June 2022 / STABLE VALUE

Comparing Stable Value Funds and Insurance Company Products

Plan sponsors may want to consider some key structural features.

Stable value strategies can be accessed through various investment vehicles offered both by insurance companies and by asset managers. The most common structures are insurance company general and separate accounts and portfolios managed by asset managers, which can include both separate accounts and common trust, or pooled, funds.

We believe plan sponsors and their consultants or advisors should consider a number of key structural features when evaluating stable value products. These include:

- Asset ownership,

- Contractual terms,

- Exit provisions,1

- Investment guidelines,

- Fees and crediting rate2 disclosures,

- Management of the portfolios underlying the principal guarantee, and

- Diversification of the principal guarantee.

Regardless of the investment vehicle, investors also need to assess not only the creditworthiness and/or capabilities of the insurance company or asset manager, but also some key structural differences between pooled funds and insurance company general accounts.

As we compare stable value products and structures, we quickly observe distinct differences in a few critical categories—such as crediting rates and portfolio durations3—that are the direct result of differing product structures.

Characteristics of Stable Value Vehicles

(Fig. 1) Pooled funds and general accounts have key differences

As of December 31, 2021.

Source: Stable Value Investment Association. Based on survey data of stable value assets from participating firms.

Features and characteristics of specific products and issuers may differ significantly.

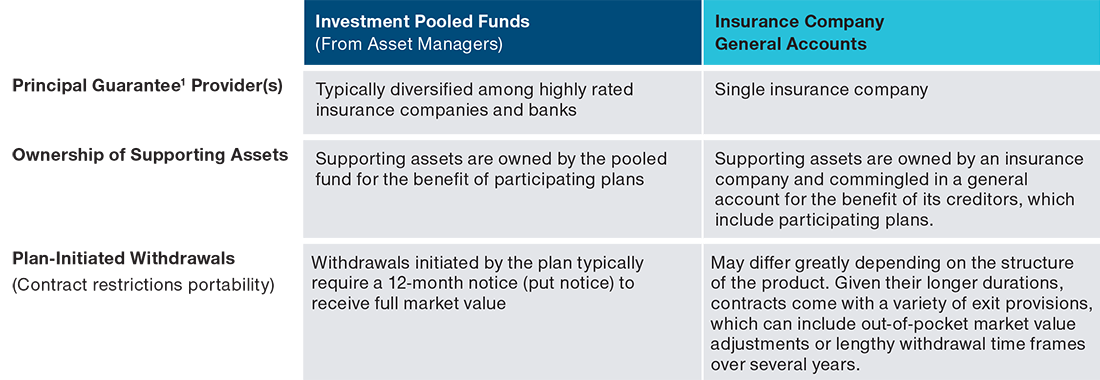

Structural Characteristics of Stable Value Vehicles

(Fig. 2) Insurer and asset manager offerings may differ notably

Source: T. Rowe Price.

There are additional differences between these products. Please refer to a product’s offering document to carefully review a specific product’s features, costs and risks. Some of the additional features of both products include offering daily liquidity for plan participants and capital preservation. Some differences are that a general account product is backed by the full faith and credit of the insurance company while investment managed pooled funds typically use several wrap providers (who “wrap” designated associated assets within a stable value investment option to provide book value protection for plan participants). General account products offer a guaranteed fixed rate of return while investment managed pooled funds offer a rate of return based on the performance of the underlying fixed income assets. Duration can vary for each product.

1 Guarantees subject to the claims paying ability of the insurer.

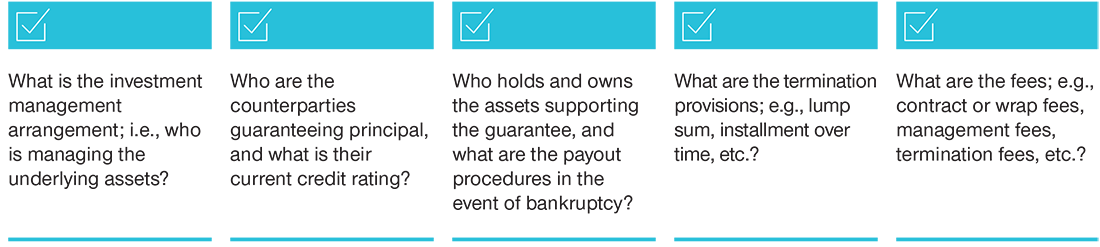

Key Considerations Checklist

(Fig. 3) Issues to evaluate when selecting stable value vehicles

Source: T. Rowe Price.

The average credit quality of insurance general accounts may also be lower compared with investment manager pooled funds as a result of structural differences.

As highlighted in survey data from the Stable Value Investment Association (SVIA), insurance products tended to have longer durations and correspondingly higher yields, while pooled funds tended to have shorter durations and slightly lower yields. (Duration is a measure of a bond’s or bond portfolio’s sensitivity to interest rate changes.)

Given that all pooled funds and insurance company general accounts are capital preservation products that provide participants with daily liquidity, there does appear to be some trade-off between interest rate risk (i.e., duration) and plan exit provisions. Insurance products, given their longer durations, typically include a variety of exit provisions that seek to offset some of the interest rate risk borne by the insurance company. Pooled funds also have plan exit provisions (put options) that typically are 12 months or greater and are commensurate with their shorter duration.

As with any investment, it is important that plan sponsors, consultants, and advisors understand their investments and are comfortable with the terms and conditions of the investment vehicle and structure. When considering stable value investment options and evaluating structures, we suggest investors develop a checklist of key questions.

A simple checklist will allow defined contribution plan sponsors and their consultants or advisors to compare stable value products with distinct structures on a common basis. T. Rowe Price and the SVIA both offer a wealth of resources to help plan sponsors and their consultants or advisors equip plan participants with the tools they need to construct an informed investment strategy.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

This material was prepared for use in the United States for U.S.-based plan sponsors, consultants, and advisors, and the material reflects the current retirement environment in the U.S. It is also available to Canadian-based plan sponsors, consultants and advisors for reference. There are many differences between the two nations’ retirement plan offerings and structures. Therefore, this material is offered to accredited investors in Canada for educational purposes only and does not constitute a solicitation or offer of any product or service.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2022 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/ or apart, trademarks of T. Rowe Price Group, Inc.

June 2022 / VIDEO

June 2022 / RETIREMENT INSIGHTS