June 2021 / INVESTMENT INSIGHTS

Seeking Value Stocks on the Right Side of Change

Accelerating disruption creates potential opportunities for value investors

Key Insights

- The recent rally in value stocks has been broad‑based, but understanding secular risk is still critical for value‑oriented investors.

- We believe the next leg of the recovery cycle could favor higher‑quality cyclical stocks.

- We are pursuing investments that offer exposure to key secular trends, including e‑commerce and the digitalization of the economy.

Value stocks have enjoyed a broad‑based rally over the past six months, as the prospect of a robust recovery prompted many investors to embrace companies in cyclical industries where the underlying businesses tend to exhibit greater sensitivity to conditions in the broader economy. We see the potential for the rally in cyclical stocks to continue, although prevailing valuations and the pattern of past recoveries suggest to us that the next leg of any upcycle may favor names with higher‑quality business models.

Having taken advantage of the sharp sell‑off in consumer discretionary, financials, and other cyclical sectors that were hard hit by the shutdown of wide swathes of the in‑person economy last year, we believe that the portfolio offers meaningful exposure to the reopening.

But selectivity is especially critical in the current environment. Now is not the time for value investors to forget the lessons of the past decade and a half, when a wave of technological innovation disrupted many traditional industries—a trend that, in some cases, the shifts in behaviors and priorities stemming from the coronavirus pandemic appear to have accelerated.

Understanding secular risk is still paramount for value investors. Not only can this knowledge help us to avoid seemingly inexpensive names that face long‑term headwinds from disruption, but it can also aid in identifying opportunities where the market may not fully appreciate the extent to which a company could benefit from the secular tailwinds associated with being on the right side of change.

These lessons, coupled with our valuation discipline and deep knowledge of individual companies and industries, inform our investment decisions as we seek quality cyclical stocks that we believe could be well positioned in the current environment and over the coming years.

Disruption and Divergent Fundamentals

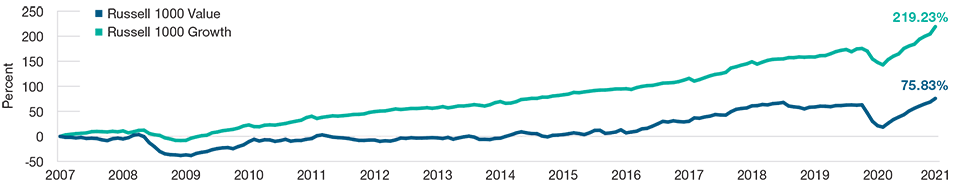

(Fig. 1) Cumulative growth in 12-month forward free cash flow per share

May 31, 2007, to April 30, 2021.

Source: T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved.

Disruption Creates Risks and Opportunities

The disruption of traditional industries by innovation has created its share of pain for value stocks over the past decade and a half, a point underscored by the sharp divergence in forward free cash flow growth between the value and growth stocks in the large‑cap Russell 1000 Index.

Over this period, widespread innovation has disrupted some industries by siphoning off profit pools or introducing deflationary pressures that weigh on profit margins. These persistent headwinds, in turn, tend to lead to shrinking valuation multiples for companies on the wrong side of innovation.

The sharp recovery rally in value stocks lifted all boats during its early phase—even those, like the energy sector, that we believe face significant challenges from disruption. In keeping with our quality bias, we have remained cautious on energy stocks and prefer to find cyclical exposure in other industries.

In our view, ongoing productivity gains from automation and improved reservoir management techniques in U.S. shale oil and gas fields, among other factors, should continue to make hydrocarbons easier and less expensive to extract, creating a challenging environment for operators to navigate. Over the long term, we are wary of the potential for growing concerns about terminal values for oil and gas assets to weigh on valuation multiples in the sector as the clean energy transition progresses.

However, powerful secular forces can also create opportunities for value‑oriented investors in mature industries where the market may not fully appreciate the extent to which these massive changes could act as a tailwind. Our emphasis on relative valuations—both relative to a company’s own history, comparable peers, and the broader market—tends to give us more flexibility to invest behind secular growth trends.

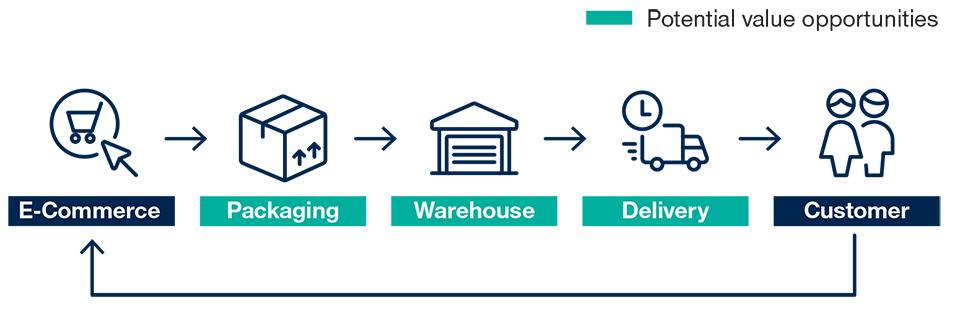

The E‑commerce Value Chain

Consider the rise of e‑commerce, a theme that is usually the province of growth investors because of elevated valuations that often price in a great deal of future earnings potential. We believe this trend has more room to run as consumers become more comfortable purchasing a growing array of products online, including groceries. Greater adoption of e‑commerce means increased demand for the real‑world logistics that enable this pillar of the convenience economy. Relative valuations in some of these supporting industries also appear favorable.

For example, over the next three to five years, we think that demand growth related to online shopping could provide a meaningful tailwind for companies that produce the containerboard used to package products for shipping. And, in contrast with the energy sector, we see the potential for containerboard input costs and the cost of adding incremental capacity to rise in the coming years, in part because the number of existing paper plants that could be converted inexpensively to producing cardboard has dwindled. This scenario of increasing demand and rising cost curves on the supply side should support higher containerboard prices—and, in our view, potentially higher profit margins for the industry’s leading players.

Opportunities From the Secondary Effects of Disruption

(Fig. 2) The e-commerce value chain

Source: T. Rowe Price.

We also like the dominant players in the U.S. air freight and logistics industry, as we believe that these companies offer exposure to rising e‑commerce shipment volumes but also have several levers that their management teams can pull to expand their gross margins in the coming years.

Semiconductors and Digitalization

We also like the companies producing the chips enabling the digitalization of the traditional economy. Although an awareness of the industry’s inherent cyclicality informs our tactical decision‑making in the near term, we regard the long‑term prospects for makers of analog chips and companies that produce the tools used to produce leading‑edge semiconductors as attractive.

In our view, analog semiconductor companies stand to benefit from the proliferation of their products in a wide range of industries as the universe of connected devices—the so‑called internet of things—expands. These chips translate inputs from the physical world into digital information, making them essential to innovations that automate real‑world processes and reduce downtime through predictive maintenance. The auto industry, for example, is an important source of demand growth as vehicles electrify and the push for autonomous driving continues.

Not only could growing demand for analog chips support growth in sales volumes for well‑positioned companies, but broadening end markets for these products should also help to moderate the cyclicality in their earnings. However, we are cognizant that, over the long term, this segment of the market could be at risk of disruption as China seeks to ramp up its capabilities in this area.

We believe that the semiconductor capital equipment companies that we favor stand to benefit from increasing demand and the rising cost of producing the faster, more‑efficient chips enabling widespread digitalization and the intensive workloads associated with artificial intelligence. Here, we also see the U.S. effort to expand the production of cutting‑edge chips in America as another possible tailwind.

In our view, the confluence of digitalization‑fueled demand growth and slowing industry productivity should create a favorable environment for the companies that provide the equipment needed to manufacture advanced chips. Moore’s Law, a rule of thumb that holds that the number of transistors on a chip doubles roughly every two years while the costs also decline by about half, has encountered resistance on both fronts because of technological limitations and the increasing complexity of the manufacturing process. We expect the rising cost of generating incremental chip performance to persist, a dynamic that should support equipment volumes and pricing—especially for the linchpin companies driving innovation.

Regardless of how the recovery cycle evolves, we remain committed to investing in quality businesses that we believe trade at attractive relative valuations and offer exposure to several potential upside catalysts over a multiyear time frame. Understanding how the forces of innovation and disruption can create potential risks and opportunities remains central to our investment process and decision‑making. To this end, we seek to avoid names that we believe face persistent secular challenges while favoring attractively valued companies that could benefit from being on the right side of change.

WHAT WE’RE WATCHING NEXT

As the recovery cycle progresses and the risk/reward profiles of our holdings and prospective investments evolve, we plan to lean on our valuation discipline and deep knowledge of individual companies and industries to find investment opportunities that look appealing on a relative basis. Accordingly, we are keeping a close eye on companies that we regard as durable growers whose stocks have lagged during the risk‑on rally. For example, we believe the market does not fully appreciate how well positioned some utilities could be to grow as they expand their low‑cost, renewable generation capacity and make the necessary grid investments to support the clean‑energy transition.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

June 2021 / MARKET OUTLOOK