June 2022 / GLOBAL FIXED INCOME

Fixed Income—New Dynamics Demand Fresh Thinking

How changing markets require investors to think and act differently.

Key Insights

- Changing dynamics mean that the past decade is probably a poor guide as to how bond markets might perform going forward.

- With central banks removing stimulus support and hiking interest rates, we expect tighter global liquidity, higher interest rates, and bouts of volatility to continue.

- While the environment is challenging, we see potential for great buying opportunities, so a flexible approach to bond investing is vital.

Bond market volatility is set to continue as markets prepare for life without central bank support. After more than a decade of stimulus measures, central banks are withdrawing liquidity and hiking interest rates in response to multi‑decade high inflation. Given that aggressive actions of central banks drove yields down so low in the first place, their withdrawal is likely to be highly disruptive—and will ultimately have a much bigger impact on markets than economic growth forecasts.

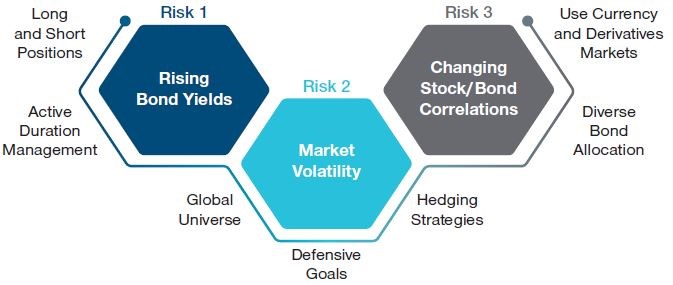

Managing Market Challenges in 2022

Three key risks and mitigation approaches

As of May 31, 2022.

Source: T. Rowe Price.

Faced with rising rates and volatile markets, we believe that bond investors will need to think differently and adopt a broader, more flexible approach that emphasizes active duration management and volatility management. Below, we explore three key risks—and ideas to help mitigate them.

Key Risk—Rising Bond Yields

This year’s sharp rise in bond yields has left many investors questioning how much longer the rout can continue. Although it is difficult to envisage further moves of the same magnitude, this rising rate environment is likely to continue until we see material signs of inflation receding.

The path to higher rates is likely to be volatile as central banks move at varying speeds to tackle inflation. The Bank of New Zealand, for example, has been very proactive and has hiked aggressively, while the Bank of England is taking a more cautious approach. Meanwhile, the Federal Reserve recently kicked off its balance sheet reduction process, which is likely to be much faster and larger in scope than ever seen before. If multiple global banks decide to reduce their balance sheets in unison, the impact could be far‑reaching.

We expect the environment to remain challenging for the foreseeable future, but at some point, there is likely to be an inflection point when valuations turn attractive and potential great buying opportunities emerge in rates markets.

Portfolio Approach—Active Duration Management Will Be Critical

We believe that managing duration actively will be critical to navigating this environment because it enables investors to tactically respond to different market environments and regime changes. It also gives investors the flexibility to take advantage of any pricing anomalies and dislocations that might occur in a volatile environment.

A broad approach with the scope to invest in different bond markets across the globe may also be beneficial as it offers opportunities to take advantage of scenarios where policy is diverging.

Key Risk—Volatility in Credit Markets to Continue

Credit markets have come a long way this year, but they remain vulnerable, in our view. The environment of slower growth and high inflation is likely to cause credit fundamentals to deteriorate, which we believe will lead to further volatility in this space.

Furthermore, credit markets are sensitive to interest rate volatility—although the cushion to absorb this has improved this year. Credit contains a duration component that exposes it to changes in interest rates—a risk that is not always fully understood by investors. Over the past decade, the duration of corporate bonds has been extended, so investors may have become much more exposed to interest rate risks than they have been in the past. Also keep in mind that duration has been a key driver of credit returns in recent years, which is not a problem when yields are trending lower. The climate has changed, though, and we have entered a rising interest rate environment.

Similar to rates markets, however, at some point, a potential great buying opportunity could emerge in the credit space. We are not there just yet, but valuations have improved. An example here is March 2020, when a huge sell‑off in credit opened up a good opportunity to add select exposures at cheap prices.

Portfolio Approach—Defensive Positioning and Active Duration Management

A defensive approach may work well in this environment as deploying hedging strategies can help to navigate volatility. Managing duration actively is also important, given the duration risks to which credit portfolios may be exposed.

Key Risk—Stock/Bond Correlations Are Changing

Fixed income markets are going through a period of strategic change as central banks retreat from supporting markets. This environment means that investors should no longer assume that fixed income will always be a diversifying asset class that typically performs well when risk markets such as equities sell off. At multiple times this year, stocks and bonds have both sold off simultaneously, demonstrating that the stock/bond relationship is not always constant and can change, especially in the current climate.

Portfolio Approach—Go Broad Using Full Toolkit of Instruments

A broad approach that deploys the full toolkit, including currency and derivatives markets, may help to balance and mitigate risks in a portfolio.

How the Dynamic Global Bond Strategy May Help in This Environment

The changing market environment means that investors can no longer rely on the post‑Global Financial Crisis investment playbook and will need to think and act differently going forward. We believe that the environment will suit our Dynamic Global Bond Strategy, which is flexible, has a strong emphasis on active duration management, and employs defensive hedges to provide diversification against risk assets. Specifically, we believe the strategy offers the following benefits:

Flexible: We manage duration actively within a wide latitude and have the ability to implement both long and short positions. This gives us the flexibility to adapt to different market cycles and environments, including rising rates. For example, when interest rates are rising, we should have the ability to quickly cut the portfolio’s overall duration to as low as minus one year to minimize potential losses, using instruments such as fixed income futures and interest rate swaps. By contrast, when rates are falling, we can increase overall duration to as high as six years to maximize gains. We believe this dynamic and tactical approach to managing duration will be critical in the current environment where high inflation and the retreat of central banks is causing bond yields to rise.

Broad: We benefit from a large global research platform that powers our investment ideas. Covering more than 80 countries, 40 currencies, and 15 sectors, our deep research capabilities enable us to uncover inefficiencies and exploit opportunities across the full fixed income investable base. Our broad approach is likely to be beneficial in the current climate as it should enable us to take advantage of scenarios where policy is diverging. Furthermore, with the stock/bond relationship positively correlated at times this year, our ability to express views across a wide range of different currencies, bonds, and sectors should help with diversification efforts.

Volatility Management: Our strategy goals are to generate regular returns, manage downside risks for our clients, and provide them with genuine diversification away from equity markets. To help achieve the latter, we implement defensive hedging positions at all times, which may include short positions on emerging market currencies, allocations to markets displaying defensive characteristics, and/or long volatility positions via options. This gives us the potential to benefit from falls in the prices of risk assets during periods of market turbulence. As we expect volatility to continue, our defensive approach could prove fruitful.

Looking ahead, the market environment remains highly uncertain with worries continuing over geopolitics, stagnating growth, inflation, and tightening financial conditions. While this is likely to be challenging, we expect great buying opportunities to emerge at some stage. Beyond simply navigating a new higher‑volatility regime, it will be crucial to identify when a potential inflection point emerges. Overall, we believe these are the conditions the strategy is designed for, with built‑in flexibility, a broad approach, and a strong emphasis on volatility management.

General Fixed Income Risks

Capital risk—The value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between the base currency of the portfolio and the currency in which you subscribed, if different.

ESG and sustainability risk—May result in a material negative impact on the value of an investment and performance of the portfolio.

Counterparty risk—An entity with which the portfolio transacts may not meet its obligations to the portfolio.

Geographic concentration risk—To the extent that a portfolio invests a large portion of its assets in a particular geographic area, its performance will be more strongly affected by events within that area.

Hedging risk—A portfolio’s attempts to reduce or eliminate certain risks through hedging may not work as intended.

Investment portfolio risk—Investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Management risk—The investment manager or its designees may at times find their obligations to a portfolio to be in conflict with their obligations to other investment portfolios they manage (although in such cases, all portfolios will be dealt with equitably).

Operational risk—Operational failures could lead to disruptions of portfolio operations or financial losses.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is no guarantee or a reliable indicator of future results.. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

June 2022 / RETIREMENT INSIGHTS