June 2022 / RETIREMENT INSIGHTS

Automatic Enrollment, Reenrollment, and Retirement Outcomes

Combining automatic enrollment features can improve retirement savings adequacy.

Key Insights

- Automatic enrollment increases participation and contributions of employees who might not have otherwise saved.

- Successful retirement outcomes are often reliant upon starting to save early in one’s career and saving persistently.

- Reenrollment can be an effective tool to reengage employees who have opted out of enrollment, have stopped saving, or need to rebalance their investment portfolios.

Millions of Americans who otherwise might not be saving for retirement have been enrolled by their employers into their 401(k) plans through automatic enrollment, and it has transformed the way that many Americans save for retirement. Plan sponsors have embraced the use of automatic enrollment as a means of creating employee engagement with retirement savings and promoting healthy financial behavior—saving for retirement. In the 15 years since the Pension Protection Act (PPA) was passed, T. Rowe Price has seen adoption of automatic enrollment almost double, and roughly three-quarters of the large market plans (>USD 25M) it recordkeeps have adopted it.

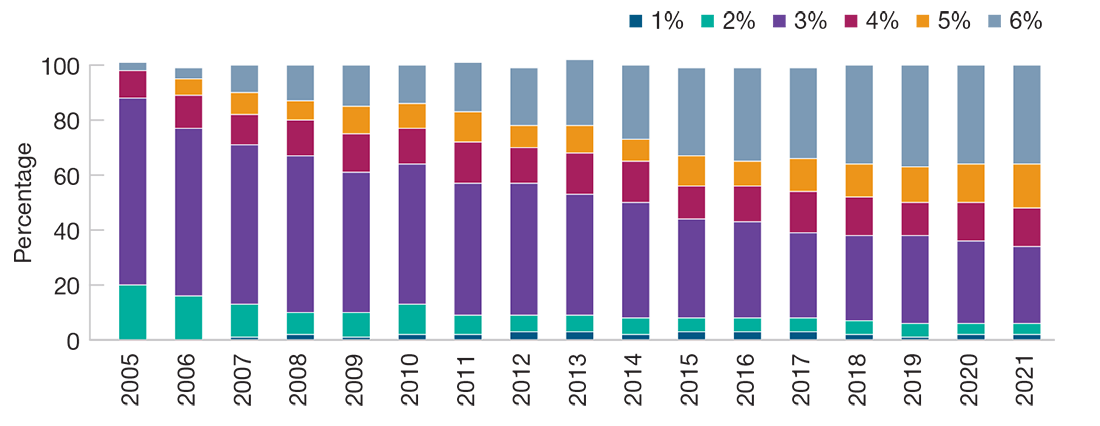

Increase of Adoption of Automatic enrollment by 401(k) Plan Sponsors

The default deferral percentage can also play a significant role in helping employees achieve financial security in retirement. When the PPA was enacted in 2006, the most common default deferral percentage was 3%, which was used by 61% of the plans recordkept by T. Rowe Price. As of year-end 2021, only 28% of plans were still using a 3% deferral default. In contrast, employers adopting at least a 6% deferral default has risen from 4% in 2006 to 36% today.

Default Automatic Enrollment Contribution Rate in 401(k) Plans

(Fig. 1) Most employers have raised the amount from 3%

Source: T. Rowe Price Retirement Plan Services.

Some may argue that the use of higher deferral defaults has been driven in large part by plan sponsors seeking to avail themselves of the safe harbor afforded to Qualified Automatic Contribution Arrangements. Despite the safe harbor, critics warn that higher default contribution rates lead to more participants choosing to opt out of plan participation. Our experience suggests that such concerns are unwarranted.

T. Rowe Price analysis of participants who were automatically enrolled in their employers’ plans in 2021 reveals that less than 6% opted out. Moreover, the percentage who opted out was similar if the default was 3% or the default was ≥6% of wages. Similarly, almost 90% of participants automatically enrolled in 2021 kept their investments in the Qualified Default Investment Alternative (QDIA) chosen by their employer. Collectively, these findings point to the power of nudges to influence behavior but raise the question of whether they go far enough or could serve a greater social purpose.

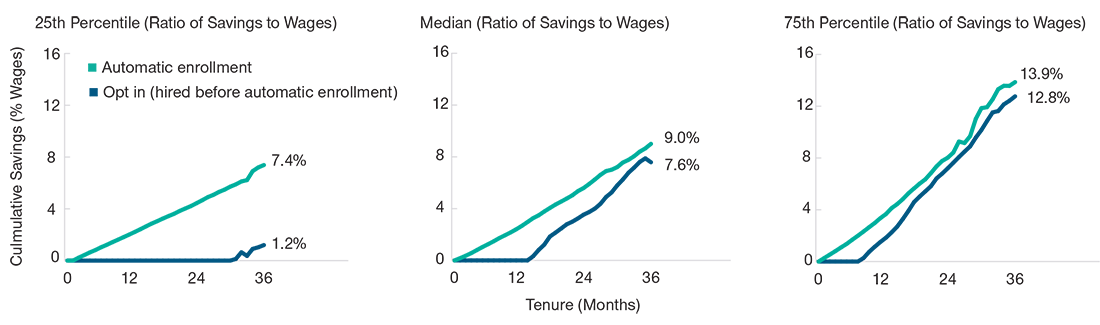

Who Benefits From Automatic Enrollment?

It is often assumed that everyone benefits from automatic enrollment, but new research suggests that may not exactly be the case. Taha Choukhmane, Ph.D., a behavioral economist at MIT Sloan School of Management, sought to answer this question by analyzing T. Rowe Price recordkeeping data and comparing participant saving behaviors 12 months prior to and 36 months after implementation of automatic enrollment. He found that for most participants, automatic enrollment does not affect their long-term savings or wealth accumulation. For many, they simply catch up by saving more in the future. However, for lower paid and/or younger participants, the impact can be significant. For these participants who otherwise would not save, automatic enrollment gets them started (see Savings Rates: Automatic Enrollment vs. Opt In). By saving earlier in their careers, they potentially benefit from additional years of saving and compounded investment returns.

So if everyone is not benefiting equally from 401(k) plans or automatic enrollment, then who is being left behind and what can be done about it? To understand this, we must consider how automatic enrollment and other behavioral finance techniques might benefit groups that have historically had lower rates of access to 401(k) plans, lower levels of participation, or lower savings rates (as a percentage of wages).

Savings Rates: Automatic Enrollment vs. Opt In

(Fig. 2) Automatic enrollment has primarily benefited those who would not have otherwise saved

Source: Analysis by Taha Choukhmane, Ph.D. (MIT Sloan School of Management), of T. Rowe Price recordkeeping data representing 600 firms that covered 4 million employees over the years 2006–2017.

Bringing an Equity Lens

T. Rowe Price analysis of the U.S. Census’ 2021 Annual Social and Economic Supplement of the Current Population Survey found that both Black and Hispanic workers were less likely to have access to 401(k) plans than their white counterparts. Further, as part of its 7th annual Retirement Savings and Spending Study, T. Rowe Price surveyed 401(k) participants and asked them when they first started to save for retirement. The data show that white participants tend to start saving much earlier than their Black and Hispanic counterparts. In fact, 38% of white respondents claimed to have started saving before the age of 30 compared with 18% and 29% for Black and Hispanic respondents, respectively. Worse, more than one-third of Black and Hispanic 401(k) participants don’t start saving for retirement until after the age of 40. Getting people to save early and often is clearly something automatic enrollment is well positioned to effect if one has access to a plan. Having access to a plan is the first step, but is it enough?

Reenrollment Complements Automatic Enrollment

It is often said that saving for retirement is akin to running a marathon. The key to finishing a marathon or saving for retirement is picking a pace that one can sustain to the finish line. Like running a race, saving enough for retirement is easier if you don’t stop. Unfortunately, we learned in our 2021 Retirement Savings and Spending Study that not only do many 401(k) participants start saving late, but approximately one-third of the participants we surveyed either stopped saving or reduced their deferrals at some point. Automatic enrollment does a great job of getting people into the race but often falls short of helping them to finish it. To finish the race, we look to reenrollment.

Automatic enrollment and reenrollment are very similar as they both enroll participants in retirement plans at a default contribution rate and investment fund. Where they differ is in practice. Typically, automatic enrollment engages workers as they become eligible for their employers’ retirement plan. In contrast, reenrollment is very flexible and can be used to engage workers who have chosen not to participate or who could benefit from resetting their savings rate or investment allocations. Moreover, reenrollment can be used both tactically and strategically to affect specific groups of employees (e.g., nonparticipants) or the whole plan (e.g., QDIA reenrollment).

The Effects of Automatic Enrollment and Reenrollment Last a Lifetime

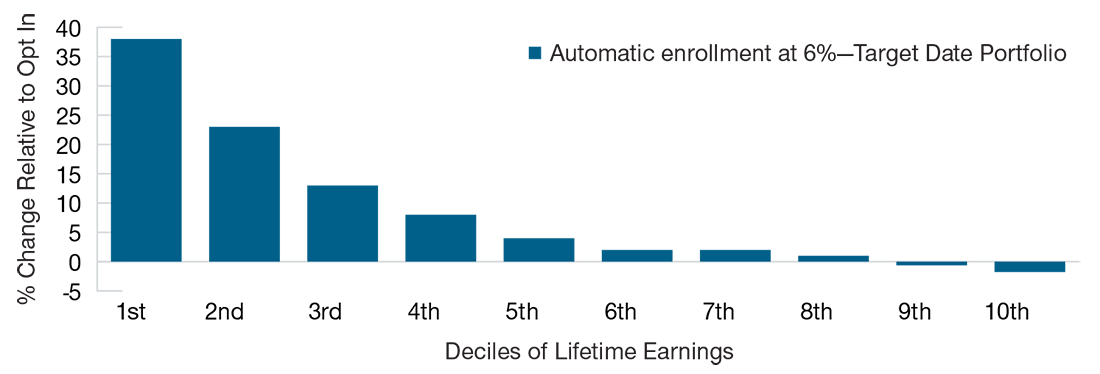

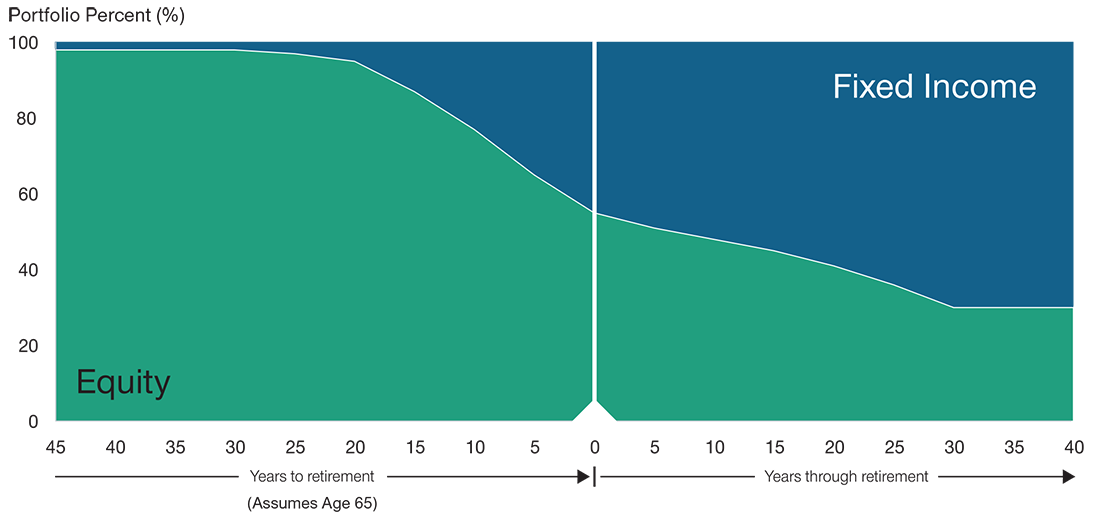

Saving for retirement is a long-term pursuit. Dr. Choukhmane’s research suggests that engaging those who are least likely to save for retirement can have a significant effect on retirement outcomes. Using the safe harbor 6% default as the baseline, the research estimates lifetime wealth accumulation, factoring employment, taxes, personal preferences and biases, demography, and financial decision-making. It compared the data of those who were automatically enrolled in their employer’s plan with those who had to proactively choose their contribution amount. The estimate assumes the default is invested in hypothetical target date portfolios that replicate the asset allocation of T. Rowe Price’s proprietary glide path.

Effect of Automatic Enrollment Default Rate and Investment Choice

(Fig. 3) Lower-wage earners and non -participants can benefit from both automaticenrollment and reenrollment

Past performance cannot guarantee future results.

Source: Analysis and modeling by Taha Choukhmane, Ph.D. (MIT Sloan School of Management), of T. Rowe Price recordkeeping data representing 600 firms that covered 4 million employees over the years 2006–2017 and T. Rowe Price (glide path). Each bar corresponds to the model-predicted percentage difference between the sum of retirement and liquid wealth at age 65 under an automatic enrollment policy with an annual rate of 6% of compensation adopted by all employers compared with an opt-in regime with varying savings rates. Assumptions: The target date portfolio is represented by a hypothetical index portfolio. The hypothetical portfolio is composed of stocks (as represented by the S&P 500 Index) and bonds with a nominal yield of 3%, which follows the asset allocation of T. Rowe Price’s proprietary glide path. (See Important Information for glide path allocation.) The model used to demonstrate the results shown was developed by Taha Choukhmane, Ph.D., and is not meant to serve as a recommendation for any specific action or investment decision. The projections or other information generated by the model are hypothetical in nature and do not reflect actual investment results. Index performance is for illustrative purposes only and is not indicative of any specific investment. Investors cannot invest directly in an index.

The analysis showed that both younger and lower-paid workers can benefit from defaults and investing in a target date portfolio. More specifically, the workers who were automatically enrolled could hypothetically accumulate almost 40% more in lifetime wealth compared with those who proactively opted into their employer’s plan.

While the benefits of automatic enrollment are less significant to higher-wage earners, the results highlight how both low-wage earners and those who have opted out of enrolling in their employers’ plan could benefit from being reenrolled.

Using Plan Design to Effect Outcomes

The challenge employers face is that ideal 401(k) plan designs should reflect what’s most effective for participants throughout a working time horizon.

However, employment tenures can be much shorter. Dr. Choukhmane’s research sheds new light not only on employee behavior, but also highlights the varying choices employers might consider to ensure that more employees could benefit from 401(k) plans by demonstrating the potentially beneficial effects of enrolling younger and lower-wage workers and ensuring persistent participation in 401(k) plans.

Since the passage of the PPA, there has been great focus on encouraging plan sponsors to adopt automatic enrollment and escalation. Unfortunately, the benefits and impact of reenrollment has taken a secondary position in the conversation. Reenrollment and its benefits of participation, adequate savings, age, and risk-appropriate investing can play an important and necessary role in pursuing the goal of 401(k) plans providing greater financial security to participants as they transition from working to retirement.

T. Rowe Price Proprietary Glide Path Asset Allocation

Change in Equity and Fixed Income Exposure Over Time

Source: T. Rowe Price. For illustration purposes only.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

All investing is subject to market risk, including possible loss of principal. All charts and tables are shown for illustrative purposes only. The principal value of target date funds is not guaranteed at any time, including at or after the target date, which is the approximate year an investor plans to retire. These funds typically invest in a broad range of underlying mutual funds that include stocks, bonds, and short-term investments and are subject to the risks of different areas of the market. In addition, the objectives of target date funds typically change over time to become more conservative.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor, and T. Rowe Price Associates, Inc., investment adviser.

S&P Indices are products of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”), and have been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by T. Rowe Price. T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P Indices.

© 2022 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.

June 2022 / INVESTMENT INSIGHTS