February 2022 / INVESTMENT INSIGHTS

White‑Label Options in DC Plans: A Framework for Consideration

Unbranded offerings can improve plan investment lineups.

Key Insights

- Many defined contribution plan sponsors are interested in simplifying their plan’s investment lineups while still maintaining appropriate diversification opportunities.

- Some sponsors are considering “white label” options—unbranded offerings that can include single or multiple portfolio managers, asset classes, and/or styles.

- Implementation of white‑label options can take many forms. The process should take into account both plan participant and plan sponsor perspectives.

- White‑label options can give sponsors more control and may improve participant returns. However, operational complexity may require close fiduciary oversight.

Designing investment lineups for defined contribution (DC) plans is a complex effort in which sponsors must walk a fine line between offering an appropriately diverse selection of investment options without confusing participants with too many choices. Positioning participants for financial success is especially challenging when you consider the demographic factors (such as employee age, income, and savings behavior) and the unique individual situations (such as company stock holdings) that the lineup must be flexible enough to accommodate.

Given these factors, it is not surprising that the number of investment vehicles in the typical 401(k) plan has risen over time and now averages 21 options.1 However, this trend has proven detrimental to investor behavior. One study found that employee participation falls about 2% for each 10 additional options added to a 401(k) plan.2 Other research has indicated that overwhelmed investors misallocate either by equally weighting all investment options or by investing far too conservatively.3

One proposed solution to the simplicity versus diversification trade‑off has been the introduction of white‑label options—unbranded plan offerings that can include single or multiple portfolio managers, asset classes, and investment styles. In theory, white‑label vehicles can reduce the number of investment choices while still providing appropriate diversification and may help produce more successful retirement outcomes.

In this paper, we will explore the white‑label concept to understand the potential benefits, what considerations plan sponsors will need to keep in mind, and which specific white‑label design features might be most beneficial for plan participants.

White‑Label Implementation

Generally, white‑label options are named after the asset class or investment objective they represent. For example, a white‑label option might be called “U.S. large‑cap stock” and include multiple underlying U.S. large‑cap equity managers selected and bundled by the plan sponsor. Participants would be able to choose the broad investment approach (U.S. large‑cap equity in this example), thus gaining diversified exposure to the strategy without having to select and weight individual managers.

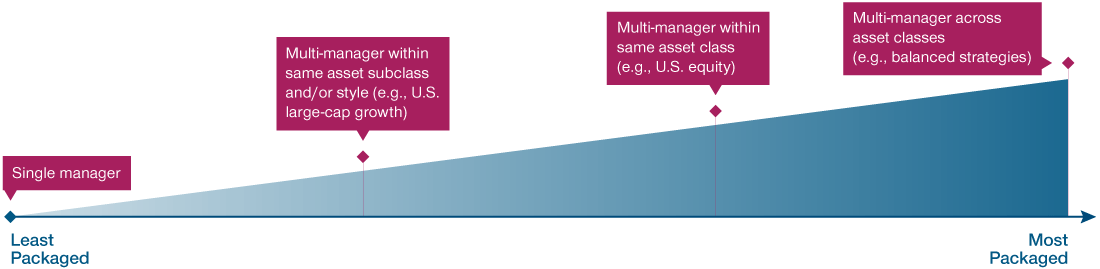

While the broad definition of white‑labeling is relatively straightforward, the implementation of the approach is not so well defined. A white‑label strategy can represent anything from an unbranded, single‑manager option to multiple managers across asset classes (Figure 1). Furthermore, a DC plan sponsor could choose to fully white‑label all the options in its investment lineup or offer a combination of white‑label and branded, single‑manager strategies. Target date investment vehicles also could be offered.

(Fig. 1) White‑Label Implementation Spectrum

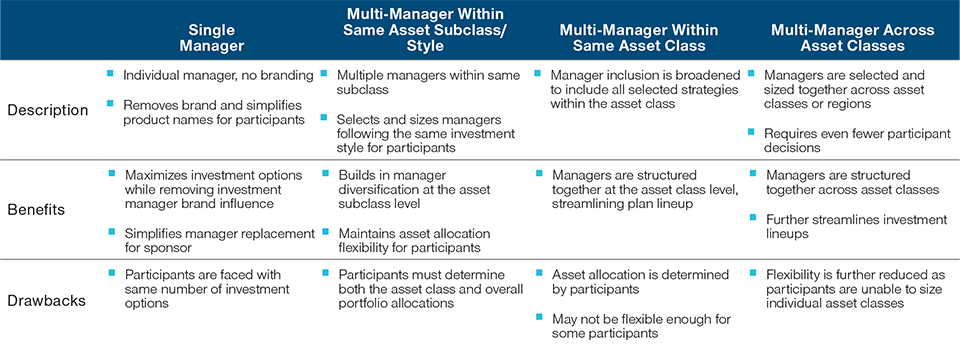

Unfortunately for plan sponsors, there is still no universally accepted framework for integrating the white‑label concept into an investment lineup. The unique characteristics of each plan’s participant base should be considered, providing a basis for the plan structure. Quantitative factors such as average age and education are important, as are more subjective factors such as participants’ general comfort level with investing. Sponsors hoping to include white‑label strategies in their lineups should use this information to determine the implementation method most appropriate for their plans (Figure 2).

(Fig. 2) Selected White‑Labeling Implementation Options

White‑Label Considerations

There are numerous issues plan sponsors need to evaluate when contemplating a white‑label approach. But any discussion of the benefits and challenges should take into account the perspectives and needs of both plan sponsors and plan participants. Again, given the variability around the actual application of white‑label options, it is difficult to draw up a definitive list of “pros and cons.” Instead, we will list and discuss what we see as some of the primary considerations.

White‑Labeling: The Participant Perspective

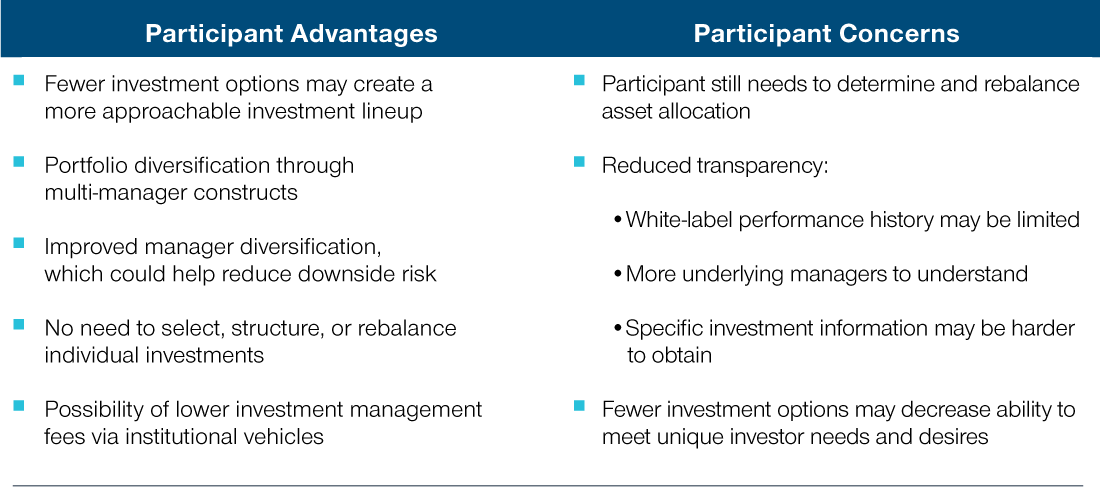

From the perspective of the participant, the primary utility achieved via white‑labeling is a more approachable investment lineup (Figure 3). The participant no longer needs to piece together individual strategies while trying to decipher fund names and investment concepts. Instead, they are faced with a more efficiently organized set of investment options that are clearly named after the desired strategy or objective. Multi‑manager white‑label options also provide built‑in diversification, which may reduce the risk of extremely negative investment results and can improve portfolio performance. These benefits may lead to higher employee participation, more engaged participants, and improved long‑term investment results.

(Fig. 3) Participant White‑Label Considerations

Under a white‑label framework, firms that also have defined benefit plans may be able to place institutional investment vehicles in their DC lineups, potentially resulting in lower management fees under asset‑based fee schedules. The inclusion of passive and active strategies within a multi‑manager white‑label option may also tend to reduce management fees. In fact, the ability to package passive and active strategies within a single white‑label option itself is a potential benefit, as it may allow for pairing higher‑tracking‑error active strategies with passive, index‑oriented approaches.

However, there also are some considerations that may cloud the overall advantages of a white‑label lineup from a participant perspective. For example, asset allocation and periodic rebalancing across the white‑label portfolios (two areas many participants have struggled with historically) remain the participant’s responsibility.

Another potential concern: Fewer investment options could reduce the lineup’s flexibility to meet specific investor needs. Because a white‑label option may encompass a broad investment opportunity set, the ability of participants to tailor their allocations to their personal financial circumstances could be reduced.

An employee working for a large‑cap U.S. firm, for example, might have a sizable position in company stock that he or she either cannot or does not wish to sell. If a U.S. equity white‑label strategy combines both large‑ and small‑cap stocks, the employee might be forced to carry an undesirable overweight to U.S. large‑cap equities. Furthermore, the participant would be tied to a sponsor’s prevailing investment perspective. If the manager of the white‑label strategy had an especially favorable view of U.S. large caps (using our previous example), then the participant might be forced to carry an even greater overweight to that sector—regardless of his or her personal viewpoint.

These considerations do not necessarily undermine the potential value that could be achieved through white‑labeling, but they do highlight the importance of designing white‑label options and utilizing an implementation framework that will be easy for participants to execute while still being flexible enough to support a wide range of participant needs. Ongoing investment education on asset class‑based portfolio construction and regular rebalancing can better prepare participants.

White‑Labeling: The Sponsor Perspective

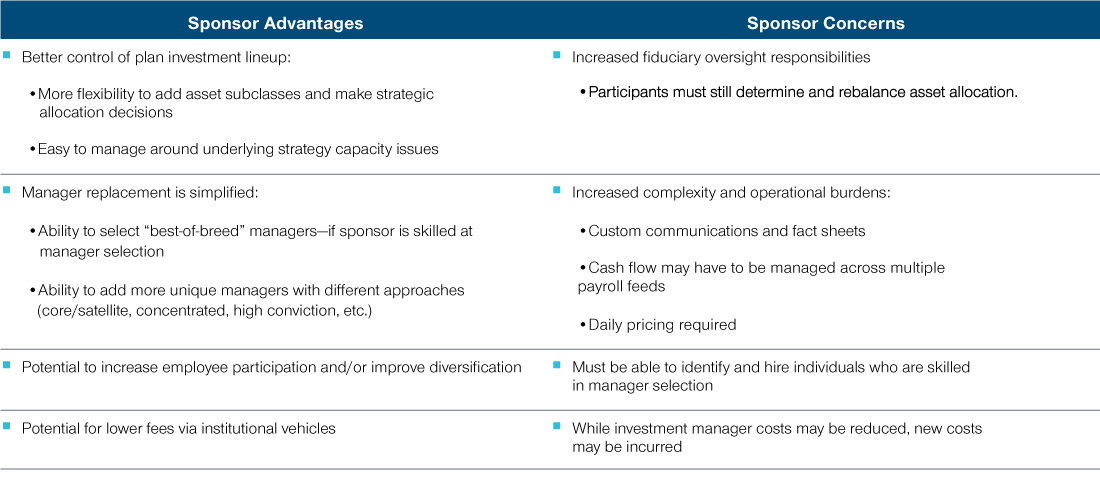

The trade‑offs for a sponsor implementing white‑label plan options are somewhat more complex than for participants (Figure 4). While they gain greater control over the plan’s investment lineup, they are also undertaking greater fiduciary oversight and increasing operational complexity. The improvement in control comes in several forms, as the generic labeling of the lineup allows the sponsor to regulate the underlying investment strategies without disturbing participants themselves:

- Underperforming managers can be swapped out.

- Manager allocations can be rebalanced and structured by the sponsor’s preference.

- Capacity constraints can be more easily managed.

(Fig. 4) Sponsor White‑Label Considerations

Greater ability to manage capacity issues could be a key benefit of white‑labeling if sponsors wish to offer more niche investment approaches, such as U.S. small‑cap, emerging markets, or sub‑investment‑grade credit strategies. Should an existing manager close a strategy to new investment, a white‑label option allows the sponsor to add an additional manager following the same approach and rebalance as necessary without negatively impacting currently invested participants.

However, just as white‑labeling offers both advantages and concerns for participants, the potential benefits for sponsors must be weighed against some important considerations:

- Increased fiduciary oversight responsibilities: Plan sponsors must understand that by taking greater control of their investment lineup, they may also be adding complexity that requires greater fiduciary oversight. At the same time, participants maintain control of day‑to‑day investment decisions. White‑label options also represent a move away from transparency at a time when regulators are stressing increased disclosure.

- Increased administrative burden: Developing custom white‑label options not only entails manager selection skills and relative allocation expertise, but it is likely to require additional operational and, potentially, advisory resources. Sponsors will have to either develop or hire someone to provide custom fact sheets and communications, which probably will need to include significant disclosures related to investments and process. An outside advisor, such as an investment consultant, may be needed to help with manager selection, sizing, and plan structure.

These factors all have practical implications that will need to be addressed in the design of a white‑label lineup and in the implementation process.

Whether a plan sponsor decides to white‑label a single strategy or an entire multi‑manager structure, the change will expand its role in delivering accurate and timely data to participants. While performance calculation and recordkeeping can be outsourced, the sponsor is ultimately responsible for the accuracy of any performance‑related data, as well as for any custom communications associated with the white‑label options. The information in these communications itself may present a challenge, as sponsors may be required to disclose historical track records on any new investments that replace old managers.

In addition, multi‑manager white‑label frameworks potentially introduce even heavier oversight and duty‑of‑care burdens. A practical concern is that the sponsor is taking on great responsibility in the design and implementation of investment options (including not only manager selection, but also sizing, rebalancing, and tactical shifts) but will have little control over the actual cash flows into and out of those vehicles. The sponsor also must be prepared to deal with irrational participant investment behavior. For example, what if significant drawdowns from a white‑label strategy during a period of market stress have a disproportionately negative impact on composite performance compared with a registered vehicle? Or what if the sponsor goes through the process of setting up a white‑label option that includes separate accounts only to find that those vehicles never attract enough flows to justify the costs?

An additional challenge is the management of cash flows into multi‑manager white‑label options, which the sponsor must then allocate among the underlying investment strategies. This raises the question of how cash flows “in transit” should be handled. Sponsors may try to use passive vehicles to temporarily absorb new inflows, or they may need to create cash buckets within each white‑label option. But the use of passive vehicles may result in volatile relative weightings among underlying managers, while dedicated cash buckets would likely drag down the relative performance of white‑label vehicles against non‑customized benchmarks.

The challenges facing sponsors in designing and implementing white‑label investment options do not necessarily mean such a framework will fail. But the issues reviewed above do highlight the fact that the white‑label approach brings with it significant practical problems that must be addressed in order for the effort to succeed. At a minimum, any fee reductions achieved through the use of institutional vehicles or by blending active and passive strategies must be balanced against the additional direct and indirect costs a white‑label program could require.

Conclusions

Retirement planning is no small task, and any strategy that has the potential to increase employee participation and lead to improved long‑term investment results must be seriously considered. The white‑label framework certainly appears to make sense from a broad, conceptual perspective:

- Plan investment lineups will be streamlined but still provide adequate diversification opportunities.

- Rather than selecting and sizing investments among individual managers, participants only need to choose among the asset classes or investment approaches themselves.

These two factors, when considered alone and implemented correctly, could reasonably be expected to lead to a less overwhelming plan lineup, which in turn could promote more favorable outcomes for both plan sponsors and participants.

Unfortunately, once the process moves from the white‑label concept to actual implementation, a number of considerations arise that may or may not outweigh the perceived benefits. A chief assumption is that white‑labeling will help participants avoid the common traps of naïve diversification and status quo bias. These are important goals, but improvement is not guaranteed. Sponsors must decide whether the additional fiduciary oversight responsibility, resource needs, and costs will outweigh the incremental benefits to participants.

Given these concerns, plan sponsors considering a white‑label lineup should first consider whether their plans are large enough to shoulder the additional responsibilities that come with a fully white‑labeled plan lineup. A practical compromise may be to take a more measured approach initially, adding white‑label options only where unique benefits appear to exist. Two areas where these advantages might be found are:

- Asset classes that are prone to capacity constraints. A white‑label framework can facilitate capacity management by providing sponsors with the ability to replace, add, or rebalance between managers without disrupting existing participant investments.

- Strategies where participants are less comfortable selecting and pairing managers. As markets evolve or financial conditions change, portfolio managers may see investment opportunities that are unfamiliar to the average participant. A white‑label framework can allow sponsors to package options in a way that provides diversified exposure to rising asset classes and/or evolving investment styles.

Ultimately, decisions about how or when to incorporate white‑label options in a DC plan lineup have to be made by each plan sponsor’s investment committee. Every plan is unique, and there is no universally accepted white‑label framework. What is certain is that the introduction of white‑label options is a resource‑intensive endeavor that requires careful and continuous planning in order to succeed.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is no guarantee or a reliable indicator of future results.. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

February 2022 / ENVIRONMENTAL, SOCIAL, AND GOVERNANCE