimal impact. If the default rate rises by 1%, one could expect the participation rate to fall roughly 1%. Additional increases result in effects of similar magnitude.

Significance of Raising Default Savings Rates in 401(k) Plans

(Fig. 3) Increasing default savings rate does not dramatically deter participation

Source: Analysis by Taha Choukhmane, Ph.D. (MIT Sloan School of Management), of T. Rowe Price recordkeeping data representing 600 firms that covered 4 million employees over the years 2006–2017.

While some may be concerned about a slight decrease in participation, the broader context shows that a clear majority of participants benefit from greater savings compared with the relative few that opt out. Further, it’s plausible that many of those who opt out do ultimately choose to save within the plan, albeit less than the default rate.

3. Automatic Enrollment Is a Progressive Benefit

The primary logic behind automatic enrollment is that it encourages saving through what Cass Sunstein and Nobel prize‑winning economist Richard Thaler dub “libertarian paternalism,” in their book “Nudge.” In other words, automatic enrollment provides a “nudge” toward saving, but the participant is free to save more, less, or the same if they so choose.

Further, the analysis does not suggest that automatic enrollment lacks utility in either the short run or long run. Rather, it points to the notion that its use must be well considered and purposeful in its intent.

Do initial nudges go far enough, or is there more to be done? The answer lies in who ultimately benefits from automatic enrollment and why. Dr. Choukhmane sought to answer this question by segmenting the results by the amount of their savings in relationship to their wages—below the 25th percentile, above the median, and above the 75th percentile.

Savings Rates: Automatic Enrollment vs. Opt in

(Fig. 4) Automatic enrollment primarily benefits those who would not have otherwise saved

Dr. Choukhmane’s analysis looked at employers who implemented automatic enrollment at 3%. He looked at the behaviors of employees who had been hired during the 12 months prior to the implementation of automatic enrollment and the behavior of new hires post‑implementation of automatic enrollment. The analysis only considers workers who are still employed at the interval measured and their cumulative savings.

What he found was that if not for automatic enrollment, low‑wage earners might not otherwise save, and younger employees could potentially enjoy greater benefit from compounding returns over longer periods of time. The 25th percentile (with largely low‑paid and younger employees) consists of the primary beneficiaries of automatic enrollment. Without their employer nudging them to save, they don’t.

Some might argue that by not participating, employees are forgoing saving and tax benefits. However, looking specifically at workers above the median, the effects of automatic enrollment are not significant. As their behavior illustrates, these employees can catch up on their “missed savings,” and they do. As a result, those who voluntarily opt in save at equivalent levels within 36 months of those who were defaulted into their plans.

The Effects of Automatic Enrollment Over a Working Lifetime

We’ve established what happens with saving in the short run. What would be the impact over a lifetime? Unfortunately, we don’t have 40 years of data to analyze to come up with an answer. To solve for this, Dr. Choukhmane created a fully dynamic model that considers:

1. The U.S. retirement environment

- Characteristics of the U.S. labor market (e.g., job changes, unemployment, etc.)

- Social Security

- Taxes

2. Personal preferences and biases

- Time (e.g., preferring buying something today versus saving to buy something tomorrow)

- Willingness to take risk

- Adjustment costs (e.g., changing one’s retirement contribution rate)

3. Demography

- Cost of household living

- Longevity

4. Decisions

- Nonretirement wealth (e.g., how much to save versus spend)

- Retirement wealth (e.g., how much to save, taking a loan, etc.)

With these parameters identified, the next step was to compare predicted behaviors with the actual behaviors observed in the T. Rowe Price data. Having established that the model is a good fit with actual behavior, the model could then estimate the lifetime impact at varying automatic default contribution rates.

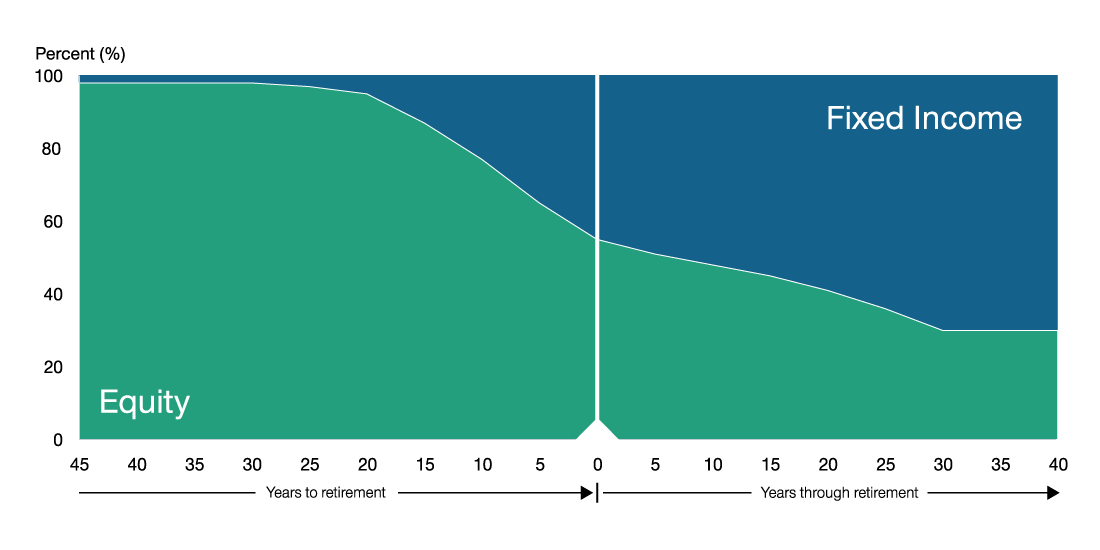

Using the safe harbor 6% default as the baseline, the research estimates the lifetime wealth accumulation compared with those who had to proactively choose their contribution amount. The estimate is one where the default is invested in hypothetical target date portfolios that replicate the asset allocation of T. Rowe Price’s proprietary glide path.

Effect of Automatic Enrollment Default Rate and Investment Choice

(Fig. 5) Lower‑wage earners can benefit more from automatic enrollment

The analysis shows that both younger and lower‑paid workers can benefit from defaults, in general, and from investing in a target date portfolio, in particular. More specifically, the workers who invested in a target date portfolio could accumulate as much as 41% more in lifetime wealth compared with those who had to proactively opt in to participate in their employer’s plan. For higher‑wage earners, the benefit of automatic enrollment is less significant because those who can afford to save more in the future do. Further, behavioral finance research has shown that high‑wage earners may undersave as a negative, yet unintended, consequence of the framing or endorsement resulting from the default rate.

What’s a Plan Sponsor to Do?

The challenge employers face is that the 401(k) plan should reflect what’s most effective for its participants throughout a working time horizon. The new reality is that unlike our parents’ working careers, which were likely with one employer for a long tenure, the median tenure for today’s workers is five years.1 In other words, employment tenures are as unique as individuals’ financial situations. Moreover, employers must consider their social preferences (e.g., benefits philosophy), the strategy they want to use to reflect those social preferences, and the plan design alternatives available to achieve their intentions.

Providing a 401(k) plan is not a one‑size‑fits‑all solution. For example, an employer may want to spend their match dollars on longer‑tenured and older employees. Because we know that younger workers are less likely to participate and save less than older workers, the matching contributions naturally skew and benefit older, often longer‑tenured, or higher‑paid employees. Though younger, lower‑paid employees are seemingly forgoing these benefits, we also know that savings forgone today can be made up later. Thus, one could conclude that an opt‑in policy is preferable.

In contrast, an employer could feel very strongly about the long‑term social welfare of its employees and set an aggressive automatic enrollment policy default rate with a maximum matching formula at the default rate. This plan design is a paternalistic intervention intended to benefit employees who otherwise would not save, and it provides a strong incentive for them to continue to save once automatically enrolled.

Naturally, there is a middle ground where employers can still set aggressive defaults while encouraging employees to save above the default rate so that they can receive the maximum employer match.

Solutions Using Plan Design

Dr. Choukhmane’s research sheds new light not only on employee behavior, but also on the options plan sponsors have at their disposal to maximize the efficacy of their retirement plan designs. There is an optimal balance that can be met by carefully considering the outcomes desired, budget parameters, and what is known about employee behavior.

One must consider the purpose and intention when evaluating plan design features. There are a great number of ways that automatic features can be implemented—be it automatic enrollment or other variations such as:

- Automatic Reenrollment: Reenroll for participants who opted not to participate in their plan. This is run on demand and could occur on a periodic basis.

- Automatic Increase: Increases a participant’s deferral rate each year coinciding with an annual event, such as an employment anniversary or salary increase. It can be implemented on an opt‑in basis or, preferably, on an opt‑out basis.

- Automatic Boost: Increases participant savings rates for those employees saving below the default savings rate or up to the maximum matching contribution level.

The field of behavioral economics has produced many new insights that are proving helpful in getting people to save more for retirement. What this research ultimately demonstrates is that there is no single solution to increase both participation and savings. Rather, it is the combination of automated approaches to enrollment, escalation, or reenrollment, that can lead to optimal results.

For many, retirement is a long way off on the horizon. For others, it is just around the corner. Plan design is a means to an end and should reflect the unique needs of the constituencies it serves at a point in time, as well as over time.

About The Authors

Joshua Dietch is a vice president of T. Rowe Price Associates, Inc., and the head of Retirement Thought Leadership. He joined T. Rowe Price in 2017 and is responsible for leading a team of researchers and writers who create retirement thought leadership.

Taha Choukhmane, Ph.D., is an assistant professor of finance at MIT Sloan School of Management. His research focuses on household finance, behavioral economics, and public economics.

T. Rowe Price Proprietary Glide Path Asset Allocation

Change in Equity and Fixed Income Exposure Over Time

Source: T. Rowe Price

IMPORTANT INFORMATION

Past performance does not guarantee future results.

This material is provided for general and educational purposes only and is not intended to provide legal, tax, or investment advice. This material does not provide fiduciary recommendations concerning investments; it is not individualized to the needs of any specific benefit plan or retirement investor, nor is it intended to serve as the primary basis for investment decision‑making.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness.

The views contained herein are those of the authors as of June 2022 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

All investing is subject to market risk, including possible loss of principal. All charts and tables are shown for illustrative purposes only. The principal value of target date funds is not guaranteed at any time, including at or after the target date, which is the approximate year an investor plans to retire. These funds typically invest in a broad range of underlying mutual funds that include stocks, bonds, and short‑term investments and are subject to the risks of different areas of the market. In addition, the objectives of target date funds typically change over time to become more conservative.

T. Rowe Price Investment Services, Inc., Distributor.

S&P Indices are products of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”), and have been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by T. Rowe Price. T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P Indices.

©2022 T. Rowe Price. All rights reserved. T. Rowe Price, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

June 2022 / STABLE VALUE