September 2022 / INVESTMENT INSIGHTS

High Inflation and Rising Rates? Think Smaller Companies

Why U.S. smaller companies may prove more resilient than many expect.

Key Insights

- For many, the world of inflation and rising interest rates is unfamiliar territory. As such, it is worth looking to history for guidance on how today’s market dynamics might play out.

- History shows us that U.S. smaller companies have tended to outperform their larger counterparts during times of inflation and rising interest rates.

- Historically, following periods of economic recession, U.S. smaller companies have generally led the market recovery, often going on to outperform over multiple years.

Investing, particularly in smaller companies, is rarely comfortable. The high inflation, rising interest rate environment in the U.S. is particularly concerning for investors. However, the lessons of history suggest that it is in times like these that thoughtful investors can potentially position portfolios for meaningful long‑term success. For many, the world of inflation and rising interest rates is new and unfamiliar territory, given the ultralow landscape that has prevailed in the U.S. for more than 30 years. Indeed, we are likely on the cusp of regime change, and with such change comes uncertainty. Accordingly, it is worth looking back to similar periods in history for guidance on how today’s market dynamics might play out moving forward.

Certainly, where U.S. smaller companies are concerned, history shows us that two characteristics have been evident during similar market environments, namely:

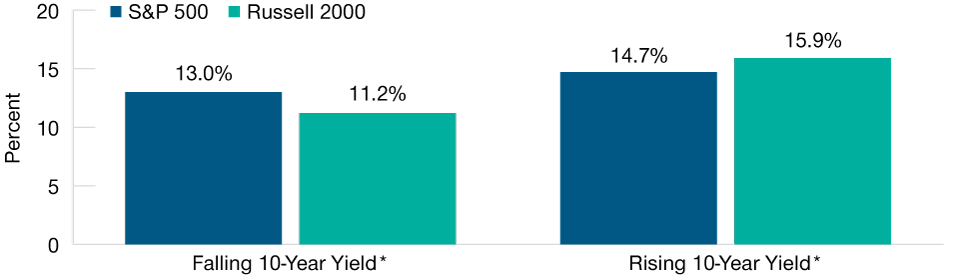

- U.S. smaller companies have tended to outperform their larger counterparts during periods of heightened inflation and rising interest rates (Fig. 1).

- Following periods of economic recession, U.S. smaller companies have generally led the market recovery—often going on to outperform larger companies over multiple years.

Historically, Rising Interest Rates Have Favored U.S. Smaller Companies

(Fig. 1) Average annual return in a rising/falling interest rate environment (Dec. 31, 1978–Dec. 31, 2021)

As of December 31, 2021.

Past performance is not a reliable indicator of future performance.

*Based on monthly change in 10-year US Treasury yields.Sources: Furey Research Partners, S&P, and London Stock Exchange Group plc and its group undertakings (collectively, the LSE Group). Analysis by T. Rowe Price (see Additional Disclosures).

In this article, we will explore these key characteristics in detail and explain why U.S. smaller companies can prove to be more resilient than might be expected.

Many Smaller Businesses Command Pricing Power

The relative outperformance of U.S. smaller companies during inflationary periods is well documented. In many cases, these businesses are operating in niche industries or under‑served areas of the market, often forming a small but critical component within more complicated chains or processes. As such, they command more pricing power than their size might suggest. And as these businesses begin to experience inflationary pressure, be it through wage increases or as a result of rising input costs, they should be able to pass on these higher costs to customers, thereby protecting their margins.

Today’s Bear Market Already Prices in the Worst Case

The current U.S. market environment is challenging for companies and investors alike. However, the downturn in the equity markets, particularly among smaller companies, is discounting the risk of a meaningful recession. This is overly pessimistic, in our view.

While the U.S. economy has recently entered into a technical recession (following two consecutive quarters of economic contraction), we believe that the downturn may well prove shorter and shallower than many are expecting. In comparison with prior economic slowdowns, many U.S. companies still maintain sizable backlogs of business, with many yet to fulfill the orders that have accrued over recent years. This suggests that there is considerable pent‑up demand, and this can help buffer any slowing in new orders.

The current bear market has seen smaller company stocks in the U.S. fall over 32% from their peak in November 2021 to the recent trough in June 2022. This compares with an average drawdown for the past 13 bear markets of -34%.1 While the future trajectory of the market remains impossible to predict, compared with history, it would appear that much of the damage may have already been done.

In terms of where we go from here, again, there is no crystal ball, but history also tells us that U.S. smaller companies have tended to lead the market recovery following a bear market. Smaller companies have led the market recovery following nine of the past 10 U.S. recessions. What’s more, their outperformance relative to larger company counterparts is often magnified during the early stages of recovery, as large companies are generally slower to respond to the changing environment.

The Impact of Rising Rates May Be Overstated by the Market’s Moves

Consensus expectations for U.S. smaller companies remain weak in the near term, the potential impact of rising interest rates weighing on investor sentiment. However, there are good reasons to suggest that these businesses are also better positioned to navigate this rate environment than at similar times in the past.

For the past nine months, the U.S. Federal Reserve has been telegraphing the fact that it is on a tightening trajectory. Anticipating an eventual end to the low rate environment, many companies preemptively moved to fix their debt, locking in low rates and extending maturities. This means they are less vulnerable to the current rising rate environment than might have been true in past cycles.

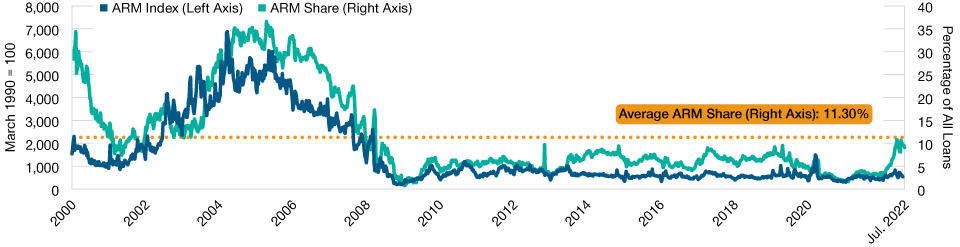

Less Than 10% of All U.S. Mortgages Are Floating Rate

(Fig. 2) Adjustable rate mortgage (ARM) loan trends

As of July 22, 2022.

Past performance is not a reliable indicator of future performance.

Source: Mortgage Bankers Association (MBA) Weekly Applications Survey. Data analysis by T. Rowe Price.

And while consumers may see the impact of rising rates in areas like credit card debt, the much larger household budget item—the mortgage payment—is less of a risk. Following the global financial crisis, volumes of U.S. homeowners reverted to traditional fixed rate mortgages. Accordingly, less than 10% of all U.S. mortgages today (new home purchases and refinancing) are now floating rate. This means that more than 90% of U.S. households have locked in fixed mortgage payments at rates well below those being quoted today (Fig. 2). This is a critical point, given all the noise in the press around rising interest rates and the potentially debilitating impact of this on U.S. household finances.

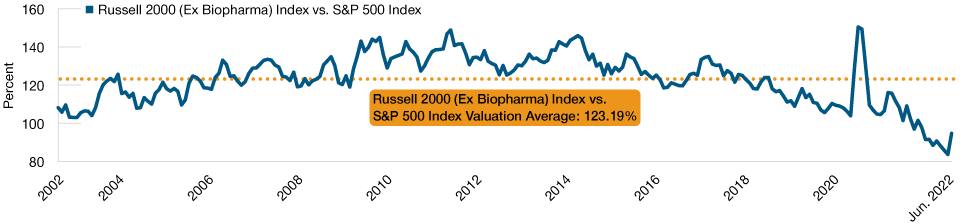

Valuations Are at Historically Low Levels

Certainly, the valuation argument has rarely been more compelling for U.S. smaller companies than it is today. The broad‑based sell‑off in U.S. equities that began in Q4 2021 has seen relative valuations of smaller companies fall to near all‑time lows (Fig. 3). Historically, when relative valuations have reached similarly extreme levels, smaller companies have typically gone on to outperform their larger counterparts over an extended multiyear period.

Small‑Cap Relative Valuations are Around All‑time Lows

(Fig. 3) Relative 12‑month forward price‑to‑earnings ratio

As of July 31, 2002 to June 30, 2022.

Past performance is not a reliable indicator of future performance.

For comparison purposes of this article, the chart focuses on the relative valuations of the Russell 2000 (Ex Biopharma) Index, representing 2,000 of the smallest U.S. listed companies, versus the S&P 500 Index, representing the 500 largest U.S. listed companies, by market capitalization.

Sources: Furey Research Partners, S&P, and London Stock Exchange Group plc and its group undertakings (collectively, the LSE Group). Analysis by T. Rowe Price (see Additional Disclosures).

Meanwhile, as tends to be the case during periods of broad‑based selling, a lot of good‑quality companies have been sold off indiscriminately over the past year with valuations, in some cases, falling to levels not seen in years. And the potential opportunities span the market spectrum—from more cyclical stocks that we believe are pricing in a deeper‑than‑anticipated recession, to higher‑growth stocks, where multiples have compressed substantially but where underlying business prospects do not appear to have been materially impacted.

This is important for a fundamental, best ideas, active portfolio manager because, despite the more difficult U.S. equity environment, we continue to be able to find many good stock ideas across the U.S. smaller company landscape. Indeed, a quality‑oriented stock‑picking approach tends to work well in the type of environment we are experiencing currently, when the market moves in broad unison and there is concerted, indiscriminate selling.

Ultimately, the sharp sell‑off in U.S. smaller companies that began in Q4 2021 is pricing in a potentially meaningful U.S. recession. However, this is overly pessimistic, in our view, and we anticipate a shorter and shallower recession than many are expecting. Meanwhile, with relative valuations currently near historic low levels, history tells us that smaller company stocks typically rebounded early and strongly once the bottom of the cycle was reached. In past market cycles, it was generally positive to be invested at this point, given that a significant proportion of the recovery total returns came in the very early stages after the bottom was reached. Accordingly, we believe that now is an opportune time to build exposure to U.S. smaller companies, with relative valuations close to historic lows and ahead of a prospective U.S. market recovery.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is no guarantee or a reliable indicator of future results.. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.