January 2024 / INVESTMENT INSIGHTS

Global Markets Monthly Update - January 2024

Key Insights

- Stock and bond returns in major developed markets were mixed as hopes dimmed for imminent rate cuts in the U.S., but European policymakers took a more dovish tone.

- Japanese equities surged as the central bank maintained its highly accommodative stance in the wake of evidence that consumer inflation was slowing.

- Chinese shares fell sharply as the nation’s property slump continued and retail sales rose less than expected.

U.S.

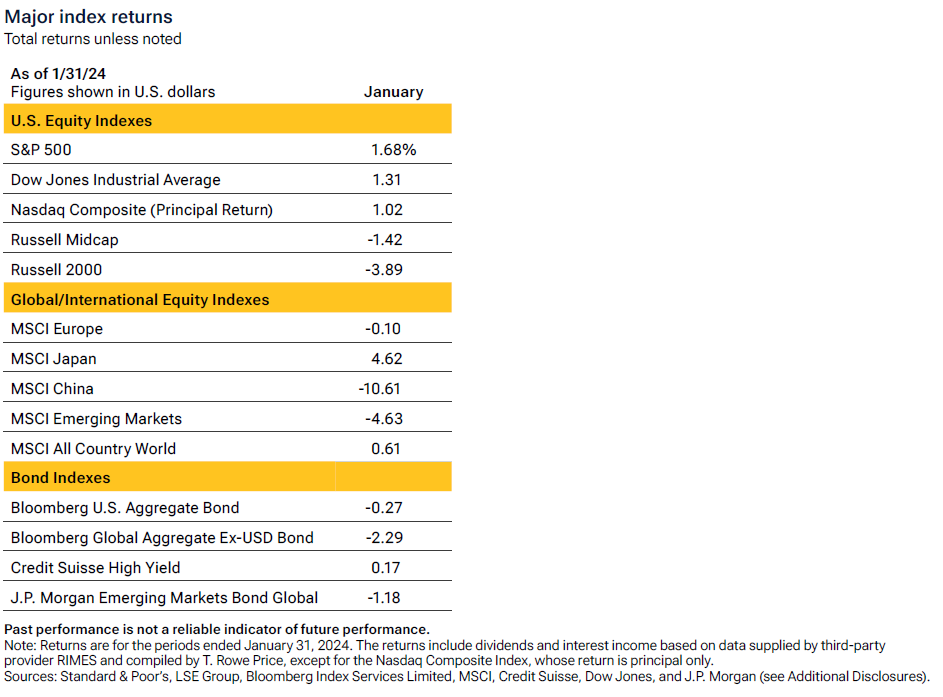

The benchmarks were widely mixed in January, with the Russell 1000 Growth Index gaining 2.49% in total return (including dividends) terms, while the small-cap Russell 2000 Index fell 4.54%. Similarly, six of the 11 sectors in the S&P 500 Index recorded losses, while communication services shares rose 5.02%. The S&P 500, Dow Jones Industrial Average, and Nasdaq 100 Index reached record highs, while small-cap stocks remained well off their previous peaks.

Overall, fixed income returns were slightly negative, as investors dialed back expectations for rate cuts in 2024, due in part to some strong economic signals. The same growth hopes helped credit-sensitive corporate bonds and other issues outperform Treasuries as credit spreads narrowed.

Stocks gain momentum as investors see recession as unlikely

Stocks got off to a slow start in the new year as investors appeared to harvest healthy recent gains in tech-oriented shares and rotate into sectors that lagged in 2023, including utilities, energy, consumer staples, and health care. Some healthy economic signals also supported the cyclically sensitive sectors. In particular, retail sales jumped 0.6% in December, with online sales growing 1.5% and hitting a record high.

Relatedly, the University of Michigan issued a preliminary report that its index of consumer sentiment jumped in January to its highest level in nearly three years and by the most since 2005; over the past two months, the index rose the most since 1991. Head researcher Joanne Hsu told Bloomberg that the increase was evidence that consumers finally believed that “inflation has truly turned the corner.”

The manufacturing sector remained the weak leg in the expansion. An index of manufacturing activity in the New York region reached its lowest level since early in the pandemic, and two separate gauges of nationwide factory activity indicated continuing contraction. However, orders for non-defense capital goods excluding aircraft, widely considered a proxy for business investment, surprisingly rose 0.3% in December.

Investors hope upstream deflation will flow into consumer prices

The disparate health of the services and manufacturing sectors was seemingly reflected in a different inflation environment. Consumer prices rose 0.3% in December, a tick above expectations, while producer prices fell another 0.1%. The core personal consumption expenditures (PCE) price index, the Fed’s preferred inflation gauge, rose 2.9% for the year ended in December, still above the Fed’s 2% target but below expectations and the lowest since February 2021.

Investors seemed unsure of how policymakers would weigh progress in lowering inflation against signs of continued tightness in the labor market and positive surprises in many other economic signals. Expectations for rate cuts in 2024 fell sharply over the month, particularly after comments at mid-month by Fed Governor Christopher Waller, who told a virtual conference that “I see no reason to move as quickly or cut as rapidly as in the past” given the healthy state of the economy.

Sentiment seemed to take another blow following the Fed’s policy meeting at the end of the month. Policymakers left rates unchanged, as expected, but stocks pulled back sharply on January 31, after Chair Jerome Powell stated at his post-meeting press conference that he didn’t think it’s likely the Fed will cut in March.

Europe

In local currency terms, the STOXX Europe 600 Index ended higher for the third consecutive month, lifted by expectations that central banks might soon start to lower interest rates. However, the pan-European index lost ground in U.S. dollar terms. The UK’s FTSE 100 Index fell in local currency and U.S. dollar terms, dragged lower by weakness in shares of energy and mining companies.

ECB holds rates steady, but tone appears more dovish

The European Central Bank (ECB) left its key deposit rate at a record high of 4%, as expected. A more dovish outlook on the economy—the meeting statement noted, “risks to economic growth remained tilted to the downside”—and a softer tone to comments from ECB President Christine Lagarde raised hopes of a shift to easier policy. Lagarde asserted that the “disinflationary process is working” and that wage growth was declining, but she suggested that policymakers had to be more confident that inflation was subsiding before reducing rates. She reemphasized that policy would continue to depend on incoming economic and financial data and stood by comments made earlier at the World Economic Forum, when she hinted that a rate cut was more “likely” in the summer.

Euro-area and UK economies more resilient than thought

Economic data indicated that growth in the eurozone and the UK was more resilient than expected.

Euro-area gross domestic product (GDP) increased by 0.1% sequentially in the fourth quarter, as expansions in Italy and Spain offset a contraction in Germany. Nevertheless, GDP increased by 0.5% in 2023, a sharp slowdown from the 3.4% registered in 2022.

The UK economy grew a stronger-than-forecast 0.3% in November, reversing a decline of the same magnitude in October, thanks to strong gains in services and industrial businesses. Nevertheless, the economy still struggled over three months through November, contracting by 0.2% on widespread weakness across manufacturing industries.

Japan

Equities in Japan had a strong start to 2024, continuing the solid performance seen last year. The MSCI Japan Index gained 8.5% in January in local currency terms, outpacing most developed and emerging markets peers. The monetary policy backdrop remained highly accommodative—and investors were forced to reassess the likelihood that the Bank of Japan (BoJ) would end its negative interest rate policy in the near term as a deadly earthquake struck Japan’s Noto Peninsula at the beginning of the month.

Yen weakness prompts fresh verbal intervention

As the chances of an imminent interest rate hike in Japan appeared to recede, the yen weakened to around JPY 146.9 against the U.S. dollar from about 141.0 at the end of December. The yen’s rapid decline prompted fresh verbal intervention by Finance Minister Shunichi Suzuki, who said that the government was watching currency moves carefully and that currencies should move stably reflecting fundamentals.

In the fixed income markets, as U.S. Federal Reserve officials adopted a more hawkish tone, the yield on the 10-year Japanese government bond (JGB) rose to 0.73% from 0.61% at the prior month-end, tracking U.S. Treasury yields higher.

Economic data support monetary policy continuity

On the economic data front, Japan’s core consumer price index (CPI) rose 2.3% year over year (y/y) in December, down from November’s 2.5%y/y return. The in-line CPI print was the lowest since June 2022; however, a slowdown in consumer inflation has been anticipated by the BoJ. Nominal wages rose just 0.2% y/y in November, decelerating sharply from 1.5% y/y in October.

BoJ stands pat but says likelihood of hitting inflation target is rising

At its January 22–23 meeting, the BoJ maintained its key short-term interest rate target at -0.1% and said it would continue with its yield curve control policy, which sets an upper bound of 1.0% for 10-year JGB yields as a reference in its market operations. Citing the effects of the recent decline in crude oil prices, the central bank revised its outlook down for consumer inflation, forecasting that the CPI will rise 2.4% y/y in fiscal 2024, down from the 2.8% y/y forecast in October 2023. Nevertheless, its medium- to long-term inflation expectations have risen moderately, with consumer inflation likely to increase gradually toward the 2% price stability target.

According to BoJ Governor Kazuo Ueda, the likelihood of hitting the inflation target is rising, a necessary precondition for tweaking monetary policy. The central bank is watching for further evidence of a positive wage-inflation cycle and will then examine the feasibility of continuing its massive stimulus program.

Prime Minister Fumio Kishida said that the government would mobilize all its policies to ensure that growth in disposable income exceeds price rises. The chief of Japan’s biggest trade union federation, Tomoko Yoshino, said that it is very important to achieve wage increases for the second year in a row at this year’s spring shunto pay negotiations, and at a level even higher than in the round of talks held in 2023.

China

Chinese equities slumped as Beijing’s attempts to support the economy failed to assuage concerns about weakening growth. The MSCI China Index fell 10.61% , while the China A Onshore Index gave up 10.14%, both in U.S. dollar terms.

China’s GDP expanded 5.2% in the fourth quarter over a year earlier and for the full year of 2023, meeting Beijing’s official annual growth target. On a quarterly basis, the economy grew 1.0%, up from the third quarter’s 0.8% expansion. However, persistent deflationary pressures weighed on sentiment. The consumer price index declined 0.3% in December from the prior-year period, the third consecutive monthly decline. The producer price index fell 2.7% from a year ago and marked the 15th monthly drop.

Other data highlighted the uneven nature of China’s recovery. Retail sales rose a lower-than-expected 7.4% in December from a year earlier, down from November’s 10.1% increase. Fixed-asset investment grew an above-forecast 3.0% for the full year amid higher infrastructure growth, but a decline in real estate investment deepened. December industrial production rose more than expected from a year ago, while urban unemployment edged up to 5.1% from November’s 5.0%. The youth jobless rate was 14.9% in December compared with a record high 21.3% in June, after which the government suspended the report, saying that it needed to do more research on its data collection methodology.

The People’s Bank of China (PBOC) said it would cut its reserve ratio requirement (RRR) by 50 basis points for most banks on February 5. The pending cut announced by PBOC Governor Pan Gongsheng on January 24 marks the central bank’s first RRR cut this year after it cut the ratio by 25 basis points twice in 2023. The central bank also announced that it would lower refinancing and rediscount loan rates by 25 basis points from January 25 in order to support agriculture and small businesses.

More evidence of China’s property slump underscored concerns about a key growth sector. China’s new home prices fell 0.4% in December, down from November’s 0.3% decline, marking the sixth consecutive monthly drop and the fastest fall since February 2015, according to the statistics bureau.

Other Key Markets

Türkiye (Turkey)

Turkish stocks, as measured by MSCI, returned 10.31% in January versus -4.63% for the MSCI Emerging Markets Index.

On January 25, the central bank held its regularly scheduled meeting and raised its key policy rate, the one-week repo auction rate, from 42.5% to 45.0%. This rate increase, which was widely expected, may be the last one in a short and aggressive tightening cycle that started in June 2023, when the repo rate was 8.5%.

In the central bank’s post-meeting statement, policymakers noted—as they have in the last few policy meetings—that the “existing level of domestic demand, stickiness in services inflation, and geopolitical risks” are continuing to support inflation pressures. However, they also noted that “domestic demand continues to moderate…as monetary tightening is reflected in financial conditions” and that factors such as improvement in “external financing conditions, strengthening in foreign exchange reserves, rebalancing in current account balance, and demand for Turkish lira denominated assets” are contributing to exchange rate stability and the effectiveness of monetary policy.

Policymakers concluded that “the monetary tightness required to establish the disinflation course is achieved and that this level will be maintained as long as needed…until there is a significant decline in the underlying trend of monthly inflation and until inflation expectations converge to the projected forecast range.” While central bank officials believe they are finished raising rates, they did leave open the possibility that they may need to resume raising rates “if notable and persistent risks to inflation…emerge.” They remain committed to bringing inflation down to 5% in the medium term.

Mexico

Stocks in Mexico, as measured by MSCI, returned -1.85% in January but outperformed the MSCI Emerging Markets Index.

On January 4, the Mexican central bank published the minutes to its mid-December monetary policy meeting, at which policymakers unanimously decided to keep the overnight interbank interest rate at 11.25%. According to the minutes, Governing Board members characterized Mexican economic activity as continuing to show “dynamism,” while observing that the labor market remained strong. Most policymakers acknowledged that inflation has “decreased significantly throughout the year,” though they noted that headline inflation increased slightly in November from October’s level.

Most central bank officials also noted that core inflation—which excludes more volatile food and energy costs—was 5.3% in November and acknowledged that it has declined from earlier levels, while non-core inflation was much lower, at 1.4%. Nevertheless, most policymakers believed that the inflation outlook “continues posing challenges,” with the balance of risks “biased to the upside,” due mainly to persistently high core readings. Ultimately, the Governing Board decided to keep the benchmark rate at 11.25%.

However, core inflation readings released in January showed an easing of inflationary pressures. Twelve-month core inflation in 2023 was measured at 5.1%, while y/y core inflation through mid-January was 4.8%. Overall, T. Rowe Price emerging markets sovereign analyst Aaron Gifford believes that policymakers will be pleased with the core readings, but he expects them to be unlikely to consider imminent interest rate cuts until there are clearer signs of longer-lasting disinflation.

Additional Disclosure

The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. “Russell®” is a trade mark(s) of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The LSE Group is not responsible for the formatting or configuration of this material or for any inaccuracy in T. Rowe Price Associates’ presentation thereof.

MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

“Bloomberg®” and Bloomberg U.S. Aggregate Bond, Bloomberg Global Aggregate Ex‑USD are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price. Bloomberg is not affiliated with T. Rowe Price, and Bloomberg does not approve, endorse, review, or recommend its products. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to its products.

© 2024 CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2024, J.P. Morgan Chase & Co. All rights reserved.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

January 2024 / MARKETS & ECONOMY

February 2024 / INVESTMENT INSIGHTS