May 2022 / VIDEO

A Challenging Environment for Stocks and Bonds

Rate hike expectations presented headwinds for both asset classes.

Key Insights

- Global stocks and bonds have both declined year‑to‑date, frustrating investors who typically rely on the diversifying benefits of fixed income allocations.

- We believe that expectations for interest rate hikes have largely been priced in; therefore, the positive correlation between stock and bond performance is, in our view, unlikely to be sustained.

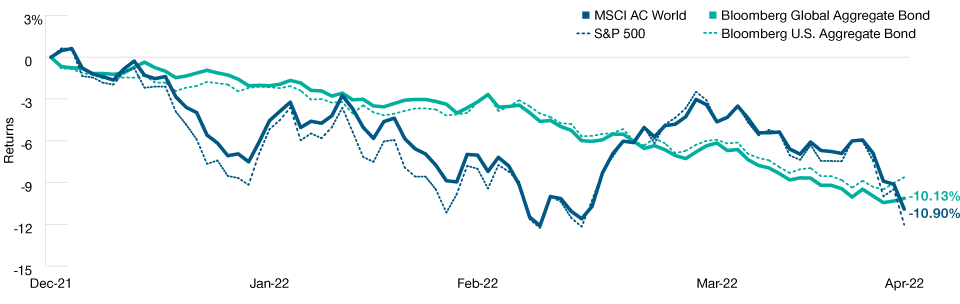

During the first part of 2022, stocks declined sharply due to rising geopolitical uncertainty and accelerated inflation. Notably, bonds—which typically help to manage downside risk in a portfolio—pulled back almost as much as stocks (Fig. 1), frustrating investors who often rely on the diversifying benefits of fixed income securities during equity market sell-offs.

A Difficult Year So Far for Stocks and Bonds

(Fig. 1) Both asset classes have declined meaningfully year‑to‑date

Past performance is not a reliable indicator of future performance.

December 31, 2021, to April 26, 2022

Sources: Standard & Poor’s and MSCI (see Additional Disclosures). Bloomberg Finance L.P. T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved.

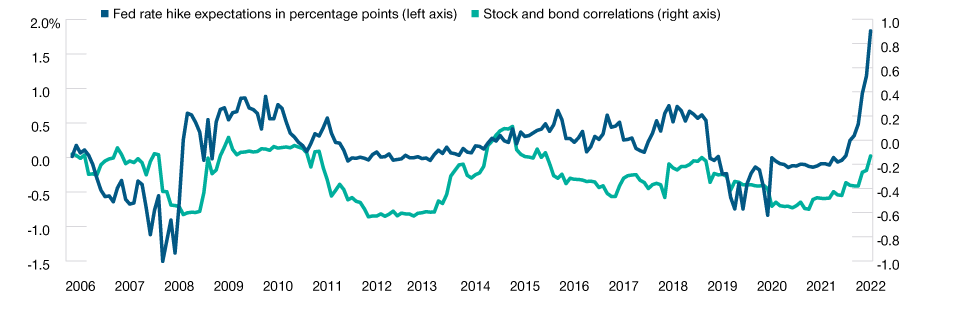

While stock and bond returns historically tend to have low or negative correlations over the long term, correlations have at times been positive over shorter periods. Environments where expectations for central bank tightening are increasing rapidly, in particular, can be challenging for both asset classes (Fig. 2). This is because rising interest rates typically push yields higher and bond prices lower. Meanwhile, stocks usually suffer in a rising rate environment because rate hikes often slow down economic growth, resulting in lower earnings.

Rate Hikes Have Presented Headwinds for Both Stocks and Bonds

(Fig. 2) Correlations were higher when rate hike expectations were rising*

Past performance is not a reliable indicator of future performance.

January 2006 to March 2022

Source: Bloomberg Finance L.P.

*Fed rate hike expectations calculated as the difference between the 2‑year U.S. Treasury yield and the federal funds rate. Stock and bond correlation is the rolling 2‑year correlation of monthly price changes for the S&P 500 Index and U.S. 10‑Year Treasury futures.

Rate hike expectations have increased rapidly in early 2022. At the beginning of the year, markets generally expected the U.S. Federal Reserve to raise rates at a measured pace—despite already elevated inflation—and then pause with rates still at relatively low levels. However, this outlook shifted dramatically in the first quarter, as inflation concerns were exacerbated by Russia’s invasion of Ukraine and a spike in oil prices.

Although a cautious approach is warranted amid growing economic headwinds, we believe that expectations for more hawkish central bank policies have largely been priced into asset valuations. If this view is correct, the strong positive correlation between stock and bond returns seen in early 2022 is unlikely to be sustained. As a result, the Asset Allocation Committee has further increased its allocation to long duration1 U.S. Treasuries, which the committee believes are more likely to offer portfolio diversification potential now that yields have adjusted higher.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is no guarantee or a reliable indicator of future results.. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.