February 2022 / INVESTMENT INSIGHTS

What’s Behind the Market Volatility, and What We’re Watching Next

Further price fluctuations loom amid Fed hikes, inflation, and post-pandemic shifts.

Key insights

- The volatile start to the year in financial markets is set to continue for a while yet.

- Fed hikes, surging inflation, a post‑pandemic repricing in stock markets, the Chinese economy, and the Ukraine‑Russia border dispute have the potential to disrupt markets.

- Steering a course through this environment will be very challenging, but market volatility and sector rotation should present good opportunities for active investors.

The volatile start to the year in financial markets is unlikely to abate soon. Sustained inflation, a looming Federal Reserve (Fed) rate‑hiking cycle, tightening liquidity conditions, and the unwinding of pandemic‑era economic distortions—among other factors—mean that further price fluctuations can be expected.

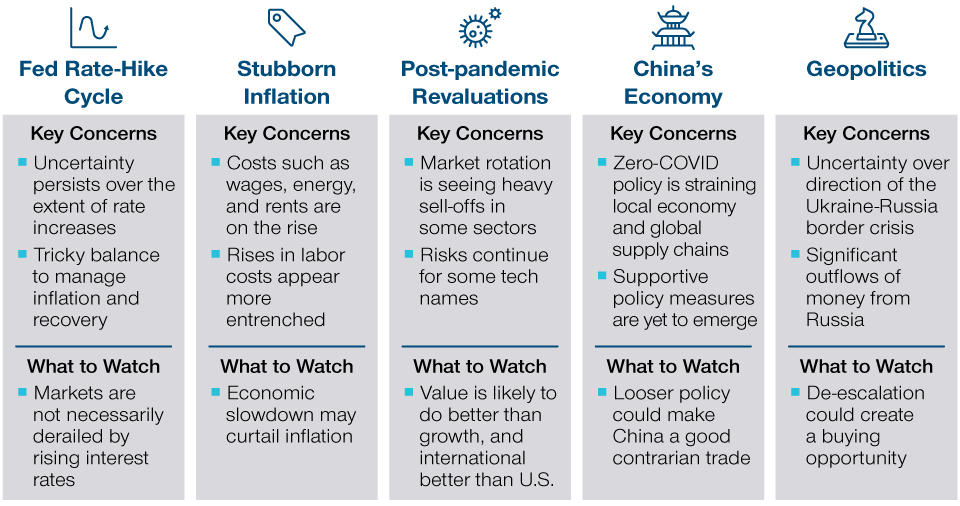

The Forces Driving Markets This Year

Five key developments to monitor

Although it is too early to say that we are entering a post‑COVID world, it is clear that the pandemic is no longer the dominant driver of markets that it has been. The new environment will be difficult to navigate—but it will also provide some excellent opportunities for stock pickers.

Fed Hikes Alone Tend Not to Derail Markets

Anxiety over Fed rate hikes was the primary cause of recent volatility. For most of last year, the Fed maintained a dovish stance, focusing more on reducing unemployment than curbing inflation. Then, in its December monetary policy meeting, it made it clear that rates would soon be rising. This prompted the markets to immediately price in rapid policy tightening, hence the declines in financial markets during January.

Markets initially responded positively to the Fed’s January statement, which confirmed March as the target for a rate hike. However, comments from Fed Chair Jerome Powell at the subsequent press conference changed the mood dramatically. “I think there’s quite a bit of room to raise interest rates without threatening the labor market,” said Powell—implying that the Fed may adopt a more aggressive hiking cycle than expected. Markets, which had been pricing in four hikes in 2022, suddenly had to price in more—sparking another bout of volatility.

We simply do not know how aggressive the Fed’s hiking cycle will be. Although it clearly needs to raise rates to combat inflation, it will not want financial conditions to tighten in a disorderly fashion. But the Fed’s hand is being forced. Inflation seems almost out of control, and Powell enters his second term knowing he has to cool it down.

We can observe that Fed rate hikes alone do not usually derail financial markets. Analysis by colleagues in our Multi‑Asset Division shows that out of the 21 rate‑hiking cycles since 1974, the U.S. equity market has delivered a positive return 17 times—an 81% hit rate—in the 12 months after a rate hike and 16 times—a 76% hit rate—in the first six months after the first hike. Although the U.S. dollar depreciated against major world currencies in the six months after the first rate hike, it appreciated 12 times—a 57% hit rate—in the 12‑month period.1

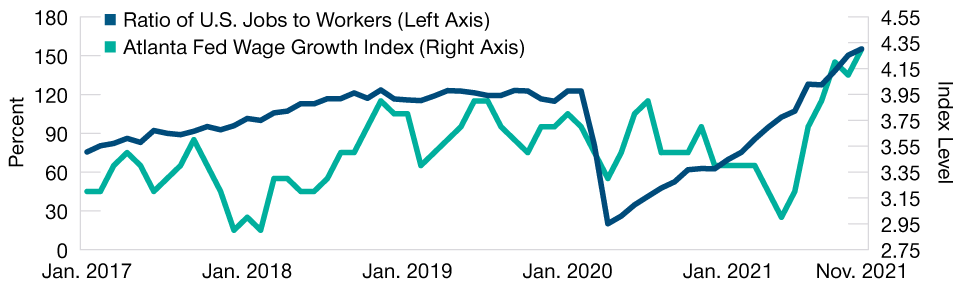

The U.S. Labor Market Is Tight

(Fig. 1) There are more jobs than workers, and wages are rising

As of November 30, 2021.

Sources: Federal Reserve Bank of Atlanta, Bloomberg Finance L.P. Analysis by T. Rowe Price.

Also, the expected end point for rate hikes—known as the “terminal rate”—is low by historical standards. This further supports the view that Fed rate hikes alone are unlikely to derail markets.

Stubborn Inflation Could Lead to a More Prolonged Slowdown

Last year, the U.S. economy registered its strongest growth in nearly four decades on the back of low interest rates, pent‑up demand, and trillions of dollars of pandemic‑related fiscal stimulus. These supportive factors are now waning. Activity in the services sector has fallen to its lowest level since July 2020, according to a January survey by IHS Markit. Retail sales have fallen. Consumer confidence is low. The International Monetary Fund has cut its forecast for U.S. growth in 2022 by 1.2 percentage points, from 5.2% to 4%.

As the economy is expected to slow, inflation continues to fuel higher costs. Wages, for example, look set to remain high—there are more jobs than workers in the U.S. Some 26 U.S. states will raise their minimum wage in 2022, and many firms are raising their pay floors even higher (Figure 1). The so‑called Great Resignation appears to be taking hold. Rents are going up, and house prices are skyrocketing. Food bills are surging on the back of higher transportation and material costs, while the price of oil remains close to its highest since 2014 amid limited supply and tensions in Europe and the Middle East.

Although rising costs in some areas may diminish in time, in other areas—for example, labor costs—they are beginning to look more permanent. The more permanent inflation becomes, the bigger dent it will have on consumer confidence and, ultimately, on consumer spending and corporate profits.

In response to the Fed’s policy update, the Treasury yield curve flattened to levels not seen since 2019–2020. The shrinking spreads indicate that investors are becoming more pessimistic and are skeptical that the Fed can raise rates as much as it would like without crossing the line from slowing to damaging the economy. While it is too early to talk of a recession, the possibility of an economic slowdown beyond what has been priced in to financial markets seems to be increasing.

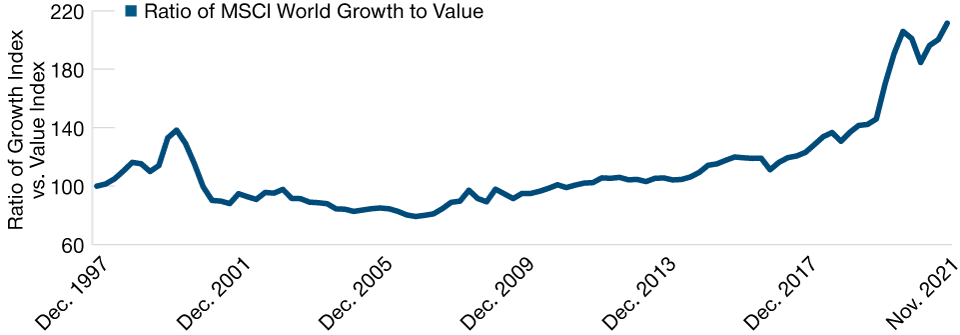

Growth Stocks Have Dominated for More Than a Decade

(Fig. 2) The MSCI World Growth Index vs. the MSCI World Value Index

As of November 30, 2021.

Past performance is not a reliable indicator of future performance.

Sources: FactSet, MSCI (see Additional Disclosures).

Pandemic Repricing Will Continue for Most of 2022

Valuations are another concern. U.S. stocks are expensive, and a repricing is taking place as investors lose faith in firms that performed well in the stay‑at‑home environment, as in more speculative investments in firms without sustainable earnings. The repricing involves a rotation from growth to value stocks—a key development following more than a decade of dominance by growth stocks (Figure 2). However, there are some mid‑cap growth firms that were largely unwanted during the pandemic and look well positioned to recover. This year may be a year when more “boring” companies outperform.

We expect the pandemic repricing cycle to continue as the valuations of companies that did well during the pandemic return to normal levels. This may take a while to work through—at least until real rates return to pre‑pandemic levels. Investment strategies that worked well over the past few years may cease to be effective.

In our multi‑asset portfolios, we prefer cyclically oriented equity markets such as global ex‑U.S. equities, value stocks, and small‑cap names. We also favor emerging markets equity, which is benefiting from a pickup in demand and improving vaccine distribution. Floating rate loans are attractive in a rising rate environment given their yield advantage and lower duration profile.

China Offers a Potential Contrarian Trade

Outside the U.S., China needs to be monitored carefully. Sections of the Chinese market, notably offshore equity and credit, are unloved, oversold, and potentially very cheap as the market has been digesting recent regulatory changes and the economy has slowed. Normally, we would by now have expected support from China’s “credit impulse” (the change in the growth of aggregate credit to gross domestic product—the so‑called Beijing put), but this has not materialized yet.

Further stimulus is likely to support the Chinese property market, which will mean that China is loosening as the developed world is tightening. This could make China—and emerging markets more broadly—an interesting contrarian trade for 2022. However, China’s zero‑COVID policy presents a tail risk for supply chains and the global economy overall.

The Ukraine–Russia Conflict Could Have Global Ramifications

There are three potential outcomes of the Ukraine‑Russia border crisis: de‑escalation, a full invasion, or some form of limited intervention in the disputed area of Donbass. Russian equities were overbought last year, but money is now pouring out of the country.

However, the ruble has not sold off to the degree of previous risk‑aversion episodes, and the Russian media does not seem to be preparing the population for war, as it did with the Crimea and Georgia conflicts. Oil priced in rubles is at an all‑time high, which shows that, economic sanctions aside, the economic backdrop is good. It is probably too early to regard the sell‑off in Russian stocks as a buying opportunity, but this is something to keep an eye on.

A Stock Pickers’ Environment

We are witnessing the unravelling of the pandemic‑era status quo in the global economy and financial markets. This has already brought considerable volatility. Many uncertainties remain—over the extent and speed of the Fed’s hiking cycle, over the persistence of inflation, over the winners and losers of the pandemic repricing, and over global concerns including China and the Ukraine‑Russia border issue.

There are still tailwinds. Household wealth gains, pent‑up consumer demand, and a potential boom in capital expenditures could sustain growth even as monetary policy turns less supportive. Much attention will be focused on how these forces play out given the volatility drivers described above. Steering a course through markets in this environment will be very challenging. However, we believe market volatility and sector rotation invariably present very good opportunities for active investors—and this year will be no different.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.