October 2023 / GLOBAL MARKETS

Global markets monthly update - October 2023

Key Insights

- Israeli shares fell sharply and major global markets turned volatile after the Hamas attacks on October 7.

- Oil prices rose in the wake of the attacks but ended lower for the month, suggesting a degree of confidence that the conflict wouldn’t widen to the Persian Gulf and elsewhere.

- Japanese government bond yields reached their highest levels in a decade, as fears that interest rates would remain “higher for longer” seemed to weigh on most major markets.

U.S.

The S&P 500 Index suffered its third straight monthly decline in October, marking the longest such stretch since March 2020. The smaller-cap indexes fared worst, with the month’s declines pushing both the Russell Midcap Index and the small-cap Russell 2000 Index into negative territory for the year‑to‑date period. Growth shares generally held up better in the large-cap space, helped by relative strength in certain technology‑oriented shares. A decline in energy stocks weighed on value stocks, as did pullbacks in the stocks of airlines and cruise operators following Hamas’ attack on Israel on October 7.

U.S. Treasury yields reach new 16-year highs

A rise in longer-term U.S. Treasury yields weighed on fixed income returns, with the yield on the benchmark 10-year note breaching the 5.00% intraday level for the first time since 2007 on October 23 before falling back to end the month at 4.88%. Worries appeared to grow that long-term yields were increasing as demand failed to keep up with high levels of issuance, but Treasuries also seemed to benefit from a “flight to safety” following the rising tensions in the Middle East. Corporate bonds and other credit-sensitive issues lost more ground than Treasuries.

Fears that a resilient economy would cause the Federal Reserve to keep interest rates “higher for longer” appeared to be the main factor weighing on sentiment during the month. After managing modest gains in the first half of the month, the major equity indexes began to pull back on October 17, following news that retail sales increased 0.7% in September, roughly double consensus expectations. The increase was particularly strong among online retailers and at restaurants and bars, indicating continued strength in discretionary spending.

Worries grow that rates will remain "higher for longer"

Positive economic signals later in the month seemed to further pressure stocks. On October 26, the Department of Commerce released its advance estimate of third‑quarter gross domestic product (GDP) showing that strong consumer spending helped increase GDP at an annualized rate of 4.9%—the best quarterly pace in nearly two years. Home sales reached a 19-month high, although homebuilder sentiment declined to the lowest level in nine months, as the 30-year mortgage rate approached 8%. Meanwhile, September job gains easily surpassed expectations, and weekly jobless claims remained near five-decade lows.

Some signals suggested that the rebound in growth was resulting in a modest increase in inflation pressures, though opinion seemed split on how the Fed would react to the data. The core (less food and energy) personal consumption expenditures price index, the Fed’s preferred inflation gauge, increased 0.3% in September, up from 0.1% in August, although the year-over-year measure ticked down to 3.7%. Core producer prices rose 2.7% year-over-year for September, which was more than expected, but core consumer prices rose 4.1%, in line with expectations and the slowest pace in two years.

Oil prices fall despite Middle East tensions

The attack on Israel and the country’s subsequent reprisal in the Gaza Strip also seemed to have a mixed impact on sentiment. Stocks fell sharply on October 19, following news that a U.S. Navy destroyer had shot down a cruise missile apparently headed from Yemen toward Israel. Reports of a drone attack on a U.S. base in Iraq also seemed to weigh on sentiment, according to T. Rowe Price traders, and defense stocks were generally strong. Oil prices fell back sharply over the month, however, suggesting a degree of confidence that the conflict would not spread to other parts of the Middle East.

Finally, third-quarter earnings reports seemed to further communicate a mixed message. As of the end of the month, analysts polled by FactSet were expecting overall earnings for the S&P 500 to increase by 2.7%, marking the first increase since the third quarter of 2022. The percentage of companies issuing negative guidance for the fourth quarter was above the five-year average, however.

Europe

In local currency terms, the pan-European STOXX Europe 600 Index fell for a third consecutive month and, at one point, came close to the year-to-date low hit in January. Volatile bond markets, rising geopolitical tensions—including renewed conflict in the Middle East—uncertainty about interest rates, the weakening economy, and downbeat company earnings weighed on sentiment. Many of the major benchmarks also declined significantly, with the UK’s FTSE 100 Index, Germany's DAX, and France's CAC 40 Index each giving up more than 3%.

The yield on the German 10-year government bond advanced to the 3% level but ultimately finished around 2.8%, below where it started the month. Meanwhile, the spread between 10-year Italian and German government bonds at times broke above 200 basis points. (A basis point is 0.01 percentage point.) These moves reflected concerns about Italy’s debt load after the government’s updated fiscal plan pegged its outstanding borrowings at 4.3% of GDP next year compared with the previous target of 3.7%.

ECB leaves rates unchanges; policymakers hint rates to stay on hold for some time

After increasing interest rates 10 consecutive times, the European Central Bank (ECB) left its key deposit rate unchanges at 4.0% and reiterated that maintaining this level for a long enough period should help to bring inflation down to its medium-term target of 2%. The Governing Council said previous tightening of monetary policy was already spreading "forcefully into financing conditions" and was "increasingly dampening demand."

Eurozone inflation drops to lowest level in more than two years; economy shrinks

The ECB's monetary policy decision, along with slowing inflation and weaker economic growth, appeared to reinforce expectations that rates would remain at current levels into next year.

Inflation in the eurozone continued to decelerate, with consumer prices in October increasing 2.9% year over year compared with the 4.3% registered in September. This data point was below expectations and marked the slowest pace of inflation since July 2021.

Meanwhile, preliminary figures indicated that eurozone GDP in the third quarter contracted 0.1% sequentially after expanding 0.1% in the previous three months. The weakness likely continued into the fourth quarter, with a Purchasing Managers’ Index (PMI) survey compiled by S&P Global showing that private sector output remained in contractionary territory for a fifth consecutive month in October.

UK economy shows signs of resilience, but inflation remains elevated

Official estimates indicated that GDP expanded 0.2% sequentially in August, after contracting 0.6% in July. However, a PMI survey for the UK showed that business activity in the private sector contracted for a third month running in October, although the slowdown in manufacturing eased somewhat.

Inflation unexpectedly held steady at an annual rate of 6.7% in September due to rising gasoline prices. Bank of England Chief Economist Huw Pill said that policymakers “still have some work to do” to bring inflation down to the 2% target.

Japan

Japanese equities lost ground in October, with the MSCI Japan Index down 3.1% in local currency terms despite continued weakness in the yen. Rising bond yields and geopolitical tensions weighed on market sentiment. This was against a backdrop of accelerating inflationary pressure in Japan, while wage growth was also in focus amid signs of a move higher in pay demands for next year.

The yen weakened past the closely watched 150 level to the U.S. dollar, spurring fears of a possible intervention by authorities. Finance Minister Shunichi Suzuki warned speculators that officials would continue to respond to the currency market “with a strong sense of urgency,” but he declined to comment on whether there had been any recent intervention to support the yen.

BoJ tweaks monetary policy to allow yields to rise more freely

The Bank of Japan (BoJ) remained committed to its ultra-loose monetary policy stance at its October meeting, leaving its short-term lending rate unchanged at -0.1%. However, the central bank adjusted its yield curve control framework for the second time in three months to allow yields to rise more freely. The yield on the 10-year Japanese government bond (JGB) rose to 0.94%—its highest level in over a decade—from 0.76% at the end of September, as the BoJ said that it would now regard its 1.0% ceiling for JGB yields as a reference rather than strictly capping interest rates at that upper bound. In the Outlook for Economic Activity and Prices, policymakers raised their consumer price inflation forecasts substantially for fiscal years 2023 and 2024, both to 2.8% which is above the BoJ’s 2% target.

Inflation accelerates; PMI shows business activity contracted

Tokyo’s core inflation rate, a leading indicator of nationwide price trends, accelerated to 2.7% in October, which was above consensus and the first strengthening in four months. The consumer price index for Japan rose to 3.3% from 2.8% in September. Separately, the au Jibun Bank of Japan Composite PMI fell to 49.9 in October from 52.1 in September due to ongoing weakness in the manufacturing sector. Activity in the services sector expanded for a 14th straight month but at a slower pace. A PMI reading below 50 is consistent with a contraction in output.

Focus remains on wage growth

Investors remained focused on wage growth, where a move higher in pay demands for next year could indicate changing wage-setting behavior and rising confidence that the BoJ is getting closer to its target. The Japanese Trade Union Confederation, an umbrella organization known as Rengo, plans to demand a wage hike of at least 5% in the 2024 "shunto" labor-management talks between unions and companies. The BoJ sees sustained wage growth as key to meeting its inflation target.

China

Chinese equities fell as evidence of the country’s persistent property sector slump offset indicators suggesting the economy may have bottomed. The MSCI China Index declined 4.26%, while the China A Onshore Index gave up 3%, both in U.S. dollar terms.

Country Garden, formerly China’s largest property developer, defaulted on its offshore debt payments for the first time after it was unable to meet interest payments at the end of a 30-day grace period. The company is the latest high‑profile casualty of China’s housing market downturn after China Evergrande defaulted on its offshore bonds in 2021, an event that sparked the current crisis. Official home price data raised concerns about the effectiveness of recent stimulus measures to shore up the property sector, a key driver of the economy. New home prices in 70 of China’s largest cities fell 0.3% in September from August, extending declines for the third consecutive month.

Concerns about property’s impact on longer-term growth outweighed a surprisingly strong GDP release, which revealed that China’s economy expanded to an above-forecast 4.9% in the third quarter over a year earlier, slowing from the 6.3% rise recorded in the second quarter. On a quarterly basis, the economy grew 1.3%, up from the second quarter’s 0.5% expansion.

Other readings added to signs that China’s economy was stabilizing after months of losing momentum since April following a brief post-pandemic rebound. The official manufacturing PMI rose to an above-consensus 50.2 in September from 49.7 in August. The nonmanufacturing PMI expanded to a better-than-expected 51.7 from 51.0 in August. Separately, the private Caixin/S&P Global survey of manufacturing and services activity both eased from the previous month but remained in expansion territory.

An improvement in industrial profits also suggested a pickup in demand after Beijing stepped up pro-growth measures. Profits at industrial firms increased by 11.9% in September from the prior-year period, marking the second consecutive monthly increase, but slowed from the 17.2% rise in August. For the first nine months of 2023, profits fell by 9% from a year ago, following an 11.7% contraction recorded in the first eight months of the year.

Other Key Markets

Israeli stocks plummet as war breaks out

Stocks in Israel, as measured by MSCI, returned -12.61% versus -4.04% for the MSCI Europe, Australia, and the Far East (EAFE) Index and -3.87% for the MSCI Emerging Markets Index.

Various Israeli assets, especially the shekel currency, were pressured in the aftermath of the October 7 Hamas attacks and Israel’s subsequent declaration of a state of war and an emergency situation across the country. As the month ended, the Israeli military initiated a ground invasion in the northern part of the Gaza Strip.

According to T. Rowe Price Sovereign Analyst Peter Botoucharov, the perception of an existential threat to Israel has taken priority over the domestic political disagreements—such as over farreaching judicial reforms and other controversial legislation—that have divided the electorate the most since Prime Minister Yitzhak Rabin was assassinated in November 1995. Israel’s leaders have agreed to form a narrow emergency government that includes the current government coalition (Likud and right‑of‑center parties) and the opposition National Unity Party. Importantly, Botoucharov notes that the government has agreed that no resolutions will be advanced through the Knesset legislature during the war that are not related to managing the war. This underscores the importance of social and financial stability that needs to be ensured by major Israeli institutions, including the Banke of Israel and the Ministry of Finance.

With regard to Israel’s fiscal situation, the outlook is likely to worsen in view of the probable increase in military spending. Botoucharov anticipates that the 2023 budget deficit is likely to widen to at least 2.0% of GDP. He also projects that there will be a budget deficit in 2024. In contrast, there was a small budget surplus in 2022.

Regarding inflation, there has been—as expected—a material decrease in the inflation rate in the last few months. However, Botoucharov believes that inflation, as measured by the consumer price index, is likely to stay above the central bank’s 1% to 3% target range for the rest of the year, due in part to the increased pass-through of inflation stemming from a weaker currency. As a result, he expects monetary policy to remain tight, with the key interest rate likely to remain steady in the months ahead. Indeed, toward the end of October, the central bank kept its key interest rate at 4.75% for the third consecutive policy meeting.

Strong gains for Polish equities

Polish stocks, as measured by MSCI, returned 16.35% and easily outperformed the MSCI Emerging Markets Index.

On October 15, Poland held parliamentary elections. While the ruling Law and Justice Party won more seats than any other party, it did not secure a majority to stay in power. On the other hand, several allied opposition parties won more than enough seats combined to secure a majority in the legislature. As the month ended, three of those parties were preparing to form a government. However, according to T. Rowe Price sovereign analyst Ivan Morozov, President Andrzej Duda, who hails from the ruling party, is likely to prolong the government formation process as long as possible.

One of the key campaign promises of the opposition was to reestablish more constructive dialogue with Poland’s partners in the European Union (EU), which is withholding approximately EUR 100 billion in funds and grants along with potentially up to EUR 34 billion in loans from the EU’s Recovery and Resilience Facility due to the EU’s disapproval of Polish judicial reforms. However, in order to unfreeze EU funds, a government of opposition parties will need to negotiate with President Duda, whose support would be needed for legislation to pass, as the opposition would not have enough votes to override a veto. Morozov believes that Duda’s level of cooperation and decisions are likely to reflect what Duda believes is best for his future career and best for the Law and Justice Party.

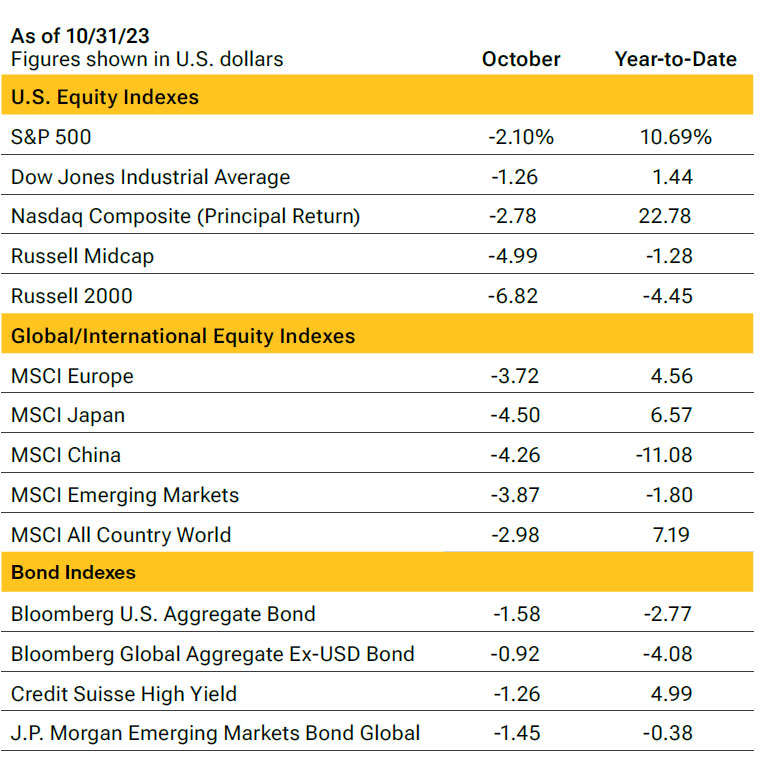

Major index returns

Total returns unless noted

Past performance is not a reliable indicator of future performance.

Note: Returns are for the periods ended October 31, 2023. The returns include dividends and interst income based on data supplied by third-party provider RIMES and compiled by T. Rowe Price, except for the Nasdaq Composite Index, whose return is principal only.

Sources: Standard & Poor's, LSE Group, Bloomberg Index Services Limited, MSCI, Credit Suisse, Dow Jones, and J.P. Morgan (see Additional Disclosure).

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.