December 2022 / MARKET OUTLOOK

An Economic Balancing Act

Aggressive rate hikes are slowing economic growth. But a deep downturn across the globe is not inevitable

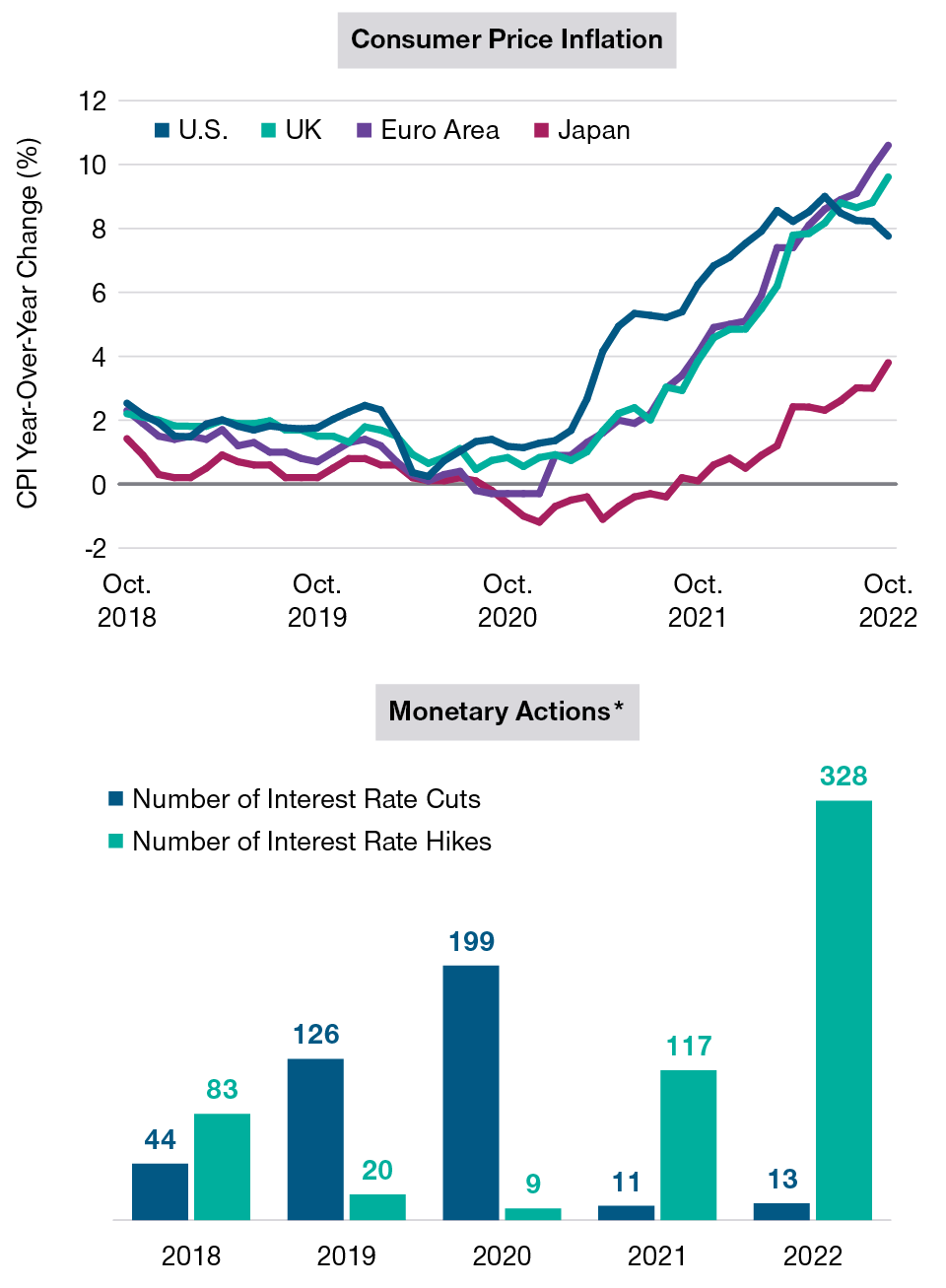

The outlook for inflation and interest rates (Figure 2) will remain critical in 2023 as investors try to estimate where ates will peak and when the Fed might “pivot” toward monetary easing.

U.S. consumer inflation slowed in late 2022, thanks to a partial unwinding of the oil and other commodity price spikes seen earlier in the year. But inflation in the services sectors remained “sticky” as tight labor markets continued to push wage costs up at a relatively rapid clip.

“In the U.S., inflation has likely peaked,” Thomson predicts. “But the key question is where it lands. And I think it’s unlikely to be at the Fed’s presumed target of 2%. We know that inflationary shocks like this one can take years, not months, to work through.”

Sticky inflation creates considerable uncertainty about where interest rates will peak in this Fed tightening cycle.

With rates now in “restrictive” territory, McCormick says, Fed policymakers, may slow the pace of hikes. But futures markets suggest investors still expect the Fed to lift the target for its key policy tool, the federal funds rate, to around 5%.

Fed policymakers hope to be able to pause at some point to allow the impact of previous rate hikes to work their way through the economy, McCormick adds. Whether a pause turns into a pivot or is followed by additional hikes, he says, will depend on the balance between inflation and recession risks. But a quick turn to easing in 2023 appears unlikely.

This means investors waiting for a clear sign that Fed policymakers are ready to cut rates could be left standing on the sidelines longer than they currently expect. “A lot of investors are looking for a Fed pivot,” Page says. “But I think it’s unlikely as long as U.S. employment numbers remain strong.”

A Mixed Monetary Picture

The inflation picture is more mixed in other major developed markets, as is the expected path of monetary policy.

- In Europe, high energy prices mean that inflation is likely to be more stubborn than in the U.S., Thomson says. This leaves the European Central Bank (ECB) in a difficult spot, McCormick adds. “Higher inflationary pressures coupled with a high risk of recession will be quite a test for the ECB.”

- Japanese policymakers may welcome higher consumer inflation in hopes that it will bleed through into wage growth, Thomson says. The Bank of Japan shows no signs of abandoning its version of quantitative easing, which involves managing the yield curve for Japanese government bonds.

Central Banks Are Struggling to Control Inflation Without Pushing the Global Economy Into Recession

(Fig. 2) Year‑Over‑Year Change in Consumer Price Inflation and Global Monetary Policy Actions

CPI as of October 31, 2022. Monetary actions as of November 30, 2022.

*Number of interest rate cuts and interest rate hikes made by all central banks globally.

Sources: Bloomberg Finance L.P. and Bloomberg Index Services Limited, CBRates.com (see Additional Disclosures).

Over the longer term, Thomson argues, a number of structural factors are likely to tilt the U.S. and other major developed economies toward higher inflation. These include:

- Slow or negative population growth in many developed countries, aggravated by lower workforce participation rates.

- A “reshoring” of global supply chains, which could make production less efficient.

- Demand pressure from heavy capital spending on the transition to sustainable energy sources.

- A greater appetite for deficit‑financed spending on the part of many developed market governments.

U.S. Dollar Strength Could Be Challenged

Fed rate hikes contributed to a surge in the value of the U.S. dollar (USD) in 2022, Thomson notes, creating tight conditions for non‑U.S. borrowers, both public and private, who rely on USD funding. Less clear, he says, is whether this trend will continue in 2023.

“The dollar has always traded as a risk‑off asset,” Thomson observes. “What was unusual this time around was its persistent strength against other major developed market currencies.”

Despite weakening somewhat in the last quarter of 2022, as of late November the USD remained between 35% and 50% overvalued against the euro, the yen, and the British pound on a purchasing power parity basis, Thomson estimates.

Exchange rates can defy fundamentals for lengthy periods, Thomson notes. But, given the level of USD overvaluation, economic surprises—such as a sooner‑than‑expected Fed pivot—easily could push the U.S. currency lower in 2023. “We should expect a weaker dollar and think about what that would mean for portfolio construction,” he says.

For illustrative purposes only. This is not intended to be investment advice or a recommendation to take any particular investment action.

Download the full 2023 Global Market Outlook insights here

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.