January 2024 / EQUITY

U.S. small-cap stocks look like a potentially big opportunity

Six key factors point to an encouraging outlook for U.S. smaller companies.

Key Insights

- The ongoing resilience of the U.S. economy has increased the potential for a soft economic landing in 2024.

- U.S. smaller companies have borne the brunt of heightened risk aversion in recent years and are now trading at an historically wide relative valuation discount.

- Consumer spending trends, onshoring of U.S. industry, and potential pricing power are just some of the factors supporting a positive outlook for U.S. smaller companies.

Amid multi‑decade high inflation, 18 months of interest rate rises, and ever‑present fears of recession, the general resilience of the U.S. economy throughout this time has gone, if not unnoticed, then generally underappreciated by many investors. However, this resilience has been underscored recently with the economy posting strong third‑quarter growth far exceeding expectations.

At the same time, inflation has declined, easing pressure on policymakers to hike rates further. The encouraging data raise the potential for an economic soft landing in 2024, defying gloomier predictions that have prevailed for much of the past two years.

Historically wide valuation discount

For U.S. smaller companies—which have borne the brunt of heightened risk aversion in recent years—this marks a significant turning point. As risk appetite returns, and fundamentals once more prevail over sentiment, the extreme relative valuation discount of smaller companies looks increasingly attractive.

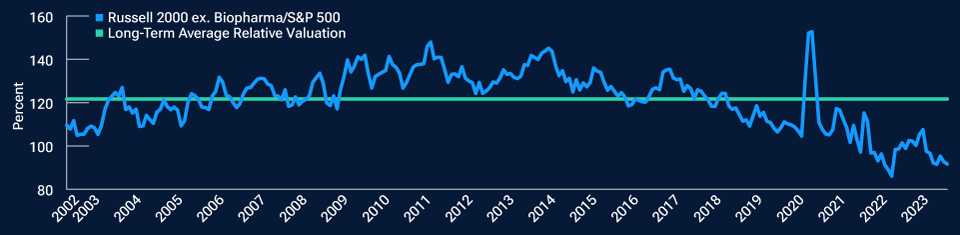

U.S. small‑cap relative valuations are at multi‑decade lows

(Fig. 1) Relative forward (next 12 months) price/earnings ratio

As of September 30, 2023.

Sources: Furey Research Partners, S&P Indices, and LSE Group; analysis by T. Rowe Price (see Additional Disclosures).

U.S. smaller company stocks have historically traded at a premium to large‑caps, reflecting their higher relative risk/return profile. In recent years, however, this valuation trend has reversed—small‑cap stocks are not only trading at a discount to their larger counterparts, but the differential has become extreme, widening to levels not seen in decades (Fig. 1).

Robust consumer spending

The U.S. economy expanded by an annualized 4.9% in the third quarter, the fastest pace in nearly two years. Meanwhile, inflation fell to 3.2% in October, marking a spectacular decline from the 40‑year high of 9.1% recorded in June 2022.

An upbeat outlook for U.S. smaller companies

Source: T. Rowe Price

One of the primary forces behind the economy’s resilience has been the continuing strength of consumer spending. A strong jobs market with a high level of employment means U.S. wages are rising, while excess savings are also at historically high levels. Importantly, U.S. consumers are also less immediately exposed to the steep rise in interest rates than many other countries. Most U.S. household mortgages—around 90%—are fixed rate, with a large percentage secured at long‑term interest rates well below the high rates available today. In short, individual balance sheets are in better shape than prior to the pandemic, giving consumers the confidence to keep spending.

However, we are also seeing a shift in underlying spending trends, away from goods and into services. This traces back to the COVID pandemic, during which the goods economy remained robust while the services economy effectively shut down. We are now seeing this imbalance swing the other way, with evidence of a concerted catch‑up in services spending. Importantly, with smaller company earnings much more geared to the services economy, this shift should help to fuel favorable relative earnings growth.

Similarly, U.S. companies, large and small alike, have also moved quickly to downsize or refinance their debt since the pandemic, resulting in generally healthier balance sheets, more cash, and less exposure to interest rate fluctuations.

Broad diversity in a highly concentrated market

A great deal has been written about the highly concentrated top end of the U.S. equity market. The S&P 500 Index has become increasingly focused in a very small group of mega‑cap companies. The so‑called Magnificent Seven—Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta—have become so highly priced that they now dwarf the value of many international equity markets.

Smaller companies offer a much more diversified exposure to the vitality of the U.S. economy and a different risk profile to large‑cap investing. The domestic bias of smaller companies, and more balanced exposure at the sector level, means they are often better positioned to benefit from changing trends in the U.S. economy.

Industry onshoring

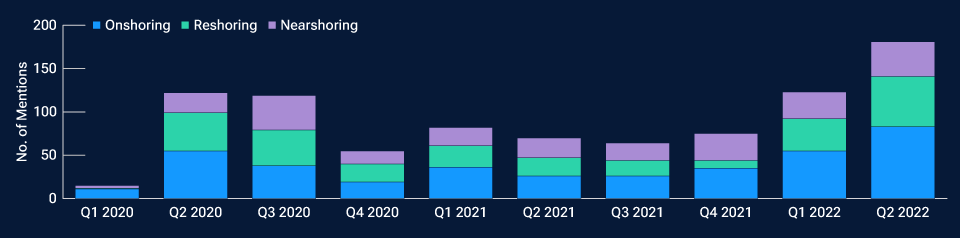

U.S. industry is coming home

(Fig. 2) Supply chain shifts are getting more attention from company management

As of June 30, 2022 (latest available).

Source: Bloomberg data; analysis by T. Rowe Price. U.S. executive mentions of the terms “Onshoring,” “Reshoring,” or “Nearshoring” during quarterly earnings calls and/or conference presentations.

The trend toward supply chain localization or “onshoring”/“reshoring” of U.S. industry is gathering pace. We have already seen a sharp rise in manufacturing and construction activity directly attributable to company onshoring/reshoring and this seismic shift is still only in the relatively early stages (Fig. 2). The full impact of new legislation, including the 2022 CHIPS and Science Act and the 2022 Inflation Reduction Act, offering big incentives for businesses to bring operations and personnel back to the U.S., is still yet to be felt. Each contains stipulations regarding the production and procurement of U.S.‑made products and components designed to benefit companies that manufacture domestically. Smaller companies, which tend to be more geared to the domestic economy, stand to benefit from this concerted shift away from globalization in favor of more locally driven supply chains.

Smaller company pricing power

One of the main risks to the positive outlook in 2024 is that inflation recommences its upward trajectory, necessitating further rate increases. We acknowledge that there is secular upward pressure on costs in the energy sector, for example. Rising inflation and higher interest rates would certainly cloud the outlook for smaller companies. However, even if this transpires, there are many smaller companies that display that all‑important attribute—pricing power.

Smaller companies are often assumed to be price takers, with limited ability to exert pricing power. In fact, many smaller businesses operate in underserved or niche industries, such as fintech, computer gaming, e‑commerce, and green energy, and so command more pricing power than their size might suggest. When these businesses begin to experience inflationary pressure, be it through supply chain bottlenecks, wage increases, or due to rising input costs, they are able to pass on these higher costs to customers, thereby helping to protect their profit margins.

Even if a smaller company cannot control the price of an end product, it is not necessarily powerless to influence its own revenues/profits. For example, many smaller companies can be critical components within more complicated processes or supply chains. As has been painfully clear in recent years, high demand and limited supply of any component along the supply chain gives pricing power to the component producer. Asset‑light companies offering business‑critical services/products, look particularly well placed to deliver recurring cash flows and potentially grow their revenues.

A premium for improving productivity

While a more positive economic outlook in 2024 is important for smaller companies at a broad level, improving productivity is likely to be a key driver of topline performance at a company level. With this in mind, there are many good opportunities to be found, often in less studied sectors, which are having a meaningful impact in terms of enabling improved productivity. Some of the most important aspects of our lives, in key areas like financial services, health care, and agriculture, for example, have not really been reimagined in the way that sectors like technology or communications have. We are seeing significant investment in these areas, and innovative smaller companies are frequently at the forefront of this advancement.

Looking ahead to 2024

The reliance of the U.S. economy, powered by U.S. consumers’ resilience has bolstered hopes for a soft‑landing scenario in 2024. If this transpires, and recession is avoided, there are many pieces in place to suggest smaller companies can perform well. Relative valuations, versus larger companies, have fallen to historically low levels, despite earnings remaining relatively resilient, and history tells us that small‑caps outperformed strongly in an improving economic environment. With powerful onshoring trends and a strong dollar also providing tailwinds, investors may wish to consider adding small‑cap exposure, focusing on those businesses driving productivity gains—and/or that command pricing power.

IMPORTANT INFORMATION

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

Canada—Issued in Canada by T. Rowe Price (Canada), Inc. T. Rowe Price (Canada), Inc.’s investment management services are only available to Accredited Investors as defined under National Instrument 45-106. T. Rowe Price (Canada), Inc. enters into written delegation agreements with affiliates to provide investment management services.

© 2024 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.