June 2021 / INVESTMENT INSIGHTS

Global Asset Allocation Viewpoints

Our experts share perspective on market themes and regional trends, plus insights into current portfolio positioning.

Market Perspective

As of 31 May 2021

- Global economic growth to remain above trend this year but nearing peak levels as major economies make progress on vaccinations and reopen over the summer.

- Global monetary policy outlook broadly supportive with most major central banks expected to remain on hold well into next year, although beginning to see a gradual trend toward tightening by some central banks, notably within emerging markets (EM), facing rising inflation.

- Asian and European economies that have trailed in pace of vaccinations should see improved growth trajectory over coming quarters as they advance reopening and benefit from their more cyclically oriented economies.

- Key risks to global markets include the path forward for the coronavirus, rising inflation, higher taxes, central bank missteps, and increasing geopolitical concerns.

Portfolio Positioning

As of 31 May 2021

- No changes in positioning over the period.

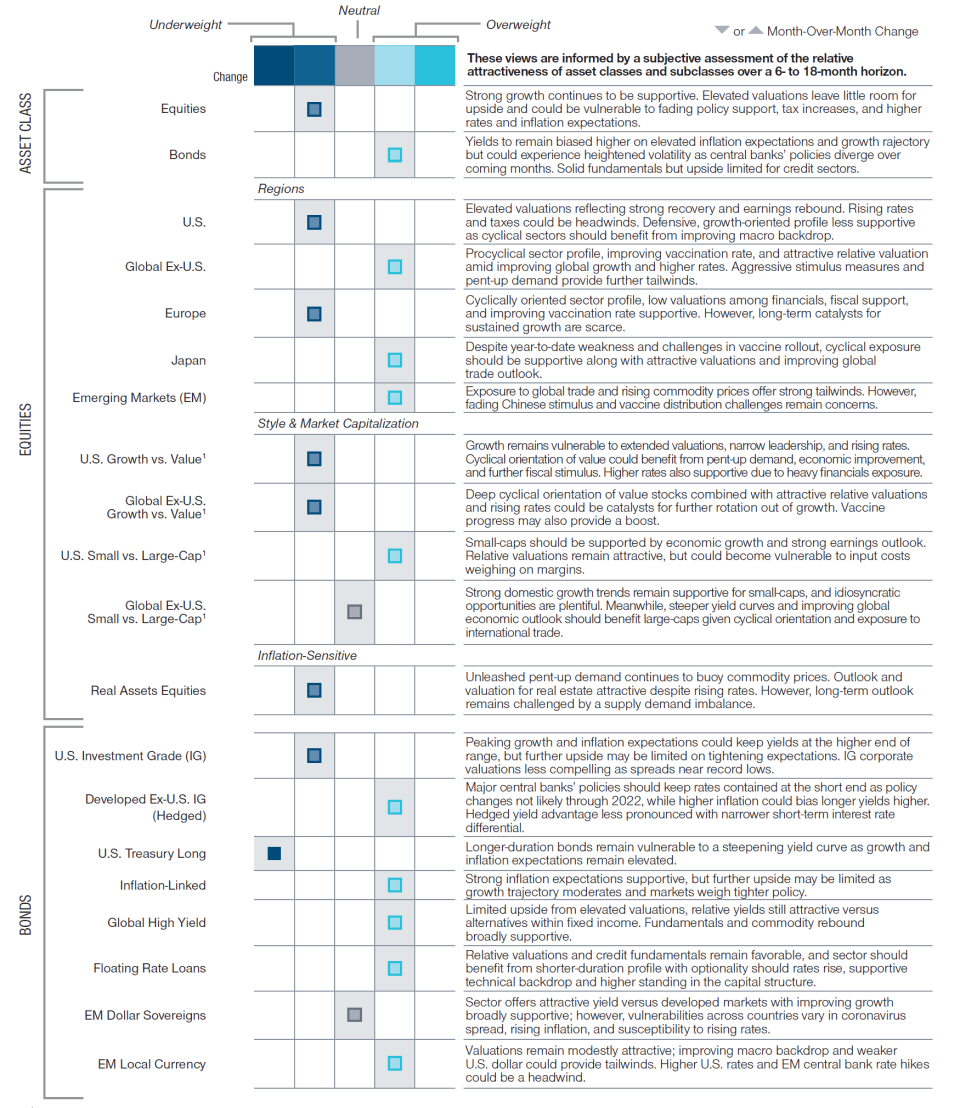

- We remain modestly underweight equities relative to bonds and cash as the risk/reward profile looks less compelling for equities and could be vulnerable to potential setbacks in the recovery, fading policy support, rising inflation, and higher taxes.

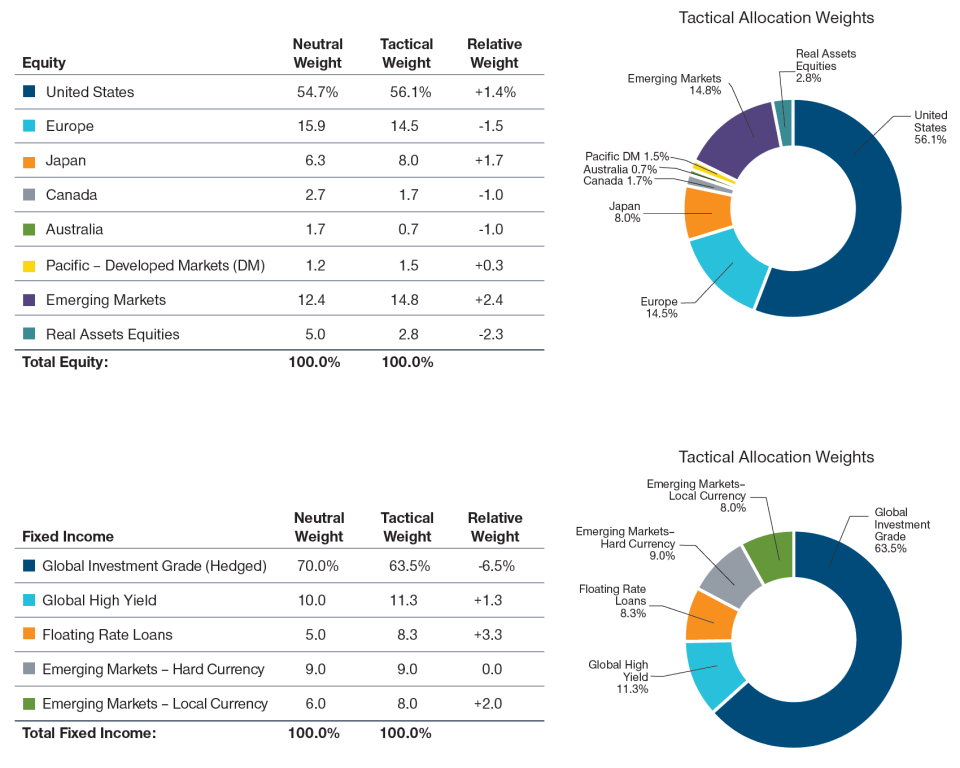

- Within equities, we favor value-oriented equities globally, U.S. small-caps, and EM stocks as we expect cyclically exposed companies to continue to benefit from the improvement in growth throughout the year.

- Within fixed income we continue to have a bias toward lowering duration risk and overweighting credit and inflation sensitive sectors such as high yield bonds, floating rate loans, and short-term TIPS.

Market Themes

As of 31 May 2021

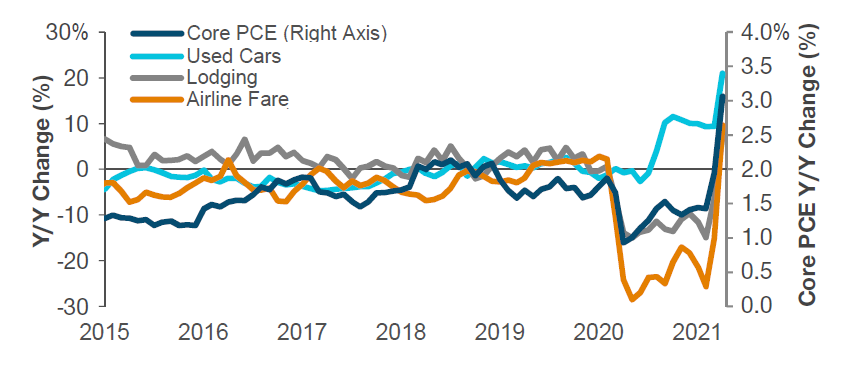

Just Passing Through?

The Federal Reserve has been consistent in its messaging that a near-term spike in inflation pressures will be transitory and recede once COVID-related impacts fade. The latest inflation print showed prices, as measured by core personal consumption expenditures (PCE), jumped 3.1% year-over-year, the highest level in three decades due to supply chain and labor shortages, unleashed pent up demand, and base effects. While the data showed consumers are facing steep price increases across a range of areas including used cars, hotel prices, and air fare, these are expected to fade as pent-up demand subsides. So far, the bond market seems to believe the Fed’s transitory view; however, the risk may be that the transition takes a bit longer than markets anticipate. Labor shortages and unconstrained fiscal spending in the U.S. could keep inflation elevated for longer, forcing the Fed and bond market to react faster than anticipated.

Inflation Spiking Across Various Segments1

As of 31 May 2021

Sources: Haver Analytics, Bureau of Labor Statistics, IMF.

1Used Cars, Lodging, and Airline Fare represented by Consumer Price Index (CPI). All rights reserved.

2Country classifications in the chart are in line with IMF groupings as of reporting date.

FOR INVESTMENT PROFESSIONALS ONLY. NOT FOR FURTHER DISTRIBUTION.

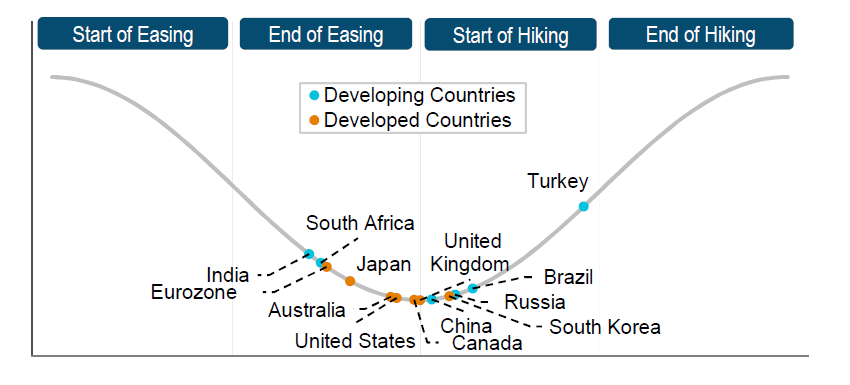

Easy Come, Easy Go

Global central banks were quick to act last year in response to the coronavirus pandemic, unleashing ultra-easy monetary policies, helping countries weather the economic impacts and aiding in the current growth rebound. Now on the back of more stable growth, some central banks have more recently announced plans to start pulling back on policy, including Canada and South Korea. Meanwhile, some EM central banks have already started raising rates this year, such as Russia, Turkey, and Brazil; however, the motivation has been more to fend off rising inflation compounded by COVID-related shortages. While the trend in global easing appears to be behind us, the major central banks are still pledging to maintain current support well beyond next year. Despite their intentions, markets have pulled forward expectations of when they’ll act on recent data showing higher inflation. The months ahead could see more volatility as investors reevaluate how fast “easy” may go.

Divergence in Monetary Policies Across the Globe2

As of 31 March 2021

Sources: Haver Analytics, Bureau of Labor Statistics, IMF.

1Used Cars, Lodging, and Airline Fare represented by Consumer Price Index (CPI). All rights reserved.

2Country classifications in the chart are in line with IMF groupings as of reporting date.

FOR INVESTMENT PROFESSIONALS ONLY. NOT FOR FURTHER DISTRIBUTION.

Regional Backdrop

As of 31 May 2021

United States

Positives

- Vaccinations widely distributed, case count near lows

- Monetary policy remains very accommodative

- More fiscal support on the way

- Healthy consumer balance sheets and high savings rate

Negatives

- Elevated stock and bond valuations

- High corporate and government debt levels

- Corporate taxes likely to rise

- Unemployment remains elevated

Europe

Positives

- Higher exposure to more cyclically oriented sectors that should benefit from economic recovery

- Pace of vaccinations has significantly improved

- Monetary and fiscal policy remain accommodative

- Equity valuations remain attractive relative to the U.S.

- Stronger long-term euro outlook

Negatives

- Spread of new variants leading to continued outbreaks

- Limited long-term catalysts for growth

- Limited scope for European Central Bank to stimulate further

- Brexit likely to negatively impact trade

Developed Asia/Pacific

Positives

- Cyclical orientation should benefit from economic rebound

- Strong fiscal and monetary support

- Improving corporate governance

Negatives

- Vaccination effort has been slower than other developed markets

- Weak economic growth going into crisis, driven by long-term demographic headwind

- Limited long-term catalysts for growth

Emerging Markets

Positives

- Exposure to cyclical areas of economy should benefit from broad global recovery

- Commodity prices rising

- Chinese economy remains strong

- Equity valuations attractive relative to developed markets

Negatives

- COVID-19 risk remains high in Central Asia and Latin America

- Vaccine supply and distribution infrastructure are well behind developed markets

- Stimulus from China is fading

- Limited ability to enact fiscal stimulus (excluding China)

Asset Allocation Committee Positioning

As of 31 May 2021

1For pairwise decisions in style & market capitalization, positioning within boxes represent positioning in the first mentioned asset class relative to the secondasset class.

FOR INVESTMENT PROFESSIONALS ONLY. NOT FOR FURTHER DISTRIBUTION.

Portfolio Implementation

As of 31 May 2021

Source: T. Rowe Price.

Neutral equity portfolio weights broadly representative of MSCI All Country World Index regional weights; includes allocation to real assets equities. Core globalfixed Income allocation broadly representative of Bloomberg Barclays Global Aggregate Index regional weights.

Information presented herein is hypothetical in nature and is shown for illustrative, informational purposes only. It is not intended to be investment advice or arecommendation to take any particular investment action. This material is not intended to forecast or predict future events and does not guarantee future results.

These are subject to change without further notice.Source for Bloomberg Barclays index data: Bloomberg Index Services Limited. See additional disclosures on final page for more information.

FOR INVESTMENT PROFESSIONALS ONLY. NOT FOR FURTHER DISTRIBUTION.

Additional Disclosures

Certain numbers in this report may not equal stated totals due to rounding.

Source: Unless otherwise stated, all market data are sourced from FactSet. Financial data and analytics provider FactSet. Copyright 2021 FactSet. All Rights Reserved.

Source: MSCI. MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Key risks –The following risks are materially relevant to the information highlighted in this material:

Even if the asset allocation is exposed to different asset classes in order to diversify the risks, a part of these assets is exposed to specific key risks.

Equity risk – in general, equities involve higher risks than bonds or money market instruments.

Credit risk – a bond or money market security could lose value if the issuer’s financial health deteriorates.

Currency risk – changes in currency exchange rates could reduce investment gains or increase investment losses.

Default risk – the issuers of certain bonds could become unable to make payments on their bonds.

Emerging markets risk – emerging markets are less established than developed markets and, therefore, involve higher risks.

Foreign investing risk – investing in foreign countries other than the country of domicile can be riskier due to the adverse effects of currency exchange rates; differences in market structure and liquidity, as well as specific country, regional, and economic developments.

Interest rate risk – when interest rates rise, bond values generally fall. This risk is generally greater the longer the maturity of a bond investment and the higher its credit quality.

Real estate investments risk – real estate and related investments can be hurt by any factor that makes an area or individual property less valuable.

Small- and mid-cap risk – stocks of small and mid-size companies can be more volatile than stocks of larger companies.

Style risk – different investment styles typically go in and out of favour depending on market conditions and investor sentiment.

IMPORTANT INFORMATION

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

Canada—Issued in Canada by T. Rowe Price (Canada), Inc. T. Rowe Price (Canada), Inc.’s investment management services are only available to Accredited Investors as defined under National Instrument 45-106. T. Rowe Price (Canada), Inc. enters into written delegation agreements with affiliates to provide investment management services.

© 2023 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.

1 June 2021 / U.S. FIXED INCOME

10 June 2021 / JAPAN EQUITIES