December 2023 / INVESTMENT INSIGHTS

Global Markets Monthly Update - November 2023

Key Insights

- Cooling inflation and falling interest rates helped most major markets to strong gains in November.

- Economic growth slowed or stalled in most regions, but investors appeared hopeful that the U.S., at least, would skirt a recession in the coming months.

- Chinese regulators announced new stimulus measures to help manage continuing stresses in the country’s troubled property sector.

U.S.

The S&P 500 Index recorded its best monthly gain since July 2022, as investors welcomed signs of cooling inflation and falling bond yields. Growth stocks, which are typically more sensitive to interest rates given the discount implied for future earnings, outpaced value shares, and the Nasdaq Composite also outperformed.

Defying the pattern over much of the year, the gains were broad-based, with small- and mid-cap shares also notching strong returns. Returns were more dispersed on a sector basis within the S&P 500, as energy stocks recorded a small decline, while health care and consumer staples stocks lagged by a considerable margin.

Fixed income returns were also exceptionally strong as the yield on the benchmark 10-year U.S. Treasury note tumbled 51 basis points (0.51 percentage point). (Bond prices and yields move in opposite directions.) Credit spreads—a measure of the additional yield demanded on riskier securities—narrowed as investors also became more comfortable taking credit risk.

Markets rise on encouraging inflation signals

Several data releases indicated that inflation pressures continued to abate, if not yet sufficiently to return inflation to the Federal Reserve’s long-term 2% target. Headline consumer inflation was flat in October, and core (less food and energy) prices rose 0.2%, bringing the year-over-year increase to 4.0%, the slowest pace in two years. On the final day of the month, the Commerce Department reported that the Fed’s preferred inflation gauge, the core personal consumption expenditures (PCE) price index, rose 3.5% over the past 12 months. Over the past six months, core PCE ran even slower, at an annualized rate of 2.5%.

The month arguably offered some evidence that the economy may be headed toward policymakers’ goal of achieving a “soft landing” without sparking a recession—put differently, a “Goldilocks” scenario of an economy running neither too hot nor too cold. Employers added 150,000 nonfarm jobs in October, but the unemployment rate ticked up to 3.9%, its highest rate since January 2022. Similarly, weekly jobless claims remained contained, but continuing claims hit their highest level in two years. A modest expansion in the services sector appeared to compensate for the contraction in the smaller manufacturing sector, and personal incomes and spending both rose at a moderate 0.2% in October.

Fed officials acknowledge progress

Fed officials continued to insist that vigilance was necessary, but investors appeared encouraged by several comments suggesting that the cycle of rate hikes may be over, at least for a while. In particular, stocks jumped at the end of the month after a noted Fed “hawk,” Board member Christopher Waller, surprised investors by stating that he was “increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2%.” He further stated that if inflation continued to moderate over the next three to five months, the Fed might start lowering rates, even if the economy remained healthy.

Investors seemed to pay an uncommon degree of attention to the month’s Treasury bond auctions, given recent fears that demand for Treasuries would be unable to keep up with the expanding supply necessary to fund swelling federal debt levels. Stocks rose after healthy demand for auctions of 3-, 10-, and 20-year securities but took a step back after the poor reception given an auction of 30-year Treasury bonds at mid-month.

Europe

In local currency terms, the pan-European STOXX Europe 600 Index ended sharply higher, snapping three consecutive months of losses. A steep decline in inflation and falling bond yields lifted investor sentiment. Major market indexes in Germany, Italy, and France surged as well. The UK’s FTSE 100 Index posted a solid gain.

Bonds also rallied strongly on investor expectations that the interest rates set by central banks had reached a peak and would soon be cut. The 10-year German government bond yield fell to about 2.45%, while the equivalent Italian bond yield dropped to roughly 4.23%. In the UK, the 10-year gilt yield slipped below 4.2%.

Central banks keep rates on hold but push back against rate cuts

Both the European Central Bank (ECB) and Bank of England (BoE) held their benchmark rates level at the start of the month. The Riksbank in Sweden and Norway’s Norges Bank also left interest rates unchanged.

Even so, central bank officials sought to disabuse markets of an imminent reduction in interest rates, stressing that they had to stay higher for longer to quell inflation.

ECB President Christine Lagarde said that it was “not the time to start declaring victory,” although she hinted that the ECB might consider an earlier end to reinvestment in bonds under its Pandemic Emergency Purchase Programme. In the UK, Governor Andrew Bailey said the BoE “will do what it takes” to bring inflation back to its 2% target, but he added that “we are not in a place now where we can discuss cutting interest rates—that is not happening.”

Slower inflation, growth reinforce hopes for policy easing

Eurozone and UK inflation were much weaker than forecast, prompting financial markets to fully price in the possibility of a first 25-basis-point rate cut in April (1 basis point equals 0.01 percentage point). Annual consumer price growth in the eurozone slowed to a two-year low of 2.4% in November, after dropping to 2.9% in October. In the UK, the headline inflation rate fell to 4.6% in October from 6.7% in September.

Meanwhile, the eurozone and the UK economies skirted recession. The eurozone economy slowed in the third quarter, growing only 0.1% sequentially and leaving growth almost flat (also 0.1%) for the year. UK gross domestic product (GDP) remained unchanged, and the BoE forecast little improvement in 2024.

Dutch far-right wins most votes in election; Spain’s Sanchez wins another term

On the political front, the nationalist, far-right political party led by Geert Wilders, a euro-skeptic, unexpectedly garnered the most votes in the Dutch general election, putting it in pole position to form a government. In Spain, socialist Prime Minister Pedro Sanchez secured a second term in office with the help of the radical left Sumar alliance and Catalan, Basque, and Galician separatist parties, triggering widespread street protests and raising fears of a constitutional crisis.

Japan

Japanese equities rallied in November as expectations that U.S. interest rates had peaked pushed riskier assets higher. The MSCI Japan Index returned 5.97% in local currency terms, with gains supported by a strong corporate earnings season and continued weakness in the yen. On the economic front, investors appeared to take Japan’s worse-than-expected third-quarter GDP data in stride, while a hot October consumer inflation print stoked speculation about further monetary policy normalization by the Bank Japan (BoJ).

Against this backdrop, the yield on the 10-year Japanese government bond (JGB) fell to 0.68%, from 0.94% at the end of October, tracking declines in U.S. bond yields. The BoJ reduced the offer amounts for its regular buying of JGBs, with which it seeks to limit volatility in yield movements.

The yen strengthened to around JPY 148.1 against the U.S. dollar, from about JPY 151.6 the prior month-end, in an environment of general weakness in the greenback. However, the Japanese currency touched its lowest point in around 33 years during the month as investors remained focused on interest rate differentials between Japan and the U.S. Japan’s government has repeatedly said that it will take every possible measure in response to volatility in the foreign exchange market.

Japan’s economy shrinks more than expected in third quarter

Japan’s third-quarter GDP data showed that the economy shrunk by a worse-than-expected 0.5% over the three months (2.1% on an annualized basis). The main drag was from private inventories, while inflation and yen weakness continued to weigh on private consumption and sluggish global demand hit exports. The contraction, which follows two straight quarters of growth, suggests that Japan’s economic recovery remains fragile.

In early November, Prime Minister Fumio Kishida’s administration announced a new economic stimulus package worth more than USD 110 billion, aimed at boosting growth and helping households cope with the rising cost of living. The measures include cuts to income and residential taxes, cash handouts to low earners, and extended fuel and electricity subsidies.

Amid accelerating inflation, speculation about monetary policy trajectory grows

Japan’s core consumer price index (CPI) accelerated for the first time in four months in October, rising 2.9% year on year, up from 2.8% the prior month. Although falling short of consensus expectations of a 3.0% rise, the hot CPI print showed that inflation continued to hover above the BoJ’s 2% target for the 19th straight month and fueled speculation that tighter monetary policy could be imminent in Japan.

However, while the BoJ has tweaked its yield curve control framework to allow JGB yields to rise more freely—but effectively only up to 1%—the central bank has indicated that it intends to wait for stronger wage growth to come through before considering removing yield curve control or lifting interest rates from negative territory. Evidence of sustained wage growth could be provided by next year’s “shunto,” or annual spring wage negotiations, which some investors believe could mark a pivotal point in the BoJ’s monetary policy trajectory.

China

Chinese equities rose as expectations for a decline in U.S. interest rates and a weaker dollar fueled a powerful rally in non-U.S. assets, offsetting concerns about the country’s slowing growth. The MSCI China Index gained 2.52% while the China A Onshore Index added 1.18%, both in U.S. dollar terms.

Official data provided a mixed picture of China’s economy. The official manufacturing Purchasing Managers’ Index (PMI) fell to a below-consensus 49.4 in November from 49.5 in October, marking the second consecutive monthly contraction. The nonmanufacturing PMI slipped to a lower-than-expected 50.2 from 50.6 in October. (Readings above 50 indicate expansion.) Other indicators showed that industrial production and retail sales grew more than forecast in October from a year earlier, while fixed asset investment growth missed estimates due to lower infrastructure growth and real estate investment. Unemployment remained steady from September.

Deepening downturn in property sector

Chinese regulators formulated a funding plan for property developers in the government’s latest bid to support growth for the crisis-hit sector. The plan, which reportedly includes 50 private and state-owned developers, will act as a guide for financial institutions to deliver a range of financing measures to strengthen balance sheets.

The reports followed mounting evidence of a deepening downturn in a key sector of China’s economy. Investment in property development fell by 9.3% in the first 10 months of the year compared with a 9.1% decline in the January to September period, according to the National Bureau of Statistics. Property sales slumped by 7.8% between January and October versus the same period in 2022. New home prices in 70 of China’s largest cities declined 0.38% in October from September, the largest month-on-month drop since February 2015.

In monetary policy news, China’s central bank injected RMB 1.45 trillion into the banking system via its medium-term lending facility versus RMB 850 billion in maturing loans, its largest net injection since December 2016, and kept the rate on the loans unchanged. The cash injection reflected Beijing’s balancing act of trying to stimulate China’s economy without weakening the yuan, which strengthened versus the dollar in November but is down about 2.5% against the greenback this year.

Other Key Markets

Turkiye’s (Turkey) central bank raises key rate to 40%

Turkish stocks, as measured by MSCI, returned 7.84% in U.S. dollar terms in November versus 8.02% for the MSCI Emerging Markets Index.

Toward the end of the month, Turkey’s central bank held its regularly scheduled meeting and raised its key policy rate, the one-week repo auction rate, from 35.0% to 40.0%. While this is far above the 8.5% level, where it was as recently as May, year-over-year inflation is slightly more than 61%, so real (inflation-adjusted) interest rates are still well below 0%.

In the central bank’s post-meeting statement, policymakers noted that “domestic demand, the stickiness in services inflation, and geopolitical risks” are supporting price pressures. However, they also noted that “domestic demand has started to moderate” and that factors such as “improvement in external financing conditions, continued increase in foreign exchange reserves,” and increased demand for lira-denominated assets are contributing “significantly to exchange rate stability and the effectiveness of monetary policy.”

Policymakers concluded that “the current level of monetary tightness is significantly close to the level required to establish the disinflation course,” while stating their commitment to bringing inflation down to 5% in the medium term.

Hungarian stocks outperform as inflation moderates

Hungarian stocks, as measured by MSCI, returned 8.39%, modestly outperforming the MSCI Emerging Markets Index.

Around mid-month, the Hungarian government released inflation data that were lower than expected. As measured by the CPI, inflation in October was 9.9% versus expectations for a reading of 10.4% and down from 12.2% in September. Core CPI momentum slowed to 0.1%, down from 0.2% to 0.3% in the last several months. Overall, T. Rowe Price credit analyst Ivan Morozov sees this trend as a dovish development that, if it continues, could bring year-over-year inflation down to 6% by the end of the year and pave the way for the central bank to continue reducing interest rates.

Indeed, on November 21, the National Bank of Hungary (NBH) held its regularly scheduled meeting and decided to reduce its main policy rate, the base rate, from 12.25% to 11.50%. The NBH also reduced the overnight collateralized lending rate—the upper limit of an interest rate “corridor” for the base rate—from 13.25% to 12.50%. In addition, the central bank lowered the overnight deposit rate, which is the lower limit of that corridor, from 11.25% to 10.50%.

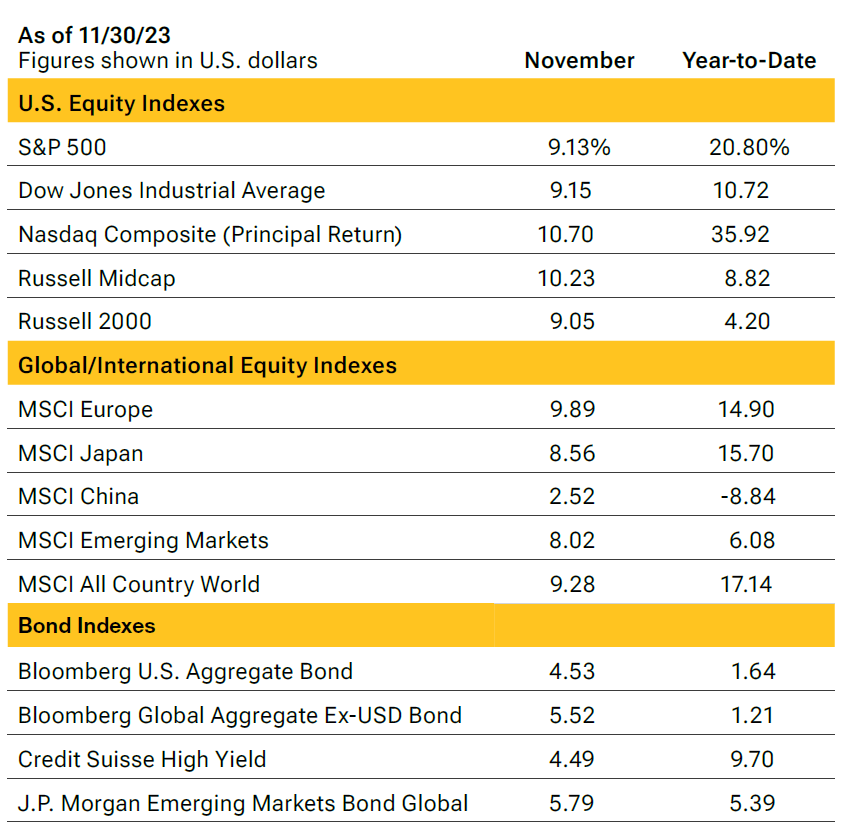

Major index returns

Total returns unless noted

Past performance is not a reliable indicator of future performance.

Note: Returns are for the periods ended November 30, 2023. The returns include dividends and interest income based on data supplied by third-party provider RIMES and compiled by T. Rowe Price, except for the Nasdaq Composite Index, whose return is principal only.

Sources: Standard & Poor’s, LSE Group, Bloomberg Index Services Limited, MSCI, Credit Suisse, Dow Jones, and J.P. Morgan (see Additional Disclosure).

Additional Disclosure

The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by

T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies. “Russell®” is a trade mark(s) of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The LSE Group is not responsible for the formatting or configuration of this material or for any inaccuracy in T. Rowe Price Associates’ presentation thereof.

MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

“Bloomberg®” and Bloomberg U.S. Aggregate Bond, Bloomberg Global Aggregate Ex-USD are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price. Bloomberg is not affiliated with T. Rowe Price, and Bloomberg does not approve, endorse, review, or recommend its products. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to its products.

© 2023 CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2023, J.P. Morgan Chase & Co. All rights reserved.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

December 2023 / GLOBAL MARKET OUTLOOK