November 2021 / VIDEO

The Investment Landscape: Implications for Retirement Savings and Spending

Global markets have staged a remarkable recovery from the historic pandemic-induced sell-off in 2020. While the virus remains a key risk to public health and economic activity, significant progress in the distribution of vaccines and the loosening of government restrictions has contributed to improved economic sentiment. Moreover, central banks and governments have taken aggressive monetary and fiscal stimulus measures, which have offset economic damage and provided a potent tailwind for returns.

However, we believe midterm returns will be lower than those seen in previous periods—in some cases considerably lower. This has significant ramifications for retirement plans and whom they benefit.

This shift in the investing landscape is why we think the longer-term outlook will be a significant theme in 2022 and beyond.

A large measure of financial success in retirement stems from the effects of compounded investment returns and its sources both prior to and after retirement. The unpredictable nature of markets is one of many factors that shape the retirement landscape. Just as important are investor behaviors, longevity, and both the access to and adequacy of retirement savings plans. Still it’s important to understand what is driving our lower capital markets assumptions.

What’s Driving Our Assumptions

In fixed income markets, lower expectations reflect levels of expected risk‑free rates that are close to historic lows. We expect yields to rise in key government bond markets over the midterm, with higher yields overall, particularly at the long end of the curve. Low rates today and rising yields in the future are likely to result in relatively low positive or negative total returns for many types of bonds.

In equity markets, there is a positive outlook for earnings growth as economies put the impact of the pandemic behind them, but this is offset by elevated valuations for many markets. As a result, we expect returns in many large markets such as the U.S. to be restrained relative to recent history. While valuations across asset classes vary, and some assets are attractively valued, the valuations of most assets are elevated on these measures.

What’s more, in our view, there are several risks on the horizon that have yet to be fully appreciated.

Strong earnings reports, unprecedented fiscal stimulus, and indications of significant pent-up demand have bolstered expectations for accelerated economic activity but have also given rise to inflation fears. In the U.S., proposals for further stimulus and infrastructure spending are likely to be married to an increase in corporate tax rates. China faces pressures from supply chain disruptions, rising commodities costs, moderating growth, and fading stimulus, while in certain other regions, virus mutations and significant struggles with vaccine distribution pose challenges. While the global economy has been buoyed by a period of extreme liquidity driven by fiscal and monetary stimulus, these tailwinds are likely to fade as central banks begin to pursue more moderate policies. Although these conditions may not materialize as significant headwinds for growth, we believe they contribute to a less compelling risk/reward profile going forward. Retirement investors will need to be positioned accordingly.

A consistent, long-term investment focus is crucial. Short-term market fluctuations generally need to be tuned out, though they can be more significant for those who are much closer to retirement. But the shifting paradigm isn’t just a blip. We believe that multi-asset portfolios in the midterm will be notably below those of recent periods. See Figure 2.

What’s Driving Lower Expectations

(Fig. 2)

For illustrative purposes only. This is not intended to be investment advice or a recommendation to take any particular investment action.

There are several implications for those saving for and spending in retirement. Individuals now have a greater personal responsibility, as predictable income from defined benefit pensions increasingly gives way to wealth accumulated by saving in defined contribution plans. Moreover, unlike pensions, DC plans require the individual to convert their wealth to income.

While lower return expectations do not paint an optimistic picture, there is a fundamental way to potentially improve outcomes. Specifically, investors may see an increased role for active management in the pursuit of higher returns. New trends and creative disruption following the coronavirus pandemic have created a fertile environment for skilled active managers to add value.

Responding to Headwinds

Investors have three basic alternatives to meet the challenge of lower return expectations. The first—and likely least attractive—is to simply save more. Investors can save more or delay retirement, which in effect will decrease the level of wealth required in retirement.

The second option is to focus on increasing exposure to growth-seeking assets, either through more equity or higher-returning segments of the fixed income market. This approach has the potential to boost long‑term portfolio return potential by increasing the level of market risk within a portfolio either through adjusting the balance of assets between equity and fixed income or adjusting within asset classes. Utilizing target date strategies with underlying actively managed components is one way to achieve this. Target date glide paths typically begin with higher allocations to equities and then gradually rebalance into fixed income assets so that the portfolio becomes more conservative over time. This could reduce market risk for those just a few years from retirement. At the same time, for investors with more time before they intend to retire, the benefits of a growthoriented glide path, including a more diversified fixed income opportunity set, could outweigh the impact of even a large market decline near retirement.

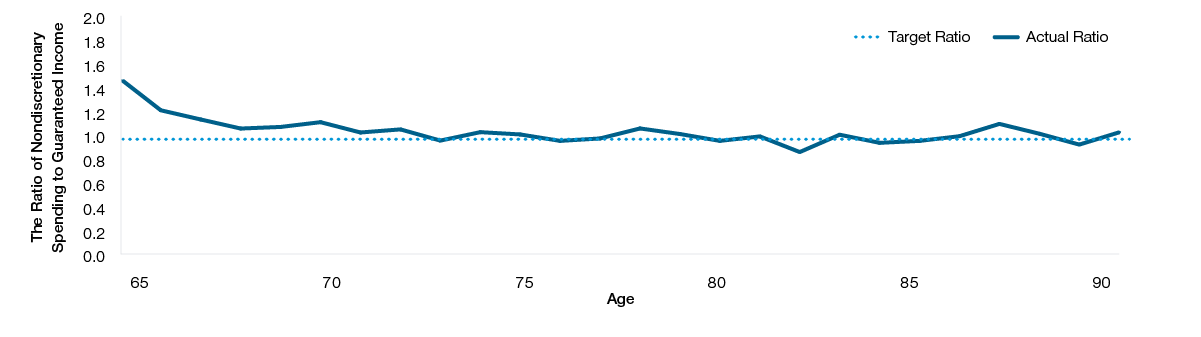

A third option to address lower return expectations is to adjust spending in retirement. T. Rowe Price analysis of retirees’ spending habits reveals that retirees tend to adjust their spending to their income. See Figure 3. Most of the retirees who do adjust their spending have the means and flexibility to do so. The poorest households, however, cannot spend less.

Retirees Adapt Spending to Their Income

(Fig. 3) The ratio of nondiscretionary spending to guaranteed income quickly approaches 1:1 after age 65

Source: T. Rowe Price estimates from Health and Retirement Study (2001–2015).

Investors have choices, and possibly the simplest response is to accept that the investment environment has changed and that returns on multi‑asset portfolios are likely to be lower than they have been in the past. For investors, this may mean recalibrating their behavior, as previously discussed.

Still, getting investments right is critical. Moving into a period of lower expectations for returns reduces the margin for error. In our opinion, retirement investors can increase their chances of success by:

- Understanding that successful retirement outcomes necessitate a longterm investment perspective.

- Diversifying across both equities and fixed income to pursue excess returns.

- Focusing on investment options that have the potential to perform well in both high- and low-return environments.

Important Information

This material is provided for general and educational purposes only and is not intended to provide legal, tax, or investment advice. This material does not provide recommendations concerning investments, investment strategies, or account types; it is not individualized to the needs of any specific investor and not intended to suggest any particular investment action is appropriate for you, nor is it intended to serve as a primary basis for investment decision-making.

The views contained herein are those of the authors as of November 2021 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation, investment advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Investors will need to consider their own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

All investments involve risk. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor, and T. Rowe Price Associates, Inc., investment advisor.

©2021 T. Rowe Price. All rights reserved. T. Rowe Price, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc. RETIRE WITH CONFIDENCE is a trademark of T. Rowe Price Group, Inc.

November 2021 / ENVIRONMENTAL, SOCIAL, AND GOVERNANCE

November 2021 / U.S. FIXED INCOME