February 2024 / MARKETS & ECONOMY

Conditions Are Ripe For A Goldilocks Economy, But Dangers Lurk

Conditions are ripe for a moderate growth recovery, but political risks pose a threat.

Key Insights

- Slowing inflation, combined with the current high level of interest rates, should give the U.S. Federal Reserve plenty of scope to cut rates this year.

- Growth should recover modestly, resulting in a “Goldilocks” global economy that is neither recessionary nor too expansionary.

- Risks to this benign outlook include the U.S. presidential election, the war in Ukraine, and continuing tensions in the Middle East and South China Sea.

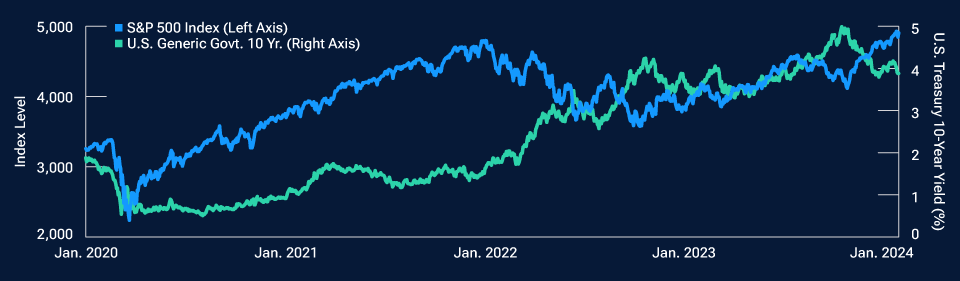

What a difference a quarter makes! At the end of October, the yield on the 10‑year U.S. Treasury bond touched 5%. By late January, it had plunged to 4.1%. Over the same period, the yield on the German counterpart fell from almost 3% to 2.3%. Risk assets, which were under pressure when yields were rising, surged in response to the rally in government bonds (Fig. 1).

Falling fourth‑quarter rates sparked an equity rally

(Fig. 1) The S&P 500 surged as Treasury yields declined

As of January 31, 2024.

Past performance is not a reliable indicator of future performance.

Source: Bloomberg Finance L.P. (see Additional Disclosure).

Digging deeper into the causes of the bond market rally should help us to understand the implications for the global economy and the world’s central banks and, by extension, the likely path for risk assets in the period ahead. The third‑quarter sell‑off in bonds was largely driven by anxiety that the combination of high government financing needs and the reduction in central banks’ sovereign bond portfolios (quantitative tightening) would trigger a buyers’ strike. There was also concern that stubborn service sector inflation would prevent central banks from cutting rates.

Two major developments changed the narrative: First, in response to the pressures in the bond market, the U.S. Treasury slowed the pace of increase in quarterly long‑term debt issuance and the Federal Reserve indicated it may have to adjust its policy stance in a more market‑friendly direction; second, and equally important, softer‑than‑expected inflation data reinforced the perception that the Fed had the required policy space to accommodate the bond market sell‑off.

Prior to these developments, the belief among many that the U.S. was heading for recession seemed to rest on the notion that the Fed had overtightened monetary policy and would be slow to respond to mounting growth risks. The pivot in the Fed’s communication, therefore, significantly cut the tail risk that the U.S. economy would fall into a recession. As is often the case, the reduction of tail risk ended up having an outsized impact on the price of growth and risk‑friendly assets such as equities.

Why I expect a downsize inflation surprise

So where do we go from here? Will central banks be able to deliver on the lofty expectations for interest rate cuts that the market has priced in? Broadly speaking, I believe they will.

In my view, inflation is likely to surprise on the downside. Growth in China—the preeminent source of demand for commodities—remains muted as the economy goes through a protracted deleveraging cycle and the authorities aim to reorient the economy toward new drivers of structural growth. Europe is already in a recession, and, given the European Central Bank’s resistance to rate cuts, it is only a matter of time before the recessionary dynamics spill out through the labor markets. The U.S. economy is resilient, but it is likely to slow throughout 2024.

These moderating growth dynamics, combined with the current high level of interest rates, suggest to me that the Fed can cut interest rates substantially without its policy stance becoming overly accommodative. As such, I don’t regard the interest rate market as grossly mispriced.

Regarding growth, I am looking for signs of improvement. Global growth remains subdued and a strong rebound is unlikely, but I am looking for the data flow to shift from bad to just weak (in financial markets, a reduction of a negative is often more powerful than the emergence of a positive). I also think we will see a risk‑friendly rotation in growth from the U.S. to Europe. Overall growth will continue to look soft and monetary policy will remain a headwind—but marginally less so.

Geopolitical risks cannot be ignored

Yet amid this Goldilocks view of the world, risks lie in the shadows. Despite the Fed’s pivot, the markets could return to the October worries about bond supply fears. The outcome of the U.S. presidential election could further elevate this fear if the market expects the next U.S. administration to return to an expansionary fiscal stance (although this risk will likely be somewhat offset by the slowing of the Fed’s balance sheet tapering).

The risk posed by the U.S. presidential election is not limited to concerns over fiscal policy. The U.S. remains as polarized as ever, and the election will bring elevated uncertainty about the future of both U.S. domestic and foreign policy. Geopolitical risk is also rising elsewhere, from the war in Ukraine to the conflict in Israel and tensions in the South China Sea.

As has been the case for the past two years, financial markets remain volatile and difficult to navigate. It is important not to lose sight of the dangers, but in the near term, I believe the likely combination of softer central bank policy, moderating inflation, and a marginal improvement in growth will keep us on a positive course.

IMPORTANT INFORMATION

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

Canada—Issued in Canada by T. Rowe Price (Canada), Inc. T. Rowe Price (Canada), Inc.’s investment management services are only available to Accredited Investors as defined under National Instrument 45-106. T. Rowe Price (Canada), Inc. enters into written delegation agreements with affiliates to provide investment management services.

© 2024 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.