August 2021 / ASSET ALLOCATION VIEWPOINT

Sticking With Value

Despite strong fundamentals, growth stock valuations are extreme

Key Insights

- The value rally has recently fizzled, and growth stocks have regained ground, narrowing the performance gap considerably.

- Despite strong fundamentals, growth stock valuations are extreme. The Asset Allocation Committee favors value stocks as potential catalysts could be supportive.

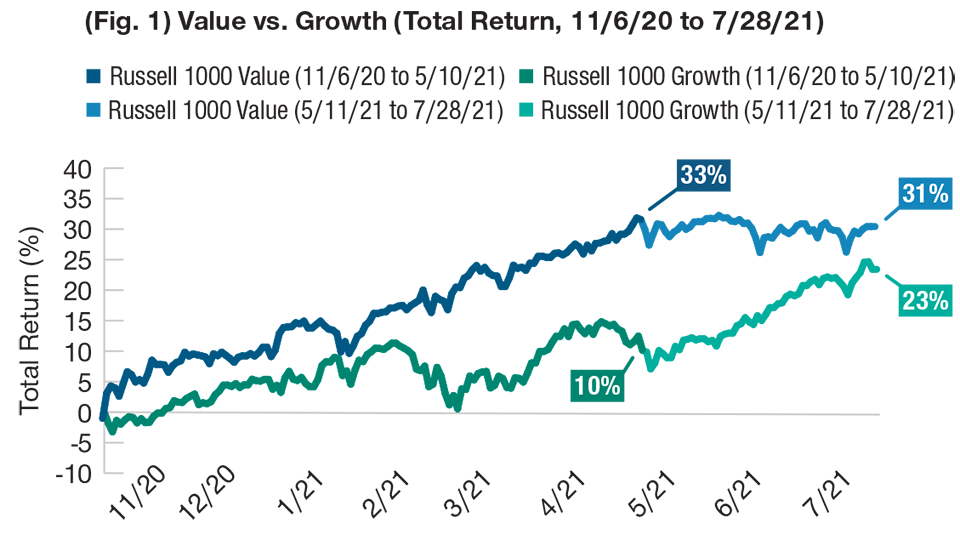

From November 2020 to early May 2021, U.S. value stocks generated strong absolute and relative performance versus U.S. growth stocks, a trend also seen in global equity markets. However, the value rally has recently fizzled, and growth stocks have regained ground, narrowing the performance gap considerably (see Figure 1).

While somewhat unexpected, the resurgence in growth stocks is supported by their attractive fundamentals—very strong revenue growth amid increasing margins over the past 10 years—versus value stocks. Going forward, investors should weigh whether or not these trends that have boosted growth stocks over the past decade will continue to prevail.

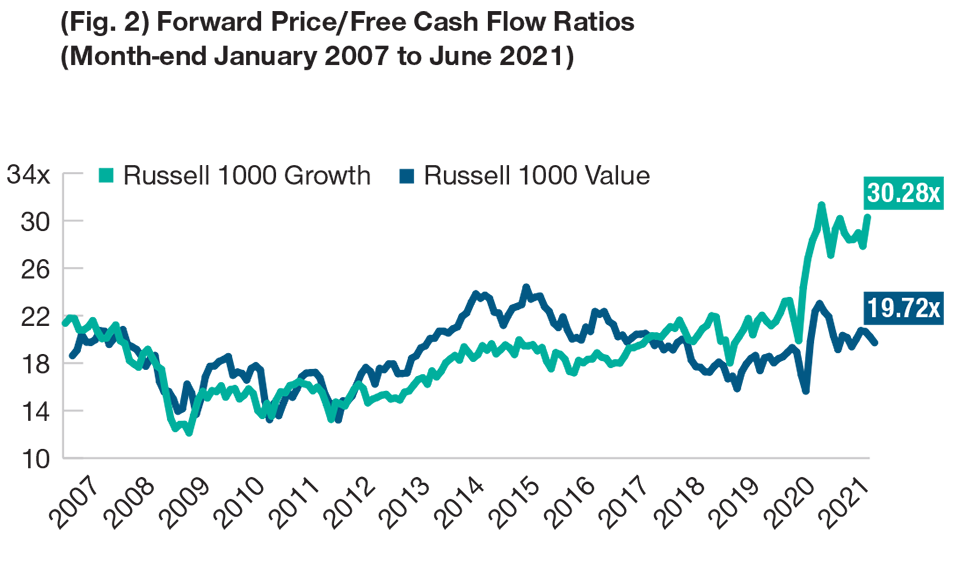

Notably, the pandemic strengthened some technology trends, including online retail, social media, video streaming, and cloud computing, and new trends—such as the push toward renewable energy—could provide additional tailwinds. However, with these high expectations, growth stock valuations have been driven to extreme levels relative to value stocks (see Figure 2), leaving little room for error should outcomes disappoint.

In our view, the significant valuation difference between growth and value stocks may not be sustainable, and potential catalysts, including higher inflation and rising interest rates, could narrow the gap in the medium term. In the U.S., increased government spending, higher taxes on foreign earnings, and tighter regulation of technology companies could also be supportive.

We believe that these conditions, should they materialize, would likely favor value stocks and be a headwind for growth stocks. As a result, the Asset Allocation Committee maintained our tilt toward value stocks.

A Short-Lived Value Rally

Stronger fundamentals for growth stocks, but valuations are extreme

Past performance is not a reliable indicator of future performance.

Sources: Russell. T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. See Additional Disclosures.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

August 2021 / MARKETS & ECONOMY