December 2023 / GLOBAL MARKET OUTLOOK

Rethinking Fixed Income

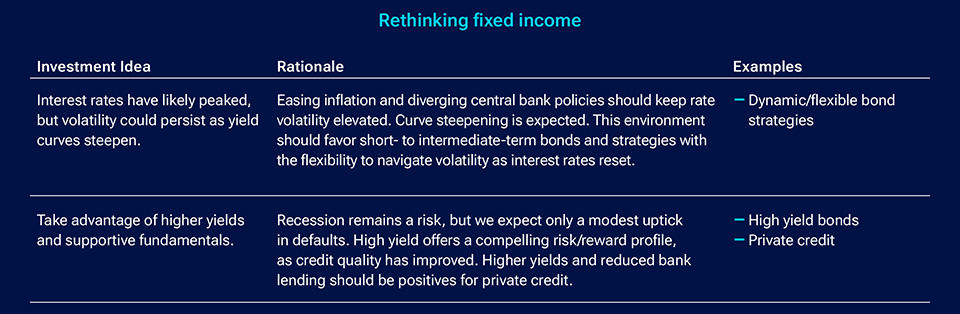

The massive tightening of financial conditions since late 2021 has produced a fixed income market vastly different from the stimulus‑fueled environment during and following the pandemic. The cross‑currents generated by these changes will challenge investors again in 2024.

Heading into the year, we think the best way to describe the macro environment is that we have reached or passed peak everything—inflation, liquidity, fiscal support, China growth, housing, credit availability, and labor market strength. In other words, most of the one‑off tailwinds that defined the post‑pandemic environment are fading away.

Although global economies—the U.S. economy in particular—have held up relatively well so far despite higher rates, a hard economic landing is not out of the question, especially following the spike in bond yields. Even if a recession is avoided in 2024, we are likely to see economic growth concerns intermittently elevated.

Higher for longer

As of late November, futures markets were pricing in four Fed rate cuts in 2024, anticipating that the U.S. central bank will ride to the rescue if the U.S. economy falls into recession. However, we believe the failure of the Fed and most other developed market central banks to get ahead of inflation following the pandemic makes them more likely to keep policy rates at relatively high levels through much of 2024.

Structural forces such as deglobalization, lower labor force participation rates, and energy price pressures also could make inflation stickier than in past economic slowdowns, further discouraging central banks from easing monetary policy.

Of course, a major episode of financial volatility could prompt monetary policymakers to look beyond stubborn inflation and cut rates or pause quantitative tightening—the contraction in central bank liquidity as bonds purchased in pandemic stimulus efforts are allowed to run off their balance sheets.

Potential “canaries in the coal mine” warning of such a correction might include a more severe banking crisis, a collapse in commercial real estate, a significant sell‑off of the mega‑cap tech stocks that led U.S. equity markets higher in 2023, or deteriorating conditions in private equity markets.

However, our base‑case outlook is that central banks will remain on hold for an extended period into 2024. This stance is likely to shift volatility to the longer end of the yield curve, as opposed to the exaggerated upward moves in shorter‑term rates seen as the Fed tightened in 2022 and early 2023.

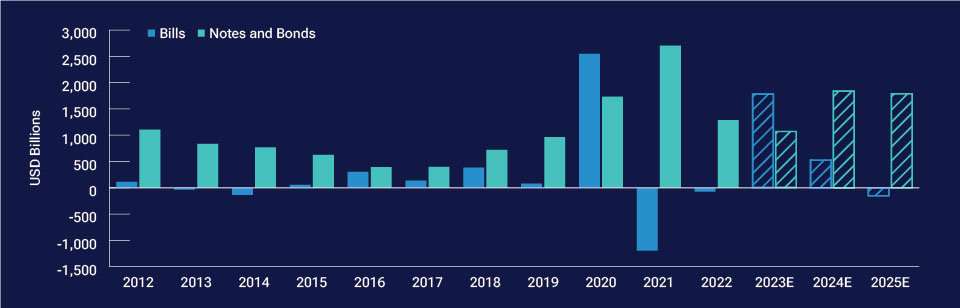

Sovereign issuance is surging

With fiscal deficits ballooning, we expect governments to continue flooding the market with new sovereign debt. This is particularly true in the U.S., where the Treasury is shifting the bulk of new issuance away from short‑term bills and into longer‑term notes and bonds (Figure 4).

U.S. Treasury debt issuance is shifting to longer maturities

(Fig. 4) Net new Treasury issuance.

As of November 18, 2023. 2023 through 2025 are estimates.

Sources: U.S. Treasury, Securities Industry and Financial Markets Association, Morgan Stanley. Estimates by Morgan Stanley.

Actual outcomes may differ materially from estimates.

This issuance shift is the basis for one of our highest‑conviction calls: that yield curves will steepen in 2024. Although yields on high‑quality sovereign debt may have peaked in late 2023, they still could move higher. Accordingly, we think curve steepening is likely to be a more significant factor than the outlook for interest rate levels.

Another implication of the surge in government bond issuance is that it could crowd corporate borrowers out of the market—or at least force up their funding costs. This could make companies less likely to spend on capital projects or hire more employees, reducing support for the global economy.

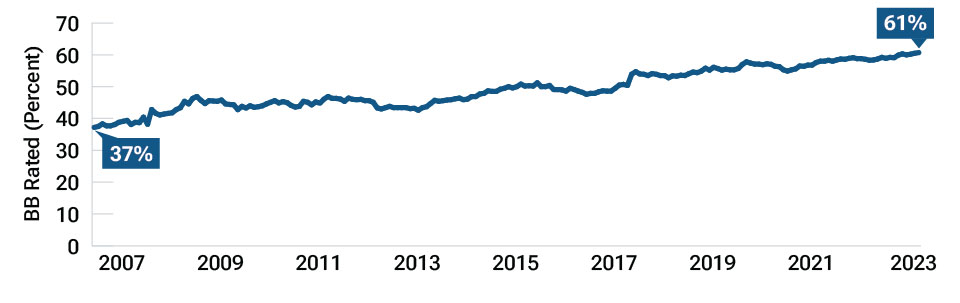

High yield credit quality has improved

Looking more closely at the corporate bond market, attractive yields should continue to support demand for high yield bonds, even though credit spreads—the yield differences between bonds with credit risk and high‑quality government bonds with similar maturity dates—appear less compelling, trending near historical averages as of late November.

Obtaining attractive yields doesn’t require investors to accept as much credit risk as in the past because the quality of the high yield bond universe overall has improved (Figure 5).

High yield ratings quality has “migrated up”

(Fig. 5) Percent of Credit Suisse High Yield Index that is BB rated.

As of October 31, 2023.

Source: Credit Suisse (see Additional Disclosures).

We also see attractive opportunities in shorter‑term IG corporates. While these instruments carry some credit risk, short maturities reduce their exposure to an economic downturn. As of late November, shorter‑term corporates provided a meaningful yield premium over money market funds and bank savings deposits, leaving investors better positioned if short‑term rates decline in 2024.

Going into 2024, credit spreads on longer‑term IG corporates aren’t wide enough to compensate for the additional risk stemming from their extended maturities, in our view. However, spread widening could create more attractive opportunities in these bonds as the year progresses.

We expect correlations between returns on high‑quality sovereign debt and the performance of risk assets such as equities and corporate bonds to remain volatile as markets adjust to the new environment of higher interest rates and as global economic growth decelerates. However, we believe duration exposure should reward investors in the event of major downturns in equities and credit.

Non‑core fixed income assets, such as high yield or EM bonds, also should provide diversified sources of return even if equities perform well or move in a sideways trend.

In 2023, many investors seemed inclined to wait for a clear peak in yields before meaningfully raising their fixed income allocations. In 2024, we think a more attractive option will be to take advantage of some of the highest yields available over the past two decades in many fixed income sectors. As always, in‑depth analysis of credit fundamentals—for both IG and high yield issuers—will be essential.

For illustrative purposes only. This is not intended to be investment advice or a recommendation to take any particular investment action.

T. Rowe Price cautions that economic estimates and forward‑looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual outcomes could differ materially from those anticipated in estimates and forward‑looking statements, and future results could differ materially from any historical performance. The information presented herein is shown for illustrative, informational purposes only. Forecasts are based on subjective estimates about market environments that may never occur. Any historical data used as a basis for this analysis are based on information gathered by T. Rowe Price and from third‑party sources and have not been independently verified. Forward‑looking statements speak only as of the date they are made, and T. Rowe Price assumes no duty to and does not undertake to update forward‑looking statements.

Additional Disclosure

© 2023 CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.

Copyright © 2023, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.