December 2023 / GLOBAL MARKET OUTLOOK

Broadening Equity Horizons

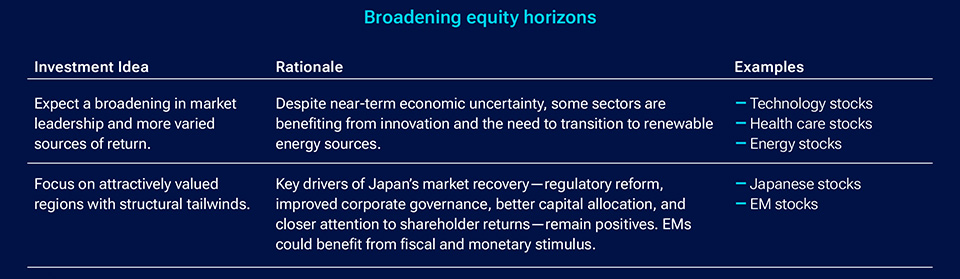

Global equity markets are likely to remain challenged in 2024 as the world transitions to a regime of higher trend inflation and interest rates. This transition could generate shifts in earnings growth expectations, triggering volatility. Close attention to risk management will be needed.

On the plus side, broader, less concentrated market leadership is likely to provide more varied sources of returns for investors who maintain a sharp focus on valuation fundamentals.

Although U.S. equity valuations appear more reasonable, they continue to face stiff competition from attractive yields on money market and short‑term fixed income assets. This suggests a need to look for pockets of attractive relative valuation.

Global equity performance in 2023 was predominantly driven by the so‑called “Magnificent Seven” mega‑cap U.S. technology stocks (Figure 6), propelled by their above average earnings performance and rising expectations for artificial intelligence (AI) applications. Through November, the Magnificent Seven stocks collectively were up over 70% for the year to date on a capitalization‑weighted basis. The remaining 493 stocks in the S&P 500, on the other hand, rose less than 9.5% (Figure 6). Such highly concentrated markets increase risk, particularly for investment strategies measured against benchmarks that require them to maintain exposure to these outsized positions.

U.S. equity performance has been top‑heavy, but that could change in 2024

(Fig. 6) Cumulative returns through the first 10 months of 2023.

As of November 30, 2023.

*The Magnificent 7 are Apple, Alphabet, Amazon, Meta, Microsoft, NVIDIA, and Tesla. Performance results shown are capitalization‑weighted averages.

The specific securities identified and described are for informational purposes only and do not represent recommendations.

Source: Standard & Poor’s (see Additional Disclosures). T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved.

Past performance is not a reliable indicator of future performance.

Stretched valuations, produced by their strong performance, leave the U.S. tech giants vulnerable to mean reversion—the historical tendency for periods of above‑average performance to be followed by subpar returns. Accordingly, we believe mega‑cap tech leadership is likely to fade in 2024 as the opportunity set broadens.

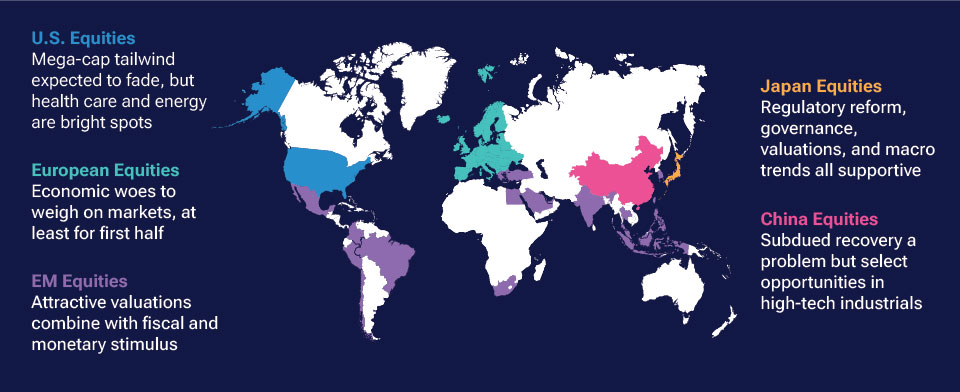

The world in equities 2024

Regional opportunities

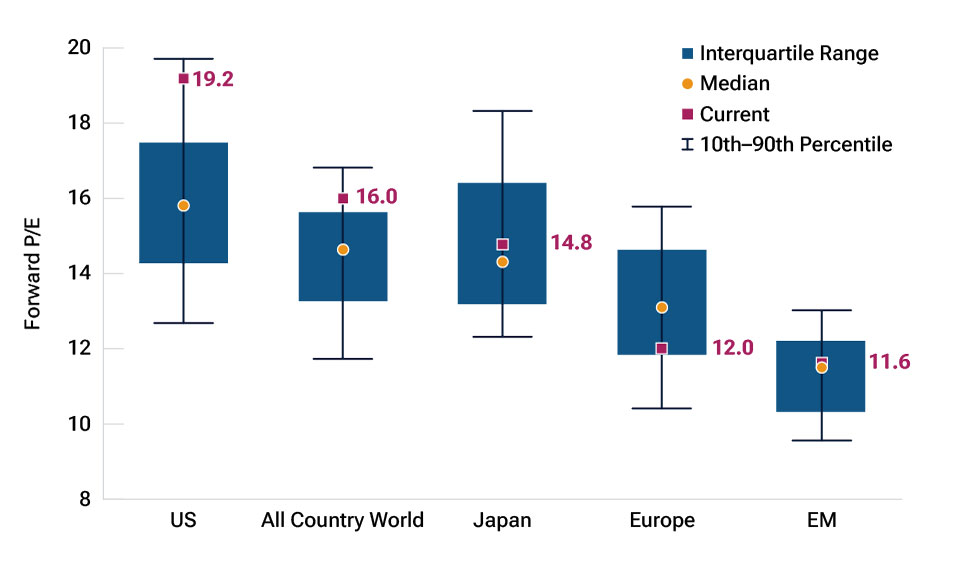

We continue to favor EM equities over developed equities as relatively attractive valuations (Figure 7), upside earnings potential, and the possibility of incremental fiscal and monetary stimulus generally are more supportive for the EMs. A shift away from highly centralized global supply chains also could favor the EMs. Potential beneficiaries include Malaysia, Indonesia, Brazil, and Chile.

EM equity valuations appear relatively cheap

(Fig. 7) Forward 12‑month price/earnings (P/E) ratios.*

As of November 20, 2023.

*Based on consensus earnings forecasts. Ranges and medians are for the 20 years ended November 2023 using monthly P/Es. U.S. = MSCI USA Index; All Country World = MSCI All Country World Index; Japan = MSCI

Japan Index; Europe = MSCI Europe Index; EM = MSCI Emerging Markets Index.

Source: Goldman Sachs Investment Research.

Within the developed markets, near‑term prospects for European equities look less attractive relative both to other developed markets and to the EMs. As the business cycle rolls over, demand is likely to weaken and profit margins could come under pressure. Companies with more robust margins are likely to navigate this environment more effectively but also will sell at higher valuations.

As Europe approaches a business cycle recovery that is likely later in 2024, further opportunities should arise in those markets, where valuations overall are likely to still be reasonable.

Japanese equities continue to look relatively attractive. The Japanese yen appears undervalued and will likely appreciate should the BoJ change its monetary policy. While a stronger yen historically has been seen as a negative for the export‑driven Japanese economy, its potential impact going forward is unclear given the positive momentum and potential for repatriated flows by domestic investors. For foreign investors, however, Japan has the triple merits of reasonable valuations, a cheap currency, and structural reform.

The growth outlook for China is less positive, as efforts to stimulate demand so far have been relatively ineffective. Beijing’s decision to allow its 2024 budget deficit to exceed 3% of GDP was a step in the right direction, but it’s not clear whether policymakers will go further. This uncertainty is reflected in relatively low valuations in China’s equity markets.

While the direction of economic growth in China is uncertain, excessively negative sentiment could produce selective equity opportunities in 2024 in sectors benefiting from the technological upgrade of China’s industrial base, including electric vehicles, semiconductors, and higher‑value industrial products.

Sectors in the spotlight 2024

Key sector themes

Technology/AI: The extent to which richly valued U.S. tech giants can demonstrate clear benefits from AI may influence how much pressure they come under in 2024, as these firms race to acquire new capabilities and refine existing ones. But, in contrast to the internet boom of the 1990s, when a relatively small number of firms reaped the bulk of the benefits, we believe AI has the potential to enhance productivity across a wide range of sectors and companies.

Attractive opportunities could include semiconductor companies that are developing leading‑edge chips, tech service firms that help companies scale and enhance their AI capabilities, and data centers that benefit from increased demand.

Health Care: Innovation—from bioprocessing to medical devices to new treatments for obesity—also could generate significant equity opportunities in 2024. The U.S. Food and Drug Administration’s approval of a class of diabetes medications for use as weight‑control drugs has the potential not only to change patient outcomes, but to remake health care economics, given that obesity is a contributing factor to many other conditions. These advances also could have longer‑term implications for the food, retail, and hospitality sectors as structural patterns adapt.

Energy and Commodities: Energy and other commodity‑related stocks could prove to be attractive hedges in 2024 if inflation is stickier than expected and/or if geopolitical factors trigger another energy price shock. These sectors also could be a major focus for investors as countries and firms push ahead with decarbonization programs. Many EMs are heavily concentrated in energy and commodity‑related sectors, so these markets should benefit if renewable energy projects fuel a capital spending boom.

The longer‑term outlook for commodity producers could improve as prices adjust upward due to peaking productivity and higher production costs. Geopolitical risks also are likely to keep energy prices high even as supply expands—with positive implications for industry profitability.

These factors do not necessarily mean that global commodities are entering a new bull market, but do imply that we may be past the trough of the long‑term cycle.

For illustrative purposes only. This is not intended to be investment advice or a recommendation to take any particular investment action.

T. Rowe Price cautions that economic estimates and forward‑looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual outcomes could differ materially from those anticipated in estimates and forward‑looking statements, and future results could differ materially from any historical performance. The information presented herein is shown for illustrative, informational purposes only. Forecasts are based on subjective estimates about market environments that may never occur. Any historical data used as a basis for this analysis are based on information gathered by T. Rowe Price and from third‑party sources and have not been independently verified. Forward‑looking statements speak only as of the date they are made, and T. Rowe Price assumes no duty to and does not undertake to update forward‑looking statements.

Additional Disclosure

© 2023 CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.

Copyright © 2023, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

December 2023 / GLOBAL MARKET OUTLOOK